The Six Biggest Myths About Gold

Commodities / Gold & Silver 2009 Jan 22, 2009 - 04:47 AM GMTBy: Nick_Barisheff

Gold. People either love it or hate it. There aren't many who feel ambivalent toward it. Unfortunately, gold is deeply misunuderstood by investors, and that misunderstanding is hurting their portfolio returns. Many in the inuvestment community trot out the old myths about gold: that it is a bad investment; that it is very risky; that it is not a good inflation hedge. But is there anything behind these assertions? If investors take the time to examine the facts, these commonly held beliefs simply do not stand up to scrutiny. It is precisely because these myths have become so prevalent that gold is still undervalued. Once the general public realizes these beliefs are not valid, the price of gold will be much higher.

Gold. People either love it or hate it. There aren't many who feel ambivalent toward it. Unfortunately, gold is deeply misunuderstood by investors, and that misunderstanding is hurting their portfolio returns. Many in the inuvestment community trot out the old myths about gold: that it is a bad investment; that it is very risky; that it is not a good inflation hedge. But is there anything behind these assertions? If investors take the time to examine the facts, these commonly held beliefs simply do not stand up to scrutiny. It is precisely because these myths have become so prevalent that gold is still undervalued. Once the general public realizes these beliefs are not valid, the price of gold will be much higher.

MYTH 1: GOLD IS A BAD INVESTMENT

A frequently cited argument is that since it peaked at $850 per ounce (all amounts in U.S. dollars unless otherwise noted) in 1980, gold's return has been poor compared to the major stock indices. However, that peak price was a short-lived, single-day aberration. Investors who avoided the mania phase and purchased gold one year earlier in 1979 at its average price of $306 per ounce also avoided any significant losses during the subsequent bear market. The performance of different asset classes varies from cycle to cycle. The previous cycle from 1968 to 1980 saw the Dow Jones Industrial Average remain flat with significant volatility, while gold increased by 2,300 percent. In the current cycle, which began in 2002, gold has posted a compounded return of 14 percent, while 15 of the 30 Dow components are negative.

Many studies compare gold to equities over peri-ods as far back as the 1700s. But these studies ignore the fact that gold's price was fixed until 1971. Prior to that time, gold was money and not an investment. Interestingly, virtually none of the stocks listed in the 1700s still exist today. Instead, the returns of major indices such as the Dow are boosted by the removal of bankrupt companies and poor performers, which are replaced by high performers. Three of the 30 companies that made up the Dow in 2000 have since been replaced.

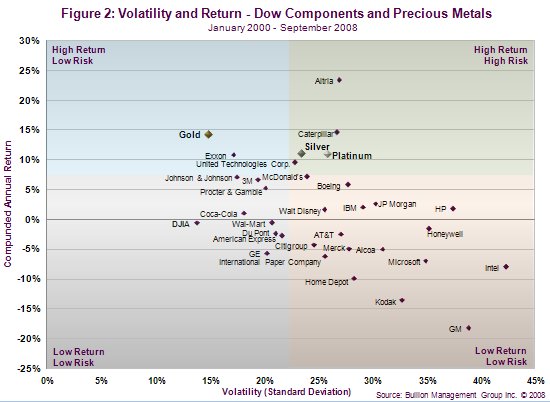

From a strategic portfolio allocation viewpoint it is easy to see why Ibbotson Associates, one of the world's most highly regarded asset allocation specialists, determined that holding between 7.1 percent and 15.7 percent in precious metals bullion reduces portfolio volatility and improves returns.

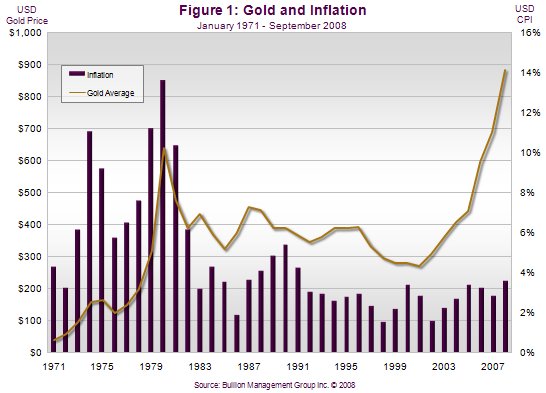

MYTH 2: GOLD IS NOT A GOOD INFLATION HEDGE

The arguments against gold as an inflation hedge are usually based on calculations arising from the intra-day price spike in 1980. While gold did not keep up to inflation using daily prices from 1980 to 2002, the annual average gold price has kept up extremely well since 1971, when the price was no longer fixed, Figure 1. During the same timeframe, the U.S. dollar lost about 80 percent of its purchasing power. In fact, all the world's major currencies have depreciated by significant amounts due to continuous excessive increases in the money supply. The impact of this devaluation on real returns is significant.

Conversely, gold has not only maintained its purchasing power but increased it against all major currencies. It will continue to do so as long as the world's central banks keep increasing the money supply by a greater percentage than their country's GDP growth.

More importantly, gold maintains its purchasing power not only during inflationary periods, but also during deflationary periods. An extensive study, published by Roy Jastram, analyzed the purchasing power of gold in England and the U.S. from 1560 to 1976. Jastram concluded that gold held its value remarkably well over time. The purchasing power of gold and precious metals actually increases during deflationary periods because other assets decline in price by a much greater amount than precious metals do.

As central banks continue to accelerate the pace at which money is printed, inflation will increase, and the purchasing power of paper currencies will decline. This will result in more and more astute investors fleeing to the safety of gold. As a con-sequence, gold's price should rise far in excess of the Consumer Price Index and the true inflation rate. In order to protect portfolios from rising inflation, Wainwright Economics concluded that an all-bond portfolio would need an 18 percent alluocation to gold, silver and platinum, while an all-equity portfolio would need 40 percent just to stay ahead of inflation.

MYTH 3: GOLD IS A RISKY INVESTMENT

Risk means different things to different investors. A pension fund may perceive risk as a failure to meet its liabilities, whereas an asset manager may view risk as a failure to meet its benchmark. Most investors, however, associate risk with a loss of their capital or underperformance of their invest-ments in comparison to their expectations. “Risk comes from not knowing what you are doing,” according to Warren Buffett.

There are many kinds of risk: currency risk, default risk, market risk, inflation risk, systemic risk, political risk, interest rate risk and liquidity risk. While all of these apply to financial assets, many do not apply to gold bullion. Physical bullion is not subject to default risk, liquidity risk, political risk, inflation risk or interest rate risk. In the rare cirucumstance of strong currencies, gold may be subuject to short-term currency risk and, at times, to market risk. Unlike financial assets, however, gold bullion cannot decline to zero. Gold is the only asset that can protect wealth from non-diversifiable systemic risk.

Volatility or standard deviation are often used as measures of risk, and gold is considered to be quite volatile. However, when annual compounded returns are plotted against standard deviation, the individual Dow stocks are all more volatile than gold, and all but two of the Dow stocks had poorer performance than gold, silver, and platinum over the past eight years. Figure 2.

Returns are important, but even more important is to compare risk-adjusted returns. Clearly, an investment that has higher volatility may still be attractive if the returns are appropriately higher. Nobel prize-winning economist William Sharpe devised the most commonly used measure of risk-adjusted performance: the Sharpe Ratio. This ratio measures the amount of excess return per unit of volatility. The interpretation of the Sharpe Ratio is straightforward: the higher the ratio the better.

Bullion is unlikely to suffer underperformance risk in the near future. Demand for gold, silver and platinum is increasing for both commodity and monetary attributes, while annual mine production is declining. As the price of oil continues to rise due to production declines and increased demand, inflation will accelerate. As central banks increase money supply at accelerating rates, the purchasing power of currencies will continue to decline. As these two major trends interact with each other, the price of gold will continue to rise.

MYTH 4: GOLD DOES NOT PAY DIVIDENDS OR INTEREST

The Bank of England used this argument to justify selling half the country's gold holdings at the botutom of the market in 1998. It wanted a “safe” investment, one that would generate interest, and it chose U.S. treasury bills. The gold was sold for under $300 per ounce. In the months following that sale, the price of gold tripled, and the value of the U.S. dollar lost 30 percent against the British pound. The currency exchange losses plus the opportunity cost resulted in billions of pounds in losses, significantly offsetting any interest income the Bank might have received.

The same is true for bond investors. In an infla-tionary environment, the “real” or inflation-ad-justed interest rate they receive is often negative. Gold, like any other asset that sits in a vault, will not earn interest or dividends, but neither is it at risk. No asset class generates income unless you give up possession and take the risk of not getting it back. However, gold's capital appreciation is many times greater than the prevailing interest yields, while not being subject to any of the risks that interest-bearing investments are subject to. For a comparative analysis of holding bonds versus a systematic withdrawal program for BMG BullionFund units, see www.bmginc.ca/bondsvsbullion

MYTH 5: GOLD IS AN ARCHAIC RELIC

Gold is often referred to as an archaic relic with no monetary role in today's modern digital society. Several facts contradict this view. The world's central banks still hold 29,000 tonnes of gold in their reserves. Gold, silver and platinum trade on the currency desks – not the commodity desks – of the banks and brokerage houses. The turnover rate of physical gold bullion, between the nine members of the London Bullion Marketing Association, currently averages $24 billion per day. Trading volume is estimated at seven to ten times that amount. Clearly, gold is still trading in its trauditional role as an alternative currency.

MYTH 6: MINING STOCKS ARE BETTER INVESTMENTS THAN BULLION

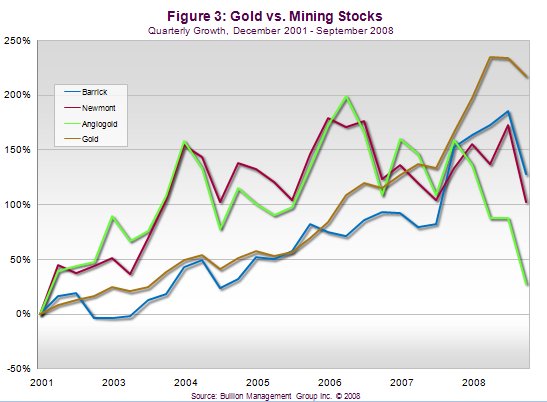

While mining stocks can generate impressive returns during an uptrend in precious metals prices, they do not always outperform bullion. It is unfair to compare junior mining companies to bullion because of the huge disparity in risk. While successful junior miners can generate impressive returns, over 90 percent of precious metals discovueries never become productive mines. A better comparison would be the larger producers. While mining stocks have outperformed bullion during the early stages of this bull market, gold bullion has outperformed the major mining indexes since March 2007. Figure 3.

Mining stocks tend to be significantly more volatile and risky than bullion, and during sharp market declines they tend to follow the broad equity markets downwards – even if the price of the metal is rising. During the late stages of the bull market of the 1970's, mining stocks underperformed bullion. In order to adequately compensate invesutors for the higher risk, mining stocks would have to outperform bullion.

CONCLUSION

Investors who take the time to carefully evaluate the benefits of bullion will realize that these com-monly held myths do not hold up to scrutiny. Those investors stand to reap significant rewards. Investors who believe these myths are missing out on the opportunity to add an asset class that diverusifies portfolios, protects against inflation, and may provide better returns than traditional assets, such as stocks and bonds.

Under a worst-case scenario of systemic risk, bullion may be the only asset that holds its value. As these myths are dispelled and the price of bullion rises, as many mainstream analysts predict, informed investors will benefit from purchasing bullion at today's undervalued prices.

When the public at large becomes fully educated with respect to precious metals, it will bid up the price. Considering that global financial assets are estimated at over $180 trillion, while total global above-ground gold is only $4 trillion (and above-ground bullion is less than $1.5 trillion), a massive wealth transfer event is likely to occur. It is inter-esting to note that even a 10 percent switch from financial assets to gold would result in a 450 percent to 1,200 percent increase in the gold price.

The BMG Special Report: "The Six Biggest Myths About Gold" is required reading for sophisticated investors and advisors. This report provides a more detailed and technical evaluation of the six myths. Please visit www.goldmyths.com to download the report.

By Nick Barisheff

Nick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca .

Nick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca .

© 2009 Copyright Nick Barisheff - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.