The Trading Opportunity of 2009 Shorting U.S. Treasury Bonds

Interest-Rates / US Bonds Jan 15, 2009 - 01:06 PM GMTBy: Guy_Lerner

In a previous post on long term Treasury bonds, I reviewed some of the technical factors that have me bearish. "So it is highly likely, from this perspective, that Treasury bonds will be an under performing asset class over the next 12 months. But more importantly, will this market top lead to an investing opportunity (i.e., by shorting Treasury bonds)? In other words, will the market top lead to a secular trend change in Treasury bonds?"

In a previous post on long term Treasury bonds, I reviewed some of the technical factors that have me bearish. "So it is highly likely, from this perspective, that Treasury bonds will be an under performing asset class over the next 12 months. But more importantly, will this market top lead to an investing opportunity (i.e., by shorting Treasury bonds)? In other words, will the market top lead to a secular trend change in Treasury bonds?"

On this, I am a little less certain. As we know, many (i.e., see the Barron's story, "Get Out Now") are calling for a top in Treasury bonds, yet as I contend, market tops don't occur when we all expect them too. Furthermore, I wonder if betting against bonds is a good strategy as a bet against Treasury bonds is a bet against the US Government. The Federal Reserve and Treasury have made their intentions known and are likely to support bond prices.

But what if bond market participants are right? What if they are buying not because there is a flight to safety (due to losses in other assets) but because they see value in borrowing at 0% and buying long dated Treasuries that yield between 2-3%? In a deflationary environment such as seen in a recession, this certainly makes sense.

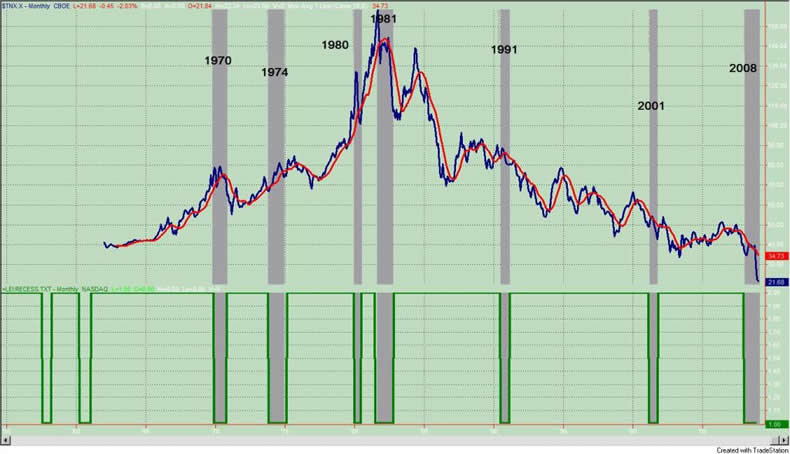

In essence, buying bonds is really a bet that the Fed's reflationary policies will not work. Buying bonds is a bet that our economic malaise will continue much longer, and this notion is clearly supported by the data. See figure 1 a monthly chart of the yield on the 10 year Treasury bond. The indicator in the lower panel is an analogue representation of the National Bureau of Economic Research's (NBER) expansions and contractions. The NBER is the government organization that officiates over the beginning and ending times of a recession. On the graph, the gray vertical bars highlight recessions. The relationship between Treasury yields and economic contractions is easily seen. It would be highly unusual for yields to rise during a recession.

Figure 1. 10 Year Treasury Yield v. NBER/ monthly

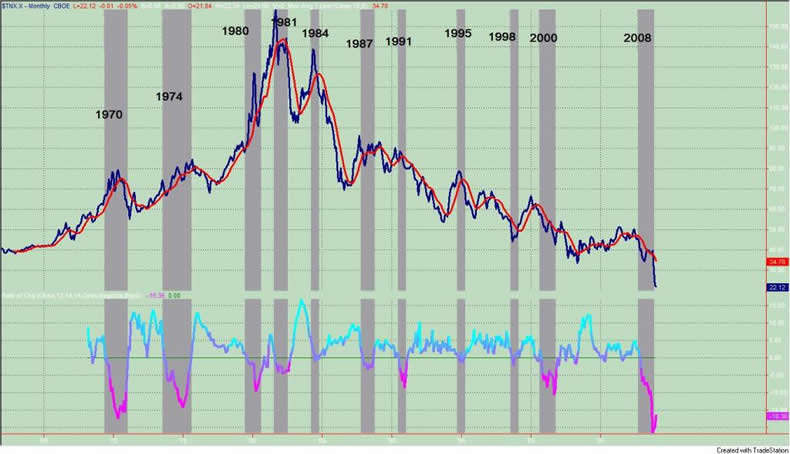

Let's look at the relationship between Treasury yields and economic activity in another light. See figure 2 a monthly chart of the yield on the 10 year Treasury bond. The indicator in the bottom panel is 12 period rate of change of the Leading Economic Indicator data from the Economic Cycle Research Institute . As noted in a prior commentary , there is a very strong correlation between negative indicator readings and contracting economic activity. The gray vertical bars highlight economic contractions.

Figure 2. 10 Year Treasury Yield v. ECRI LEI/ monthly

In 10 out of the 11 instances sited, long term Treasury yields headed sharply lower during the economic contraction. The lone exception was in 1974, and yields went higher only to retrace that move once the expansion took hold.

If the past relationship between Treasury yields and economic activity is any guide, we should not see Treasury yields rise while the economy is contracting. However, once the Fed's policies begin to take hold and when the economy begins to expand, then it would seem more probable that a secular trend change for yields is on the horizon.

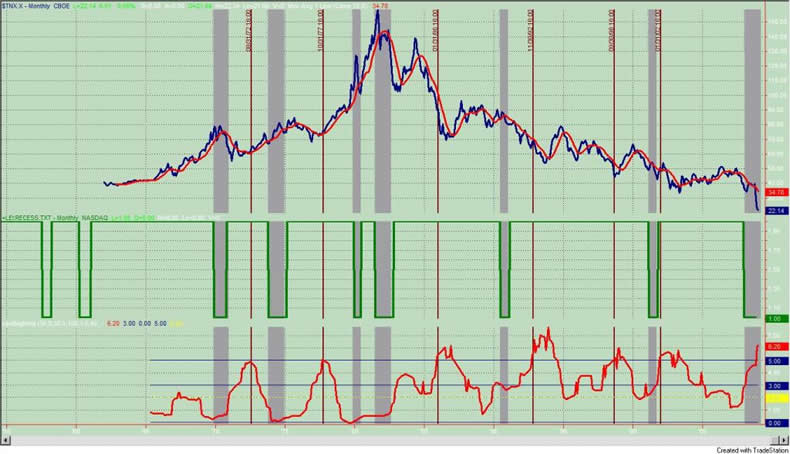

My bearishness on Treasury bonds is based upon the 'next big thing" indicator, which is a tool that I have developed that helps me identify the potential for a secular trend change in an asset. I have shown this indicator in figure 3, which is a monthly chart of the 10 year Treasury yield with the NBER data in the middle panel. Recessions are identified with the vertical gray bars and peaks in the indicator, which correspond to a bottom in yields, are noted with the maroon colored bars. The indicator is in the extreme zone, and once again, suggestive of a top in bonds or at the very least,Treasury yields should not go much lower.

However, the real story of figure 3 is this: bottoms in yields don't come during economic downturns, and more often than not a bottom in yields will come once the economic expansion is well on its way.

Figure 3. 10 Year Treasury Yield v. NBER v. "Next Big Thing"/ monthly

It does not seem likely that long term Treasuries will sell off (i.e., leading to higher yields) until the economic landscape improves. However, given the size of the Fed's stimulus response so far that sell off could be brutal once our economic fortunes improve. Given that the "next big thing" indicator is in the extreme zone, it is worthwhile keeping this asset class on the radar screen.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.