Precious Metals Investing: Gold or Platinum

Commodities / Platinum Jan 10, 2009 - 12:16 PM GMT

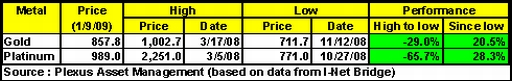

“Au” and “Pt” may be dull chemical elements, but gold and platinum have certainly played their respective parts during the unfolding of the financial crisis. Revisiting the metals' movements, it is clear from the table below that gold's decline was much smaller than that of platinum - as platinum suffered from the deterioration in the auto industry - but the recovery of gold has also been lesser than that of platinum.

“Au” and “Pt” may be dull chemical elements, but gold and platinum have certainly played their respective parts during the unfolding of the financial crisis. Revisiting the metals' movements, it is clear from the table below that gold's decline was much smaller than that of platinum - as platinum suffered from the deterioration in the auto industry - but the recovery of gold has also been lesser than that of platinum.

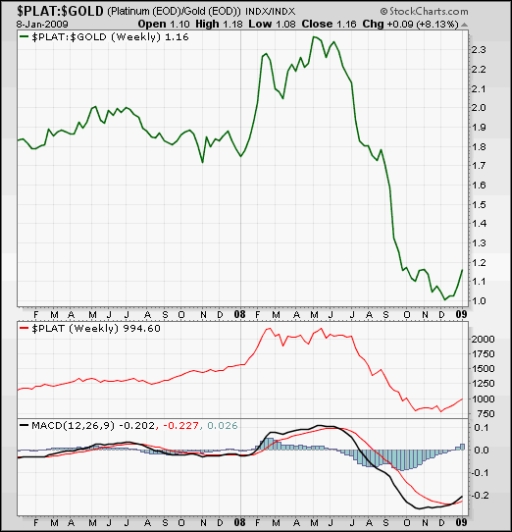

The weekly chart of platinum relative to gold illustrates the massive underperformance (declining green line) of platinum relative to gold from May to early December. However, platinum has since reversed course and outperformed (increasing green line) gold to the extent that it now commands a premium of 16% - up from parity in December.

The red line shows the platinum price, having peaked in March 2008 at $2,251 and topped out relative to gold in May at a premium of 140%. Technical analysis-orientated readers will also notice the blue MACD histograms moving into positive territory, indicating a buy signal for platinum in relative terms.

Although gold may experience a further pull-back in the short term (also as commodity index re-weighting runs its course), the longer-term outlook seems fairly positive as a result of a solid supply/demand situation, a likely waning appetite for US dollars and store-of-value considerations. According to the Telegraph , Merrill Lynch predicted that gold would soon break through its all time-high of $1,030 an ounce, and would hit $1,150 by June. Paul Walker, CEO of GFMS , said gold could rise to $1,100 by the end of 2009 as a result of the monetization of government debt. However, based on the relative chart above, platinum should have more upside potential than the yellow metal over the next few months.

The magnitude of gold or platinum's out- or underperformance will depend on a number of fundamental factors, as summarized by Rhona O'Connel ( GFMS Analytics ), in an article on Mineweb .

• To what extent is the market discounting or overdiscounting a recovery in the auto sector, in the US in particular?

• To what level will the relative fortunes of the jewelry market help to sustain an outperformance by platinum over gold?

• When will the global economy start to stabilize and at what point does the market start to fear systemic inflation risks?

Although platinum does not have the same currency characteristics as gold, it could regain favor as a result of a revitalization of the platinum jewelry trade (especially in China) and tightening environmental restrictions. And let's not forget that platinum is 30 times rarer than gold!

In short, there is a place for both gold and platinum in an investment portfolio, but be cognizant of the fact that precious metals are inherently volatile and are best bought following corrections. (The tickers for the gold and platinum ETFs are NYSE:GLD and LON:PHPT respectively. No platinum ETF is quoted in the US.)

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.