Obama Stock Market Bounce or Bump?

Stock-Markets / Financial Markets 2009 Jan 20, 2009 - 05:16 AM GMTBy: PaddyPowerTrader

U.S. markets were closed yesterday for Martin Luther King Day ahead of Obama's big day out today. So will we get a Barack bounce or bump? Well we will most likely see some sort of knee-jerk rally on such a historic day. But then we will have the hangover induced by the same old same old issues of evaporating earnings, dismal future guidance, rising unemployment, continued falls in house prices and an increasing foreclosure rate.

U.S. markets were closed yesterday for Martin Luther King Day ahead of Obama's big day out today. So will we get a Barack bounce or bump? Well we will most likely see some sort of knee-jerk rally on such a historic day. But then we will have the hangover induced by the same old same old issues of evaporating earnings, dismal future guidance, rising unemployment, continued falls in house prices and an increasing foreclosure rate.

Markets had a sobering session overnight with renewed and heightened banking worries from the UK. RBS were down 70% at one stage yesterday as they are set to report the biggest loss in British corporate history.

Today's Market Moving Stories

- The German tabloid paper Bild quotes a government report predicting an unprecedented 2.25% contraction in the country's economy as it enters “a deep recession” at “extraordinary speed”. Over to you Mr Trichet. Being a Central banker is easy; it's just events that trip you up. How stupid does he look (yet again) now just four days after ruling out a February rate cut? Note that the EU Commission also slashed their 2009 “growth” forecast for the Euro area to a discomforting –1.9%.

- The UK bank bailout package was overshadowed by a lack of detail as to how the ‘ bad banks ' will work in practice, a fear of full RBS nationalization and whether still more capital will be required for the other high street banks. There are suggestions that ABN could be sold back to the Dutch government! But not for the €50bn RBS unwisely paid for it in CASH.

- A story doing the rounds is that Anglo Irish Bank will be used as a ‘ bad bank ' and recipient of bad assets from AIB and Bank of Ireland and run down over say 10 years. Anglo would then be merged with Irish Life and Permanent, Irish Nationwide and EBS to leave then large banks across the system. All sounds a tad complicated to me.

- The British peso in under the hammer again today and has slipped to a record low versus the Yen this morning.

- Japanese consumer confidence fell to an all time low of 26.7 from 31.2.

- Check out this brilliant flow diagram explaining the path of the financial crisis .

- And money is too tight to mention for U.S. corporates .

Some Thoughts On Where We Are In The Banking Bailout Mess

Although major banking system rescue packages were introduced last October, they clearly didn't go far enough. We should not be surprised, since financial history teaches us that governments rarely, if ever, resolve banking crises first time round. Lack of political courage and/or lack of full awareness of the state of solvency in the banking system are normally the main factors. Financial stability, therefore, remains both a mirage, and a sine qua non for an eventual recovery in financial markets and, later, in the economy.

A succession of recent events and earnings announcements (Germany, Ireland, US and UK) highlights the importance of another round of capital injections, loan guarantee arrangements, and this time, attempts to formalise bad bank schemes . As we move into and through this stage, we are likely to see more nationalisation and more separation of good from bad banks. The main issue with a bad bank solution is of course the PRICE that is paid for the toxic assets. This is likely to be OVER the market clearing price (which of course has never been established) therefore leaving the taxpayer overpaying for the bailout of the bailout.

Most economists believe that the Achilles Heel of the current US bank rescue plan is that it gets money into banks, but the capital does not come out the other end in the form of loans to businesses and individuals. Businesses cannot conduct their affairs in the normal course. The average citizen cannot get a home loan or expand his access to credit, even though it is his taxes, present and future, which is the source of the bailout funds in the first place.

Thoughts On The “Economist” David McWilliams

The Irish banks took a mighty thumping yesterday. Part of the reason was because of populist “economist” and shameless self publicist David McWilliams shouting the financial equivalent of fire in a crowded theatre in an interview with the state broadcaster RTÉ.

These comments were picked up by the Telegraph. Never a paper to let the facts get in the way of a bit of Paddy Bashing, they whipped it up. This of course was picked up by various ill informed commentators calling David McWilliams a former Irish central bank economist. God he was barely out of short trousers when he was there, neglecting of course to say why such a guru had been fired by both UBS and BNP Paribas! Let's not forget that he's been calling the top in Irish housing since the late 90's. Yawn. At this stage a large sock full of manure down his big ginger mouth would be in the national interest.

Equities

- Fiat to take a 35% stake in Chrysler . I don't know who to feel sorrier for.

- Profit warnings from household names BASF and Air France.

- Computer mouse maker Logitech is off 10% after reporting sales down 70%.

- Belgian bank KBC needs more capital (share price down 30% yesterday).

- Luxury goods maker Burberry managed to buck the trend with sales up on discounting.

- Earnings today from IBM (expected EPS $1.14), J&J ($0.92) and State Street Bank ($1.14).

- Watch the smaller regional banks to see what extent the reported slump in CRE (commercial real estate) is impacting their already distressed bottoms lines.

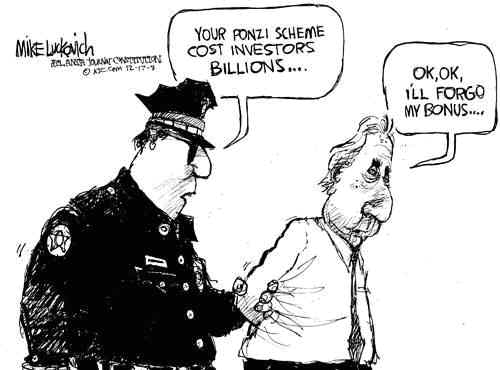

And Finally… Bernie Madoff Cuts A Deal

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.