Financial Markets Wrap - US Economy, Bonds, Currencies and Stock Market

Stock-Markets / Financial Markets Apr 23, 2007 - 04:55 PM GMTBy: Douglas_V_Gnazzo

Economy

The Labor Department reported that on a seasonally adjusted basis, the CPI advanced 0.6% in March, following a 0.4% increase in February.

Overall energy costs increased 5.9% in March, with the index for petroleum-based energy up 10.1% and the index for natural gas and electricity up 1.3%. Healthcare was up 3.96%.

Electric Rates on the Rise

For the first three months of 2007, consumer prices increased at a seasonally adjusted annual rate of 4.7%. This compares with an increase of 2.5% for all of 2006.

Excluding food and energy, the CPI advanced at 2.3% in the first quarter, following a 2.6% rise in all of 2006. So, remember - don't eat or use any energy and you're good to go.

The Cleveland Fed's Median CPI increased 3.76% year over year.

Housing starts increased 0.8%, an annualized rate of 1518k. Building permits also increased 0.8%, an annualized level of 1544k.

Talking about housing and whether or not the recent subprime lending fiasco is over or has just begun, Bloomberg reports that:

"Banks began foreclosure proceedings against 47% more U.S. homeowners last month compared with a year ago as falling housing prices made it more difficult for borrowers to refinance mortgages. More than 149,000 filings were posted in March. Owners of 168,829 homes in the first three months of 2007 received notice that lenders had filed for foreclosure due to failure to pay loans or liens."

Perhaps I'm misinterpreting what is being said, but it doesn't sound quite over to me..? Keeping within the topic of financial problems, Bloomberg also reports that:

"Texas owes state workers $50 billion in future retirement benefits and refuses to acknowledge the obligation . Texas Comptroller Susan Combs says she won't follow a new national accounting standard that requires states and cities to disclose the estimated costs of benefits promised to retired workers... The government would need to set aside $4 billion a year over the next decade to keep from falling short on what it owes, according to...the state's Legislative Budget Board."

I hope I'm wrong on this, but just as I said years ago that derivatives and carry trades would become household words, I'm also concerned that the refusal to meet obligations owed is going to become much more prevalent as things unfold. I wish it weren't so - but I'm afraid it is. Another reason to own some gold.

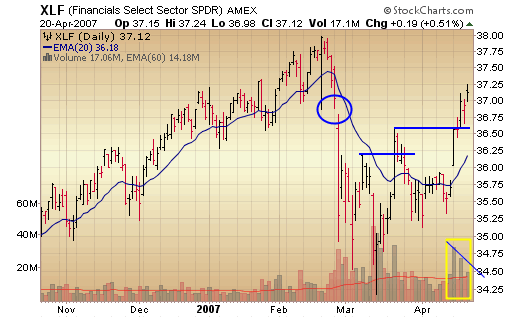

Stocks

The Dow was up 2.8% to a new all time high, while the S&P 500 gained 2.2% to a 6-year high. The Transports also made a record high up 3.4%, and the Utilities added 2.2%, also making a new record high. High fives were the order of the week - all around.

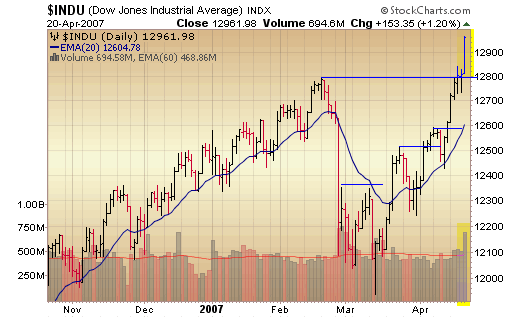

Our first chart shows the Dow Industrials forging to a new all time record high.

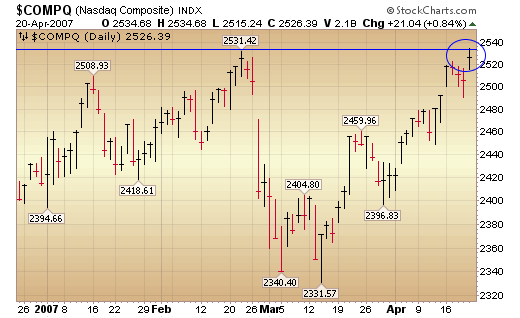

The Nasdaq Composite has yet to better its February highs let alone set any new records. To set a new record the index would have to double in value, as it has been cut in half since its previous rise to fame.

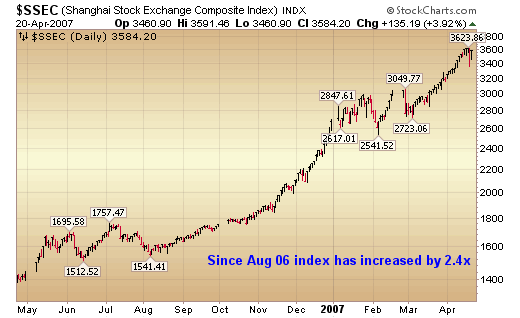

And it's not just our market that's making new highs - highs are being made by several world markets. Below is the chart of China's Stock Market that has more than doubled since August of 2006 .

Bonds

Two-year yields were down 11bps to 4.65%. Five-year yields lost 12 bps to close the week at 4.57%. Ten-year yields gave up 9 bps to 4.67%. The Long-bond yield lost 8 bps to 4.85%.

The spread between the two-year and the 10-year note closed the week in positive territory at +2 bps. Although yields were down across the curve, lower rates were down a bit more than longer rates - thus providing the positive 2 bps slope to the yield curve.

A few weeks ago the Fed had its coveted inverted yield curve. Now rates have started to revert back to a positive yield curve. It will be interesting to see how interest rates react to the many conflicting elements in today's financial and monetary markets. We still maintain that any surprises will be to the upside with rates.

Fed Foreign Holdings of Treasury Debt rose $4.6 billion last week to a record $1.91 trillion, a 30.4% increase this past year . Custody holdings are up 19.4%.

The chart below has been in the past several weeks' reports. It has improved tremendously. The gap has been filled, but plenty of work remains.

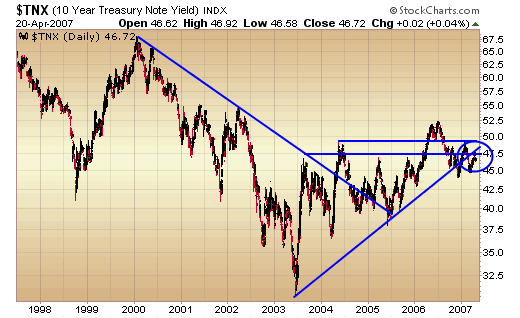

Interest rates have begun to back up some. Below is the chart of the 10-year yield. Resistance is indicated.

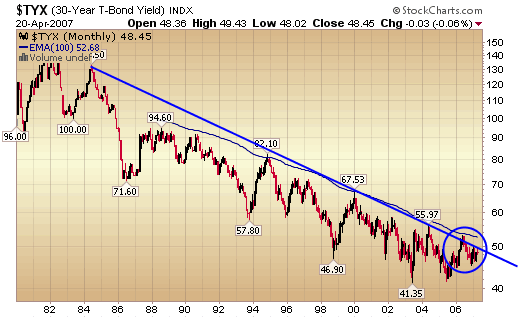

Next up is the 30-year bond yield that is bumping up against its falling upper trend line going back to 1984 . A break out above this trend line would be very significant.

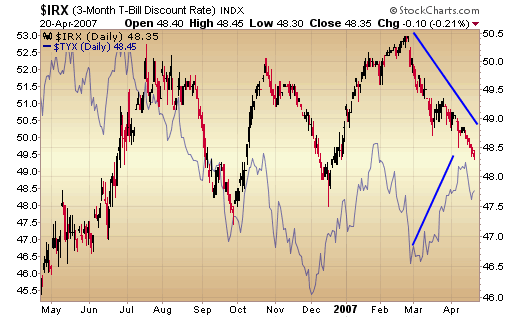

Below is a chart comparing the 90 day T-Bill rate with the 30 year T-Bond yield. Since March short term rates have been coming down, while long term rates have been going up. This warrants watching, as it would kill the real estate market if it continues.

Russian Helicopters

U.S. Dollar

Ever notice how everyone is always trying to tell the other guy how to fix his currency? No one ever concentrates on the soundness of their own currency. If they did, others wouldn't have to recommend fixing them.

For example, Jean-Claude Trichet, President of the European Central Bank (ECB) stated:

"The Japanese economy is on a sustainable growth path and the exchange rates should reflect these economic fundamentals."

He then went on to say that the U.S. States "still favors a strong dollar policy." It seems that Mr. Trichet hasn't checked with U.S. Treasury Secretary Henry Paulson, who hasn't publicly mentioned a strong dollar policy since February. But perhaps he's still in favor of it and has just forgotten to mention it. He does have a lot to keep track of - trillions and trillions of things.

The dollar index declined 0.6% to 81.45. The Japanese yen gained 0.9%. The euro gained 0.5% this week. It is up 1.8% against the dollar this month. The currency is within 1 cent of its record high of $1.3666 set on Dec. 30, 2004.

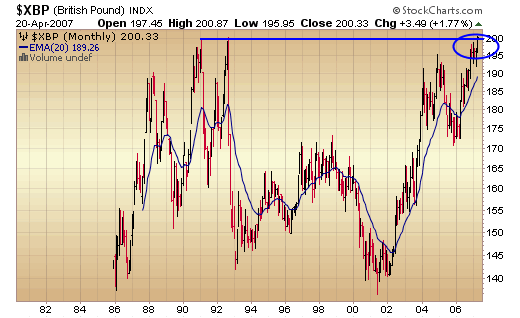

Even more telling of the dollar's weakness was the gain this week of the British Pound, which broke through the $2 dollar level that marked a 26 year high. This is the same British Pound that the dollar rescued from disaster at the Bretton Woods Conference - how things do change.

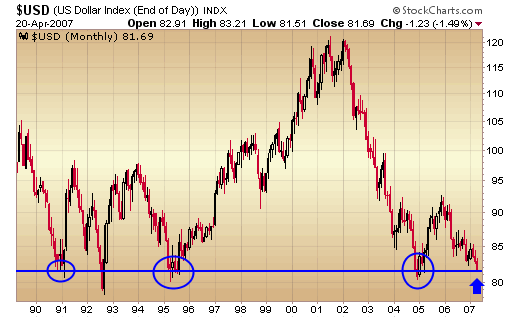

The first chart below shows the demise of the U.S. Dollar. The second chart illustrates how close the dollar is to completely breaking down. If the support indicated on the chart by the circled lows does not hold up - the dollar could go into freefall. We do not think that this is likely at this time.

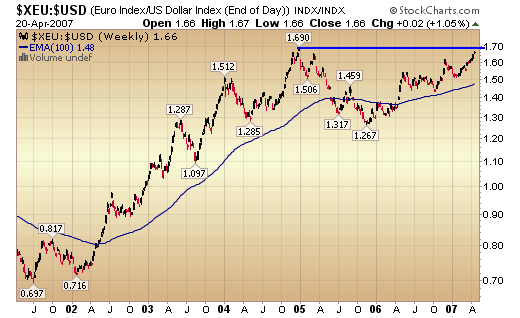

Next up is a chart comparing the euro to the U.S. dollar. The euro is presently bumping up against resistance that has held since 2005. If the euro breaks through and resistance becomes support - the euro will be entering upon another leg up. This tends to favor gold as well.

International reserve assets, excluding gold, were up $432 billion or 29% annualized , to a record $5.2 trillion.

Below is the chart of the British Pound versus the U.S. Dollar. It too is bumping up into overhead resistance - resistance that goes back to 1992.

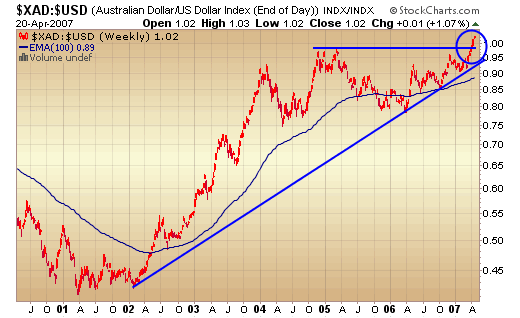

The Australian dollar isn't waiting around - it has already broken through overhead resistance.

Summary

Stock markets around the world are rising in unison, buoyed by a rising sea of liquid - of paper fiat debt-money. The United States is the leader of this monetary orgy with Japan close on her heels. Together they have fostered massive liquidity bubbles across the globe, causing other nations to either join in the celebration or go without.

The dollar has been acting very poorly of late; however, an oversold rally is likely. Many players are on the same side of the boat, and when it starts to flip - it will do so very quickly and violently, as we have seen in the past. If the dollar rallies, it will create a headwind for gold.

China is implementing an investment fund to diversify its holdings. Everyone wonders what they will invest in. My guess is stuff; stuff that when you drop it on your foot it hurts - in other words real things - commodities.

China's forex reserves were up a LARGE 36% in the first quarter of 2007, totaling $1.2 trillion (US dollars). 70% of the reserves are in dollar-based assets.

The dollar is the reserve currency of the world. At the Bretton Woods Conference the U.S. dollar replaced the British Pound as the eminent world currency of the time. Just the other day the Pound traded over 2 to 1 to the U.S. dollar. This speaks volumes on the state of the U.S. Dollar.

If and when the dollar breaks below 80, it will be the proverbial shot heard round the world. It could end up being one of the most significant events of the decade, if not the century. Much will depend on how the Federal Reserve and other central banks and players react to the event. Their collective reaction could create more force then the precipitating action of the dollar falling. The cure could be worse than the disease.

It appears that Mr. Wolfowitz has bit off a bit more than he can chew. Fascinating times we live in. Good luck. Good trading. Good health. And that's a wrap.

By Douglas V. Gnazzo

Honest Money Gold & Silver Report

Douglas V. Gnazzo is the retired CEO of New England Renovation LLC, a historical restoration contractor that specialized in the restoration of older buildings and vintage historic landmarks. Mr. Gnazzo writes for numerous websites, and his work appears both here and abroad. Just recently, he was honored by being chosen as a Foundation Scholar for the Foundation of Monetary Education (FAME).

Disclaimer: The contents of this article represent the opinions of Douglas V. Gnazzo. Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Douglas V. Gnazzo is not a registered investment advisor. Information and analysis above are derived from sources and using methods believed to be reliable, but Douglas. V. Gnazzo cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions. This article may contain information that is confidential and/or protected by law. The purpose of this article is intended to be used as an educational discussion of the issues involved. Douglas V. Gnazzo is not a lawyer or a legal scholar. Information and analysis derived from the quoted sources are believed to be reliable and are offered in good faith. Only a highly trained and certified and registered legal professional should be regarded as an authority on the issues involved; and all those seeking such an authoritative opinion should do their own due diligence and seek out the advice of a legal professional. Lastly, Douglas V. Gnazzo believes that The United States of America is the greatest country on Earth, but that it can yet become greater. This article is written to help facilitate that greater becoming. God Bless America.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.