Financial Markets Vertigo and Forecasts for 2009

Stock-Markets / Investing 2009 Jan 13, 2009 - 11:04 AM GMTBy: John_Mauldin

I get a lot of newsletters from money managers around the country, which I try and read as they are written by people who are “in the trenches,” actually making decisions on behalf of their clients. It broadens my perspective. Frankly, most are not all that well written and unimaginative, but who ever said writing was easy? But some really strike a chord with me. Today’s Outside the Box I have read twice, which is unusual for me. Cliff Draughn is a wealth manager in Savannah, Georgia (Draughn Partners) and a good friend. His letter is a wide ranging tome on a variety of topics, but is full of common sense and one that I think will resonate with readers. I trust you will enjoy this.

I get a lot of newsletters from money managers around the country, which I try and read as they are written by people who are “in the trenches,” actually making decisions on behalf of their clients. It broadens my perspective. Frankly, most are not all that well written and unimaginative, but who ever said writing was easy? But some really strike a chord with me. Today’s Outside the Box I have read twice, which is unusual for me. Cliff Draughn is a wealth manager in Savannah, Georgia (Draughn Partners) and a good friend. His letter is a wide ranging tome on a variety of topics, but is full of common sense and one that I think will resonate with readers. I trust you will enjoy this.

John Mauldin, Editor

Outside the Box

Market Vertigo

by Cliff Draughn

"We give you a Republic; now see if you can keep it." -- Ben Franklin

As I have remarked in prior calendar-turning newsletters, it is this time of the year when most people pause to reflect on the past, ponder the present, and plan the future. The New Year always rings in with the soothsayers and fortunetellers of the market invading our consciousness with their predictions for the future. Investors' behavioral "herding instinct" seeks reassurance from the analysts of Wall Street that we indeed possess wisdom, and we search to find our thoughts confirmed in The Wall Street Journal, The Economist, Business Week and Forbes. Like most market pundits at the beginning of every New Year, I am tempted to weigh in on the absolute numbers prediction game and throw out my best guess as to what the next twelve months hold in store.

However, experience has taught me that these types of predictions always prove me to be far smarter or dumber than I deserve. For if I had predicted at the beginning of 2008 we would experience freezing credit markets, bankruptcies and near bankruptcies of our largest of financial institutions, massive amounts of taxpayer monies used to "save" the financial system, the worst recession numbers since the Great Depression, unemployment at 7% and rising, mortgage defaults at unprecedented levels, "deleveraging" on a global basis -- and toss in oil going from $95 a barrel to $145 a barrel and back to $37 -- then you would have sought to admit me into a mental ward for treatment last January. Add the miserable economic news reports of 2008, with market declines for the S&P 500 of 37%, the EAFE at -41.04%, and Emerging Markets of -48.88%, and is anyone surprised that most investors are beginning 2009 shell-shocked, scared, and (after Uncle Bernie's confession) doubtful that anyone on Wall Street is capable of the truth? Or, should we even call Wall Street the financial center anymore, since power in the financial markets has clearly shifted to Pennsylvania Avenue?

I fear that the US Treasury, the Federal Reserve, and the White House may decide who wins and who loses in the capital markets over the next three to five years. At the core of their decision-making process is the cattle prod of all cattle prods to get this economy moving: the existing TARP plus Obama's promised $850 billion stimulus package (with $310 billion in tax cuts). Could Pennsylvania Avenue be administering electrical stimulation to a dead horse? Perhaps it's time they consider breaking a new horse to ride, preferably one that does not gobble financial engineering as its main fare.

I titled 2008's first-quarter Newsletter "The Year of the Rat: Ultimate Minsky Time," and was that ever appropriate. In Hyman Minsky's economic teachings he states:

"The Financial Instability Hypothesis suggests that over periods of prolonged prosperity, capitalist economies tend to move from a financial structure dominated by hedge finance (stable) to a structure that increasingly emphasizes speculative and Ponzi finance (unstable)."

Our economy and markets could not have been perceived to be more stable from 2003-07, only to become completely unstable in 2008. As evidence of the market's instability, Howard Silverblatt, a noted S&P senior index analyst, observed that the S&P 500 rose or fell more than 5% on 17 trading days in 2008. When one considers there were only 17 trading days in the previous fifty years when the S&P rose or fell more than 5% in a day, then I think you can appreciate the unprecedented volatility we have experienced! As my grandmother would say, "Lordy, Lordy, what's the world coming to?" The increased volatility, sudden failure of credit and confidence, and a market crash unlike we have seen since the Great Depression are definitely indicative of "Ultimate Minsky" time. The volatility of the last quarter begs the question: could we get any more unstable?

In another reflection on last year's newsletter title, 2008 gave us the ultimate of all rats: Bernie Madoff. The warning signs were there: people like Harry Markopolos wrote the SEC on numerous occasions, and yet nothing was done. In my opinion, Mr. Madoff has done more harm to the investment community than any single individual I can remember in financial history. Samuel Isreal, Jerome Kerviel, Brian Hunter, Giancarlo Paretti, Nick Leeson, Ivan Boesky, Lou Pearlmen, and the eponymous Mr. Ponzi all pale in comparison to the economic, social, and trust destruction wrought by this single investment sociopath. In the Old Testament, the Bible speaks of the "Toevah," which is defined as "an abomination." On Bernard Madoff's tombstone, I hope they inscribe "The Great Toevah."

However, the financial crisis of 2008 cannot be blamed on worthless financial instruments; rather the fault in the system is worthless people. The credit default swap and derivative traders of AIG and other financial institutions who siphoned millions of dollars in bonuses for abusing the financial system and knowingly created unprecedented amounts of risk liability should be made to pay the bonuses back or be thrown in jail. The same could be said for SEC enforcement officers who turned a blind eye to certain institutions in hopes of securing lucrative employment once they left the SEC, from the very people they were supposed to be regulating. It disgusts me to think the taxpayers of this country are financing the multi-million dollar lifestyles of rogue traders and executives who now lounge on the beaches of Monte Carlo. I do not blame Main Street for its anger at Wall Street and the regulators who supposedly oversaw the investment world.

Without a doubt, 2008 was an historic year from a number of perspectives, and it is frankly one that I am glad to see in the rear-view mirror.

At the beginning of last year we put forth the following themes that would influence markets during 2008:

- Credit and Liquidity

- Bond Insurance Woes -- AMBAC, MBIA, FGIC

- The Dollar

- Commodities

- Investor Psychology

Our thesis of a contracting credit market in the face of a declining real estate market was one of the easier predictions for 2008. What we missed, as did the Federal Reserve Chairman, Treasury Secretary, and almost everyone else in the investment world, was the severity and swiftness of the contraction and subsequent deleveraging of bank balance sheets. What happened to regulatory oversight and orderly markets? As we entered the fourth quarter of 2008 our financial system teetered on the edge of collapse, and the banking industry's ability to raise capital in the face of mounting loan and investment losses became impossibly difficult. Therefore, the Fed and the Treasury did the only thing they knew and utilized the taxpayers' balance sheet to be the lender of last resort for banks (Keynesian economics). Subsequently every other business lined up with its hand out, too.

My fear of the 2008 government actions, specifically the enactment of the Housing and Economic Recovery Act (aka "HERA") in July and the Emergency Economic Stabilization Act (aka "EESA") in October, is that we are replacing our "Capitalist" system with a "Socialist" system and jeopardizing the principles that made this country great. The slope of socialism narrows and turns very slippery once government intervention and ownership of certain industries occurs. When corporate welfare programs begin, then it is inevitable that everyone jumps on the free-lunch bandwagon. One only need look at France and its economic picture to realize the problems associated with socialism in a supposedly free market environment. It reminds me of when Dr. Phil questions one of his guests who is obviously going down the wrong path. After the participant cops to his or her mistake, Dr. Phil typically looks up and asks, "And how's that working for you?" If the US continues a path of socialism and industry bailouts, then in another ten years our children are going to look up and ask, "So how's this working for you?' I think we know the answer.

So Cliff, what now? We all are very aware of where we are, but it is impossible to move forward by driving in the rear-view mirror.

My investment themes for 2009 are as follows:

- President Obama -- Great Expectations (also known as "ObamaRama")

- Aging and Saving -- The Face of the American Consumer

- A Market of Hope

Barrack Hussein Obama -- America's 44th President

"So now, as an infallible way of making a little ease great ease, I began to contract a quantity of debt." -- Charles Dickens, Great Expectations

In November of 2008 we witnessed an election of epic proportions for the United States of America. The 2008 election will, in my opinion, foretell the fate of our industry and country throughout the lives of my children, as the actions taken over the next twelve months could reshape our systems and capital structure. To all the Op-Ed pieces that have been written on President Barrack Obama, I do not think I could add more commentary as to how one man will turn things around. He has instilled a sense of hope and a level of confidence not only to Wall Street but more importantly to Main Street. Hope and confidence are crucial to the eventual reversal of our current financial and economic woes, because they lead to the re-establishment of trust that is essential to the restoration of the global economy.

However, I caution anyone willing to place significant bets that Obama's "stimulus" plan will reverse the current recession tide any time soon, to simply examine the largess of issues confronting our economy. Expectations are off the charts as to the list of "fixes" that our President-elect and Congress should enact. Congress is essentially the same entity it was in 2004 and 2006, and the "system" does not change easily. The unions expect new labor laws (i.e. "protectionism"), investors expect revised financial regulations (i.e., protect us from the crooks), the auto industry expects to be saved (i.e., revive a corpse), environmentalist expect "green laws" (increased energy costs), the unemployed expect health care and extended benefits (entitlement, "it's my right"), the minorities expect enhanced affirmative action plans (ignoring a competitive global job market), and the average American consumer wants to continue to live an unrealistic lifestyle, given the level of global job competitiveness and increasing amounts of debt incurred by both consumers and our government (i.e., I deserve my father's lifestyle). As my own wise father once said, "Son, you can't borrow yourself out of debt".

President-elect Obama's immediate challenge is to deal with the current financial crisis and the economic recession. In periods of normal recessions, government debts (ours or anyone else's) generally rise because tax revenues decline and government expenditures climb. In 2008, the loss of about 1 million jobs, combined with declining corporate profits, resulted in a deficit of $455 billion versus a 2007 deficit of $163 billion (I am not including any expenses associated with the recent HERA or EESA bailout efforts). Will an $850 billion stimulus package that includes $310 billion of tax reductions work? Better yet, can Obama and his team even get the legislation passed in a timely manner without Congress layering on the special-interest pork and drawing out the legislative process for months while the recession only gets worse? Oh, and did I forget to mention Obama's promise for the withdrawal from Iraq? Israel's invasion of Gaza? The Russians now holding Europe hostage for natural gas? Or, that Pakistan is emerging as THE MOST volatile hot spot for military instability (remember, they have nukes)?

Even if Obama is able to pass the stimulus package and soften the current recession, our country still faces the fiscal task of dealing with the costs of Medicare, Social Security, and Medicaid that are growing at exponential rates due to an aging population. These entitlement programs, if left unchecked, are going to land our country in a much bigger financial crisis within the next 15 years than we are in today. I encourage you to visit these web sites:

- www.fms.treas.gov/frsummary/index.html

- www.gao.gov/financial/fy2008/citizensguide2008.pdf

- http://www.pgpf.org -- Go the documentary feature I.O.U.S.A.

And, I fault Republicans and Democrats alike on this issue, as every administration and Congress since Reagan have punted Medicare, Medicaid, and Social Security to the next elected group. Should we expect any different this time around?

"When the people fear their government, there is tyranny; when the government fears the people, there is liberty." -- Thomas Jefferson

Obama faces multiple risks in the first year of his administration. In my opinion, the first risk he faces is one of "drifting," where he fails to deliver on the promises of the campaign trail and potentially loses credibility. Part of the "drifting" effect will be Congress' ongoing need to participate in all financial issues (and we thought the hearings on use of steroids in baseball were a waste) and to place demands on Obama's team to provide some form of "proof" that the benefits of public spending justify the costs. Of course, this is a ridiculous demand as (a) at no time before has Congress ever demanded proof to justify spending or tax cuts and (b) we are at an unprecedented moment where there are no comparative economic circumstances from which one could hypothecate proof.

The second major risk Obama faces will be the eventual protectionist cries in the name of defending American jobs. By restricting trade and imposing import tariffs (smells like Smoot Hawley all over again), our President and Congress will seek to protect America from an ever more competitive global economy. Sorry to say, but protectionism has not worked in the past nor will it work in the future. However, as unemployment continues to rise, Joe Plumber will want to know why his job is going overseas. The unions did not fully support Obama without reason, and I assure you that Mr. Gettelfinger will be calling on the current administration. When one considers that since the last G20 meeting in November, five of the twenty nations present have already announced intentions to raise import tariffs and restrict trade, then would it be any wonder if the unions pointed to these actions and demanded reciprocity? The countries who intend to begin "protectionist trade practices" include Russia, India, Indonesia, Brazil, and Argentina. What's good for the goose is … beware Mr. President, the wolves are close to the door.

The third risk I foresee for Obama's administration is the continued thought process of "too big to fail." Whether it is financial services, autos, transportation, etc., the "top-down" approach of providing more and more taxpayer dollars to weak corporations is ill-advised. In my opinion, if you're using taxpayer dollars, then either nationalize the company or let it fail. And, if you nationalize the company then wipe out the bond holders and shareholders, replace the management and board, sell the good assets to qualified buyers, and then and only then, have the taxpayers eat the remaining deficit. With the current "bailout system" we are merely trying to sustain the status quo, which penalizes those banking institutions that did not make bad decisions while at the same time rewarding poorly managed institutions by handing them taxpayer money. Until you put the stimulus money back in the hands of the private sector (i.e., the individual) you're fighting today's housing/mortgage fires with a garden hose. The bailout funds need to be distributed to the homeowners, not the banking and lending institutions.

Banks currently taking the government TARP money (our tax money) are adding it as capital to their balance sheets and then sitting on the funds in anticipation of further losses, rather than lending back into the system. Obama should follow the laws of nature: if you have a herd of animals and some become sick, get rid of the sick. Why continue sustaining the sick animals that will eventually die anyway and at the same time risk the entire herd? A prime example of propping up the status quo occurred in December of this year when Treasury Secretary Paulsen made the unilateral decision to guarantee $306 billion of CitiGroup's assets. The guarantee was in addition to the $25 billion Citi had already received in TARP funding. The $306 billion "guarantee" was not part of TARP and was extended without Congressional approval! $306 billion is equal to what our government spent in 2007 for the departments of Agriculture, Education, Energy, Homeland Security, Housing and Urban Development, and Transportation combined. (The Economist) Unfortunately, the only money makers to come out of TARP and the proposed stimulus bill, in my opinion, will be the lobbyists, the legislators (imagine, with our taxpayer money, the campaign contributions to be received!), and a few "selected" legal, accounting, and infrastructure firms.

To date, the Fed/Treasury have made nearly $2 trillion of emergency loans in response to the economic crisis. On December 12, 2008, Bloomberg News sued the Treasury and the Federal Reserve for disclosure of the collateral being supplied by those institutions that were accepting these loans. To date, both Fed and Treasury have refused to disclose, claiming "It would be a dangerous step." Talk about taxation without representation. For the latest on TARP, I refer you to the following report:

www.ustreas.gov/initiatives/eesa/docs/TARPfirst-105report.pdf

"Any system produces winners and losers. If the gap between them gets too great, the losers will organize themselves politically and seek to recast the existing system -- within nations and between them." -- Henry Kissinger, in The Economist

Aging and Saving -- The Face of the American Consumer

Imagine if you will a snake that catches a rabbit for dinner. As we know from 7th-grade biology class, the digestive tract of the snake simply engulfs the rabbit and, if watched over a period of days, the huge bubble progresses through the snake until the rabbit is gone. Now, as a metaphor, would you care to imagine the Baby Boomer generation as the rabbit in the American economy?

Initially, the boomers were the stimulus of economic expansion:

1950s -- parents buy new houses and cars, suburbs emerge, and America is King of Production

1960s -- more housing, more cars, college educations, Made in Japan = cheap, Vietnam, shaken values, Johnson's "War on Poverty"

1970's -- the Boomers emerge with jobs, are new consumers -- more housing, international manufacturing becomes more competitive, US corporations locate operations overseas

1980s -- Reagan tax cuts = increased discretionary spending, revenues up, social programs funded, Iron Curtain falls, technology enables global expansion

1990s -- peak Boomer earnings, corporate America dissolves pensions (funding liabilities, regulatory liabilities, increasing PBGIC premiums) and convince Boomers to "control" their retirement with self-directed 401(k)'s, Moore's Law at work in technology, the Internet becomes hostile to profits, emergence of private equity and venture capital on a large scale, increased financial engineering

2000s -- oops, where did the American Dream go?

The Boomers are now becoming retirees. The latest census data counted 303,824,640 US citizens. We are experiencing an annual birth rate of 14.18 births per 1,000; it is estimated we need at least 24.50 births per thousand to sustain our population (can you say immigration?). More importantly, we are only experiencing 8.27 deaths per 1,000, and the average life expectancy of an American male is 75.29 years, while the average expectancy for a female is 81.13 years … and growing. (CIA.gov library). America is aging, and as a result we are experiencing a decline in the number of workers that provide tax revenues and, more importantly, consumption.

The "big bulge" known as the Baby Boomer generation has been the growth engine of this country for the past five decades. But something happened in the last fifteen years that was not present in the prior years: we stopped saving. The bull market from 1982 to 2000, along with the ever-increasing value of our homes, made our balance sheets appreciate. Why save when our 401(k)'s were up an average of 15% a year and we kept upgrading our homes? Americans became spenders. During the period from 1980 to 2007, our savings rate went from 7.4% of wages and salaries to 1.7%. More importantly, since 2003 our savings rate has averaged less than 2% per year, and these numbers include both the private and government labor force. (Bureau of Economic Analysis)

Wages and salaries (both private and government) make up about 60% of personal income in the US. The remaining 40% is the combination of other labor income (benefits), proprietor's income (farm and non-farm), interest and dividend income, rental income, and transfer payments. Current annual income in the US is estimated at $12.1 trillion per year. As of 12/31/07, the average household income was $50,233 per year and the median was $67,609 per year. In addition, the current average savings rate in the US, as mentioned above, is currently at 1.7% of income per year, and the average amount of debt as a percentage of income is 21.19%. Why bring all this up? If you've read this far, stay with me a little further.

The American Consumer has been the engine of the last expansion. We have bought houses, cars, flat screens, beach condos, etc. and financed the purchases either by extracting the equity from our increasing home prices (home equity lines) or incurring additional debt through credit cards and other forms of consumer finance. In the average American's mind, as long as the bottom line of the balance sheet continued to increase (i.e., assets greater than liabilities) then all was well. But in 2008 something happened that had not happened to these Baby Boomers before: the value of all assets (stocks, houses, rental properties, etc.) declined. As a result the debt party began to unwind as the value of the assets declined while the debt (liabilities) remained, thereby shrinking the balance sheet. Americans are feeling poorer … much poorer.

If one considers that the average 401(k) is now a 201(k) and the average house (according to Case/Shiller) declined 26% from its peak value in 2006, then it's easy to understand why the Baby Boomer is feeling gut punched. The financial shock of watching the asset side of their balance sheets crumble while the debt side remained the same or actually grew has now forced the American consumer into a dilemma: How do I retire and live the same lifestyle that my parents enjoyed? Answer: I have to save money and reduce debt.

The consequence to the economy is, in my opinion, going to be a protracted, painful recession. Why? Because this recession is driven by asset devaluation, and that is different than a cyclical downturn. There is a need for institutions and households alike to reduce debt and restore equity to the balance sheet. For the consumer/individual this will only happen with an increase in his/her saving rate to reduce debt and fund future retirement. For example, if the average consumer goes from a 1.7% savings rate to a 5% savings rate, then that equates to $400 billion a year in either debt reduction or retirement funding. From the contra angle, that means there will be $400 billion less of American consumption. I label this the "Paradox of Thrift," in that we can't restore our balance sheets without additional savings, and our stock markets cannot recover without consumer spending and corporate profitability.

A Market of Hope

We have all read the papers and understand that 2008 was the worst year for stocks since the Great Depression. (As an aside, why do we call it "Great"?) As I read through the analysts reports, newsletters, Bloomberg, etc., there appears to me to be a decisive line between those who are either (a) cautiously optimistic that we have seen the worst and markets will improve or (b) see greater doom ahead, that will equal or surpass the depression of 1929 to 1936. I glean from the community of optimism the following:

- How much more can stocks decline? A 52% decline in the S&P 500 from October of 2007 to the market low on November 20, 2008 is the most dramatic decline in history. The thought is that this decline reflects all the bad news of the economy looking out to 2010, and therefore the worst is over.

- Mutual fund assets currently reflect that 37% of all mutual funds are invested in money market funds. In 2008, the net withdrawal from stock funds was a record $320 billion (Financial Times). The thought here is that at some point, with the cattle prod of .25% Fed Funds rates and negative T-Bill rates, the cash will seek other investment opportunities. Right now, the cash is simply scared while the market reprices risk.

- The recent fall in gasoline prices will promote consumer spending again. The premise here is that the majority of Americans could care less about saving for the future. As a result, they will utilize any savings from energy expenses to resume their prior consumption practices and revive the economy.

- The credit freeze and financial crisis continue to thaw, and the Keynesian policies of the Treasury and Federal Reserve will actually work this time.

- Real estate prices are at a bottom, which will ease the credit and default issues of the mortgage market.

As you have heard me say or have read in prior newsletters: Hope is not a strategy. The following is data from my friend John Mauldin's newsletter regarding corporate earnings:

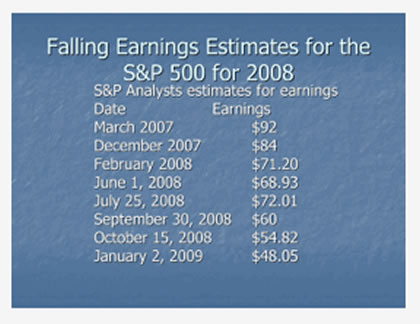

Let's look at their estimates for earnings in 2008. They started at $92 in early 2007 and are now down to $48. This chart is not something to inspire confidence in stock analysts.

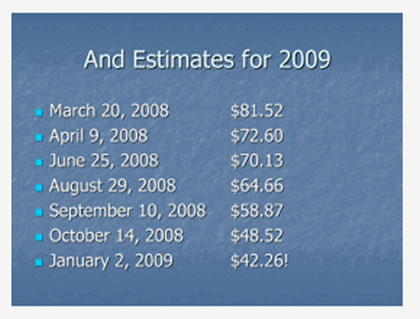

On a trailing one-year basis, that puts the Price to Earnings Ratio (P/E) at over 19 as of today's close at 925, which does not make the market cheap. But last year's earnings are history. What about 2009? Again, the analysts are in a race to find the bottom.

The current projections are for $42.26 for 2009. That makes the forward P/E 22. That doesn't look like value at all, when the historical average is closer to 15.

Stocks are not cheap by valuation measures. As a result, we are finding far more opportunity in the credit (bond) markets than the equity markets at this time. I opine that we are bound to a "trade range" on stocks for 2009, with a bottom of 770 on the S&P and a top of 1120. On the housing and real estate front, I estimate that while most of the dramatic declines have occurred, real estate will not begin to recover until late 2010.

All bets and predictions to the upside of the stock market have as their common foundation a belief that the combined spending of the government, at unprecedented levels, combined with extremely low guaranteed interest rates (i.e., my "cattle prod") will lead the herd to a market recovery and stem the recession tide. For a lot of investors who have experienced 30% to 70% losses, the stock market is a thing of the past; however, the stock market is not dead. Short-term the market is a voting machine; long-term it is a weighing machine. In my opinion, we remain in a secular bear market that began in 2000. However, we will experience "mini-bull" markets and "mini-bear" markets during the secular bear that will probably last until 2014. One of the great sucker plays since the bear began in 2000 has been the "buy and hold for the long term" mantra that has been chanted by the sages of Wall Street. Simply look at the returns: from 12/31/99 to 12/31/08, if you invested in an S&P 500 index and held for "the long term," then your total return during this time would have been -28.13%, or an annualized rate of -3.6% per year. Small caps were better, with a total return of 11.66% or 1.23% annualized. If you expect to make money in the equity markets in 2009 going forward, then you must be willing to "trade" the volatility while also maintaining a high proportion of income-producing assets.

"Jay: You do know Elvis is dead, right?

Kay: No, Elvis is not dead. He just went home."

-- Men in Black

Because it is still applicable, I want to repeat two paragraphs from last year's first-quarter letter.

The Investor Psychology

People make mistakes when they invest. They do so as a result of their biases of judgment or mistake their perceptions as reality. There are several basic mistakes:

- Over-Optimism: Most investors tend to exaggerate their own abilities.

- Over-Confidence: Lends investors to overstate their knowledge, understate the risks, and exaggerate their ability to control the situation.

- Cognitive Dissonance: Investors often have an incredible degree of self-denial.

- Heuristic Rules: Rules of thumb that we employ for dealing with the daily information deluge by evaluating based on how closely a situation, person, etc., resembles someone or something, rather than examining and questioning; i.e., we "frame" and/or "anchor" the event/person/action.

Freud once said, "Thinking is rehearsing." What he meant was that after you accumulate the data and analyze the opportunities, then you have to take action. In the world of investing, there is no substitute for taking action. Therefore, as an advisor, I seek to understand our biases and attempt to make rational and prudent decisions based on fact and not perception. Savvy investors understand the risks inherent in their assumptions and adopt a more businesslike approach to investing by reducing and hedging risk. Investors are typically surprised when facing a loss, and the power of the loss far outweighs the power of gains. Each of you will always know of someone who made more money than we did: always. The critical thing we ask you to ask yourself is, What amount of risk was taken for the performance? Losses are inherent in any investment process; the key is to limit the size of the loss in order that you have more marbles to play with when good times return. Therefore remember the critical rule of compounding: Don't lose money.

As an investor, there are two steps you can take to improve your ability to handle the coming year:

- Actively Manage the Asset Mix -- look to be contrarian (this is our primary job).

- Develop Reasonable Expectations -- Wishful thinking is not a strategy.

It's not what you make, it's what you keep.

Cliff W. Draughn, Managing Principal

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.