Obama Ups U.S. Job Creation Program to 4 Million

Economics / US Economy Jan 11, 2009 - 09:16 AM GMTBy: Mike_Shedlock

While increasing his jobs creation forecast to 4 million jobs, Obama Calls for Sacrifice, Scaling Back Campaign Promises .

While increasing his jobs creation forecast to 4 million jobs, Obama Calls for Sacrifice, Scaling Back Campaign Promises .

President-elect Barack Obama said turning around the U.S. economy will require cutting back on some campaign promises and personal sacrifice from Americans.

“I want to be realistic here, not everything that we talked about during the campaign are we going to be able to do on the pace we had hoped,” Obama said in an interview on ABC's “This Week” program, scheduled to air tomorrow. ABC posted excerpts of the interview, Obama's first since returning to Washington as president-elect, today on its Web site.

Obama is pressing Congress to act quickly on a two-year economic stimulus plan of about $775 billion that includes new government spending and tax cuts. In appearances last week the president elect warned that failure to pass legislation enacting his proposals within the next few weeks risks letting the U.S. fall into a deeper and more prolonged recession.

All Americans will have to sacrifice to put the economy back on track, Obama said. “Everybody's going to have to give, Everybody's going to have to have some skin in the game.”

Stimulus Package To Create 4 Million Jobs

Somehow, without increasing the cost of the plan, the number of jobs Obama wants to creat has risen from 2 million to 3 million to 4 million. Please consider Obama Says Stimulus Package Creates 4 Million Jobs .

President-elect Barack Obama said his two-year plan to boost the U.S. economy will generate as many as 4 million jobs, higher than his previous estimates, the biggest portion of them in construction, manufacturing and retail.

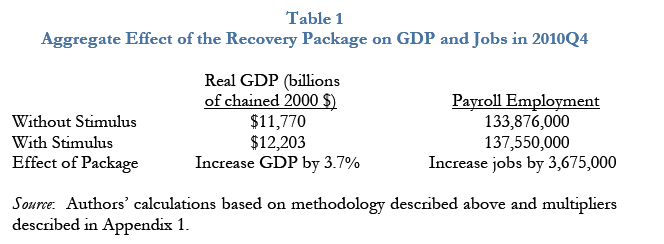

The plan would also result in the U.S. gross domestic product increasing by 3.7 percent more by the end of 2010 than it would without the stimulus, according to a study compiled by Obama's economic advisers. The study gives a forecast based on a package of spending and tax cuts totaling “slightly over” the $775 billion that has been discussed by the transition team with members of Congress.

The single biggest job gains would be in construction, according to the report, with 678,000 created by the fourth quarter of 2010. Another 604,000 jobs would be created or saved in the retail sector and 408,000 in manufacturing.

Most of the jobs created by government spending on infrastructure, education, health and energy would come in 2010 and 2011 because of the time it would take to carry out programs in those areas, the report said.

Obama reiterated some of the details that he originally provided in a speech earlier in the week, saying he would aim to double the production of alternative energy in the next three years, modernize 75 percent of federal buildings, and improve the energy efficiency of two million homes.

He also promised that the investments would go toward making all medical records computerized within five years. As part of infrastructure spending, Obama would expand broadband lines across the country, and he has called for a “smart grid” that would allow users and producers of electricity to communicate with an eye toward reducing energy use.

Job Impact of ARRP

Inquiring minds are reading Obama's blueprint for the economy entitled The Job Impact Of The American Recovery And Reinvestment Plan .

Key Preliminary Findings

A package in the range that the President-Elect has discussed is expected to create

between three and four million jobs by the end of 2010.

• Tax cuts, especially temporary ones, and fiscal relief to the states are likely to create fewer jobs than direct increases in government purchases. However, because there is a limit on how much government investment can be carried out efficiently in a short time frame, and because tax cuts and state relief can be implemented quickly, they are crucial elements of any package aimed at easing economic distress quickly.

• Certain industries, such as construction and manufacturing, are likely to experience particularly strong job growth under a recovery package that includes an emphasis on infrastructure, energy, and school repair. But, the more general stimulative measures, such as a middle class tax cut and fiscal relief to the states, as well as the feedback effects of greater employment in key industries, mean that jobs are likely to be created in all sectors of the economy.

• More than 90 percent of the jobs created are likely to be in the private sector. Many of the government jobs are likely to be professionals whose jobs are saved from state and local budget cuts by state fiscal relief.

• A package is likely to create jobs paying a range of wages. It is also likely to move many workers from part-time to full-time work.

Effect of Recovery Package on GDP

The table shows that we expect the plan to more than meet the goal of creating or saving 3 million jobs by 2010Q4. There are two important points to note, however:

First, the likely scale of employment loss is extremely large. The U.S. economy has already lost nearly 2.6 million jobs since the business cycle peak in December 2007. In the absence of stimulus, the economy could lose another 3 to 4 million more. Thus, we are working to counter a potential total job loss of at least 5 million.

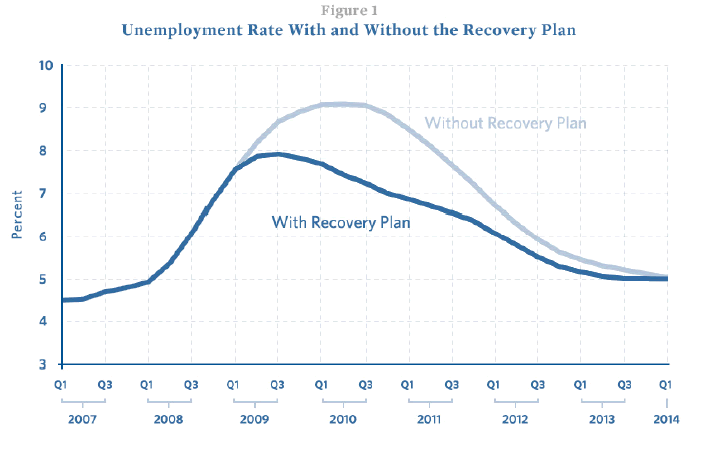

As Figure 1 shows, even with the large prototypical package, the unemployment rate in 2010Q4 is predicted to be approximately 7.0%, which is well below the approximately 8.8% that would result in the absence of a plan.

Projected Unemployment Rate With And Without Plan

The Timing of Job Creation

Because it takes time to carry out new spending programs authorized by legislation, we expect the jobs created by spending on infrastructure, education, health, and energy to be concentrated in 2010 and 2011.

Color Me Skeptical

The employment curve in figure 1 shows a net gain of jobs that are going to last as opposed to shifting future demand to the present. I do not buy it.

2003-2008 Recap

- The period from 2003 to 2008 was the biggest credit bubble in history, not just in the US but worldwide. It is unrealistic to expect the bust to be anything other than the biggest credit bust in history.

- Banks and brokerages made immense profits being leveraged 30-1 to 50-1. However, brokerages are now under control of the Fed. Leverage is still unwinding and will be lowered to 10-1 or possibly lower. Reduced leveraged means less risk, but also reduced lower profit opportunity.

- Boomers are heading into retirement, and a portion of their retirement plan (rising home prices) has been wiped out. Another portion of boomer retirement plans are being wiped out in the stock market crash.

- As a result of the above, boomers will be doing less spending and more savings. Retail sales and retail jobs will not come soaring back anytime soon.

- Peak Credit has been reached and a secular shift to frugality and risk aversion has begun.

- A housing Boom

- Housing prices

- Stock market prices

- Leverage

- Financial wizardry jobs

- Lend To Securitize Model on credit cards and homes

- 0% down payments

- Liar Loans

A huge portion of the jobs created during the period 2003-2007 were a result of excessive leverage, excessive risk taking, and ridiculous lending standards, especially in housing and credit cards.

The impact of that housing boom should not be underestimated. I discussed the housing boom and its effect on the economy in Krugman Still Wrong After All These Years . Please give it a look if you haven't already.

Secular Attitude Shift - The Age Of Frugality

I have been talking about frugality for quite some time. Here is a partial list.

- March 23: A New Phenomenon: Haggling Over Prices

- April 24: Cool to Be Frugal

- August 10: The Future Is Frugality

- August 26: Frugality Is The New Reality At Citigroup

- October 19: The Age Of Frugality

Consumer attitudes have shifted from consumption towards saving. Try as they might, the Fed is not going to succeed at getting now-panicked boomers heading into retirement to spend as they did when home prices and the stock market was soaring.

Children who have seen their parents wiped out in bankruptcy or foreclosed on are going to have a completely different attitude towards debt than their reckless parents did. Expect to see more frugality from parents and their children alike.

Those expecting retail spending to come soaring back are sadly mistaken. And retail spending is 75% of the economy!

I Urge Congress To Scrap Davis Bacon

When it comes to jobs creation, we need to get the most done for the cheapest amount and the way to do that is scrap the Davis-Bacon act. Please see Thoughts on the Davis Bacon Act for details.

Inquiring minds may also read Greg Mankiw's post Passing the Buck for this thoughts on Davis Bacon.

More public projects would pass a cost-benefit test if we repealed the Davis-Bacon Act. This law requires contractors on these public projects to pay "prevailing wages," which are typically union wages well in excess of what would occur in a free market. If the government paid market-determined wages for infrastructure projects, we could have both more infrastructure and less government debt. Without doubt, that legacy would benefit future generations.

I do not agree with much of Mankiw's monetarist leanings, but he is bang on about Davis Bacon.

Keynesian Free Lunch Theory Yet Again

The curve in figure 1 amounts to the Keynesian Free Lunch Theory of economics all over again. If stimulus could create permanent jobs, then why not triple it, create 12 million jobs, and eliminate unemployment altogether?

With that, I wish to repeat what I said in Jobs Contract 12th Straight Month; Unemployment Rate Soars to 7.2% ....

Government cannot really "create" any jobs per se. It can raise taxes and shift private sector jobs creation to government jobs creation (typically a malinvestment), and it can bring production and consumption forward for those jobs that are genuinely needed (filling potholes), but once the potholes are filled, one has to ask the question, "What will we do for an encore?"

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.