Financial Market Forecasts 2009 for Gold, US Dollar and Crude Oil

Stock-Markets / Investing 2009 Jan 06, 2009 - 02:24 PM GMTBy: Daniel_Smolski

The year 2008 will be written about in finance textbooks for generations to come. The inevitable collapse of the boom, built single-headedly on credit, finally came home to roast. Ironically, further liquidity is what has, thus far, ensured the survival of the system. Having received the rubber stamp for a $700B bailout, leave it to politicians to decuple that number to, a now estimated, $7 trillion. A liability that is set to fall on the shoulders of your kids and grandkids that realistically will never be paid off. By next year, America will join the likes of Japan and Italy with GDP-to-debt ratios in excess of 100%. How will congress dig itself out of this whole? All fingers are pointing to the monetization of debt.

The year 2008 will be written about in finance textbooks for generations to come. The inevitable collapse of the boom, built single-headedly on credit, finally came home to roast. Ironically, further liquidity is what has, thus far, ensured the survival of the system. Having received the rubber stamp for a $700B bailout, leave it to politicians to decuple that number to, a now estimated, $7 trillion. A liability that is set to fall on the shoulders of your kids and grandkids that realistically will never be paid off. By next year, America will join the likes of Japan and Italy with GDP-to-debt ratios in excess of 100%. How will congress dig itself out of this whole? All fingers are pointing to the monetization of debt.

Fundamentally, things could not be looking better for the gold. The printing presses are running on overtime and there seems to be no end to this Japan-style bailout of America. Helicopter Ben is well on his way in fulfilling his legendary promise to never allow deflation. The explosion in money supply has been unprecedented, only comparable to Zimbabwe and the likes of Argentina, Poland and the Roman Empire, among many others. History is plagued with examples of nations that have taken this destructive path. Given the current events, are precious metal markets reacting the way they should be? Many would argue NO.

Gold has kept its own in the face historic redemptions and the rush for liquidity but had one foretold the current events, most analysts would have predicted gold to be four digits in such an environment. The impossibility to purchase bullion the past few months has given further rise to the manipulation argument. Is the proposition that the Fed may have a hand in the gold price so ludicrous a theory? In reference to the 1980s, Paul Volker himself stated “Letting gold go to $850 was a mistake.” Gold has been money for over 2000 years. Watching the price of the dollar plummet in gold terms would signal nothing less than the slow extinction of our dollar. This evident loss in value of our currency is in direct consequence to the Federal Reserve, whose primary responsibility is not to ensure growth (as it is adamantly doing now) but to maintain the dollar's value (an irony in itself with the dollar having lost 96% of its value since inception). Nevertheless, whether there is a hand in the gold market or not, we use the charts to evaluate our investments.

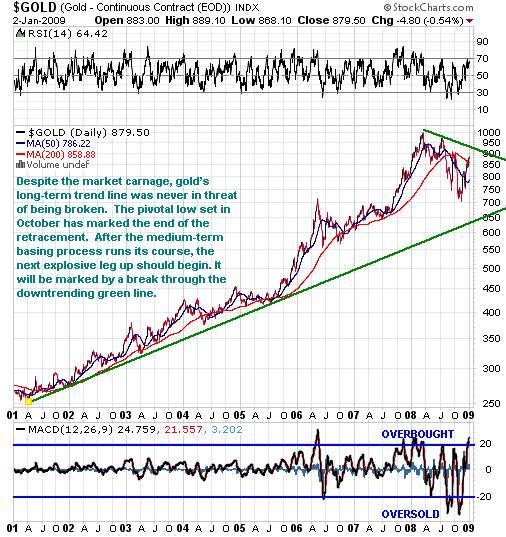

In times of distress, the best solution is often to take a look at the long-term picture of things. Over the long-term chart we have seen no changes in gold, it continues to be one of the best performing asset classes of the decade. The carnage in the markets have pulled down gold and it remains in a trend of lower lows and lower highs so caution is warranted but gold remains in a long-term bull market. Short-term, the MACD is conveying that gold is oversold is a consolidation is in the cards. Ideally we would like to see a breakout through the green downward trend, with a curling up and crossover of the 200 and 50-day moving averages. Gold will once again have its day but patience is warranted.

Gold stocks appear much healthier than physical gold. After the savage plunge in October, gold stocks have been performing very well, nearly doubling from their lows of 150. Ideally we would like to see HUI consolidate between 250 and 300, while gold corrects, before blasting higher by the end of the first quarter. It is important to note that HUI has performing very well relative to general market. This is of vital importance as gold stocks always lead the gold price at the start of any leg up.

The dollar has had an impressive run into the second half of 2008, after building a base in the earlier part of the year. A small head and shoulders topping pattern was erected from October to December, the dollar has now clearly broken its uptrend line and the long-term bear will gain stronghold once again. The forced redemptions and liquidations that brought life back into dollar are now coming to a close. All asset classes were severally sold off to obtain dollars to purchase treasury bills.

The days of running to T-Bills as a safe-haven are also numbered. It is only a matter of time before investors throw in the towel and refuse 0% returns on a currency whose supply has literally more than doubled the past year. We can almost hear the popping sound of the last remaining bubble in Treasury Bills. The dollar can be expected to consolidate here for a few weeks before resuming its downward spiral towards its intrinsic value, zero.

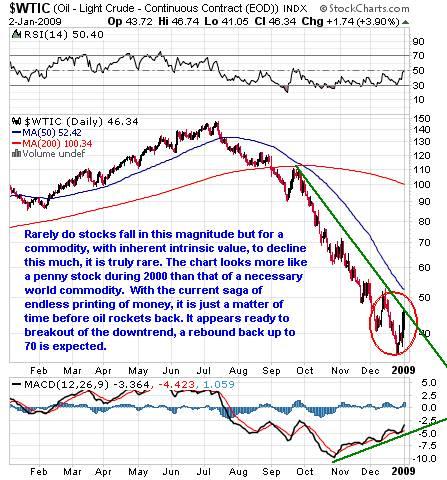

A commodity that is necessary for maintaining our industrially and technologically-reliant way of life, would never be expected to fall off the proverbial cliff in this manner. Oil has lost nearly three-quarters of its value in the second half of 2008. This retracement can only be viewed as temporary, with world oil reserves declining at nearly double digits rates and the money supply growing exponentially, the price of oil will recover. Oil needs to get above 50-day moving average to show signs of life but a relief rally is inevitable. A 50% retraction of the decline leads us to a target of at least $70.

CONCLUSION:

Over the long-term gold is set to continue its dramatic rise, as long as the printing press continue to run full-tilt. We will maintain our long-term precious metal stock positions, established in late October and November. Traders may have chosen to take some profits and unwound their GLD positions. A consolidation should provide us with fresh opportunities to re-enter positions that can be held for the remainder of the year. We will maintain our positions in oil, established the past couple few weeks. It appears that the crisis has somewhat abated and this should bring some stability back into the markets going forward. We will be reviewing where the stock market is headed and the specific sectors that are showing the most promise in the next few issues.

By Daniel Smolski

smolski@gmail.com - Smolski Investment Newsletter

For a limited time , we are opening our services to new subscribers and are currently offering a FREE trial to the Smolski Investment Newsletter. We had an extremely profitable year in 2008 but we strongly believe 2009 will be one of the best in a long time; those correctly positioned will reap the biggest rewards. In the next few weeks, we will continue to monitor the markets and specify which sectors are poised to provide the greatest returns. Do not hesitate to send us an email with “SIGN UP” as the subject line at smolski@gmail.com .

© 2009 Copyright Daniel Smolski - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.