Deflationary Pressures Impact on Stocks, Gold and Commodities

Stock-Markets / Financial Markets 2009 Jan 17, 2009 - 11:06 AM GMT

Consumer prices going down -The Consumer Price Index for All Urban Consumers (CPI-U) decreased 1.0 percent in December, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The December level of 210.228 (1982-84=100) was 0.1 percent higher than in December 2007.

Consumer prices going down -The Consumer Price Index for All Urban Consumers (CPI-U) decreased 1.0 percent in December, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The December level of 210.228 (1982-84=100) was 0.1 percent higher than in December 2007.

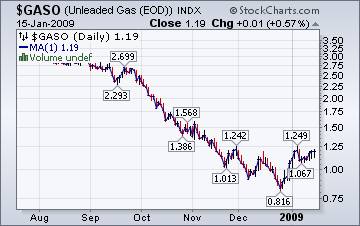

A record plunge in gasoline prices pushed overall consumer prices down for the third straight month in December, closing out a year in which inflation rose at the slowest rate in more than a half-century. Concerns remain low about possible deflation, but represent a marked change from just six months ago when soaring energy prices threatened to trigger a widening inflation problem that many analysts believed the Federal Reserve would have to fight by raising interest rates. Now the Fed has reduced interest rates to zero, prices are still going down.

Fed becomes the largest shareholder of Bank of America.

Two weeks after closing its purchase of Merrill Lynch at the urging of U.S. regulators, the government cemented a deal at midnight Thursday to supply Bank of America with a fresh $20 billion capital injection and absorb as much as $98.2 billion in losses on toxic assets, according to people involved in the transaction.

The bank had been pressing the government for help after it was surprised to learn that Merrill would be taking a fourth-quarter write-down of $15 billion to $20 billion, according to two people who have been briefed on the situation, in addition to Bank of America's rising consumer loan losses. Do taxpayers get shares of B of A stock?

Temporary setback or new trend?

-- A decline in U.S. stock indexes below the 2008 lows from November may trigger a rout that pushes benchmark averages to levels not seen since the mid-1990s, according to two leading technical analysts.

-- A decline in U.S. stock indexes below the 2008 lows from November may trigger a rout that pushes benchmark averages to levels not seen since the mid-1990s, according to two leading technical analysts.

“Hopefully we don't make new lows, because if we do, all bets are off,” said Ralph Acampora , who retired from Knight Capital Group Inc. in October 2007 after four decades on Wall Street. We'll find out soon. But first, the Obama Rally.

Will Bonds rally again?

-- Treasuries dropped , with 10-year notes ending a six-day rally, after the U.S. agreed to invest $20 billion in Bank of America Corp. and lawmakers unveiled an $825 billion plan to snap the recession. Benchmark securities fell the most in almost two weeks, pushing yields to about a quarter percentage point more than the record low set last month, on speculation President-elect Barack Obama will increase borrowing to record levels to pay for the stimulus packages.

-- Treasuries dropped , with 10-year notes ending a six-day rally, after the U.S. agreed to invest $20 billion in Bank of America Corp. and lawmakers unveiled an $825 billion plan to snap the recession. Benchmark securities fell the most in almost two weeks, pushing yields to about a quarter percentage point more than the record low set last month, on speculation President-elect Barack Obama will increase borrowing to record levels to pay for the stimulus packages.

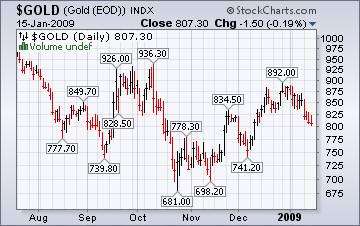

Gold may be under deflationary pressure.

Gold rose the most in five weeks as a weaker dollar boosted demand for the precious metal as an alternative investment. Silver also gained. “The dollar is weaker and the stock market is stronger, so people aren't having to sell gold to cover losses in other markets,” said Matt Zeman , a metals trader at LaSalle Futures Group in Chicago. “There's a general return to risk appetite.” But will it last?

Gold rose the most in five weeks as a weaker dollar boosted demand for the precious metal as an alternative investment. Silver also gained. “The dollar is weaker and the stock market is stronger, so people aren't having to sell gold to cover losses in other markets,” said Matt Zeman , a metals trader at LaSalle Futures Group in Chicago. “There's a general return to risk appetite.” But will it last?

Japanese stocks face reality as “window dressing” period is over.

-- Japanese stocks rebounded, paring their steepest weekly decline in more than a month, as a weaker yen raised speculation that company earnings will improve. The gauges extended their gains in afternoon trading after the yen weakened to the day's low and the U.S. government said it agreed to invest $20 billion more in Bank of America Corp. to prevent the financial crisis from deepening.

-- Japanese stocks rebounded, paring their steepest weekly decline in more than a month, as a weaker yen raised speculation that company earnings will improve. The gauges extended their gains in afternoon trading after the yen weakened to the day's low and the U.S. government said it agreed to invest $20 billion more in Bank of America Corp. to prevent the financial crisis from deepening.

When will the Shanghai Index see a hard landing?

-- ( Bloomberg ) -- China's stocks advanced, sending the benchmark index higher for a second week, on speculation the government will speed up support for machinery makers and brokerages to revive earnings and counter an economic slowdown.

-- ( Bloomberg ) -- China's stocks advanced, sending the benchmark index higher for a second week, on speculation the government will speed up support for machinery makers and brokerages to revive earnings and counter an economic slowdown.

China faces an economic “hard landing” with growth slowing to 6 percent or less this year, the weakest pace since 1990, Fitch Ratings said today.

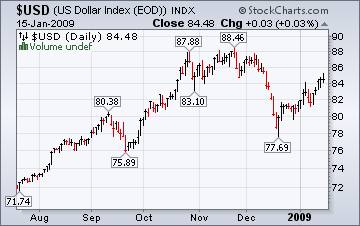

The Dollar declines…what happens next?

( Bloomberg ) -- The yen dropped the most in a month against the euro while the dollar declined as measures to stabilize banks reduced demand for the currencies as havens.

( Bloomberg ) -- The yen dropped the most in a month against the euro while the dollar declined as measures to stabilize banks reduced demand for the currencies as havens.

“Risk aversion being reduced is really what's happening in the market,” said Meg Browne , a currency strategist at Brown Brothers Harriman & Co. in New York. “The U.S. dollar in general is under pressure.” The question is, will banks stabilize or will more of them need assistance?

Foreclosure prevention not working.

( Reuters ) - U.S. foreclosure activity jumped 81 percent in 2008, with one in every 54 households getting at least one filing notice, suggesting various state laws and private programs to slow the process have been ineffective, RealtyTrac reported on Thursday.

( Reuters ) - U.S. foreclosure activity jumped 81 percent in 2008, with one in every 54 households getting at least one filing notice, suggesting various state laws and private programs to slow the process have been ineffective, RealtyTrac reported on Thursday.

"Clearly the foreclosure prevention programs implemented to date have not had any real success in slowing down this foreclosure tsunami," James J. Saccacio, chief executive officer of RealtyTrac, said in the report.

Change of trend…or a bump in the road?

The Energy Information Administration reports that, “ One of the consequences of the dramatic deterioration in the economic outlook is a reduction in expected petroleum consumption. Over the last 12 months the forecast for average 2009 total U.S. petroleum consumption has been lowered by just over 2 million barrels per day (bbl/d) as shown on Table 1. This lowering of the 2009 consumption outlook not only reflects the poorer 2009 economic outlook, but also the dramatic decline in consumption during 2008 in response to pressure from rapidly rising prices in the first half of the year and the accelerating economic downturn in its latter half. ”

The Energy Information Administration reports that, “ One of the consequences of the dramatic deterioration in the economic outlook is a reduction in expected petroleum consumption. Over the last 12 months the forecast for average 2009 total U.S. petroleum consumption has been lowered by just over 2 million barrels per day (bbl/d) as shown on Table 1. This lowering of the 2009 consumption outlook not only reflects the poorer 2009 economic outlook, but also the dramatic decline in consumption during 2008 in response to pressure from rapidly rising prices in the first half of the year and the accelerating economic downturn in its latter half. ”

Natural gas prices decreased for the week in the lower 48 states.

The Energy Information Agency's Natural Gas Weekly Update reports, “ Spot prices at trading locations in the Northeast increased sharply this week, gaining on average more than $5 per MMBtu. However, spot market locations in other areas of the country exhibited significant decreases, including the West. Weather conditions largely dictated the difference in price movement. However, trading locations in the Midwest largely failed to react to the cold temperatures.” The reason is that home heating is only a small part of natural gas prices. Industrial use of natural gas plummeted as factories went idle this month.

The Energy Information Agency's Natural Gas Weekly Update reports, “ Spot prices at trading locations in the Northeast increased sharply this week, gaining on average more than $5 per MMBtu. However, spot market locations in other areas of the country exhibited significant decreases, including the West. Weather conditions largely dictated the difference in price movement. However, trading locations in the Midwest largely failed to react to the cold temperatures.” The reason is that home heating is only a small part of natural gas prices. Industrial use of natural gas plummeted as factories went idle this month.

Is there “blood in the Streets,” or is it only red ink?

Here's an article by Gary North.

Red ink is flowing because politicians, economists, and central bankers believe that boondoggles are better than unemployment. They believe that fiat money is a substitute for capital creation. Capital creation requires increased thrift, and we have been told by Keynes that thrift is destructive in a recession, let alone a depression. We must spend ourselves into prosperity.

It will not work. The unemployment rate will rise, home prices will fall, sales of new cars will fall, and the manufacturing sector will continue to decline.

At some point, there will be blood in the streets. Investors will give up hope of ever getting their money back in the stock market. That will be a time to buy . . . Asian stocks.

At some point, there will be blood in the streets. Investors will give up hope of ever getting their money back in the stock market. That will be a time to buy . . . Asian stocks.

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.