Bailouts Breeding Something for Nothing Economic Policy

Economics / Credit Crisis Bailouts Jan 02, 2009 - 11:41 AM GMTBy: Mike_Shedlock

How "Something For Nothing" Ideas Become Policy - Leaders all over the world are now in an Undeniable Shift to Keynes even though every such attempt in history has failed. Please consider the madness:

How "Something For Nothing" Ideas Become Policy - Leaders all over the world are now in an Undeniable Shift to Keynes even though every such attempt in history has failed. Please consider the madness:

The sudden resurgence of Keynesian policy is a stunning reversal of the orthodoxy of the past several decades, which held that efforts to use fiscal policy to manage the economy and mitigate downturns were doomed to failure. Now only Germany remains publicly sceptical that fiscal stimulus will work.

Gordon Brown, UK prime minister, told reporters in late December that if monetary policy was impaired - in large part because of problems within the financial system - "then governments have to use fiscal policy, and that has been seen in every country of the world".

Launching France's fiscal stimulus, President Nicolas Sarkozy said: "Our answer to this crisis is investment because it is the best way to support growth and save the jobs of today - and the only way to prepare for the jobs of tomorrow."

Germany has voiced the strongest principled objections to large-scale fiscal stimulus packages. Peer Steinbrück, the finance minister, has complained about the "crass Keynesianism" pursued by Mr Brown, accusing him of "tossing around billions" and saddling a generation with having to pay off British debt.

Jürgen Stark, an executive board member of the European Central Bank, who was previously vice-president of the Bundesbank, warned of a "substantial risk" of a repeat of the 1970s. "I really cannot see why discretionary fiscal policies, which have proven to be ineffective in the past, should work this time," he said.

Jean Claude Trichet, ECB president, has taken a cautious stance, arguing in a Financial Times interview for countries to allow their deficits to rise in line with the so-called automatic stabilisers - such as higher unemployment benefits and reduced tax revenues during a recession - but warning that the prospect of future tax rises could reduce consumer confidence. "One might lose more by loss of confidence than one might gain by additional spending," he said.

In the US, Lawrence Summers, the former Treasury Secretary now lined up to head Mr Obama's National Economic Council, said the fiscal stimulus will address the need to increase investment in energy, education, health and infrastructure as well as the need to stimulate the economy.

The essential idea of John Maynard Keynes's The General Theory of Employment, Interest and Money is that modern economies can suffer from a persistent lack of demand, consigning millions to what he argued is unnecessary unemployment and misery.

Keynes Discredited

It is amazing that so much love exists for a man whose ideas have been thoroughly discredited on many occasions. Here is a little blurb from the American Journal of Economics and Sociology .

The crisis policy devised by John Maynard (Lord) Keynes, which seemed to work well during World War II and in postwar reconstruction, met its nadir in 1975. Contrary to Keynesian theory, formalized in the Phillips Curve argument that inflation and mass unemployment are mutual trade offs, double digit inflation and record unemployment made further deficit spending an impossible policy.

In other words the stagflationary 70's killed (or rather I say should have killed), Keynesian theory given that the "impossible" happened (rising unemployment and rising inflation).

The Japanese Experiment

Sadly, Keynesian ideology persisted right through another episode that should have thoroughly discredited the theories: Deflation in Japan.

Here are a few snips from Housing Update - How Far To The Bottom? where I compare Japan to the United States.

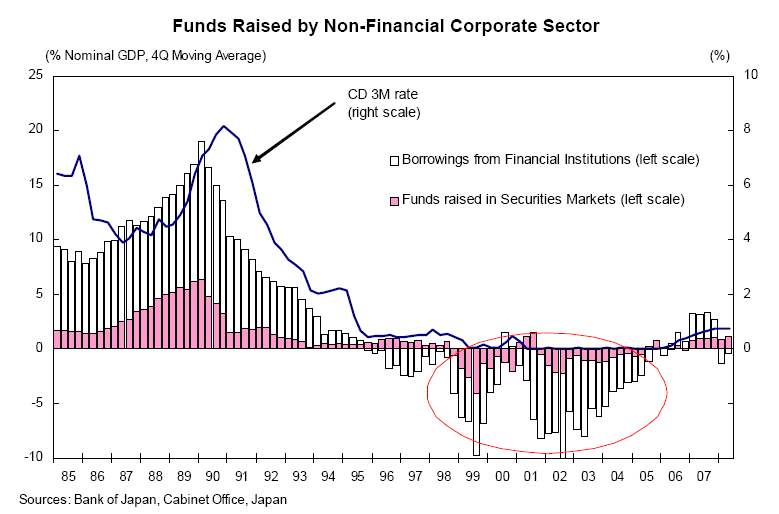

Exhibit 5. Balance Sheet Problems Forced Japanese Businesses to Pay Down Debt even with Zero Interest Rates

Balance Sheets and Paying Down Debt

There is every reason to believe US banks will face the same experience of paying down debts in a Zero Interest Rate world as opposed to going on a lending spree.

Some will challenge this notion because of Obama's pledge to create jobs and rebuild infrastructure.

The counter is that Japan went on a wild spending spree as well, building bridges to nowhere and it did not do Japan any good. Here is an article by James Shaft quoting Richard Koo in A long, shaky bridge to recovery that discusses this very issue.

Japan pumped massive amounts of money into the economy and went on a spending spree and it did no good. Did Japan learn from this? Of course not.

Japan PM announces record budget

The Prime minister of Japan, Taro Aso announces record budget .

”Japan cannot avoid the tsunami of the world recession, but it can try to find a way out,” Mr Aso told a news conference, in which he illustrated the government's stimulus plans with a diagram of a three-stage rocket.

”The world economy is in a once-in-a-hundred-years recession. We need extraordinary measures to deal with an extraordinary situation,” he said.

Japan's Extraordinary Measures Have Blown Up Already.

Extraordinary measures are a way of life for Japan. From currency intervention to building bridges to nowhere, Japan has taken extraordinary measures for decades. In that timeframe, Japan went from being the largest creditor nation to a nation deep in debt.

As of November 17th 2008, BusinessMirror notes " Japan's public debt that exceeds 180 percent of the GDP, limiting the government's ability to stimulate growth ".

It takes pretty extraordinary measures to achieve public debt of 180% of GDP, and although that feat did not produce anything worthwhile, Aso wants to try it again.

Did The Keynesian Economists Give Up Their Theories Confronted With Japan?

The answer is no. Stagflation in the 70's discredited Keyensian theory as did Japan's building bridges to nowhere.

Keynesian economists now say the problem was Japan simply did not act fast enough. Let's take look.

Swift US action may avert Japan-style "lost decade"

Forbes is writing Swift US action may avert Japan-style "lost decade"

Concerns that the U.S. economy may suffer a repeat of Japan's "lost decade" have risen but Washington's swift response to pump trillions of dollars into the financial system may yet avert that kind of long slump.

Unlike Japan, analysts point out, the U.S. central bank has been much quicker to react to the cratering housing market which roiled the economy and the banking system. The Fed's latest moves to directly buy $500 billion of mortgage-related securities are a key effort to lower home loan rates and address a root cause of the economy's woes.

The Federal Reserve has dramatically doubled its balance sheet to more than $2 trillion as it tries to shore up faltering credit markets. Where it once largely held U.S. government debt, it has exposed itself to an array of tottering banks, insurers, quasi-governmental mortgage agencies and short-term securities markets.

That figure is expected to rise to near $4 trillion soon, analysts say.

Learning from Japan's 'Lost Decade'

On March 13, 2008 NPR was discussing What the U.S. Can Learn from Japan's 'Lost Decade'

Japanese banks were the biggest victims of the country's real estate bust. They were in danger of insolvency, yet Japan's central bank was slow to intervene. Eventually, in 1995, the Bank of Japan began to cut interest rates, and today they are near zero percent. But by then the economic damage already had been done.

Among the Bank of Japan's critics was a prominent Princeton University economist, who blamed "exceptionally poor monetary policymaking" for the country's protracted malaise. The central bank's failure to lower interest rates in the early 1990s ultimately drove the economy into a deflationary death spiral, according to the Princeton academic.

That economist was Ben Bernanke, now chairman of the U.S. Federal Reserve. Bernanke has clearly taken the lessons of Japan to heart. The Fed has twice cut short-term interest rates sharply, lowering its benchmark rate to 3 percent, and suggesting that it is prepared to lower rates yet again. In addition, the Bush administration hopes the government's economic stimulus package — including tax rebates for families and tax breaks for businesses — will help boost the faltering economy.

Advantages for the U.S.

That quick action on the part of the Federal Reserve is one reason why many economists believe the U.S. is better positioned than Japan to weather a real estate crisis.

To be fair, the article did get many things right including a warning about Keynesian public spending projects, the savings rate, and transparency. Here are a few more snips.

Japanese Lessons

Don't Try to Spend Your Way Out of a Crisis. Japan ramped up spending on public works projects. It didn't ease the financial crunch, and left the Japanese countryside riddled with concrete.

Save, Save, Save. Japan's economic fall was cushioned by the fact that Japanese consumers have one of the highest savings rates in the world. That allowed them to maintain virtually the same rates of consumption throughout the 1990s. American consumers have no such savings to draw upon.

Be Transparent. In Japan, it took years before the government stepped in and forced banks to come clean about bad loans. That prolonged the crisis, since nobody knew where the bottom was. In the U.S., where the financial system is generally more transparent, banks have already swallowed large write-offs for losses on subprime mortgage deals.

US Makes Same Policy Mistakes As Japan

- Promoting consumer spending

- Stopping transparency and mark to market accounting

- Initiating massive public works projects

- Treasury bailed out failed banks, auto companies, insurance companies, etc. Promises more of the same.

Please consider Government must borrow from banks to create money .

Milton Friedman and Anna Schwartz in their classic book, A Monetary History of the United States , blamed the Federal Reserve for allowing the money supply to fall in the early 1930s (the Fed focused instead on maintaining bank reserves). Irving Fisher in his classic Debt Deflation also stressed that the money supply must not be allowed to fall. Money being destroyed by a collapse in bank lending to the private sector must be made good by bank lending to the public sector. In other words, given the current circumstances, the government should sell fewer government bonds than are needed to cover its borrowing requirement. It should under-fund.

If bank'' claims on the private sector fall, the initial effect on the other side of the balance sheet is a matching decline in their deposit liabilities (ie, the quantity of money). In these circumstances there is a risk of a debt-deflationary spiral. If so, the right policy response is for the government itself to borrow from the banks. It can do so either by direct borrowing or by the ensuring that banks buy substantial quantities of Treasury bills and gilts.

Of course neither Friedman or Schwartz addressed the issue that massive borrowing is what caused the problem in the first place. It's curious how massive borrowing is both the problem and the cure.

Eight More Believers of the Free Lunch Theory

- Philip Booth, Cass Business School

- Tim Congdon, Lombard Street Research

- Charles Goodhart, Financial Markets Group, London School of Economics

- John Greenwood, Chief Economist, Invesco Perpetual Group

- Michael J. Oliver, Lombard Street Research and ESC Rennes School of Business

- Gordon Pepper, Lombard Street Research

- David B. Smith, University of Derby

- Simon Ward,Chief Economist, New Star Asset Management

The above list consists of those signing the above Financial Times article.

Ideas On Propping Up The Stock Market

Roger E.A Farmer is writing How to prevent the Great Depression of 2009 .

For much of the post-war period, the US Federal Reserve has been relatively successful at combating recessions by lowering the interest rate to stimulate aggregate demand. The policy was unavailable in the 1930s because the interest rate on treasury securities was already near zero, just as it is today. It is this fact that makes the current crisis more like the Great Depression than any other of the post-war recessions.

So where do we go from here? The only actor large enough to restore confidence in the US market is the US government. The current policy of quantitative easing by the Fed is a move in the right direction but it does not, as yet, go nearly far enough.

It is time for a greatly increased role for monetary policy through direct intervention of central banks in world stock markets to prevent bubbles and crashes. Central banks control interest rates by buying and selling securities on the open market.

A logical extension of this idea is to pick an indexed basket of securities: one candidate in the US might be the S&P 500, and to control its price by buying and selling blocks of shares on the open market.

Even the credible announcement that a policy of this kind was being considered should be enough to boost the markets and restore consumer and investor confidence in the real economy.

Critics will argue that this policy is dangerous socialist meddling. But I am not arguing that the government should pick winners and losers: only that it should stabilise a broad basket of stocks.

Stock prices are going to go where they are going to go regardless of how many shares the US government buys. If the US bought every share of GM would the shares be worth more than $3.20? Fannie Mae is effectively nationalized at .76 a share, Freddie Mac at 73 cents a share. AIG is nationalized at $1.57. If the government offered $10.00 a share for AIG, or $20 a share for Citigroup, it would soon own every share. Exactly what would that solve?

Stock prices of individual companies are going to go where they are going to go whether individual companies are purchased or stock market indices are purchased.

Every attempt to prop up stock market prices in history has failed, yet somehow Farmer thinks this time is different. It's not different, and the idea that government cans prop up the stock market is pure lunacy.

Ambrose Evans-Pritchard In On The Act

Here is an article by Ambrose Evans-Pritchard that is too hard to take without comment: Mr Bernanke correctly judged the risk of deflation .

US inflation was minus 1.7pc in November, and minus 1pc in October. This entirely vindicates the brave decision by Ben Bernanke at the US Federal Reserve -- and our own Mervyn King at the Bank of England -- to “look through” the oil spike earlier this year and keep his focus on the underlying forces at work in the global economy.

Mr Bernanke has not run out of ammunition yet. He has a nuclear arsenal, and has begun to use it. The Fed is already buying mortgage debt. It has infinite means of injecting stimulus into the economy by 'quantitative easing', if needs be. It can ultimately print money and hang it on Christmas trees.

Mr. Bernanke correctly judged the risk of deflation. His critics did not anticipate this price collapse. The burden in now on them to explain why they are sure that deflation can safely be left to run its malign course.

Bernanke Correctly Judged Nothing

Bernanke considers himself an expert on the great depression and on the Japanese deflation as well. Trying to act quickly, Bernanke has come out blazing with 8 new policy tools, including the TALF, TARP, PDCF, ABCPMMMF, CPFF, TAF, and MMIFF to go on top of Open Market Operations, Discount Rate setting, and setting reserve requirements.

The result so far is deflation. The result in Japan was deflation.

There is only one way to defeat deflation and that is to not let the conditions that foster it to build up in the first place. What caused this deflationary bust is the credit boom that preceded it. What caused the great depression was the credit boom that preceded it. Hoover's policies and FDR's policies made the great depression worse.

Bernanke's policies are going to make this depression worse. Yes, I used the word depression. It may not be as big as the great depression, but the word "recession" does not do justice to what we are in and what is coming down the pike.

Obama's Bridge To Nowhere

Inquiring minds are reading Obama's Economic Plan is a Bridge to Nowhere

John Maynard Keynes died in 1946, but to hear President elect Obama speak you would think he was going to be heading the treasury department. What does Obama propose to do when he takes office in January? Well other than raise taxes, and increase spending he believes in public works. That's right, that's his big plan. The same plan that didn't help us during the Great Depression, or didn't help the Japanese during their recession in the 1990's, and they basically paved over everything they could.

When governments decide to follow the Keynesian philosophy they have to get the money for it, and there is only one place where that money can come from. The taxpayers will be paying the bill for all these new, and mostly useless, projects. This means government becomes bigger and has more control over the economy, it becomes more powerful, and governments don't like to give up power or cut the fat out. Government is already too big, the expansion that Obama wants is practically Orwellian.

Aside from the government getting bigger and more intrusive there is the simple fact that Keynesian economics don't work. When the stock market crashed in 1929 President Hoover, and later President Roosevelt decided that public works were the way to go. We built the Hoover Dam, put thousands of men to work on construction projects. Yet none of that prevented an even bigger stock market crash in 1936, and unemployment was never lower than 14%, that's hardly an economic success story.

In the 1990's the Japanese economy, suffering from a downturn fueled by deflation, the Japanese government desperate to keep unemployment low and to stimulate economic activity went on a building binge. They built bridges to nowhere that would have made Ted Stevens ashamed. All the building didn't get the Japanese economy moving up until deflation ended, consumers started spending, and business became more productive.

Obama's economic plan won't accomplish any real economic growth. The only engine for economic growth is the free market. The Keynesian belief won't add anything to the economy, but it will add to the debt, the tax burden, and increase the federal leviathan. If Obama goes through with his economic plans we can expect the economy to go from shaky to catastrophic. John Maynard Keynes is dead, it's time his wrong headed economic philosophy join him.

Inquiring minds might be wondering why people, including some very prominent and otherwise highly intelligent professors believe in clearly discredited Keynesian Claptrap. The answer has to do with belief in something for nothing.

How Discredited "Something For Nothing" Ideas Become Policy

1) Those with money control policies in Congress. In return for sponsoring policies that make no economic sense, corporations pour massive amounts of money into campaign coffers of those who will support whatever legislation the corporations want. The first thing corporations want is government sponsorship at taxpayer expense. The last thing corporations want is a free market.

2) Inflation (expansion of money and credit) is a stealth tax (theft), demolishing the middle class over time. Inflation allows government to collect more every year in property taxes, sales taxes, income taxes, etc., typically to pay for war mongering and social redistribution activities sponsored by the corporations that benefit from war mongering and social redistribution activities. The expansion of credit scheme "works" until it all blows up in deflationary bust every few generations.

3) Academia is a breeding ground for socialists. I discussed this aspect at length in Fiscal Insanity Virus Rapidly Spreading The Globe (Part 1) and Fiscal Insanity Virus Rapidly Spreading The Globe (Part 2) . Academia likes to promote socialism and blame the free market for failures caused by excessive regulation.

4) People want to believe someone is in control. Even though it is crystal clear that the Fed is a huge part or the problem, people want to believe the Fed is in control. It is very discomforting to think the Fed has no idea what it is doing, so people simply refuse to accept the fact that the Fed has no idea what it is doing.

5) People want to trust the experts even though the experts screw them time and time again. The same thing exists in the stock market. People want to believe stocks will go up so they believe anyone who tells them stocks will go up.

6) There is an overwhelming propensity by everyone to seek something for nothing. People will listen to and vote for anyone promising something for nothing. Economic professors and members of Congress are both particularly adept at promoting something for nothing.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.