Depression 2009 The Largest Train Wreck in Economic History

Economics / Great Depression II Jan 06, 2009 - 10:52 AM GMTBy: Darryl_R_Schoon

Change is a constant whether perceived or not; but only when we see it do we believe it has occurred. Then, it is too late.

Change is a constant whether perceived or not; but only when we see it do we believe it has occurred. Then, it is too late.

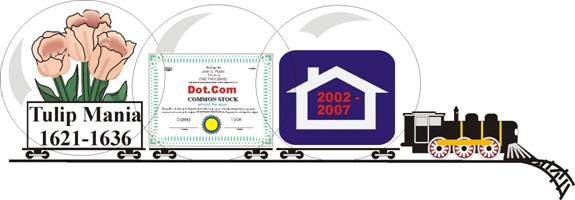

The phrase, speculative bubble, is used to describe the financial tumescence that characterizes the often manic unfounded rise of asset values. The phrase, however, is inadequate for it fails to convey the destructive aftermath that follows; for such purposes, train wreck, is a better description. In 2009, the largest train wreck in economic history is about to occur.

Unfounded manic speculation, e.g. the 2002-2007 real estate bubble, is not new. Similar manic speculation occurred in internet stocks in the 1990s, radio stocks in the 1920s, as it did in railroad stocks in the 19th century and in tulip bulbs in the 17 th century. Manic speculation is as human as the markets.

THE DELUSION OF RATIONAL MARKETS

The first stock exchange in the world was the Amsterdam Stock Exchange, established in 1602. Amsterdam was also the site of the world first speculative bubble, Tulip Mania, which appeared shortly thereafter, 1621-1636

This is from Wikipedia's recounting of Tulip Mania:

http://en.wikipedia.org/wiki/Tulip_mania :

.. traders signed contracts before a notary to purchase tulips at the end of the season (effectively futures contracts). Thus the Dutch, who developed many of the techniques of modern finance, created a market for durable tulip bulbs.

Short selling was banned by an edict of 1610, which was reiterated or strengthened in 1621 and 1630, and again in 1636. Short sellers were not prosecuted under these edicts, but their contracts were deemed unenforceable…

As the flowers grew in popularity, professional growers paid higher and higher prices for bulbs with the virus [a tulip-specific virus that caused more spectacular colored tulips] . By 1634, in part as a result of demand from the French, speculators began to enter the market.

In 1636, the Dutch created a type of formal futures markets where contracts to buy bulbs at the end of the season were bought and sold. Traders met in "colleges" at taverns and buyers were required to pay a 2.5% "wine money" fee, up to a maximum of three florins, per trade.

Neither party paid an initial margin nor a mark-to-market margin, and all contracts were with the individual counterparties rather than with the exchange. No deliveries were ever made to fulfill these contracts because of the market collapse in February 1637…

The contract price of rare bulbs continued to rise throughout 1636. That November, the contract price of common bulbs without the valuable mosaic virus also began to rise in value. The Dutch derogatorily described tulip contract trading as windhandel (literally "wind trade"), because no bulbs were actually changing hands. However in February 1637, tulip bulb contract prices collapsed abruptly and the trade of tulips ground to a halt.

It is clear that today's “complex and sophisticated” markets are not as unique as some would believe. What is new, however, are the circumstances and consequences of the current collapse. Today, financial markets are a global phenomena; and so, too, will be the consequences.

The invention of the stock market in Amsterdam in 1602 combined with the issuance of the Bank of England's credit-based paper money in 1694 was to change the course of human history for the next three hundred years. That epoch is now ending.

The world that credit gave rise to is collapsing as is its credit-based foundation, turning like the proverbial carriage into a pumpkin at midnight, as the hoped for financial fairy tale turns instead into a nightmare of defaulting debt in 2009.

The collapse of global markets and global trade is a sign we have reached the end of this epoch. The current financial collapse is the beginning of its end. When it is over, so, too, will be the era it spawned. Human history moves in waves. Another is about to begin.

ON THE TRAIL OF JOHN LAW

Last year during the Christmas holidays, Martha and I toured the Bank of England's museum on Threadneedle Street in The City of London, the original cistern of the global well of paper-based credit. Last year, the mood in London was still hopeful. It is no longer.

This Christmas holiday, we followed the trail of John Law from Amsterdam to Paris to Venice . John Law, a Scottish banker and economic theoretician was well acquainted with Amsterdam 's financial markets before introducing paper money and subsequent financial ruin to the nation of France on his way to escape, exile and eventual burial in Venice .

It is perhaps appropriate than John Law is buried in the Chiesa di San Moisè; a church in Venice now surrounded by fashionable stores such as Gucci, Fendi, Valentino, Prada, and Versace, luxury retailers who profited handsomely from the excesses of the recent global bubble.

But just as the speculative bubble of Tulip Mania presaged today's markets, the story of John Law has particular relevance to the current collapse. The combination of financial markets and paper money is a volatile mixture and none was ever so destructively volatile as John Law's introduction of paper money to the financial markets of France .

But just as the speculative bubble of Tulip Mania presaged today's markets, the story of John Law has particular relevance to the current collapse. The combination of financial markets and paper money is a volatile mixture and none was ever so destructively volatile as John Law's introduction of paper money to the financial markets of France .

John Law believed it was not necessary that money possess intrinsic value such as did gold or silver, money could be fiat, paper notes issued by government edict, an idea resembling those later promoted by American economist Milton Friedman.

John Law's disastrous experiment with paper money combined with his role in the Mississippi Land Company, a stock bubble on the scale of Tulip Mania, eventually transformed France and much of Europe into an economic wasteland leading eventually to the overthrow of the French nobility.

John Law's destructive influence on France has been exceeded, however, by today's extraordinary über- mixture of central bank credit-based paper money, excessive risk and leverage and the globalization of markets—a volatile mixture whose fragility, extreme size and combustibility are now about to destroy the 300 year old world built on debt and paper money.

ON THE SELF-CORRECTING NATURE OF IRRATIONAL MARKETS

In November 2006, Professor Antal Fekete addressed the 2007 class of MBA students at the University of Chicago , the then bailiwick of Milton Friedman, the well-known academic apologist for fiat currencies.

Professor Fekete was to deliver a scathing rebuttal of Friedman's theories. The professor, a long-time proponent of the gold standard and its role in monetary affairs, believed that John Maynard Keynes on the left and Milton Friedman on the right had given intellectual comfort to policies responsible for today's monetary problems—the elimination of gold from the international monetary system.

But Professor Fekete did not deliver his address criticizing Friedman. The day before he was to speak, Milton Friedman passed away. Instead of criticizing Friedman, Professor Fekete instead warned the students about the fragility of today's paper markets, markets that had become an extraordinary inverse pyramid of derivatives (then $480 trillion, now $668 trillion) and potential defaults built on irredeemable promises.

The students gave little thought to the Professor's warnings. They had prepared too long for their chance at the brass ring offered by Wall Street investment banks, the wealthy moneychangers in the temple of fiat currencies.

As about-to-be graduates of the prestigious MBA program at the University of Chicago , the students had much to expect upon graduation. When the Professor delivered his remarks, the August 2007 credit contraction was still nine months in the future; close, but still well outside the world of possibilities the students believed real.

One student asked:“Even if you're right, won't the markets self-correct?”

To the true-believers in paper money, paper markets and paper profits, self-correction was the accepted ideological panacea to whatever the markets would do.

That student never expected that the coming self-correction would wipe away his expected future. That instead of a large starting salary with significant bonuses at Lehman's, Bear Stearns, Merrill Lynch, or Morgan Stanley, he instead would be wondering how he could repay his student loans when the bank he believed would be his future home had collapsed or merged with another institution to avoid insolvency.

At the time, such possibilities appeared improbable if not outright impossible. Today, they have become the precursors of what is yet to be. A world so at odds with yesterday, that few can imagine what will happen next.

Dmitry Orlov is one of the few that can do so.

DMITRY ORLOV'S FIVE STAGES OF COLLAPSE

Dmitry Orlov, author of Reinventing Collapse; The Soviet Example and American Prospects (New Society Publishers, 2008), watched the collapse of the Soviet Union in the 1990s and predicted a similar crisis would later occur in America .

Buckminster Fuller had also predicted the collapse of the Soviet Union and America in 1981— the twilight of the world's power structures— in his book, The Critical Path (St. Martin's Press, 1981). Both nations crippled by excessive debt brought on by excessive military spending (what Bucky called killingry ) were fading behemoths whose passing would make way for a better world.

Orlov writes:

Having given a lot of thought to both the differences and the similarities between the two superpowers - the one that has collapsed already, and the one that is collapsing as I write this - I feel ready to attempt a bold conjecture, and define five stages of collapse, to serve as mental milestones as we gauge our own collapse-preparedness and see what can be done to improve it…

Stage 1: Financial collapse. Faith in "business as usual" is lost. The future is no longer assumed to resemble the past in any way that allows risk to be assessed and financial assets to be guaranteed. Financial institutions become insolvent; savings are wiped out, and access to capital is lost.

Stage 2: Commercial collapse. Faith that "the market shall provide" is lost. Money is devalued and/or becomes scarce, commodities are hoarded, import and retail chains break down, and widespread shortages of survival necessities become the norm…

Stage 1 in Orlov's scenario is well underway. The vast majority of investment and commercial banks are now insolvent, propped up and still in business only because of recently granted government guarantees designed to prevent workers from realizing their life savings are in imminent danger.

In Orlov's Stage 1, savings and access to capital are lost. In modern economies, capital, i.e. credit-based paper, has been substituted for real money, gold and silver. Credit-based paper money is no more real money than an image/belief in god is GOD. Savings, in mature credit-based economies as the US and UK are now virtually non-existent.

Capital is but thinly disguised credit and credit is now rapidly disappearing, a condition that will be fatal for those addicted to its continuing presence, e.g. corporations, governments and workers, especially in the US , UK , Europe , etc. New loan activity has fallen 91 % year to year. The consequences will be unprecedented and extraordinary.

In 2009, the economic train wreck now in motion will occur. It will not be a one time event. It will be a successive series of protracted crisis in conjunction with continuing breakdowns in access to credit, goods and services, an escalating and cascading series of pre vio usly unimaginable events.

In today's monetarily debased markets, credit has become essential for all commercial activity. This dream of bankers is the nightmare of producers and savers. Credit becomes compounding debt which becomes bankers' profits also resulting in increasing defaults and bankruptcies. Modern economics is not rocket science. It's an abomination on the economic body of mankind.

Stage 2 in Orlov's scenario will follow in the wake of Stage 1. Stage 2 is closer today than it was yesterday. The end game predicted by some will now become the reality for all. The predicted events have no basis in recent memory for those who will be affected.

The three hundred year old world founded on credit-based paper money is ending. The world's central banks which substituted paper for gold are finding themselves unable to solve the problems their fiat money has created. The consequences are far greater than people can imagine—a limitation that will not prevent them from happening.

GOLD, SCISSORS, PAPER

We who have grown up in the world of credit and debt have no memory or real understanding of the role that gold played in monetary affairs prior to the substitution of central bank credit-based paper for sound money. When the connection was cut between gold and money, few understood the consequences, consequences which are now upon us.

Uncle Milton and Uncle John

Gave much thought to what was wrong

But their bright ideas about the public purse

Have now made things so much worse

Discussion of the monetary role of gold and silver has been expunged from discussion in today's universities. One of the world's great economic thinkers whose writings consistently predicted today's collapse, Ludwig von Mises of the Austrian School of Economics was never accorded a paid position in an American university.

Although given the status of a visiting professor by New York University , Mises was not paid a salary and had to depend on outside assistance in order to survive. That far lesser teachers were salaried in America is an indication why today most American economists are unable to adequately explain or solve our economic problems.

PUTZES FROM PRINCETON

The influence of the US military-industrial complex over academic discourse, while exceedingly effective, has come at a considerable cost to the nation. President Dwight D. Eisenhower warned of this possibility in his Farewell Speech to the nation in 1961. Freedom and intellectual inquiry are not unrelated—nor are tyranny and blind obedience.

Professor Fekete's intended address at the University of Chicago was titled Where Friedman Went Wrong and included the following quote from Professor Walter E. Spahr, Chairman of the Department of Economics at NYU from 1927 to 1956:

What is the meaning of a gold standard and a redeemable currency? It represents integrity. It insures the people's control over the government's use of the public purse. It is the best guarantee against the socialization of a nation. It enables a people to keep the government and banks in check. It prevents currency expansion from getting ever farther out of bounds until it becomes worthless. It tends to force standards of honesty on government and bank officials. It is the symbol of a free society and an honorable government. It is a necessary prerequisite to economic health. It is the first economic bulwark of free men.

Professor Spahr's eloquent words are a timely reminder of the importance of the gold standard and do much to explain how we have arrived at our current circumstances. The gold standard is the constraint upon bankers and government that would have prevented the disaster that is now upon us; and, now in 2009, it is too late to undo what they have done.

Professor Spahr understood that the essential role of gold in monetary systems is to prevent bankers and government from overstepping the bounds of sound governance and prudent banking, bounds, which if undone, will bring ruin to the nation and to its people.

When President Nixon severed the ties between the US dollar and gold—as encouraged to do so by Milton Friedman—the very fears of men such as Spahrs and Fekete were set in motion. Now, three decades later, the results are in.

Financial markets are frozen, global trade is slowing rapidly, governments have debased their now fiat currencies and the collective excesses of government and bankers have brought the world to the edge of another Great Depression.

The warnings of those such as Spahr and Fekete were not heeded. Indeed, they were not even heard. The suppression of open dialogue and issues contrary to the purposes of corporate, banking and government interests carried over into colleges and universities as well as the media. It has cost America dearly.

Only When Freedom Is Lost Do The Reasons For Its Absence Become Clear

For those interested in the critical role of the gold standard, Professor Fekete will be giving a series of lectures March 27, 28 and 29 in Hungary . The gold standard as well as the backwardation of gold and silver and the coming depression will be discussed. For information, contact GSUL@t-online.hu . I will also give a talk at the conference.

THE LEGACY OF JOHN LAW

VERSUS

THE FUTURISTIC VISION OF R. BUCKMINSTER FULLER

I was fortunate to have met Marshall Thurber in law school in 1966, a friendship that has lasted far longer than my abbreviated tenure at law school. I am especially fortunate that Marshall later became a close friend and important supporter of Buckminster Fuller and his work.

In November, during a discussion about the current crisis which was predicted by Fuller more than 25 years ago, Marshall recommended I read Fuller's final book, Grunch Of Giants (Design Science Press, 1983).

Out of print and offered at the time through Amazon at a collector's price of $199, Marshall offered to send me his original signed draft if the book was not readily available. Fortunately, Marshall then directed me to the website of the Buckminster Fuller Institute where its price was $17.95, see http://bfi.org/?q=node/406 .

I finished reading Fuller's extraordinary work, Grunch Of Giants , on Christmas Day as Martha and I crossed the Alps . At this time I will refrain from a personal recapitulation as the work stands on its own and readers are easily capable of reaching their own conclusions. Nonetheless, Grunch of Giants confirmed for me the greatness and breadth of Fuller's vision.

After reading Grunch of Giants I could not help but see the clear distinction between two diametrically opposed visions/versions of our world: At one end of the spectrum is John Law's “Scarcity Theory of Value” and at the other is Buckminster Fuller's “False Assumptions of Scarcity”

The two assumptions and theories are diametrically opposed in intent and consequence and do much to explain the difference between today's world of crisis (confirming John Law's theories on scarcity) and tomorrow's possible promise (Buckminster Fuller's belief in abundance)

EMERGENCE THROUGH EMERGENCY

Because of Marshall Thurber 's friendship with Buckminster Fuller, I am aware of Fuller's belief in “Universal Emergence Through Emergency”. It is increasingly clear that today's crisis is rapidly approaching that of an emergency—the prerequisite for Universal Emergence.

Let us stand aside and help its birth. A new and better world is on its way. Gold and silver will help in the interim.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.