Airline Sector Stocks: The Death of a Bear Market

Stock-Markets / Sector Analysis Jan 18, 2009 - 12:10 PM GMTBy: Daniel_Smolski

Anyone who has recently flown can probably attest to the feeling of uneasiness, loss of control and an overall uncomfortable feeling that grips one, as they step into an airport and submit themselves to the grueling process of check-in and boarding. The deregulation of the airline sector in the late 1970s has brought prices down so greatly, that it flying is now available to the masses. This has resulted in airports growing to mammoth-sized structures resembling small cities.

Anyone who has recently flown can probably attest to the feeling of uneasiness, loss of control and an overall uncomfortable feeling that grips one, as they step into an airport and submit themselves to the grueling process of check-in and boarding. The deregulation of the airline sector in the late 1970s has brought prices down so greatly, that it flying is now available to the masses. This has resulted in airports growing to mammoth-sized structures resembling small cities.

They are filled with the typical noise and chaos found in any metropolis. Before boarding the plane, you are now forced to deal with the humiliation of removing your shoes, all articles of clothing beyond your first layer and having your bags picked at by a stranger wearing protective gloves, unless of course you are a non-citizen then expect to be fingerprinted and photographed. Despite these ever increasing annoyances, people are increasingly travelling simply because seeing the world has become more affordable than ever. Over one billion people flew last year, an astounding number considering a world population of just under 7 billion.

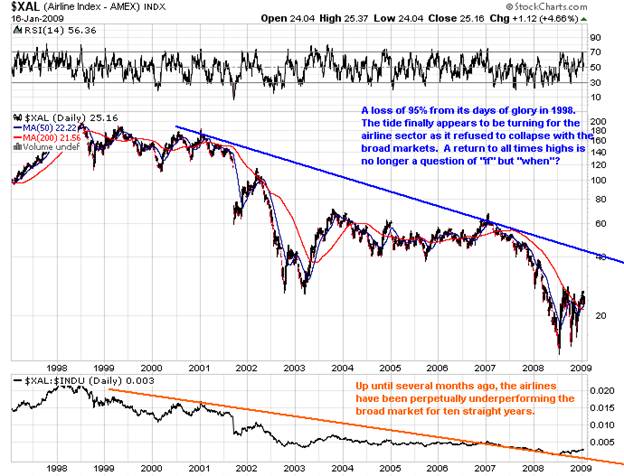

The past decade, however, has been an absolute write-off for airlines. Since 1998, the airline sector has declined an amazing 95%. This makes it one of the worst, if not the worst, performing sector of the past ten years. The bursting of the dot-com bubble triggered a recession that dealt a major blow to the aviation industry, then the tragedies of September 2001 occurred but the continuously rising oil price is what delivered the final knockout. With oil prices hovering in excess of $100, jet fuel accounted for more than half of all operating expenses for most airlines. All the majors in the US have either consolidated or been placed under Chapter 11 bankruptcy protection, some more than once.

Airlines have survived by trimming all possible excess fat. News of layoffs and cutbacks in the airline industry has become so common, that we have grown to ignore it. Much as we have grown to ignore AIG's continuous requests for, additional, tens of billions of dollars. Pilot salaries have been slashed, in many cases, to near half of what they used to be. All work that can be outsourced and privatized has been. Airlines have either eliminated their unprofitable routes or have teamed up with others to eliminate competition. Load factors, the percent of available seats filled, has been steadily increasing as fewer planes are being flown. Simply put, the airlines of today are the leanest and most efficient they have ever been.

The losses taking place in the airways industry have been astounding, globally averaging $3-4 billion every year since 2005 and even greater losses prior to 2005. Despite the deep recession, it is expected that losses will decline to $2.5 billion this year. It is a marked improvement but still a very large number, however it should be kept in mind that most of those losses are expected to come from Asia, where almost half of air traffic is comprised of the cargo market. The North American market is actually anticipating recording a profit of $300 million. Upon reviewing the largest airlines in North America there is a remarkable pattern of extremely high growth expectations for 2009. Continental (CAL) expects growth of 283%, US Airways (LCC) 135%, United (UAUA) 124%, American Airlines (AMR) 150%, all with positive forward P/E. You would be hard pressed to find another sector that is expected to show so much growth in 2009. Airlines have simply gone through so much hardship and become so lean, that they are ready to triumph despite the largest recession since 1930s.

In the stock market we are currently in a phase of transition. We have probably already seen the vast majority of the decline but the main indices are nowhere near ready to start a new bull market. I do not believe the recession is over, or even close to being over, but we must keep in mind the stock market always leads the real economy by many months. I expect the broad markets to consolidate and base for much of 2009 as news continues to get worse, with rising unemployment and continued bankruptcies. During this consolidation, however, the sectors that are poised to lead in the next bull market will actually begin to slowly breakout out of consolidation on their own. These sectors are ahead of the curve, when the market officially shifts from a consolidation phase to a bull phase, they will have already been in a bull market for many months. Expect them to top the charts as the best performers at the end of 2009. Going forward the key is to identify these sectors. Your responsibility as an investor is to simply prepare and get ready for the inevitable upswing. To do this, we study the charts using relative strength as a key tool.

Relative strength is a simple technically analysis tool that measures how a stock is performing relative to others. It is calculated by dividing the price performance of a stock or sector by the price performance of another sector. It is an absolutely vital instrument to be used at the end of bear markets. I believe it is virtually the only way of telling us which sectors are going to lead in the upcoming bull, besides using fundamental analysis. The problem with fundamental analysis is that it holds true in the long term and if there is anything of benefit Keynes contributed, it is the adage that “in the long run, we are all dead.” Thus, we are forced to study the charts and adapt to the trend, not argue why there should be a trend. Adapt and stay ahead of the curve.

Historical and fundamental analysis aside, the charts are what initially sparked our interest in the airline sector. Upon reviewing the relative strength of a few hundred sectors in the stock market, we have found that it is currently, by far, the best performing. The charts speak for themselves:

As years of excess liquidity and an out of control hedge fund industry finally caught up with the market, the rush for liquidity quickly drove down stocks but airlines somehow managed to hold their ground. From mid-July to the end of November, the DOW declined over 30% while the XAL increased over 20%. That is correct, airline stocks actually INCREASED while the global stock markets crashed. The trend of consistently higher lows since July, in the face of a global meltdown, is remarkable. We could find no other sector that boasts anything close to level that performance. It is a very strong indication that airlines will outperform going forward, as the stock market consolidates and eventually enters a bull market. As I did not want my chart to mirror a Picasso, I chose not to include a horizontal line in the $28 dollar area that would convey that there may be an ascending triangle forming. A very bullish configuration that, if broken, would lead to an explosive upward movement. Furthermore, note the movement about the 200-day MVA, such positive action is still months away for the broad indices. Going forward, the best approach will be to wait for a further correction in the airlines, as they are not yet oversold. If they do not continue their retraction then we will scale-in on a breakout of the ascending triangle.

Other sectors were critically reviewed in the same manner but they all came up short in one way or another. The gold sector, however, does standout and show plenty of promise. As airlines made their lows in July, gold stocks took until October to make their lows. It is still a month ahead of the stock market and thus a bullish indication but not the four months that airlines offered. Furthermore, the HUI cannot be discounted, as gold stocks are historically a very volatile sector. They have already more than doubled, just like airlines, from their lows. On a percentage basis, gold stocks should offer just as much opportunity but the key is not put all your chips in just one sector and risk you entire portfolio on one bet. We were forced to do this last year but only because we believed the markets were topping. At the time, shorting using ETFs was the only viable option. In bull markets however, there is a lot more opportunity to diversify and that opportunity should be taken advantage of.

A long-term view better conveys the carnage that has taken place. As the stock market went wild up to 2000, airline stocks had already topped in 1998, a very bearish signal right from the get-go. The sector would go-on to fall the next ten years, as it continuously underperformed in all rallies and lead in all declines. The tides, however, have turned and today's action suggest the next few years will be some of the strongest seen in a very long time.

Unfortunately, there is currently no convenient ETF through which to purchase a basket of airlines. My understanding is that Claymore Securities has applied and is awaiting approval to launch its airline ETF. It will be compromised of 24 airlines, 70% domestic and 30% international and could start trading as early as this month. Until that option is made available to us, we will be strictly covering individual airline stocks. I personally believe picking individual stocks provide more opportunity to profit, as you can mitigate business risk by diversifying among several companies while being able to avoid ones that hold less promise.

Below we present the charts of major airlines of interest, most appear to be creating an ascending triangle pattern, much like the $XAL. Once this pattern is broken out of, the rise could be very sharp and immediate. Just as we compared the relative strength of the airline sector to the stock market, we go even further to compare the relative strength of the individual airlines to the airline sector to find the ones with most potential.

The largest North American Airline, Delta, was not included as it is trading at a very expensive valuation. The premium may be the result of being the “go-to” airline since it is the biggest. Although relative strength is very strong, we simply believe there are better opportunities elsewhere. Southwest has been demonstrating extremely weak relative performance. Although fundamentally, it appears to be a bargain with forward P/E of 14.11 and trading at just $8.61, the charts are telling us something is wrong. We will continue to monitor but for now, stay away.

For Canadian investors, the airline sector has unfortunately become very small, as the past decade has brought endless bankruptcies and mergers. Canadians currently only have a choice between two major airlines, Air Canada and West Jet. Air Canada looks abysmal on the charts and bull market or not, they will underperform the rest of the sector. Despite bankruptcy protection, they simply cannot get their act together. They are bogged down by unions and incompetent management. West Jet is the only viable option, union-free and trading at $14 with forward P/E of 9.68. One could easily argue West Jet is the best run airline in North America but looking at the charts, it has had an incredible run the past few weeks and buyers should hold off for a dip.

It looks as though the markets may have put in a bottom on Thursday with an intraday reversal. If this is the case then the Obama rally may actually come to materialize and airlines would be expected to break out in the coming days. If markets still continue lower than the airline stocks should hit resistance very soon. Either upon break-out or at resistance, we will be looking to add some positions. They should provide great returns in the coming rally that should last into the spring, before a final retracement back to November lows. Subscribers should look forward to an email update if we add any positions.

By Daniel Smolski

smolski@gmail.com - Smolski Investment Newsletter

For a limited time , we are opening our services to new subscribers and are currently offering a FREE trial to the Smolski Investment Newsletter. We had an extremely profitable year in 2008 but we strongly believe 2009 will be one of the best in a long time; those correctly positioned will reap the biggest rewards. In the next few weeks, we will continue to monitor the markets and specify which sectors are poised to provide the greatest returns. Do not hesitate to send us an email with “SIGN UP” as the subject line at smolski@gmail.com .

© 2009 Copyright Daniel Smolski - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daniel Smolski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.