US Dollar Volatile Two Way Action as Sterling Strengthens

Currencies / Forex Trading Jan 07, 2009 - 10:39 AM GMTBy: ForexPros

The USD started the day on a strong note rising to early highs against most pairs in New York but has since falling back to make lows in some cases. Traders note that today’s US data was as expected and showed no real surprises suggesting that today’s action was driven by technical factors more so than sentiment. Most pairs met technical objectives for S/R during the past 24 hours or so lending some credibility to the argument.

The USD started the day on a strong note rising to early highs against most pairs in New York but has since falling back to make lows in some cases. Traders note that today’s US data was as expected and showed no real surprises suggesting that today’s action was driven by technical factors more so than sentiment. Most pairs met technical objectives for S/R during the past 24 hours or so lending some credibility to the argument.

GBP continued to firm making highs against the EURO and the USD; climbing to a high print at 1.4994 and holding near the highs. Euro-Sterling cross traders continued to see liquidation and that rate traded to lows late in New York trade adding more upside pressure to GBP.

EURO remained under pressure all day but rallied after the fix to make a try for the upper end of the range; high prints at 1.3660 remained unchallenged but the rate rallied over the 1.3520 area after making lows only six hours earlier at 1.3312. traders note that volumes were OK and sovereign or official bids were seen into the lows earlier in the day.

Despite better stock prices and the DJIA making highs late in the day USD/JPY was unable to hold gains as expected; high prints in early New York at 94.65 gave way to aggressive selling and the rate gave up the 94.00 handle and remains near 93.70/80 into the end of the day. Traders note that offers were think from smart money above the 94.00 area suggesting that the failure at the 50 day MA was large hands adding to shorts. In my view, the USD has little chance of maintaining a strong upward trend against the Yen through 2009 so today’s technical failure simply underscores the current USD weakness.

USD/CHF also failed to hold early gains falling back from high prints at 1.1281 to trade the 1.1160/70 area; traders note the rate has a technical resistance area around the 1.1280/1.1320 area suggesting that sellers are turning aggressive near that area. Traders also expect a rally in Gold prices to add downward pressure to the pair.

USD/CAD continues to weaken making low prints at 1.1759 but failing to find solid stops in size. Buyers showed up and that pair rallied back to the 1.1800 handle for now. Traders warn a pullback could get ugly if US fundamentals remain poor through the end of month and the BOC keeps rates firm.

In my view, the USD is set to continue in volatile two-way action so traders with open trade gains from today’s reversals need to remain nimble; we will likely cover a lot of the same ground twice.

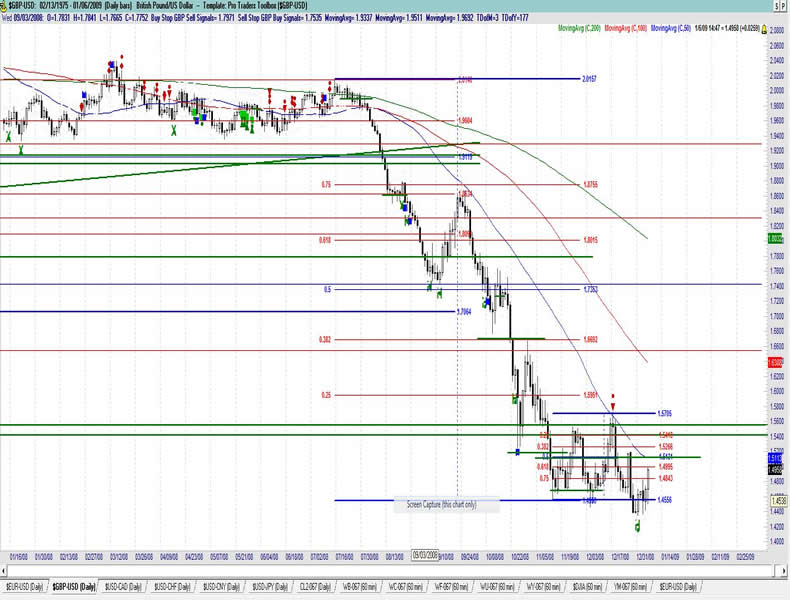

GBP/USD Daily

Resistance 3: 1.5100, Resistance 2: 1.5050, Resistance 1: 1.4990, Latest New York: 1.4960

Support 1: 1.4420/30, Support 2: 1.4350, Support 3: 1.4280

Comments

Rate is two-way and firmer due to cross-spreaders liquidating EURO-Sterling; repatriation also lending to the firm tone. Rally to highs during New York today likely some stops and short-squeeze. Rate is likely to have a knee-jerk reaction to more rate cuts due later in the week but with a new 2008 low late in the month last month the probabilities are good that any rate cut is factored in. Rate sees upside stops cleared overnight putting the next level resistance around 1.5050/1.5100 in play. Spillover from EURO not there today as spreaders unwind. Traders note solid two-way action. Sellers hold control above 1.5100 area so far but if unable to make a new low or test the low—expect a short-squeeze..

Data due Wednesday: All times EASTERN (-5 GMT)

5:30am GBP BRC Shop Price Index y/y

EURO/USD Daily

Resistance 3: 1.3740/50, Resistance 2: 1.3700, Resistance 1: 1.3660, Latest New York: 1.3526

Support 1: 1.3300, Support 2: 1.3250/60, Support 3: 1.3200

Comments

Rate drops to new lows overnight as cross-liquidation continues but rallies back hard as official bids absorb offers under the 1.3350 area. Aggressive liquidation by EURO-Sterling cross spreaders providing the main selling but traders note lots of stops active under the 1.3400 area. Late longs are under pressure and can’t ignore a break of the 50% fib defense numbers. Bears took a stand at 1.4700 area last year and likely have reached technical levels around the 1.3300 area so expect some firmness in this area. Traders note some stops within range overnight suggesting longs are late or nervous. Correction lower is likely to continue a bit further but that will likely be a buy point.

Data due Wednesday: All times EASTERN (-5 GMT)

2:00am EUR ECB President Trichet Speaks

3:55am EUR German Unemployment Change

5:00am EUR PPI m/m

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.