John Lee's Forecasts On Gold And Financial Markets For 2009

Stock-Markets / Investing 2009 Jan 16, 2009 - 04:07 PM GMTBy: John_Lee

In 2008 we saw some of the most dramatic financial events in a century:

In 2008 we saw some of the most dramatic financial events in a century:

* $trillions of subprime mortgage implo sion, which bankrupted the entire US banking system .

* Lehman's fallout with entangling positions in equities, futures, real estate, and derivatives in the $hundreds of billions . The magnitude dwarfed LTCM.

* Biggest squeeze on the dollar . D espite worsening fundamentals, dollar rallied 20% in the second half of 2008 as banks refused to loan and assets are sold to pay dollar debts.

* Largest de-leveraging process . Margin calls caused severe corrections (-50% or more) in broad equities and commodities.

* Un precedented intervention with multi-$trillion financial bailouts and record - low interest rates o f near 0% .

What's in store for 2009?

We will make our calls with the aid of following charts

Gold:

Case for: Gold is liquid, compact, universally accepted, and can not be created or diluted at will. As investors face zero% yield, uncertain economic times, and daunting deficits, it's no surprise that gold came through 2008 unscathed.

Case Against: Gold has faired very well while all other asset classes endured severe correction in 2008. Gold right now is near its historic high compared to oil and copper. It is an emotional investment, which makes the top and bottom difficult to call.

Verdict: I look for side-way action for gold between $700 and $1,000 / oz as markets battle through fears of depression to come to gri p s with inflation.

US Dollar:

Case For: US A is the world's largest economy by far. US dollar is the most liquid currency and de-facto settlement currency for global trades. As we go through the deleveraging process, dollars will continue to be raised for debt repayment. Comparatively speaking, currencies that make up the dollar index basket are in no better shape.

Case Against: US budget deficit will exceed $1 trillion /year, well over 5% of GDP for the foreseeable future. This puts a strain on the dollar. There are also record amount of dollars ab road yet to be diversified and spent .

Verdict: The factors that drove up the dollar are temporary; therefore a dollar correction could be underway soon. I see dollar index between 88 and 72 for 2009.

S&P 500 :

Case For: S&P 500 dividend yield is on par with interest rate yield; something not seen since 1950's and provides support for equities. Globalization helps Americans tab into new markets (for example, there are 350 million smokers and net-users in China ) and enables international investors tab into US equities. Lastly the financial sector has been decimated and is weighted minimally in the index.

Case Against: The world economy is slowing down. Many companies are straddled with debts and phased - out products, and likely won't survive.

Verdict: Today's dollar is perhaps half of what it was 10 years ago. The S&P500 index is trading at a decade low . At zero % interest rate, I don't see much downside and would peg S&P500 between 800 and 1,200 for 2009.

Gold Stocks:

Gold stocks provide leverage to the gold price with high fixed cost and low marginal cost. Gold stocks couldn't shake off the equity bloodbath and disappointed investors by losing 30%+ in 2008. The action for 2009 will remain volatile as margin calls will continue to cause weak hands to sell into strong hands. There are also many poorly managed gold companies that won't survive through permitting issues, high operating cost, and geopolitical risk. Gold equity valuation is about earnings and ounces in the ground. I am not wildly bullish on gold stocks yet as speculative spirits could take months to return . H owever a modest rebound to 150 from current 105 is very reasonable and represents healthy percentage gains.

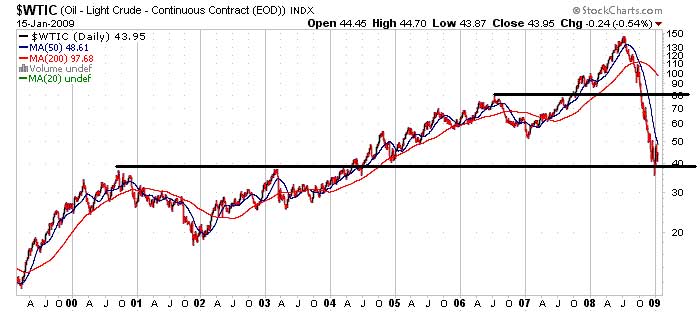

Oil, Copper, Silver :

Case For: In 2008, Oil and Copper staged the biggest crash in their respective history with oil losing 75% in 6 months ($145 to $35 /barrel ), and copper down 70% from $4 to $1.25 /pound . Commodity prices such as nickel, zinc , and oil are at decade lows having adjusted for inflation. The large contango in oil futures suggest s big moves could be ahead. With the margin calls winding down, the slightest addition of speculative money will provide oil with substantial lift.

Case Against: Inventories are piling up for oil and select commodities. The global slowdown will continue to put a demand constraint on commodity usage. Many of the oil investors are licking their wounds and might not return in short order.

Verdict: Faced with imminent dollar correction and inflationary monetary policies, commodities at today's prices have more room to go up than down, particularly zinc which peaked much earlier and therefore has a stronger base. My calls for oil are between $40-$60 /barrel , copper $1.25-$2 /pound , silver $10-$15 /oz, and zinc 60cents to $1/pound .

S&P TSX Ventures Index (Proxy to Junior Mining Stocks) :

Case for: In the heat of the credit crunch in Nov 2008, we saw a handful of junior mining issues trading at upwards of 70% discount to cash values. Toronto saw zero IPOs in Q3. Unless oil dives to $20 and copper goes below $1, I would say the capitulation has already occurred in the junior resource sector.

Case against: Majors such as Teck and Rio Tinto are straddled with debt and depressed commodity prices , this make s junior buyouts less likely. Financing junior issues will continue to be difficult, and speculative appetite (i.e. dispensable cash) will not return to the 2008 level with growing unemployment.

Verdict: Look for 700 as bottom and 1 , 250 as peak for 2009. Bargains abound today so you can be very selective. Avoid gigantic low grade deposits with big promises and big CapEx . Buy companies that are debt free, cash - rich with confirmed economic deposits, and preferably already producing or developing with secured financing.

Global Equities (using Shanghai Stock Exchange Index as Proxy) :

Case for: The index lost a stunning 70% in 2008 and currently rests on decade- long support level. China 's GDP growth while slowing still project s to be 5-10% for 2009. Asia is minimally involved in the subprime crisis and Asian consumers have collectively better balance sheets than American counterparts.

Case against: Exports to US account for 10-20% of China's GDP, US slowdown invariably affect s the Chinese economy. Lingering economic concerns and shrinking investment capital means spring-board style rebound is not likely in 2009.

Verdict: In Asia, 2009 will mark a major shift of focus from US exports to developing domestic consumption . D espite good fundamentals, I am not wildly bullish on Asian markets just yet. However a decent rebound of 20-25% from currently depressed level is achievable in 2009.

Conclusion: Since 2001, we saw world GDP grow at the fastest pace since WWII, doubling to $55 trillion. Fundamentally, industrialization of Asia and Middle-east spurred growth and vast commodity consumption. On the investment side, dollar savers of 20 years came to the epiphany that dollars are no better than Brazil Real (literally based on currency performance) and started the massive flight from dollars.

This dollar diversification coupled with low interest rates further fueled commodity, real estate, and equity markets world wide. All this is at the expense of the dollar, which lost some 60% measured by the dollar index. Gold predictably went up 300% from $250/oz to over $800/oz.

2008 is a hiccup to the above trend. Housing implosion bankrupted US banks and caused temporary hard squeeze on the dollar. Helicopter Ben and Mr. Obama have promised to take whatever fiscal and monetary action necessary to revive the economy. And those official don't mince with their words as witnessed by the Fed's purchase of $trillions of bad loans and Obama's massive fiscal stimulus proposals. All this seals the death fate of the US dollar and will likely invoke imminent panic from dollar holders.

Growth in Asia and elsewhere in the world will not stop just because no more dollars are coming from the US consumers. Pick China as an example; frankly would China worry about not getting more dollars when it already has $1.5 trillion ? Granted the US economy is in emergency distress mode, but can the US population, which account for 5% of the world population, really drag down the rest of the world for years and years to come? I think not.

In fact, from a long term worldly perspective, 2008 might be the catalyst that accelerates global wealth distribution and growth going forward. When will we see good times again in Shanghai and Buenos Aires? When will happy patrons return to the empty restaurants and department stores? Processor speed doubles every 18 months, the pace of progress is fastening exponentially. While growth maybe anemic in 2009, don't count out packed seats in the Vancouver Winter Olympics in 2010!

John Lee, CFA

johnlee@maucapital.com

John Lee is a portfolio manager at Mau Capital Management. He is a CFA charter holder and has degrees in Economics and Engineering from Rice University. He previously studied under Mr. James Turk, a renowned authority on the gold market, and is specialized in investing in junior gold and resource companies. Mr. Lee's articles are frequently cited at major resource websites and a esteemed speaker at several major resource conferences.

John Lee Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.