Gold Retreats from Resistance Towards Support

Commodities / Gold & Silver 2009 Jan 08, 2009 - 09:27 AM GMTBy: Chris_Vermeulen

Gold traders should have exited today as prices are showing strong signs of lower prices in the near future. Gold slid over 4% this week so far, while gold stocks have dropped an average of 9%.

Gold traders should have exited today as prices are showing strong signs of lower prices in the near future. Gold slid over 4% this week so far, while gold stocks have dropped an average of 9%.

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

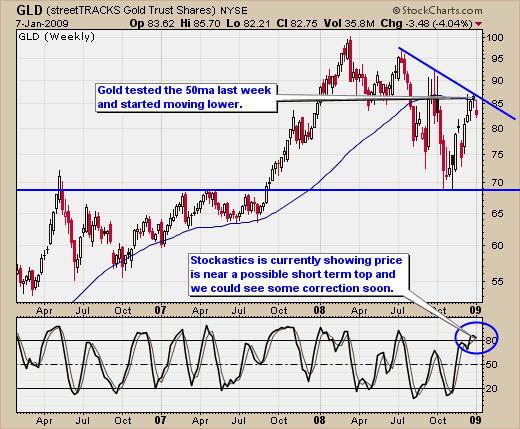

Weekly Gold Trading Chart

Gold Stocks Lead the Price of Gold

In many cases gold stocks tend to lead gold. This daily chart below clearly shows a classic 5 wave counter trend rally and trend line breakdown. Gold stocks hit resistance last week and have been sliding lower since hitting their heads on the 200 moving average. Stochastic and MACD both signaled this is a high probability move, indicating there could be much more downside pressure.

Daily Gold Stock Chart

Gold Trading Fund and Analysis

The price of gold continues to have sellers stepping in this week. We continue to hold our core position as gold consolidates (pulls back) while short term traders take profits. We are looking for prices to drift lower and hold above the support trend line providing a reversal candle and pivot low with risk less than 3% for our next entry point. If gold stocks take another big hit this week then the HUI:GLD ratio will turn bearish and that's not good for the price of gold. All we can do now is to wait it out.

Daily GLD Exchange Traded Fund

Conclusion:

The broad market as well as commodities have been holding their ground and making small gains for the past month. Fewer buyers seem to be at these higher prices, leaving me with a cautious vibe. Stick with your stops, you can always buy back in. I will provide a full Special Report covering Gold, Silver and Oil this weekend.

For more information, questions or to receive my Free Weekly Special Report please visit my website: www.TheGoldAndOilGuy.com

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.