Fed Manipulating Market Prices, Gold, Oil and Bonds

Stock-Markets / Market Regulation Jan 20, 2009 - 02:28 PM GMTBy: Rob_Kirby

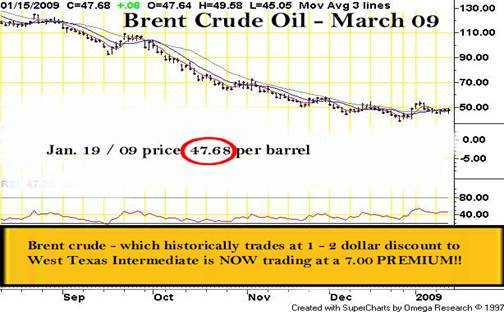

Questions Begging Answers - To say that markets have been behaving “strangely” recently is an understatement. In recent weeks and months we've been witness to historic lows in sovereign interest rates in-the-face-of record amounts of debt being issued by governments? We've seen the price of gold behave counter intuitively by “not rising” in-the-face-of unprecedented systemic global economic malaise? Last, but not least, we've witnessed a “complete flip-flop” in the traditional pricing of Brent Crude Oil [IPE-London] versus West Texas Intermediate [NYMEX-N.Y.]?

Questions Begging Answers - To say that markets have been behaving “strangely” recently is an understatement. In recent weeks and months we've been witness to historic lows in sovereign interest rates in-the-face-of record amounts of debt being issued by governments? We've seen the price of gold behave counter intuitively by “not rising” in-the-face-of unprecedented systemic global economic malaise? Last, but not least, we've witnessed a “complete flip-flop” in the traditional pricing of Brent Crude Oil [IPE-London] versus West Texas Intermediate [NYMEX-N.Y.]?

So we have the price of gold, the price of crude oil and interest rates – three items vital to the integrity of the U.S. Dollar - ALL trading in total disregard for their underlying fundamentals?

The following is a thought provoking analysis with commentary:

The Situation In Gold

First and foremost it is imperative that everyone realize and understand that Gold “is” Money . We know that gold is money because every Central Bank in the world carries gold on their balance sheets as ‘an official reserve asset'.

With that in mind, folks would do well to read one of James Turk's latest articles titled, The Fed's blueprint for market intervention . In this article, Turk offers commentary on a recently unearthed 1961 document from the archives of the late, long-time former Chairman of the Federal Reserve, William McChesney Martin Jr. which details in the Fed's own pen; their plans to intervene surreptitiously in the currency and gold markets to support the dollar and to conceal, obscure, and falsify U.S. government records so that the intervention would not be discovered. In Turk's words,

“In short, [the newly unearthed document] lays out what the Treasury and Federal Reserve needed to do in order to begin intervening in the foreign exchange markets, but there is even more. This document plainly shows what happens when government operates behind closed doors. It also makes clear the motivations of the operators of dollar policy long described by the Gold Anti-Trust Action Committee and its supporters -- namely, that the government would pursue intervention rather than a policy of free markets unfettered by government activity. The run to redeem dollars for gold had put the government at a crossroads, forcing it to make a decision about the future course of dollar policy. This paper describes what the government would need to do by choosing the interventionist alternative.

This document provides primary, original source supporting evidence that GATA has been right all along.”

In Feb. 2007 here's what the Royal Bank of Canada 's Chairman, Tony Fell had to say , confirming unequivocally that gold is money,

"At Royal Bank of Canada, we trade gold bullion off our foreign exchange desks rather than our commodity desks," says Anthony S. Fell, chairman of RBC Capital Markets, "because that's what it is – a global currency, the only one that is freely tradable and unencumbered by vast quantities of sovereign debt and prior obligations.

"It is also the one investment and long-term store of value that cannot be adversely impacted by corrupt corporate management or incompetent politicians," he adds – "each of which is in ample supply on a global basis."

In short, says Fell, "don't measure the Dollar against the Euro, or the Euro against the Yen, but measure all paper currencies against gold, because that's the ultimate test."

Fell's admission coupled with the recently unearthed account of the Fed's game plan shows that gold “is” and always has been feared as competition for the U.S. Dollar and a game plan has long been in place to thwart it. This explains why economic data has been falsified and the price of gold has been surrepticiously managed and interfered with by the United States Treasury and the Federal Reserve.

The mounting evidence is this regard is so compelling that from this point forward any ‘economist' attempting to explain our current situation without prefacing their explanation with an EXPLICIT ACKNOWLEDGEMENT that our capital markets are not free and are in fact RIGGED by officialdom – their analysis is not worth the time to read it. In this regard, perhaps never have more prescient words been uttered than GATA's Chris Powell in Washington in April, 2008 – when he opined, There are no markets anymore, just interventions .

The recent decoupling in price of gold as measured by the spread between the futures price and the cost to obtain physical ounces is a stark reminder that smart money is beginning to repudiate fiat money by seeking tangible ownership of goods perceived to posses value instead of derivative ‘promises' to deliver the same.

The Oil Picture

Back in June, 2007, Market Watch reported ,

Normally, Brent crude costs $1-$2 less than WTI crude, according to James Williams, an economist at WTRG Economics. At its peak, the price spread between the two topped $5, according to his data.

The article went on to explain,

WTI usually trades at a premium to Brent " because of the slightly higher quality , and the extra journey" oil tankers have to take to get the oil to the U.S. , according to Amanda Lee, a strategist at Deutsche Bank. So "WTI minus dated Brent should be roughly equal to the freight rate," she said. Indeed, "crude-oil prices usually depend on two things: quality and location," said Williams. "The greater the distance from the major exporters, the greater the price."

But here's what's happened recently in the global crude oil market:

Brent Crude trading at a 7 Dollar premium to West Texas Intermediate is like the SUN rising in the west and setting in the east – and no-one asking any questions why?

Thanks to the unearthing of the Fed's Playbook Document, referenced above, along with cumulative knowledge of the existence of the President's Working Group On Financial Markets [aka the Plunge Protection Team]; we know that interference in strategic markets with national security implications is now practiced commonly by the Government and the Fed working together. No other explanation for this distortion is plausible other than NYMEX regulators like the Commodities Futures Trading Corp. [CFTC - Plunge Protection Team members] are more brazen and actively complicit in market rigging of strategic commodities than their London counterparts. This manipulation is all being done in desperation; to preserve U.S. Dollar hegemony by perpetuating the illusion that inflation is being held at bay. Ample anecdotal evidence exists in a host of articles – particularly relating to derelict CFTC oversight of COMEX gold and silver futures - archived at kirbyanalytics.com to support this position.

Spiking VLCC Rates Reflect “The Movement to Tangibles”

The “unusual” premium for Brent Crude is even more perplexing given that crude oil shipping rates [unlike their dry goods shipping counterparts, as depicted by the Baltic Dry Index] for VLCCs [very large crude carriers] have, as recently as Dec. 2008, been enjoying robust and improving charter rates,

Last week the spot rate for Suezmax tankers was in the low $40k per day range. Yesterday, I check the rates and they have popped to over $90k this week! VLCC (very large crude carriers, i.e. supertankers) rates have not jumped as much but appear to be following the trend. So what is the deal here? Oil prices are falling and so is the apparent global demand for oil. Are not oil tankers just sitting around idle like the dry bulk carriers?

The answer is somewhat counter intuitive. The spike in spot tanker rates is actually the result of the low oil prices. Many tankers are being leased on the spot market as storage tanks. Oil producers, for whatever reason, do not want to significantly slow their oil production, but at the same time do not want to sell it for $45 a barrel. So they are leasing tankers to store oil in the hope or belief that oil prices will recover shortly. Two names in news articles that I have read doing this are Royal Dutch Shell and Iran . The majority of the planet's oil production is owned by national oil companies that have policy and employment as well as financial reasons to keep the oil flowing. So at least in the short term, the current low oil prices are a boon for tanker owners.

Oil tanker companies, like their dry cargo brethren, can sign their ships to either long term, multi-year leases or charter them on the spot market where they are leased for a single voyage at the current spot rate.

The fact that “smart money” is now paying elevated prices to lease very large crude carriers [to store physical crude for later sale] is further evidence that faith in fiat money is waning simply because – you can do the same “trade” on paper – utilizing futures - without the bother and nuisance of leasing ships and handling the physical. Ask yourself why smart money has recently become engaged in buying ‘relatively illiquid' physical crude oil, in a world allegedly awash in the stuff, for resale at a later date – instead of playing futures, accepting promises and holding cash?

Smart money is in the process of losing confidence in cash.

Interest Rates

It is vital that everyone understand that the function of interest rates in a system of usury is to solemnly act as the efficient arbiter of capital – rising to restrict money / credit growth when the economy overheats and falling to create the opposite when the economy cools.

Interest rates no longer serve this function.

As deceitfully disastrous as the surreptitious interventions in the crude oil and gold markets has been – they pale in comparison to the travesty which has been perpetrated through the premeditated hobbling of usury.

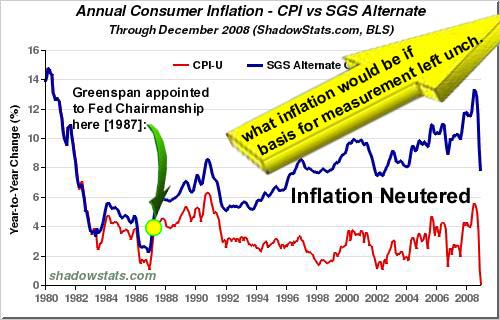

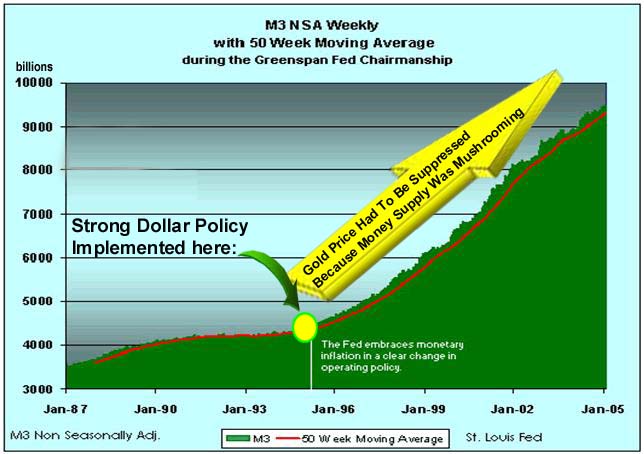

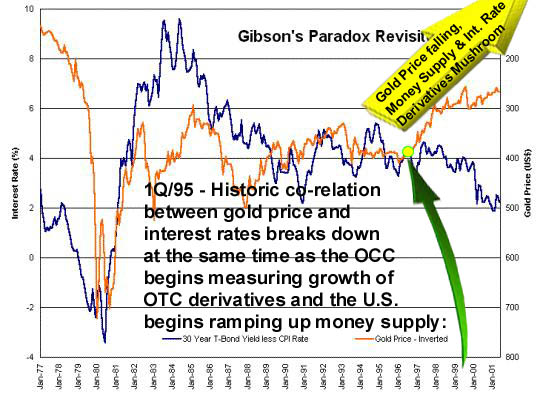

The roots of this most wicked experiment are traceable to the appointment of Alan Greenspan as Chairman of the Federal Reserve and then to academia – Harvard – where Robert Barsky and Lawrence Summers co-authored an academic research paper in the 1980s titled, Gibson's Paradox and the Gold Standard . The “elevator speech” of what the paper examined was the co-relation between bond prices, inflation and the price of gold and, by extension, theorized that interest rates could be driven down [or kept low] – without sacrificing the currency - in the face of and despite profligate monetary policy so long as gold prices declined or did not rise.

After a stint as Chief Economist at the World Bank, Mr. Summers brought this “theory” to Washington mid-way through the first Clinton Administration [late1993] as Under Secretary of Treasury to Robert Rubin where he began laying the groundwork – with co-conspirators Greenspan, Rubin and Clinton - for the implementation of his “theoretical research”:

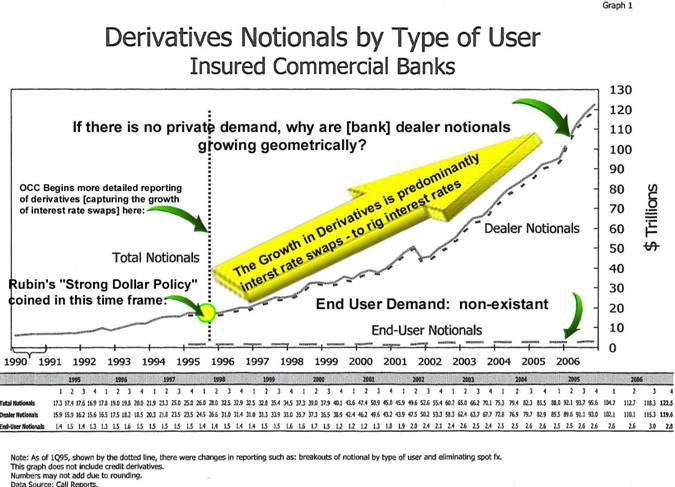

Gold price suppression began in earnest concurrently with changes in how the Office of the Comptroller of the Currency [OCC] begins records the mushrooming growth of derivatives [mostly interest rate swaps which – absent end user demand – only create artificial demand for government bonds]:

The Federal Reserve acting in cahoots with the U.S. Treasury utilizing the futures pits in N.Y. [COMEX] and the obscenity that has become J.P. Morgan's Derivatives Book – the Fed / Treasury combo seized control of both the gold price and interest rates. The mechanics of how interest rate swaps were utilized to suppress interest rates is chronicled and explained in detail at Kirbyanalytics.com in a paper titled, The Elephant in the Room .

Subscribers are reading about the logical implications, and what comes next, as a result of the market manipulations outlined above as well as actionable suggestions to help insulate your investment portfolio from the inevitable fallout.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research. Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.