Zero Interest Rate Policy and the Liquidity Trap

Interest-Rates / Credit Crisis 2008 Jan 07, 2009 - 09:43 AM GMTBy: Mick_Phoenix

Welcome to the Weekly Report (published 4 Jan 09). I had a nice break over Christmas and the New Year, having spent a week in Norway skiing enjoying guaranteed snow and a good exchange rate to Sterling, thus avoiding the horrible reality of a less than 1:1 Sterling/Euro tourist rate. Sometimes all this macro-econobabble has its uses.

Welcome to the Weekly Report (published 4 Jan 09). I had a nice break over Christmas and the New Year, having spent a week in Norway skiing enjoying guaranteed snow and a good exchange rate to Sterling, thus avoiding the horrible reality of a less than 1:1 Sterling/Euro tourist rate. Sometimes all this macro-econobabble has its uses.

When it comes to skiing, I am no Franz Klammer. I started skiing in my mid 30's and after a knee injury and operation some 8 years ago I now use various knee support devices to combat weakness and arthritis in both knees. One day I will have to face reality and recognise that even with the knee supports I will be unable to ski. These days I do gentle red runs and look carefully at the piste map and terrain before sliding downhill. As I was riding a long T-bar lift (you hook the bar under your behind and ski uphill) I realised my knees and the global financial economy have a lot in common.

My knee worked fine until it didn't, I blew out the medial ligaments and ruptured the cartilage doing no more than gently gliding along, I didn't even have time to react to the fall. I knew the risks involved in skiing, especially for a beginner yet I took no added precautions against the risk, indeed I found it difficult after the fall to believe I had done serious damage to my knee. I continued to ski and skied off the mountain. However the swelling and pain warned that I had done some damage so I went to a local doctor who unsurprisingly had seen this type of injury before. I ended up on crutches and a month later had keyhole surgery to repair the cartilage. The ligaments managed to recover under their own steam.

The global financial system worked fine until it didn't, it blew out in 2007 as commercial paper markets withdrew liquidity, as signs that ABCP might not be AAA, even though the global economy seemed to be gliding along. It didn't even have time to react to the drawdown. Those involved knew the risks, especially as the derivatives markets had only expanded to their colossal size in the previous 5-6 years, yet they took no added precautions to the risk, indeed as the borrow short / lend long model unwound it was believed the damage was contained and the system continued to adhere to the financial models used prior to the damage.

However as the default rates on overstretched mortgages began to show large scale losses in MBS/CDO packages, it was realised that the sellers of insurance, the CDS writers, couldn't cover the losses. Some local doctors tried to warn the patient that something was wrong but the patient decided to keep dancing until the music stopped. What could and should have been a period of convalescence aided by crutches and some surgery turned into a major disability and toxic infection, requiring the liberal use of life saving equipment. The Banks were unable to self heal and had to hoard cash to repair the overstretched conduits that allowed credit to be enabled. The patient remains in a critical condition.

My knees creak and groan and let me know when it's going to rain but they still function - as long as I recognise the risk and avoid overstretching their impaired ability. Banks feel nothing from the chest down.

Worse is the effect on those that relied on Banks. Without the support of continuous rolling credit those businesses reliant on credit to function suddenly realised that the game was over. From Hedge Funds to Automotive makers, from Retailers to Mortgage brokers the world stopped. Ponzi schemes fell apart (You think Madoff is a renegade one off?), Insurance companies collapsed and the spectre of mass unemployment in a deflationary environment reared its ugly head.

The Fed and the US treasury stepped into the Intensive Care Ward and cringed at the carnage facing them. After the initial shock they began to infuse the patients with cash and cash like assets in exchange for the toxins that kept the patient at deaths door, when this proved ineffective they nationalised those too far gone to rely on conventional medicine and dosed them with straight cash, right into their veins. The Fed stayed by the bedside, often giving emergency care after normal hours on a Friday or over the weekends in desperate moves to keep the heartbeat of finance beating.

However even all this intensive care was not enough, credit remained clotted, choking the lungs of the economy, requiring non-conventional processes to be adopted just to keep the possibility of a heart attack at bay. Some patients didn't make it. When Lehman exhaled its last shuddering breath, the Fed stood back unwilling to prolong the agony.

Has all this emergency care and medicine helped the economy at large, especially those businesses with lower credit ratings?

No. Rates for A2/P2 are back at the highs seen when the 2007 and 2008 shocks took place but now are at a massively higher spread from all other CP, that is some risk premium.

Whilst the Fed pumps funds into the Banking sector the same is not happening for the economy. Banks are rebuilding reserves and setting aside cash to cover further losses, right now there is no spare capacity to pass on funding to anyone or any business that might have risk attached to it.

The Liquidity Trap

I keep referring back to the Eggertsson Theory articles, which laid out the approach the Fed and US Treasury would follow as we fell into a deflationary period caused by the collapse of credit mechanisms. Without doubt we are past the mid point of the experiment to see if Friedman was right and Keynes wrong. Keynes said that at zero bound rates (where we are) that monetary policy becomes ineffective, Friedman disagreed. Here is a quote from another paper, The Liquidity Trap , written by GB Eggertsson to expand on this:

- A liquidity trap is defined as a situation in which the short-term nominal interest rate is zero. In this case, many argue, increasing money in circulation has no effect on either output or prices. The liquidity trap is originally a Keynesian idea and was contrasted with the quantity theory of money, which maintains that prices and output are, roughly speaking, proportional to the money supply.

According to the Keynesian theory, money supply has its effects on prices and output through the nominal interest rate. Increasing money supply reduces the interest rate through a money demand equation. Lower interest rates stimulate output and spending. The short-term nominal interest rate, however, cannot be less than zero, based on a basic arbitrage argument: no one will lend 100 dollars unless she gets at least 100 dollars back. This is often referred to as the 'zero bound' on the short-term nominal interest rate.

Hence, the Keynesian argument goes, once the money supply has been increased to a level where the short-term interest rate is zero, there will be no further effect on either output or prices, no matter by how much money supply is increased.

Whilst we have seen short term rates dip below zero as the rush to seek safety overcomes any requirement for returns, this is an infrequent occurrence.

Right now we have a situation that reflects the '30's and the Japanese 90's - 2006 were nominal rates are at zero and money supply is being increased at a massive rate. Why are the Fed following such a policy if we know there are inherent difficulties in breaking out of such a situation? Bond bears need to pay attention. We are back to public expectations, as Eggertsson points out:

- In contrast to the static Keynesian framework, monetary policy can still be effective in this model even when the current short-term nominal interest rate is zero. In order to be effective, however, expansionary monetary policy must change the public's expectations about future interest rates at the point in time when the zero bound will no longer be binding.

For example, this may be the period in which the deflationary shocks are expected to subside. Thus, successful monetary easing in a liquidity trap involves committing to maintaining lower future nominal interest rates for any given price level in the future once deflationary pressures have subsided.

We move our attention to the last FOMC announcement:

- Meanwhile, inflationary pressures have diminished appreciably. In light of the declines in the prices of energy and other commodities and the weaker prospects for economic activity, the Committee expects inflation to moderate further in coming quarters.

The Federal Reserve will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability. In particular, the Committee anticipates that weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.

However, we are no longer in normal circumstances. We are in an environment that has changed radically.

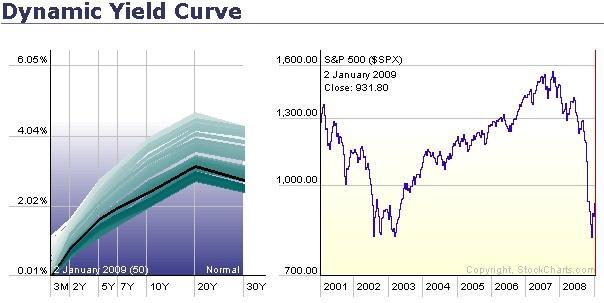

The Fed are buying Treasuries along the curve as well as Agency debt. This keeps a bid in place, keeping prices high and lowering the yield:

Courtesy of StockCharts.com

To read the rest of the article visit An Occasional Letter

By Mick Phoenix

www.caletters.com

An Occasional Letter in association with Livecharts.co.uk

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.