Unintended Consequences of the 20th Century and Beyond

Economics / Recession 2008 - 2010 Jan 08, 2009 - 02:33 PM GMTBy: James_Quinn

“The law of unintended consequences is what happens when a simple system tries to regulate a complex system. The political system is simple. It operates with limited information (rational ignorance), short time horizons, low feedback, and poor and misaligned incentives. Society in contrast is a complex, evolving, high-feedback, incentive-driven system. When a simple system tries to regulate a complex system you often get unintended consequences.” Andrew Gelman

“The law of unintended consequences is what happens when a simple system tries to regulate a complex system. The political system is simple. It operates with limited information (rational ignorance), short time horizons, low feedback, and poor and misaligned incentives. Society in contrast is a complex, evolving, high-feedback, incentive-driven system. When a simple system tries to regulate a complex system you often get unintended consequences.” Andrew Gelman

Andrew Gelman is dead on. He states that the political system is simple. I'd go a step further and say that lifetime politicians and entrenched government bureaucrats are simple. They show no indication of knowledge or expertise in American history or rational financial theory. The President, Congress, Federal Reserve, and Treasury try mightily to direct our economy. It is an impossible task. With a GDP of $14 trillion, there are thousands of inputs and outputs that feed the system. Their hubris leads them to believe that they are in control and can manipulate the gears of capitalism in a way that will produce their desired outcomes. If a desired outcome occurs, it is simply due to dumb luck. The more likely result of their manipulations of our complex system is a set of bigger problems that never occurred to them.

Congress definitely fits Mr. Gelman's definition of a simple system. I can't think of a body of people operating with more ignorance than Congress. The information they act upon, is provided by the 17,000 lobbyists that wine and dine them on a daily basis. Corporate lobbyists, PACs, unions, and special interests buy their votes. Their time horizons are less than a few months.

They are constantly running for re-election, raising money and handing out goodies to their constituents. The only feedback they care about is their standing in the polls and the amount of money they've raised from “donors”. Their incentives are poor and not aligned with the needs of the American people. They are not willing to do what is right for the country because they have no incentive to do so. Their only incentive is to get re-elected by insuring that their district gets as much pork spending as possible. They do this by selling their votes to the highest bidder.

Unintended Consequences of the Last 100 Years

The 20th Century is a laundry list of events that led to unintended consequences.

- Assassination of Archduke Ferdinand of Austria

The assassination of Archduke Franz Ferdinand of Austria by anarchists in 1914 was the fuse that set off World War I by causing various Treaties to cause all the countries of Europe to take sides. All sides envisioned a short painless war. The war lasted 4 years and killed 20 million people, with another 20 million casualties. It also lead to the Russian Revolution of 1917 with Lenin and Marxists gaining control of Russia.

- Treaty of Versailles

The harsh terms inflicted upon Germany by the victorious Allies were so ruthless that Germany was unable to meet their reparation obligations without printing currency at tremendous quantities. This eventually led to a hyperinflationary collapse of the German Mark and weakened the Weimer Republic. This eventually led to the rise of Adolph Hitler as dictator and ultimately to the deaths of 70 million people in World War II.

- Creation of Federal Reserve

The Federal Reserve was created in 1913 in order to make bank panics less likely and to manage the nation's monetary policy. They have created persistent inflation that has caused the U.S. dollar to lose 95% of its value since 1913. Their actions contributed greatly to the Great Depression of the 1930's. Alan Greenspan's self serving actions, in the late 1990's and early 2000's, led to the recent collapse of the worldwide financial system.

- FDR's New Deal

The programs created during the Roosevelt administration to combat the Great Depression, particularly Social Security, have been on automatic pilot for eight decades. A program whose purpose was to protect poor old people from starving during a Great Depression has morphed into a perceived right of all Americans and has led to an unfunded future liability of $10 Trillion.

- Appeasement

As Adolph Hitler was beginning to gain power and started to flaunt the Treaty of Versailles, other European countries could have crushed him as early as 1935. His military was not yet powerful. Hitler became emboldened by his early success and took more aggressive actions with the Rhineland, Sudetenland, and Czechoslovakia. The appeasement strategy practiced by British Prime Minister Neville Chamberlain to avoid bloodshed allowed Hitler to gain enough power to bring about the most destructive war in history. Winston Churchill explained the consequences after the war. “I cried out but no one would listen and now Europe is devastated…There never was a war easier to win…Not a single shot needed to be fired…But, no one listened.”

- Manhattan Project

Robert Oppenheimer's project was to create an atomic bomb before the Germans could invent one. The atomic bomb led to the end of the war in the Pacific as the bombs were dropped on Hiroshima and Nagasaki. His response after the successful test was, “Now I am become Death, the destroyer of worlds." It led to the positive development of the nuclear power industry. It also led to an arms race with the Soviet Union which almost led to nuclear war in 1962. The proliferation of nuclear weapons is one of the biggest dangers to world peace today.

- Creation of Military Industrial Complex

The United States had no Defense Industry prior to World War II. The rise of this industry was essential to winning World War II. In his Presidential farewell address, President Eisenhower warned about the increasing power of the defense industry. “In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military-industrial complex. The potential for the disastrous rise of misplaced power exists and will persist.” His unheeded words have led to the Defense Industry amassing overwhelming power in Washington DC, with spending on defense in the U.S. exceeding $800 billion per year and representing 50% of all the military spending in the world. The U.S. spends as much as the next 43 countries combined.

- LBJ's Great Society

President Lyndon B. Johnson stated his goal in 1964. “We are going to assemble the best thought and broadest knowledge from all over the world to find these answers. I intend to establish working groups to prepare a series of conferences and meetings—on the cities, on natural beauty, on the quality of education, and on other emerging challenges. From these studies, we will begin to set our course toward the Great Society.” These noble words led to the creation of Medicare and Medicaid. The unfunded future liability of Medicare is $61 trillion, six times the unfunded liability of Social Security. The programs did not reduce poverty or improve the healthcare system. The Great Society became the Debt Society. Barrack Obama's soaring rhetoric is reminiscent of LBJ's vision. Beware!

- Semi-privatization of Fannie Mae & Freddie Mac

Their purpose was to purchase and securitize mortgages in order to ensure that funds were consistently available to the institutions that lend money to home buyers. LBJ moved them off the government books in order to make his government deficits appear better. The two companies have been compromised for decades by the Democratic Party and were pushed to loosen their standards by politicians like Barney Frank and allowed millions of unqualified buyers to get home mortgages they could never pay off. Both companies have lost tens of billions and are now under the conservatorship of the U.S. government. The likely future liability to the U.S. taxpayer is $200 billion.

- Richard Nixon takes U.S. off Gold Standard

After World War II a Gold Standard was established by the Bretton Woods Agreements. Under this system, many countries fixed their exchange rates relative to the US dollar. The US promised to fix the price of gold at $35 per ounce. Implicitly, then, all currencies pegged to the dollar also had a fixed value in terms of gold. Alan Greenspan argued in 1966 that, “under the gold standard, a free banking system stands as the protector of an economy's stability and balanced growth… The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit… In the absence of the gold standard, there is no way to protect savings from confiscation through inflation.” Under the regime of the French President Charles De Gaulle, France reduced its dollar reserves, trading them for gold from the U.S. government, thereby reducing US economic influence abroad. This together with the fiscal strain of the Vietnam War led President Richard Nixon to eliminate the fixed gold price in 1971. The U.S. dollar has lost 93% of its purchasing power since 1971. The welfare statists have confiscated middle class savings through inflation while being aided and abetted by Alan Greenspan and the Federal Reserve.

- China Embraces Capitalism

The process of economic reform began in earnest in 1979, after Chinese leaders concluded that the Soviet-style system that had been in place since the 1950s was making little progress in improving the standard of living for Chinese citizens and also was failing to close the economic gap between China and Western nations. The reforms of the late 1980s and early 1990s focused on creating a pricing system and decreasing the role of the state in resource allocations. The reforms of the late 1990s focused on closing unprofitable enterprises and dealing with insolvency in the banking system. After the start of the 21st century, increased focus has been placed on narrowing the gap between rich and poor in China. The huge influx of peasants from the countryside to the cities led to a manufacturing boom in China and the gutting of manufacturing in the United States. The feedback loop of Americans borrowing at low rates and spending on Chinese made goods while China kept buying US Treasuries, which kept U.S. interest rates low, has led to an unsustainable boom that has now gone bust. Allowing this unsustainable trend to grow beyond all reasonableness is now leading to social unrest in China.

- Greenspan Put

Alan Greenspan in his role as Federal Reserve Chairman attempted to solve every financial crisis by lowering interest rates and increasing liquidity. It began when he came to the rescue after the stock market crash of 1987. The Fed did the same thing after the Gulf War, the Mexican crisis, the Asian crisis, the LTCM implosion, Y2K, the bursting of the Dot Com bubble, and the 9/11 tragedy. Investors became convinced that Greenspan would always come to the rescue and keep stock prices from falling. This belief caused investors to take much greater risks and led to the colossal overleveraging that took place between 2000 and 2008. The artificial perception of safety led to the worst financial crisis in history. Ben Bernanke is now following in Greenspan's footsteps.

- U.S. Maintains Military Base in Saudi Arabia after Gulf War

Osama Bin Laden returned to Saudi Arabia in 1990 as a hero of jihad, who along with his Arab legion, "had brought down the mighty superpower" of the Soviet Union in Afghanistan. During this time frame Iraq invaded Kuwait and Bin Laden met the Crown Prince of Saudi Arabia, and told him not to depend on non-Muslim troops and offered to help defend Saudi Arabia. Bin Laden was rebuffed and publicly denounced Saudi Arabia's dependence on the US military. After the 1st Gulf War, the U.S. with the support of the Saudi rulers allowed a permanent U.S. military base in Saudi Arabia. This presence led Bin Laden to declare a jihad against the U.S. infidels and eventually led to the 9/11 attack and the War on Terror. This has led to mammoth budget deficits, thousands of unnecessary American and Iraqi deaths, and contributed hugely to the financial crisis of 2008.

- 9/11 Attack

The terrorist attack on the World Trade Center killed almost 3,000 Americans and provided President Bush with worldwide support to capture or kill Osama Bin Laden and his supporters. The U.S. successfully defeated the Taliban and cornered Bin Laden in the mountains of Afghanistan. The Bush administration declared a War on Terror, invaded Iraq on false pretenses wasting the lives of 4,500 Americans and damaging the lives of 30,000 Americans who were wounded, wasted $800 billion of borrowed taxpayer money, created the Department of Homeland Security at a cost of $50 billion per year, tortured captives, and has allowed the government to monitor private conversations of Americans without a warrant. An attack by 19 men with knives has led to the decline of the United States stature throughout the world and pushed the U.S. towards bankruptcy. The beacon of freedom has seen its light dim.

- SEC takes Deregulation to Heart

Alan Greenspan and the free market ideologues in the Bush administration thought that no regulation was the best policy for the financial markets. They believed that markets would regulate themselves. This led to non-enforcement of existing rules and regulations. The SEC waived the 12 to 1 leverage ratios for the five biggest investment banks. Those banks then leveraged 40 to 1 and collapsed the worldwide financial system. The SEC failed to catch the Enron and Worldcom accounting frauds. The SEC was given indisputable proof that Bernie Madoff was conducting a ponzi scheme as far back as 1999. It ignored the facts and allowed a $50 billion fraud to destroy any remaining trust in the U.S. financial system. The SEC is in the back pocket of Wall Street. Its executives leave the SEC and get million dollar jobs on Wall Street. Non-enforcement of rules is not deregulation it is government corruption and incompetence.

Ignorance, Stupidity, and Hubris

Sociologist Robert K. Merton popularized the concept of unintended consequences in a paper written in 1936. Some possible grounds for the unintended consequences are the world's complexity, human stupidity, self deception, hubris and biases. Merton's five possible causes were:

- Ignorance (It is impossible to anticipate everything, thereby leading to incomplete analysis)

- Error (Incorrect analysis of the problem or following habits that worked in the past but may not apply to the current situation)

- Immediate interest , which may override long-term interests

- Basic values may require or prohibit certain actions even if the long-term result might be unfavorable (these long-term consequences may eventually cause changes in basic values)

- Self-defeating prophecy (Fear of some consequence drives people to find solutions before the problem occurs, thus the non-occurrence of the problem is unanticipated)

Ignorance, error, and immediate interest sound like a perfect motto for the U.S. Congress, Federal Reserve, and Treasury. When media pundits, pompous economists, self proclaimed “experts”, and corrupted politicians assure you that they have the solutions to all of our problems they are practicing the most evil form of hubris. The arrogance and self importance of these people is an insult to the intelligence of all Americans. They put their unproven theories into practice by committing trillions of taxpayer funds. They are only concerned about the next election cycle and not about the long-term consequences of their ignorance and ignorance of crucial facts. The accumulation of blunders over the decades by government has led to unintended consequences that could bring down our country. Recent developments will have disturbing consequences for all Americans.

Unintended Consequences of Cheap Oil

When oil reached $147 a barrel in the summer of 2008, panic was setting in among the sages in Congress. Windfall profit taxes on oil companies and government intervention to support alternative energy were the mantra of congressmen and Presidential candidates. Government intervention was going to work its magic. Instead, the markets adjusted rapidly to a worldwide decline in demand and the price plummeted to less than $40 a barrel. This drop has put an additional $200 billion of money back into the pockets of Americans. This was a needed relief in the midst of a grinding recession. The law of supply and demand worked without government intervention. The short-term focus of our politicians and many Americans will likely squander this temporary reprieve.

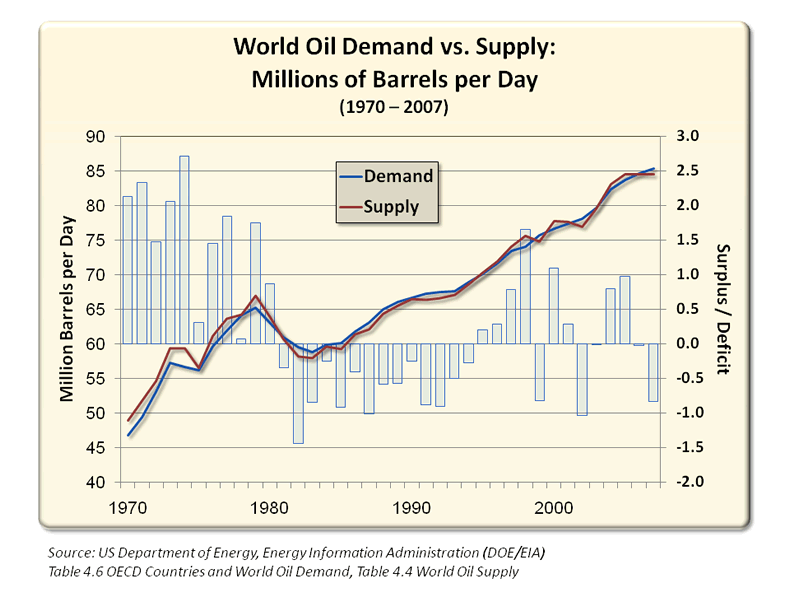

The pundits concluded that oil reaching $147 a barrel was due to speculators. Once the speculators were forced out, oil prices collapsed. Their view is that this temporary crisis has passed and life will go back to normal. American oil demand declined by 13% in September 2008, but Chinese demand grew by 28%. Auto financing at 0% for five years on SUVs will prevail and all will be well. The ignorance of the true facts by our leaders will lead to a future crisis that will make the current financial crisis seem like a walk in the park. The current economic downturn which has temporarily decreased worldwide demand will end. Oil demand will resume its upward slope, while supply has likely reached its peak. The facts based on exhaustive research by Matt Simmons are:

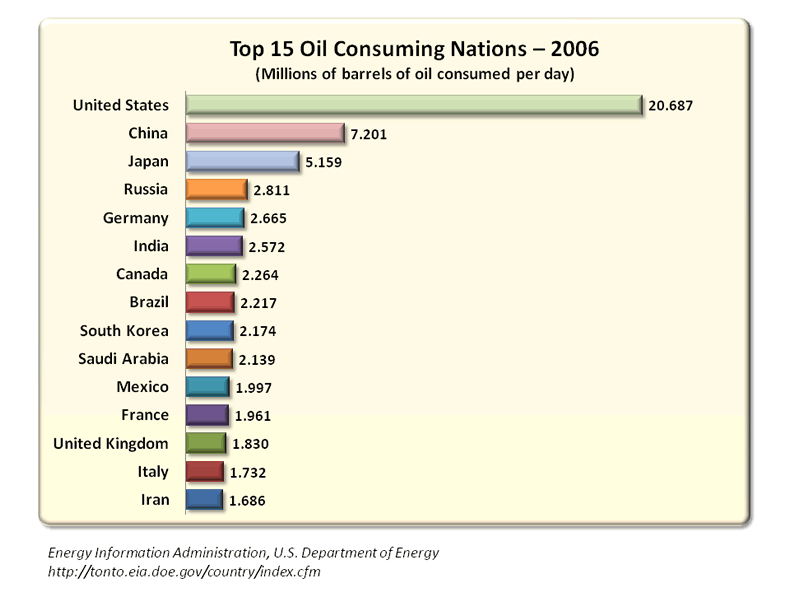

- 60% of the world's oil is consumed by 10% of the world's population.

- America represents 5% of the world's population and consumes 24% of the world's oil.

- Middle East oil use is growing more rapidly than China's.

- China now uses 8 million barrels per day versus 3.5 million barrels per day in 1997.

- China now consumes 2 barrels per person versus 24 barrels per person in the U.S.

- The U.S. has 220 million automobiles for 305 million people. China has 32 million cars for 1.3 billion people.

- Peak supply of 86 million barrels of oil per day has been reached. Demand will grow to 115 million to 125 million barrels per day in the next 20 years.

The price of oil is now dangerously low. There are large amounts of untapped resources in non-traditional places. These include oil sands in Canada, oil shale in the Western U.S., and deep water oil. At $40 a barrel, the cost to extract oil from these sources is greater than the revenue that can be generated. Therefore, all projects in these areas will be stopped or delayed indefinitely. Drilling rigs are being shut down, employees are being laid off, and all expensive deep water projects are being abandoned. Supply has topped out at 86 million barrels per day. Mature oil fields throughout the world are in decline. Projects can take decades to bring on-line. Projects not started today will result in supply shortages in the future.

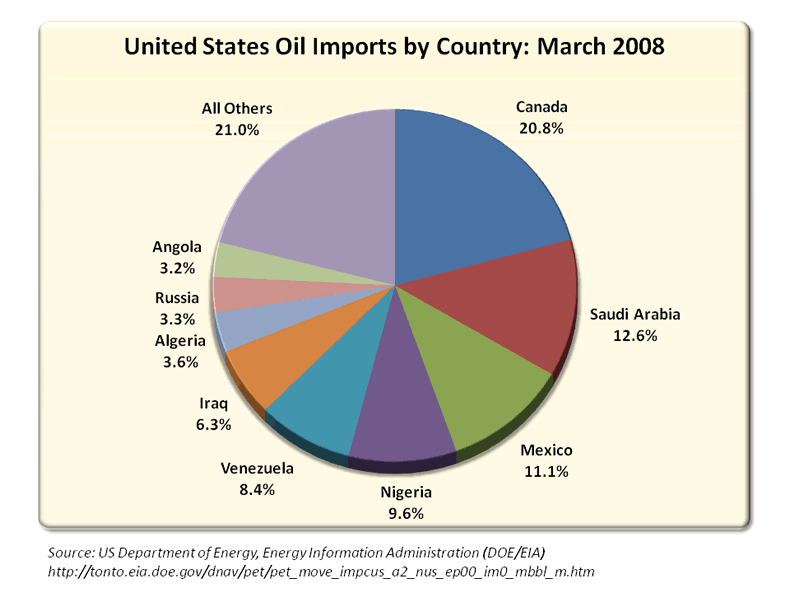

If the U.S. leaders allow today's low prices to reduce its sense of urgency regarding energy independence, the consequences will be shocking. The existing energy infrastructure is rusting away. The estimates to rebuild the crumbling infrastructure, that is 80% beyond its original design life, run as high as $100 trillion. The Cantarell oil field in Mexico is collapsing and will lead to Mexico becoming an oil importer in the next five years. The U.S. currently gets 11.1% of our supply from Mexico, almost as much as from Saudi Arabia. Another 30% comes from unstable countries such as Venezuela, Iraq, Nigeria, and Russia. We are not in command of our energy future. By doing nothing today, we insure that $147 oil will seem like a bargain in the not too distant future. An all out effort to implement the Pickens Plan now is necessary to regain the upper hand regarding our energy future. Converting our country to wind power, natural gas, and nuclear power would decrease our dependence on foreign oil and keep $700 billion in the United States rather than transferring it to the Middle East.

Unintended Consequences of 0% Interest Rates

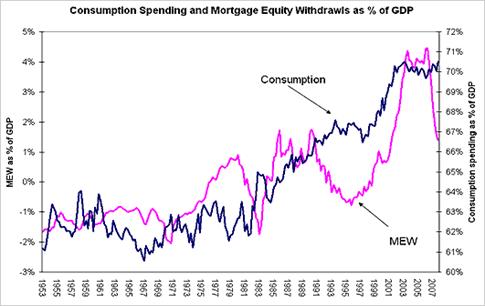

The Gross Domestic Product of the United States is $14.4 trillion. Consumer spending makes up $10.2 trillion or 71% of GDP. Government spending makes up $2.9 trillion, or 20% of GDP. Domestic investment makes up $2.0 trillion, or 14% of GDP. The trade deficit of $700 billion reduces GDP by 5%. President Obama has quite a dilemma in trying to revive this economy. The American consumer has borrowed from their homes and credit cards to fuel a colossal spending spree in the last twenty years. The dilemma is that the U.S. economic growth during the entire Bush administration was a debt induced fraud. From 1953 through 1983, consumption as a percentage of GDP ranged between 61% and 64%. Consumers rarely, if ever, borrowed against their houses. Paying off your mortgage was a goal of all families. A normalized level of consumer spending at 65% of GDP will require consumers to spend at least $1 trillion less per year. Less consumer spending will also contribute to reducing the trade deficit. The Federal Reserve and politicians running our country see a $1 trillion reduction in consumer spending as a disaster. Their positions of power would be in jeopardy. They will do everything in their power to not allow this to happen. The unintended consequences will commence shortly.

Source: Creditwritedowns.com

From the time Alan Greenspan took over as Federal Reserve Chairman in 1987, consumption and household debt rose at a faster rate than the economy. The Greenspan Put was a major contributor to these developments. Everyone knew that Greenspan would lower rates and inject liquidity into the system whenever an economic bump in the road came along. Greenspan's reduction of the discount rate to 1% in 2003 led to the greatest debt bubble in history that still threatens to bring down the financial system.

![[Household+debt.jpg]](../images/2009/Jan/debt-pcent.jpg)

Source: Creditwritedowns.com

The entrenched politician rulers of our country who are bought and sold by Big Business lobbyists, the Military Industrial Complex, and Big Media want to preserve the status quo. Their power base depends upon it. Prior to the creation of the Federal Reserve in 1913, depressions were violent and short. Prices for goods and wages adjusted rapidly, which allowed businesses and workers to survive. Having the dollar pegged to gold, limited what the government could do. The Federal Reserve artificially inflated the money supply in the 1920s causing a normal depression to become a Great Depression. Government interference with wage and price controls and government make work projects did not allow the system to fix itself. It took a World War to pull our economy out of the Great Depression.

Source: Perotcharts.com

It's the End of the World As We Know It

What is required to happen and what will happen, in the next year, will have calamitous consequences for the future of our country. What needs to take place is:

- Consumers need to cut back dramatically on consuming. Spending as a percentage of GDP needs to decline to 65%, or by $1 trillion. This would be approximately $3,000 less spending per household per year.

- Twenty years of consumer debt accumulation must be unwound. This required deleveraging needs to eliminate $2 trillion of household debt. The result will be thousands of retail store closings, mall closings, restaurant closings, and auto dealership closings. The distinction between needs and wants will reveal itself like a sledgehammer.

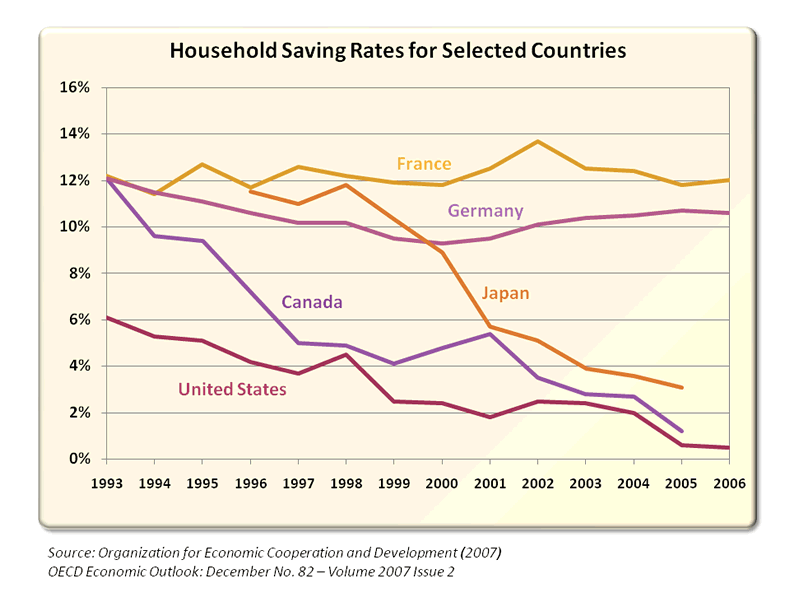

- The consumer needs to increase their savings rate from 2% to 10%. This would provide more capital for investment.

- People who cannot afford the mortgage on their home need to sell or enter foreclosure. When home prices fall far enough, the market will clear the inventory. Lower prices are the only way to eliminate excess supply.

- Companies that have failed to prepare for this downturn by taking on excessive debt, allowing expenses to soar, and having no clear strategic plan should go bankrupt. Unemployment will reach 9%. New businesses will be created and Americans will be hired.

- The Government should make sure that no one starves to death or has to sleep on the streets. The safety net of food stamps and unemployment insurance should be strengthened.

- The Government's purpose is to protect its citizens, enforce the laws and maintain the public infrastructure. Our roads are crumbling, we have 156,000 structurally deficient bridges, millions of miles of pipes under our streets are rusting away, and our power grid is antiquated. The job of Government was to maintain these things. They have failed miserably. Why does anyone think a new government infrastructure plan will work? Bridges to nowhere will be everywhere.

- Reducing spending dramatically on our military empire would provide funds to support the social safety net that is required during a depression. Congressmen in the pocket of the Defense industry will never allow it to happen.

What needs to occur would inflict too much pain for our politician leaders to allow. A violent short depression will be traded for a decade long extended depression. A painful deflationary depression will be converted into a hyperinflationary depression that could threaten the very existence of our country. President elect Obama has begun his finely orchestrated marketing plan to spend $775 billion of borrowed taxpayer money. His rationale for the stimulus package is classic Washington politics -

"Economists from across the political spectrum agree that if we don't act swiftly and boldly, we could see a much deeper economic downturn. That's why we need an American Recovery and Reinvestment Plan that not only creates jobs in the short-term but spurs economic growth and competitiveness in the long-term." An economist is an expert who will know tomorrow why the things he predicted yesterday didn't happen today. – Laurence J. Peter

Not one economist on the face of the earth predicted the events of 2008. None of Obama's list of blue chip economists saw a crisis coming and they have no idea how long or deep the current downturn will be. They make weather forecasters look highly accurate in comparison. Most economists are either, sellouts (Lawrence Yun), cheerleaders (Larry Kudlow), ideologues, or academic theoreticians. If Barrack Obama is depending on economists to determine our future, all is lost. Alan Greenspan was an economist. If we had done the opposite of everything he recommended in the last 20 years, the country would be on the right track. President Obama, with the overwhelming support of a Democratic Congress will double down on the trillions already poured down a rat hole by the Bush administration. The scenario that will play out is:

- The $775 billion plan will grow to at least $1 trillion as Obama will need to buy off various factions within Congress with pork projects.

- Congress will approve the 2nd $350 billion tranche of TARP funds. Barney Frank and Nancy Pelosi will shovel billions to homeowners who should be foreclosed upon. Billions more will be given to the automakers. GMAC will get more funds from the taxpayer at 8% interest so they can then loan it to subprime borrowers at 0%. This doesn't sound profitable, but they'll make it up on volume.

- TARP funds will be given to commercial developers who foolishly overleveraged, overbuilt, and overpaid for properties. Credit card companies that handed out credit like candy for the last 20 years will see their write-offs triple to over 10% by 2010. The government will give more of your tax dollars to these incompetent bankers so they can send out another 5 million credit card offers to deadbeats.

- The Federal Reserve will buy mortgage debt and long-term Treasuries to artificially reduce market interest rates. With money market funds paying .25%, senior citizen savers will be forced to take on risk to get a return on their money. Penalizing savers to resuscitate reckless gamblers is the path that Ben Bernanke has chosen. When the Markets decline another 20% in 2009, more senior citizens will see their retirements destroyed by Mr. Bernanke.

- Consensus among the talking heads on CNBC is that markets will go up in 2009 because they went down so much in 2008. This is what amounts to analysis by business television. The people they interview have a vested financial interest in the market going up. So despite the fact that earnings will collapse in 2009, these pundits are sure the markets will rise. I'd bet against the consensus.

- Citicorp and JP Morgan will require additional enormous injections of capital from the taxpayer due to their looming credit card and commercial loan losses. The top 10 biggest banks are insolvent. They are being kept alive on life support systems provided by the Federal Reserve and Treasury. All the bankers who didn't bankrupt their banks should be outraged at this misappropriation of taxpayer capital to incompetent, reckless, immoral, politically connected bankers.

- Home prices will drop another 15% in 2009 and will remain depressed until 2015. The market will adjust to its natural equilibrium level despite all government efforts to keep prices artificially elevated. When you can buy a house and rent it out and generate a positive cash flow, houses will be reasonably priced.

- Despite the immense spending, zero interest rates, and propping up bankrupt financial institutions, consumers will not spend. Economists, bureaucrats and politicians are so focused on models and theories that they have failed to realize that the social mood of the country has changed forever. The poor economic conditions are being caused by the mood change, not vice versa. A return to frugality, saving, and simpler lives will keep a cap on spending for at least the next decade.

The sum total of all that has been done and all that will be done will eventually lead to a hyperinflationary bust. The money supply is being expanded too rapidly, fiscal stimulus spending will be borrowed from foreigners, the dollar will fall as foreigners refuse to accept 2% for 10 years, and the Federal Reserve will react too late just like they did when this crisis began. This overstimulation of the economy will lead to a panic out of dollars and into real assets. The government will attempt to control the situation by confiscating gold as they did in the 1930s and Americans will be forced to surrender more liberties. In periods of economic and social upheaval - war, revolution, or dictatorship become possibilities. The average American needs to wake up from their materialistic stupor and understand the risks that lie ahead. An educated concerned citizen is our only defense against tyranny. Orwellian governmental policies will be inflicted upon the populous. Seek out those who are telling the truth. David Walker, Boone Pickens, Ron Paul, Mike Shedlock, Doug Casey, and John Mauldin are among the truth tellers.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2008 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.