Deep Global Economic GDP Contraction During 2009

Economics / Recession 2008 - 2010 Jan 04, 2009 - 12:16 PM GMT Financial Times: GMAC gets $6 billion injection from US Treasury

Financial Times: GMAC gets $6 billion injection from US Treasury

“The US Treasury department late on Monday unveiled up to $6 billion in aid for GMAC, the financial services group which is critical to part-owner General Motors‘ turnaround.

“The Treasury said in a statement it would buy $5 billion in senior preferred equity with an 8% dividend from GMAC, characterizing the investment as part of ‘a broader program to assist the domestic automotive industry in becoming financially viable'.

“It will also lend GM up to $1 billion to participate in a rights offering at GMAC in support of GMAC's reorganization as a bank holding company.

“Diminished access to capital had forced GMAC to cut back on vehicle financing, which in turn jeopardized GM itself.

“‘With the Treasury investment, we intend to resume our automotive lending quickly,' GMAC spokeswoman Gina Proia said.

“The aid, which is being made under the Troubled Assets Relief Program (Tarp), comes after the Treasury earlier this month said it would extend a $17.4 billion emergency loan package to GM and Chrysler.”

Source: Nicole Bullock, Henny Sender and Bernard Simon, Financial Times , December 29, 2008.

Karl Denninger (Market-Ticker): GMAC's “money-losing strategy” makes no sense

“The government ‘buys' preferred equity that pays an 8% coupon. GMAC must pay that 8% coupon (9% if the government exercises the warrants).

“GMAC turns around and loans out money at 0% which it has to pay 8% to acquire, and at the same time decides that it will make loans to people with credit scores significantly worse than average, when before they would make loans only to people with scores that were slightly better than average. And we wonder how we got into this mess?

“The Federal Reserve and Treasury approved an application that contained as it's essence an intentional money-losing business strategy, enabling the literal looting of the public treasury under the false pretense of an ‘investment'.”

Source: Karl Denninger, Market-Ticker , December 31, 2008.

Financial Times: Fed pushes on with mortgage bond plan

“The Federal Reserve pushed ahead with its plan to buy mortgage bonds issued by Fannie Mae and Freddie Mac on Tuesday, saying it would start buying early next month and purchase up to $500 billion by the end of June.

“The aggressive tactics – the Fed had previously said it would buy this amount over ‘several quarters' – highlights the central bank's determination to hammer down the risk spreads on the mortgage bonds and thereby reduce mortgage rates.

“The Fed also announced that it had selected four asset managers – BlackRock, Goldman Sachs, Pimco and Wellington Management – to manage the process. It had agreed a ‘competitive fee structure' but did not disclose this.

“The Fed said ‘the program is being established to support the mortgage and housing markets and to foster improved conditions in financial markets more generally'.

“The move comes as policymakers at the central bank and in both the outgoing Bush and incoming Obama administrations look to target mortgage rates in the hope that lowering them would arrest the decline in house prices and thereby support financial asset prices.”

Source: Krishna Guha, Financial Times , December 30, 2008.

Bloomberg: Barclays's head says “worst is ahead” for US economy

“Ethan Harris, co-head of US economic research at Barclays Capital, and Richard DeKaser, chief economist at National City Corp., talk with Bloomberg's Peter Cook about the outlook for the US economy.”

Source: Bloomberg (via Blinx ), December 31, 2008.

Paul Krugman (The New York Times): The yield curve is wonkish

“I'm a little late getting to this, but … I see that economists at the Cleveland Fed are taking some comfort from the positive slope of the yield curve . Long-term interest rates are higher than short-term rates, which is usually a sign that the economy will expand.

“Not this time, I'm afraid. It's all about the zero lower bound.

“The reason for the historical relationship between the slope of the yield curve and the economy's performance is that the long-term rate is, in effect, a prediction of future short-term rates. If investors expect the economy to contract, they also expect the Fed to cut rates, which tends to make the yield curve negatively sloped. If they expect the economy to expand, they expect the Fed to raise rates, making the yield curve positively sloped.

“But here's the thing: the Fed can't cut rates from here, because they're already zero. It can, however, raise rates. So the long-term rate has to be above the short-term rate, because under current conditions it's like an option price: short rates might move up, but they can't go down.

“Indeed, if we look at Japan we find that the yield curve was positively sloped all the way through the lost decade. In 1999-2000, with the zero interest rate policy in effect, long rates averaged about 1.75%, not too far below current rates in the United States.

“So sad to say, the yield curve doesn't offer any comfort. It's only telling us what we already know: that conventional monetary policy has literally hit bottom.”

Source: Paul Krugman, The New York Times , December 27, 2008.

Karl Denninger (Market-Ticker): Uh oh … monetary multiplier below zero

“What is this?

“I could go through the derivation of how money supply works in a fractional reserve monetary system, but won't, because most readers would have their eyes glaze over.

“The important part of this graph is what it denotes. Bernanke has lost control of ‘N' (or velocity), which is the actual knob that he is trying to diddle when borrowing rates are changed (and in fact its the market that sets that, despite his protests).

“In fact the most useful tool in The Fed's box in terms of influencing monetary policy is the soapbox, that is, jawboning (whether it be by cajoling or threatening.)

“The problem with an M1 multiplier below one is that the effect of printing money is of course multiplied by the velocity. That is, if you print up $10 into the economy the impact it has on economic activity depends on how many times that $10 circulates in a given amount of time. The more it circulates the higher the impact and the more your efforts do for the economy.

“The bad news is that when the multiplier is less than one the more money you spew into the economy the worse the impact, as you get less for each additional dollar.”

Source: Karl Denniger, Market-Ticker , December 30, 2008.

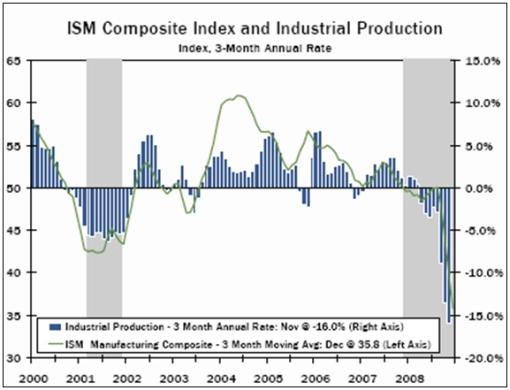

John Silvia (Wachovia Economics Group): ISM Manufacturing – economy remains in teeth of the recession

“December's ISM manufacturing index came in at 32.4, well within recession territory and consistent with levels of the 1980-82 recession period. Weakness remains in new orders, production and employment. The inventory correction is ongoing. Prices paid fell sharply to 1949 lows and suggests lower inflation ahead.”

Source: John Silvia, Wachovia Economics Group , December 30, 2008.

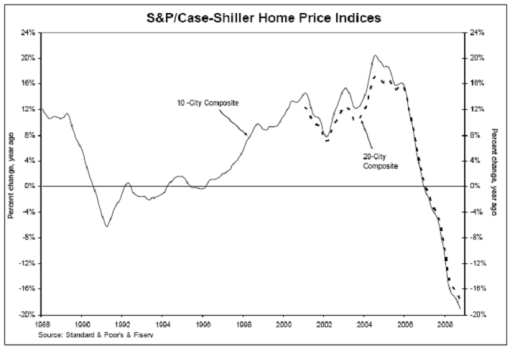

Standard & Poor's: Case-Shiller – home price declines worsen

“Data through October 2008, released today [Tuesday] by Standard & Poor's for its S&P/Case-Shiller Home Price Indices, shows continued broad based declines in the prices of existing single family homes across the United States, with 14 of the 20 metro areas showing record rates of annual decline and 14 now reporting declines in excess of 10% versus October 2007.

“The chart above depicts the annual returns of the 10-City Composite and the 20-City Composite Home Price Indices. Following the lead of the 14 metro areas described above, the 10-City and 20-City Composites set new records, with annual declines of 19.1% and 18.0%, respectively.

“‘The bear market continues; home prices are back to their March, 2004 levels.' says David Blitzer, Chairman of the Index Committee at Standard & Poor's. ‘Both composite indices and 14 of the 20 metro areas are reporting new record rates of decline.'”

Source: Standard & Poor's , December 30, 2008.

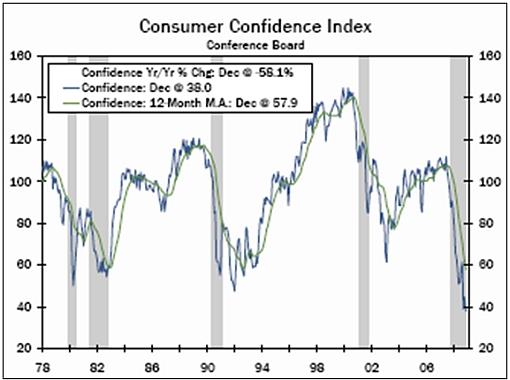

Mark Vitner (Wachovia Economics Group): Consumer confidence falls to a new low “Worries about employment and income prospects were likely weighing on consumers' minds this holiday season, contributing to a larger than expected drop in consumer confidence. The Consumer Confidence Index fell 6.7 points to an all-time low of 38.0 in December, with most of the drop in the present situation series.

“While the present situation index is responsible for most of December's drop, the record low in the overall index is due mostly to consumers' extremely pessimistic view of future economic conditions. The present situation index plunged 12.9 points in December to 29.4, which is the lowest reading since the aftermath of the 1990/91 recession. The future expectations component, however, remains near all-time lows, even though it declined just 2.4 points to 43.8 December and remains above its October low.

“The Consumer Confidence Index is one of the longest running measures of consumer behavior, dating all the way back to 1947. The index has a very good record of tracking the performance of overall economic activity but has a very mixed record as a leading indicator.”

Source: Mark Vitner, Wachovia Economics Group , December 30, 2008.

The Wall Street Journal: Retail sales plummet

“Price-slashing failed to rescue a bleak holiday season for beleaguered retailers, as sales plunged across most categories on shrinking consumer spending, according to new data released Thursday.

“Despite a flurry of last-minute shoppers lured by the deep discounts, total retail sales, excluding automobiles, fell over the year-earlier period by 5.5% in November and 8% in December through Christmas Eve, according to MasterCard Inc.'s SpendingPulse unit.

“When gasoline sales are excluded, the fall in overall retail sales is more modest: a 2.5% drop in November and a 4% decline in December. A 40% drop in gasoline prices over the year-earlier period contributed to the sharp decline in total sales.

“But considering individual sectors, ‘This will go down as the one of the worst holiday sales seasons on record,' said Mary Delk, a director in the retail practice at consulting firm Deloitte LLP. ‘Retailers went from ‘Ho-ho' to ‘Uh-oh' to ‘Oh-no'.'

“Luxury goods, once considered immune from economic turmoil, were hardest hit, with sales falling 21.2%, compared with a jump of 7.5% a year ago, when the economy had just begun to sputter. Including jewelry sales, the luxury sector plunged by a whopping 34.5%.

“During the same period last year, overall retail sales rose a modest 2.4%, helped by late-season discounting that enticed procrastinating shoppers. But this year, after a moderate uptick in shopping activity boosted by steep promotions the Friday after Thanksgiving, shoppers closed their wallets and reopened them only cautiously, worried by job losses, a sinking stock market and a recession climbing into its second year.”

Source: Ann Zimmerman, Jennifer Saranow and Miguel Bustillo, The Wall Street Journal , December 26, 2008.

Reuters: Bush signs pension relief bill into law

“President George W. Bush on Tuesday signed into law a measure intended to help company pension plans and retirees that have been hard hit by the financial crisis.

“Despite some concerns about the legislation, Bush decided that in the current financial environment the benefits outweighed the problems, the White House said.

“Generally healthy multi-employer pension plans hurt by the stock market decline would not have to make drastic pension plan contribution increases and worker benefit cutbacks that many companies had feared.

“A multi-employer pension plan, unlike a traditional single-employer plan, covers workers from more than one company and allows workers to move from job to job and still contribute to the plan.

“People 70-1/2 years old or older would not have to take distributions from their retirement plans as required under current law, allowing them to keep savings intact and avoid a bear-market tax hit.

“White House spokesman Tony Fratto said the administration had concerns that the legislation would increase the costs of near-term claims on the Pension Benefit Guaranty Corporation and could result in some benefits lost to workers over the long term. ‘Our concerns with the legislation remain, but we do believe that, in this current economic environment and current economic circumstances, that the benefits of the legislation outweighed our objections,' he said.”

Source: Tabassum Zakaria, Reuters , December 23, 2008.

Financial Times: Auditors urge rethink on pension

“Auditors are pressing companies to reconsider how they calculate their pension liabilities and urging them to use formulas that could give rise to much larger reported deficits than would be the case if they stayed with the current approach.

Market volatility has raised questions over the so-called ‘discount rate' used to calculate the present-day value of a fund's future liabilities.

“The lower the rate used, the higher the present liabilities will be. The rates currently used by companies to calculate those liabilities are roughly equivalent to those on less risky high-grade corporate bonds. However, these have soared amid the market turmoil, sharply shrinking reported fund deficits.

“Some schemes have actually reported a surplus even as the values of the stocks they hold have plunged.”

Source: Norma Cohen and Jennifer Hughes, Financial Times , December 30, 2008.

Financial Times: Money flows out of hedge funds at record rate

“Investors pulled a net $32 billion from hedge funds last month, making 2008 the first year in their recorded history that the funds have had significant outflows and ending the industry's 18 years of asset growth.

“Money has been taken out of funds following every strategy, even those – such as macro funds – which were showing returns, according to data from fund trackers Hedge Fund Research.

“The funds enjoyed net inflows for the first part of the year, even as the financial crisis hit and traditional mutual funds began to show outflows.

“However, in September a tide of redemptions began, according to TrimTabs, another fund tracker.

“Conrad Gann, chief operating officer of TrimTabs, said: ‘We estimate outflows in November were $32 billion, and there is an additional pipeline of redemptions that have not been filled, there could be $80 billion [of redemptions] in December.

“‘There are $57 billion of redemptions that we know are in, that are not reflected yet,' he said.

“Mr Gann said it was difficult to estimate outflows for coming months because hedge funds had different redemption cycles.

“In recent months funds have also tried to halt outflows by limiting or suspending investor withdrawals. This means that data on outflows, which reflect actual repayments to investors, understates the true picture.

“This is the first year since at least 1990 that hedge funds have seen a drop in assets.”

Source: Deborah Brewster, Financial Times , December 30, 2008.

MarketWatch: Sam Stovall bullish on 2009, his father less so

“It's been a horrible year for stocks overall – the worst, in fact, since 1931. Oft-cited market pundit Sam Stovall of Standard & Poor's and his father, Robert Stovall, a veteran money manager at Wood Asset Management, review the past year with MarketWatch's Steve Gelsi.”

Source: MarketWatch , December 31, 2008.

Richard Russell: Stock crashes have look of completed declines

“Over the weekend, I reviewed the charts of hundreds of leading NYSE stocks. Many of these stocks have crashed. In almost all cases, RSI has plunged to severely oversold levels. I note that at the end of each crash, the price action has been forming a sideways pattern. These numerous crashes have the look of completed declines – declines from which bases are forming. Following a true crash, stocks and stock averages have a habit of recovering roughly 50% of the action lost in the crash.

“And I'm wondering whether these patterns are now indicating that a tradeable low has been reached by this bear market. The news continues awful, and yet these various stock bottoms, following crashes, appear to be holding.”

Source: Richard Russell, Dow Theory Letters , December 29, 2008.

Bloomberg: Leuthold – cash at 18-year high makes stocks a buy

“There's more cash available to buy shares than at any time in almost two decades, a sign to some of the most successful investors that equities will rebound after the worst year for US stocks since the Great Depression.

“The $8.85 trillion held in cash, bank deposits and money-market funds is equal to 74% of the market value of US companies, the highest ratio since 1990, according to Federal Reserve data compiled by Leuthold Group and Bloomberg.

Leuthold, Invesco Aim Advisors, Hennessy Advisors and BlackRock, which together oversee almost $1.7 trillion, say that's a sign the Standard & Poor's 500 Index will rise after $1 trillion in credit losses sent the benchmark index for American equities to the biggest annual drop since 1931. The eight previous times that cash peaked compared with the market's capitalization the S&P 500 rose an average 24% in six months, data compiled by Bloomberg show.

“‘There is a store of cash out there that is able to take the market higher,' said Eric Bjorgen, who helps oversee $3.4 billion at Leuthold in Minneapolis. ‘The same dollar you had last year buys you twice as much S&P 500 as it did a year ago.'

“Leuthold Group, whose Grizzly Short Fund returned 83% in 2008 thanks to bets against equities, said in its December bulletin to investors that stocks offer ‘one of the great buying opportunities of your lifetime'.”

Source: Eric Martin and Michael Tsang, Bloomberg , December 29, 2008.

David Fuller: 10 tangible reasons for a rally

“I have listed and illustrated 10 tangible reasons for a rally (no cheerleading here), and also discussed a crucial missing ingredient.

1. Governments have flooded the system with liquidity. It takes time for this to filter through to the economy but it will reach the stock market more quickly.

2. Interest rates are at record lows for the US and UK, both short-term and long-term, and heading lower elsewhere. This is an ideal background for stock market recoveries.

3. Valuations are much improved, despite legitimate concerns over the earnings outlook for at least the first half of 2009. Equity yields are competitive with government bond yields, despite the near certainty of more dividend cuts than increases over the next six months.

4. Corporate bond yields peaked in October and November and have fallen significantly. They have also begun to improve their performance relative to government bonds.

5. Various measures of investor/advisor sentiment reached extreme lows in October.

6. The VIX Index peaked in October and is trending lower.

7. Commodity indices have fallen significantly, lowering inflationary pressures. Historically, equities have done best in disinflationary environments.

8. In many countries, the financial sector is showing strength relative to the broader indices. This is a key lead indicator.

9. Levels of cash are at record highs.

10. Most broad stock market indices show some evidence of base formation development. This is less clear for the DOW, but can be seen for the FTSE 100, DAX, SX5E, FSSTI and NKY, to mention a few of many.

“In conclusion, technical evidence remains more conducive to a stock market rally rather than another slump. Over the last three weeks we have repeatedly mentioned the December reaction lows. They need to hold to remain consistent with our expectations for a ranging stock market recovery extending well into Q1 2009.

“The crucial missing ingredient for stock markets to date has been confidence. Nevertheless that could change in January, given the high levels of cash held by most institutional investors. If stock markets languish in the New Year, as many expect, there will be little reason for investors to reinvest in the stock market. However, if stock market indices surprise the bearish consensus and start to break upwards rather than downwards from their trading ranges, institutional investors will be under increasing pressure to participate. Failure to do so would put them at a competitive disadvantage in terms of 2009's performance.

“Lastly, if the global economy does not show evidence that the recession is ending by Q3 2009, in response to the stimulus programmes, stock markets will be susceptible to a significant retracement of gains achieved during the first half of the year.”

Source: David Fuller, Fullermone y, December 30, 2008.

Barron's: Seasonal patterns for the market

“Barron's Michael Santoli discusses what market patterns to expect in the closing days of 2008 and the beginning of 2009.”

Source: Barron's , December 29, 2008.

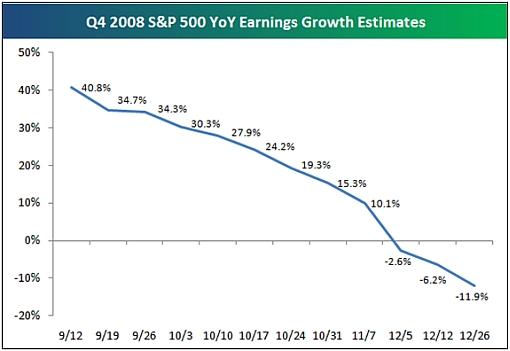

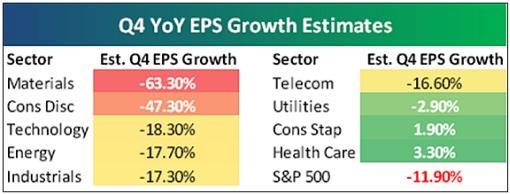

Bespoke: Estimated earnings growth for the S&P 500

“Below we highlight historical earnings growth estimates for the S&P 500 for Q4 2008 and full-year 2009. As shown, EPS estimates have dropped sharply over the last few months, and analysts are currently expecting the S&P 500 to see year-over-year earnings fall by 12% in the fourth quarter.

“At the start of September, analysts were actually expecting growth of 40%, which was largely because financial companies were expected to bounce back from a very poor Q4 in 2007. Instead, these companies are struggling much more than they were at this time last year.

“Estimates for 2009 have been dropping significantly as well. Back in September, analysts were expecting 2009 earnings growth of 24.7% versus 2008. But estimates are now at just 4.5%, and judging by the current trend, analysts will be looking for negative 2009 growth in no time.

“Earnings for Materials are expected to fall the most at –63%, while Consumer Staples and Health Care are the only two sectors expected to see year over year growth.”

Source: Bespoke , December 29, 2008.

John Hussman (Hussman Funds): Prices of Treasury bonds at dangerous levels

“… bond yields at this point are vulnerable to very sharp reversals. Given the level of extension in yields, it would not be difficult for the bond market to generate losses of say 10% in the 10-year Treasury bond, and as much as 20% to 25% in the 30-year Treasury bond over a very short period of time. Straight Treasuries may have safety from default risk, but the price risk is becoming downright dangerous.

“Corporate yields are much more reasonable, but there will be more fallout in this sector, and as I've noted before, taking a significant position in corporate would be essentially like a ‘bottom call' in stocks, since corporate bonds tend to trade much like stocks during periods of elevated default risk.

“For our part, we strongly prefer Treasury inflation protected securities here. Despite near term deflationary prospects, the enormous expansion in government liabilities is unlikely to be accompanied by long-term inflation rates near zero, which is essentially the level that is priced into TIPS at present.”

Source: John Hussman, Hussman Funds , December 29, 2008.

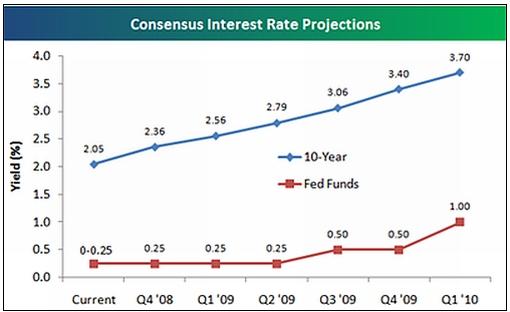

Bespoke: Economists' interest rate projections

“Below we highlight average estimates for the 10-Year Treasury Yield and the Fed Funds Rate going out to Q1 ‘10 based on Bloomberg's survey of more than 50 economists. As shown, economists are expecting the 10-Year Yield to increase steadily in 2009, while they don't expect the Fed Funds Rate to move back up to 50 bps until the third quarter. By the first quarter of 2010, economists expect the Fed Funds Rate to be back up to 1.00%. It's hard to find an economist or analyst on the street that doesn't think Treasuries will fall after the gains they've had in recent months. However, just like oil's rally from $110 to $120 to $140, asset classes can move in one direction a lot more than most people expect.”

Source: Bespoke , December 31, 2008.

Forbes: Big Brother investing

“William Gross has buying power few can match. The founder of money manager Pimco in Newport Beach, Calif. oversees $790 billion, most of it invested in fixed income. But now there's a new bully on the block: Uncle Sam. The government is on a buying spree the likes of which has never been seen, its purchases of corporate debt held back only by the speed of the dollar printing presses.

“Many of the targets of Washington's largesse are shaky financial outfits that Gross normally wouldn't touch, like AIG. Its bonds trade now at 12% yield to maturity – junk level last summer. Investors may be fleeing, but Gross knows when he's been outmuscled. In the past year the 64-year-old King of Bonds has bought $100 billion of preferred shares and senior debt of financial companies receiving taxpayer loans. His bet is that the government will throw good money after bad rather than let them fail.

“Gross may be buying what others are anxious to sell, but don't interpret this as meaning he thinks the economy is soon recovering. In fact, he's quite bearish. With stocks down 40% this year, he predicts Americans will shift from risk to thrift for at least a generation. He says higher savings, plus a move away from leverage by businesses and money managers, means the US economy will grow no more than 2% annually for years, a third slower than its 20-year average. Profit margins will narrow, stock gains will slow to a crawl and the government will find itself lending to the private sector for a long time.

“Gross' theory is that the government will arrange to get itself paid back and that his investors can safely travel on the government's coattails. Gross figures Washington is getting a return on its preferred securities, including the value of its equity warrants, of 6% annually. With investors fleeing banks, though, his yield is much higher for essentially the same securities: 10% to 13%. He says these issues are like $20 bills on the street that no one picks up because they can't believe it's true. ‘It's the most incredible value I've ever seen,' he says.”

Click here for the full article.

Source: Bernard Condon, Forbes , January 12, 2009.

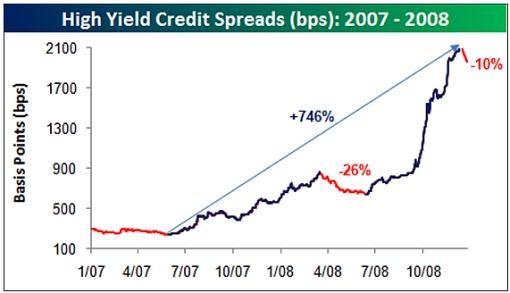

Bespoke: High yield spreads contract 10% from December highs

“While it may be cold outside, the thaw we have been seeing in the credit markets reached a notable milestone on Friday. Based on data from Merrill Lynch indices, high yield spreads tightened from 1,979 to 1,955 basis points. From their peak reading of 2,182 basis points on December 15, high yield spreads have now contracted by 10.4%.

“While these levels are still extremely high, they are moving in the right direction. The hope now for the bulls is that this move is sustainable in the new year, when trading desks are back at fully staffed levels.”

Source: Bespoke , December 29, 2008.

BBC News: China to allow freer yuan trades

“China has said it is to allow some trade with its neighbours to be settled with its currency, the yuan. The pilot scheme was announced in a package of measures designed to help exporters hit by the global downturn.

“It means if the two parties to a trade have yuan available, they need not enter world exchange markets to pay. Most of China's foreign trade is settled in US dollars or the euro, leaving exporters vulnerable to exchange rate fluctuations.

“The yuan is not yet a freely convertible currency.

“Officials did not say when the trial scheme would start. When it does, the yuan could be used to settle trade between parts of eastern China (Guangdong and the Yangtze River delta) and the territories of Hong Kong and Macau, and between south-west China (Guangxi and Yunnan) and the Asean group of countries (Brunei, Burma, Cambodia, Indonesia, Laos, Malaysia, the Philippines, Singapore, Thailand and Vietnam).”

Source: BBC News , December 25, 2008.

Gulfnews: Single currency to increase clout

“A single currency backed by a common economic agenda and a unified monetary policy could make the Gulf a strong regional economic bloc, say economists and financial experts.

“‘The single currency is a huge opportunity for the Gulf region to make its economic clout felt in the international arena. Creation of a strong currency supported by nearly 50% of world's oil wealth will prove to be a major stabilising factor for the regional economies,' said Dr Nasser Saidi, Chief Economist of Dubai International Financial Centre.

“Besides attracting foreign investments, analysts say, a strong currency could become a key factor in preserving the region's financial wealth and help recycle oil wealth within the region.

“Analysts believe the current global economic environment presents an ideal opportunity for the creation of a strong common currency that could emerge stronger than many international currencies such as the dollar, euro, yen and sterling.

“‘The Gulf common currency supported by the region's resource wealth could become a major reserve currency attracting global reserves into the region. It could also help regional financial centres emerge as global financial centres competing with others such as New York and London,' said Dr Saidi.

“Economists and currency experts believe the pegged currency regimes in the region and the direct link to the US monetary policy was one of the main reasons for the recent economic volatility in the region. Once the currency union is launched, the immediate priority of the Gulf Central Bank will be to launch a flexible monetary policy that ensures exchange rate stability.”

Source: Babu Das Augustine, Gulfnews , December 29, 2008.

Financial Times: Steel output set for historic drop

“The steel business faces a fall in production in 2009 of at least 10%, analysts say. This would be the biggest year-on-year fall for more than 60 years.

“According to the gloomiest projections, it could be at least four years before output returns to the levels of 2007.

“This would make the period of the expected downturn only the fifth occasion in the past century, leaving aside times of world war, when a slump in the steel industry has lasted four years or longer.

“The sector has been among those worst hit by this year's financial storms, with share prices in many steel groups having fallen by more than two-thirds since the middle of 2008.

“Hit by a sudden reduction in orders in September and October from businesses such as construction, cars and white goods, many producers including Lakshmi Mittal's ArcelorMittal, Severstal of Russia and Corus, owned by India's Tata Steel, have sharply cut production.”

Source: Peter Marsh, Financial Times , December 28, 2008.

Asha Bangalore (Northern Trust): Global factory activity mired in a slump

“In Europe, Germany, France, and the UK all reported declines in indexes of purchasing managers in December.

“The overall Markit Eurozone Purchasing Managers' Index (PMI) for the manufacturing sector declined to 33.9 in December, a record low in the 11-year history of the survey.

“The German Markit Purchasing Managers' Index fell to 32.7, the lowest since the survey began in 1996, and the December decline marks the fifth monthly contraction in factory activity.

“The French Markit/CDAF purchasing managers' index for manufacturing dropped to 34.9 in December versus 37.3 in November. This reading is the lowest since record keeping for this series began in April 1998.

“Britain's manufacturing sector contracted for an eighth straight month running in December.

“China's, factory sector has contracted for the fifth month running according to the CLSA China Purchasing Managers' Index.

“Although the Australian Industry Group-PricewaterhouseCoopers Australian Performance of Manufacturing Index rose one point in December from November to 33.7 index points, this index has recorded readings below 50.0 for seven consecutive months, indicating an extended period of contraction in factory activity.

“In sum, weak economic conditions across the world is a challenge for policy makers in the months ahead.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , January 2, 2009.

International Herald Tribune: Germany resists calls to spend its way out of trouble

“With battle lines sharpening, the German government appears determined to resist calls to spend an additional €40 billion to fight its way out of the recession, according to officials attending a meeting in the Chancellery in the past week.

“Chancellor Angela Merkel is being pulled in all directions as she plans a January 5 follow-up to a meeting of German government officials, business executives and union leaders she called two weeks ago to discuss ways to counter the recession.

“The business community, leaders of German states and other European Union nations are calling for the additional spending, which would amount to $56 billion. Industry chiefs, meanwhile, are calling for tax cuts.

“Merkel, facing federal elections in September, has said the focus of any spending measures must be preserving jobs. At the meeting two weeks ago, industry lobbyists promised to go along on that point, but now they have backed away even as they exert more pressure on her.

“The European Union, while weakening its criticism of Merkel's cautious approach to dealing with the economic crisis, still wants the German government to do more because of its size: It has the largest economy in Europe.

“Merkel, so far, has kept the lobbyists, the state leaders and the EU guessing about her final package.”

Source: Judy Dempsey, International Herald Tribune , December 26, 2008.

Reuters: Further house price declines in store for UK

“Housing prices in England and Wales fell 8.7% in 2008, bringing the average price of a house to 159,900 pounds, property consultant Hometrack said in its monthly survey on Monday.

“At 0.9%, the pace of monthly decline eased slightly from November's 1.1% drop, although prices have now fallen consistently over the last 15 months and 9.3% since the start of the credit crunch in August 2007.

“British house prices tripled in the 10 years running up to their peak in the middle of last year, but have since fallen as much as 15% in other surveys as the global financial crisis has caused the supply of mortgages to dry up.

“‘The onset of recession and the prospect of rising unemployment over 2009 will continue to dampen confidence and in turn demand, which will inevitably lead to further house price falls over the next 12 months,' said Richard Donnell, director of research at Hometrack.

“Two other key indicators – time taken to sell a property and proportion of the asking price achieved – demonstrate the current weak housing market.

“Hometrack found the average time to sell a property in December was 12 weeks, up from 8.3 weeks a year ago and a low of six weeks in April 2007. The proportion of the asking price being achieved reached 88.6%, down from 93.5% a year ago, and well down on the high of 95.7% seen in April 2007.”

Source: Maureen Bavdek, Reuters , December 29, 2008.

US Global Investors: China's manufacturing PMI remains in contraction

“According to CLSA, China's manufacturing activity, responsible for 43% of the country's GDP, contracted for a fifth month in December though the figures were an improvement from November. A sustained de-stocking cycle in the industrial sector has pushed the employment situation to a 56-month low, a tangible menace for consumer confidence and social stability.”

Source: US Global Investors – Weekly Investor Alert , January 2, 2009.

CNBC: Expect a V-shaped recovery in China

“Sun Mingchun, senior China economist at Nomura, sees a V-shaped recovery in China, with GDP growth starting to rise in the second-quarter of 2009. He explains his optimistic outlook to CNBC's Martin Soong.”

Source: CNBC , December 29, 2008.

Bloomberg: Japanese economy may shrink 12.1% “Japan's economy will probably shrink at an annual 12.1% pace this quarter, the sharpest drop since 1974, as exports collapse, Barclays Capital said.

“Gross domestic product in the three months ending tomorrow will fall at almost three times the 4.1% rate previously predicted, said Kyohei Morita, chief Japan economist at Barclays in Tokyo, after reports last week showed industrial production and exports posted the biggest declines on record in November.

“‘Given the speed and the length of the contraction, this recession could be the most severe in the postwar era,' Morita said. ‘We expect negative growth will continue for a fifth straight quarter to the April-June period of 2009.'

“A 12.1% annualized contraction would be the steepest since the first quarter of 1974, when the oil shock caused the economy to shrink 13.1%, according to Barclays.”

Source: Keiko Ujikane and Tatsuo Ito, Bloomberg , December 30, 2008.

CEP News: Singapore GDP contracts more than expected

“Singapore's preliminary gross domestic product (GDP) contracted 12.5% in the fourth quarter, against expectations for a 3.4% quarter-over-quarter contraction and the upwardly revised 5.4% decrease seen in the third quarter, originally reported as -6.3%.

“GDP was down 2.6% year over year, against a 0.3% annual decline in the third quarter.

“The report, released by Singapore's Ministry of Trade and Industry Friday morning said the sharpest annual declines were in the manufacturing sector, down 9.0% from one year ago. The construction sector was up 13.3% annually and the services and producing component was up 1.1%.”

Source: CEP News , January 2, 2009.

US Global Investors: Brazil's manufacturing confidence plunges

“The Brazilian Manufacturing Industry Survey compiled by the Getúlio Vargas Foundation in Brazil revealed a significant decline in the seasonally-adjusted Industry Confidence Index, from 83.9 in November to 74.7 in December. This was the fourth consecutive decline in this leading indicator of economic activity. In December, the index fell to its second-lowest level since the data series was created in April 1995.”

Source: US Global Investors – Weekly Investor Alert , January 2, 2009.

Financial Times: Russia braced for unrest

“Russia is bracing for further unrest as the rouble on Friday slid to a new low against the euro after a succession of moves to devalue its currency.

“A cut on Friday extended six weeks of devaluations by Russia's central bank designed to offset the impact of the global economic crisis and falling oil prices as the country's main export commodity approached its lowest level since 2004.

“Mikhail Gorbachev, the former Soviet leader, warned Russia faced ‘unprecedentedly difficult and dangerous circumstances' and could be ‘heading into a black hole'. ‘It is not clear what the fate of our rouble will be or if society has sufficient financial and moral resources,' he said.

“After the depreciation, which was the eighth so far this month, the rouble declined as much as 1.2% to Rbs29.06 versus the dollar on Friday, a four year low. The rouble has now lost nearly 20% of its value against the US currency since August.

“Analysts at Barclays Capital said the best case scenario would see Russian policymakers, facing the mounting evidence of a recession, allowing a one-off depreciation of 10% or more.

“The rouble's slide comes as the government faces scrutiny over its policies. A demonstration earlier this month in the far eastern city of Vladivostok marked the first major challenge to the Kremlin since the onset of the global financial crisis.

“Mikhail Sukhodolsky, a deputy interior minister, warned on Christmas Eve that there could be further protests. ‘The situation may be exacerbated by a growth in frustration of workers over the non-payment of wages or those threatened with dismissal,' he said.

Source: Isabel Gorst and Anuj Gangahar, Financial Times , December 26, 2008.

The New York Times: Russia cuts off gas deliveries to Ukraine

“In the face of mounting economic troubles, Russia cut off deliveries of natural gas to Ukraine on Thursday after Ukraine rejected the Kremlin's demands for a sharp increase in gas prices.

“A similar reduction in supplies to Ukraine in 2006 caused a drop in pressure throughout Europe's integrated natural gas pipeline system and led to shortages in countries as far away as Italy and France.

“But with a recessionary drop in demand, ample supplies and assurances from both countries that gas would flow westward without interruption, there were few signs of the near hysteria in Europe that accompanied the 2006 cutoff.

“Even Ukraine, which says it has enough gas in reserve to last through the winter, took Russia's action in stride, underscoring how the political potency of the Kremlin's energy card has plunged along with the price of oil and gas.

“Gazprom, the Russian natural gas monopoly, likened its actions to a utility cutting off service to a deadbeat customer. “The message is very simple,” Ilya Y. Kochevrin, the executive director of Gazprom's export arm, Gazexport, said in a telephone interview. ‘If you receive a product, you have to pay for it. If you don't pay, you don't receive it.'

“But energy experts said that the Kremlin's decision to employ the gambit again in a pricing dispute with Ukraine was an indication as well of Russia's deepening economic woes.”

Source: Andrew Kramer, The New York Times , January 2, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.