Ten Major Threats Facing the U.S. Dollar in 2009

Currencies / US Dollar Jan 02, 2009 - 06:41 AM GMTBy: Eric_deCarbonnel

1) Foreign central banks selling US assets

1) Foreign central banks selling US assets

Most of the nations which have been financing the US's massive current account deficits in recent years have either begun to sell their dollar reserves last year or are planning on selling them this year in order to support their currencies. These nations generally fall into three categories:

A) Oil Producing Nations

Oil producing nations have built up lavish spending habits and large dollar reserve in recent years as a result of profits from rising oil prices. Now that commodity prices have crashes, those profits are gone, and those Oil producing nations will have to bankroll their spending by selling their accumulated dollar assets. Saudi Arabia, for example, is projecting a 2009 Budget Deficit , which it intends to finance by selling off its US holdings. Russia, meanwhile, has already sold over 20% of its $598.1 billion reserves , and it can be expected to continue doing so this year.

B) Emerging markets that have been relying on capital flows to fund their trade deficits

Many emerging markets around the world have been running trade deficits in recent years financed by capital flows. The most prominent example from this group is India.

India's strong capital flows from tourism, software services, and remittances not only financed its trade deficit, but also increased its foreign reserves to an all-time high of 316.2 billion in May of 2008. However, due to the global slowdown and selloff of emerging markets, those capital flows have now reversed. India's central bank, for example, has been forced to sell off its US holdings to curb its currency's decline, and its total reserves have decreased by $62.2 billion. The central bank's dollar sales in October alone exceeded purchases by a record $18.7 billion. India now has $254 billion foreign reserves left, the majority of which will be sold this year to protect its currency.

C) "Developed" Nations

The US isn't the only "developed" nation in trouble. Other "developed" nations ( ie : nations that chose to outsource the polluting and labor-intensive parts of their economies) are also collapsing. Japan, for instance, has seen a disastrous drop in demand for goods.

Japan's Industrial production fell 8.1% in November from the previous month (the biggest drop in the measure since the government started releasing comparable figures in 1953). Demand for Japanese exports is vanishing: November shipments of automobiles plunged 31.9 percent and shipments of microchips and other electronics components fell 29.0 percent. Due to this disappearing demand, Japan has incurred a trade deficit for two straight months for the first time since October-November of 1980.

With their own economic problems to deal with, it will not be other "developed" nations like Japan which will fund the US trade deficit in 2009. In fact, should the dollar begin to collapse, these nations could even be forced to sell their dollar reserves to protect their own currencies.

The dollar implications of this should be clear

After years of bankrolling US consumption with the purchase of dollar assets, most nations are going to be net sellers of dollars in 2009. Just Russia, Saudi Arabia, India, and Japan alone have around $2 trillion in US holdings, and, if the current trade trends continue, America can expect foreign central banks to sell at least 1 trillion dollars this year. This begs the question: who exactly is going to be buying all these assets?

2) The worsening US Trade deficit

The US Trade deficit is worsening because, while imports to the US are falling, exports are falling even faster. Demand for the big ticket durable and capital goods produced by "developed" nations is plummeting much faster than demand for cheap consumer imports, causing widening trade deficits with nations like China. The US's increasing trade and current account deficits means that America needs to attract over 700 billion dollars this year to keep the dollar from weakening.

3) Treasuries

It is extremely important to understand that treasuries are the modern day equivalent of money under the mattress, and that, when a crisis confidence hits the dollar, treasuries will be redeemed for printed cash from the fed. This is due to the fact that the US can't allow treasury prices to crash, for fear of having the world's financial system break down and global trade collapse. So a sustained selloff in treasuries would therefore force the fed to expand its balance sheet by trillions to monetize much of the outstanding federal debt.

Why the government can't let treasuries collapse

Even if the government does not step in to support treasury prices amid a selloff , the end result will be the same. Allowing a crash in treasury market would make the financial system insolvent and cause runs on the bank. The fed would then have to print money to make good on the 6.5 trillion insured deposits around the country, the 1.5 trillion insured senior bank debt, etc... Since trillions of printed dollars would be hitting the marketplace in either case, the fed will choose the least disruptive option of putting a floor under treasury prices with printed money.

Selling treasuries is equivalent to printing money

It is deceptive to think that, because the government is borrowing to fund its deficits and bailouts, it isn't printing money. This is false. Treasuries should be seen for what they really are: "promises to print money".

4) Gold

Rising demand for physical gold is a threat to the dollar because it signals a growing loss of confidence in the paper currency. It is also key to understand that gold prices aren't rising because of the changing fundamentals of gold, but because of the changing fundamentals of the dollar. In other words, gold isn't rallying, THE DOLLAR IS FALLING.

Gold is history's oldest and most stable currency. Its utility is simply that it is rare, and for 5,000 years people have used it to store value for the future. All the gold that has ever been produced would fit in a solid cube of about 19 meters on each side, and this cube is only expanding by about 12 centimeters a year (2%). Since the value and supply of gold itself is fairly constant over long periods of time, the main driver of the fluctuations in gold prices is the ebb and flow of confidence in paper currencies. Rising gold prices are, therefore, a signal of a weakening currency, which is why governments hate them and try to suppress them .

Right now, there is unprecedented worldwide demand for physical precious metals. As a result of this surging demand, gold futures have experiencing backwardation , a rare market condition where gold futures trade under spot prices. It is a signal that gold prices are headed higher and that confidence in our currency is fading quickly. When gold prices break above 1,000 again, the event should be recognized for what it is: the herald of a dollar collapse.

5) China and the yuan

China is in a different situation that most other nations as it has a growing trade surplus, which stood at $40 billion as of November. As a result of disappearing Asian demand for luxury items and commodity prices plunging, imports to China crashed 17.9 percent in November while its exports only fell 2.2 percent. This leaves China with a problem the US could only dream of: huge, unsustainable upward pressure on its undervalued currency.

In order to maintain the dollar peg, China would need to fund not only a large part of the US's gigantic trade deficits, but also the trade deficits of those nations around the world which are selling their dollar reserves. If imports keep falling at their current pace, China will have to buy close to 1 trillion dollars this year alone, which leads to yet another problem: right now, China is not interested In any kind of risky US assets , and what "safe" assets does the US have to sell? (Please don't say treasuries. All dollar denominated assets are inheritably unsafe due to the currency's horrible fundamentals.)

Trying to prop up the dollar would end up destroying its currency without benefiting its economy, and China knows this, which is why you have Chinese central bankers on record as saying that, "The US dollar is unlikely to be stable next year" . Even more ominous for the dollar, China stealthily announced its plan to make the yuan an international currency on Christmas Eve last year. Whether intentional or not, by allowing Chinese exporters to settle their trades in yuan, China is taking a major step towards supplanting the dollar with the yuan as the world's reserve currency.

6) Never ending bailouts

Although many Americans such as myself are growing tired of America's never ending bailouts, it is important to brace yourself because there are a lot more on the way. Here are a few of the bailouts we will be seeing this year which haven't gotten much media coverage.

A) State government bailouts

State budget troubles are worsening . States have already begun drawing down reserves, and the remaining reserves are not sufficient to weather a significant economic downturn. Also, many states have no reserves and never fully recovered from the fiscal crisis in the early part of the decade.

The vast majority of states cannot run a deficit or borrow to cover their operating expenditures. As a result, states must close budget shortfalls by either drawing on reserves, cutting expenditures, or raising taxes. These budget cuts often are more severe in the second year of a state fiscal crisis, after reserves have been largely depleted. The federal government will eventually be forced to step in and offer states some form of assistance to prevent economic collapses and humanitarian disasters. This means another bailout.

B) Unemployment bailout

State-funded trusts which pay unemployment benefits are running out of money . The federal government has increased these funding problems through its repeated extensions of unemployment benefits, with the total run of the benefits now being 10 months. Since there is a massive, post-holiday wave of layoffs on the way, shortfalls in unemployment funding are going to come faster and be bigger than most anyone expects. In response to these shortfalls, congress will loan the states whatever is necessary to keep unemployment benefits coming, even if they have to print every last penny. After propping up financial institutions and indirectly paying their executives billions of dollars, they now have, politically speaking, no choice.

C) Pension Benefit Guaranty Corporation ( PBGC ) bailout

PBGC is an agency established by Congress to insure participants in defined-benefit pension plans against losing their pension in the case their employer goes under. Nearly 44 million Americans in more than 29,000 private-sector plans are protected by PBGC , and some 1.3 million workers are already covered by plans that have been taken over by the agency. Although the PBGC is financed from insurance premiums collected from companies and the assets it assumes from failed pension plans, it is a widely presumed that the federal government would bail out PBGC . if it became unable to meet its obligations for retirees.

There are several reasons to expect that PBCC might need such a bailout this year. First, PBCC is underfunded by $11 billion (based on very optimistic projections). Second, the economic downturn and financial market meltdown will likely cause PBCC to take over many private pension plans this year and most of these will be severely underfunded. Third, the agency's board decided recently to move a large share of the portfolio out of safe assets like Treasury bonds and into riskier assets like stocks. So, depending on how underfunded the pension plans it takes over next are and how badly its investment portfolio does, it is possible the PBCC might require a federal bailout by the end of the year.

D) Housing bailouts

Since a recovery from our downward spiral is unlikely until the housing markets stabilize, there is a good possibility that we will see another, bigger federal housing bailout this year as congress tries to jumpstart the economy. It is important to note that with every new bailout congress passes, it becomes harder to say no to such a homeowner bailout.

The true moral hazard of bailouts

Most commentators misunderstand the true moral hazard of bailouts. While bailouts might have an adverse effect on the future actions of individuals and businesses by encouraging risk taking, the real problem is their effects on future actions of the government. Specifically, each bailouts makes it harder to say no to the next bailout. This pressure to fund future bailouts is made far worse if those receiving bailout money are truly undeserving. After all, If the government is going to give $45 billion to Citigroup (one of the banks responsible for our current mess) and insure $306 billion of its riskiest assets, then how can it say no to bailing out the state of California or South Carolina?

This "me too" phenomenon will get much worse after the treasury market collapses, and the fed starts monetizing the treasuries that were sold to fund the current bailouts. If fed printed money to bailout the banks, why shouldn't it print more money to fund unemployment benefits? Politically speaking, you can't bailout the irresponsible and then let the responsible sink, which means congress isn't going to be saying no to a lot of the bailout requests this year. Unfortunately, these bailouts will become increasingly meaningless because, when you bail out everyone, you bail out no one as you destroy your currency.

7) US budget deficits and (lack of) Tax revenues

The federal government is a facing record breaking budget deficit in 2009. According to the latest government figures, the deficit currently is expected to be $438 billion. For a reliable idea of what our 2009 deficit will look like, to this number we need to:

A) Add the cost of funding the on-going wars in Iraq and Afghanistan

B) Add the cost of recent programs such as the TARP

C) Add the cost of current and future bailouts for the auto companies

D) Add the cost of another stimulus package

E) Add the cost of the programs promised to us by the new administration

After subtracting a further 500 billion for lost tax revenues due to our collapsing economy, it is easy to project a budget deficit of at least 2 trillion. So far, the deficit now totals $401.6 billion in just the first two months of this budget year, and, at this annual rate, the budget shortfall is already on track to exceed our expected number. All this isn't even taking into consideration our long term funding shortfall vis -a- vis baby boomers (the future of social security and Medicare is, unfortunately, clear: I would not expect it to be there when you retire (at least not anything like it is today)).

Our 2009 budget deficits will force the government to sell at least another 2 trillion treasuries this year. Taken together with planed sales by foreign central banks and the expected 1 trillion new bailouts mentioned above, at least 4 trillion treasuries will be sold in 2009. The question remains: who is going to buy them? The answer is that the fed will buy them with printed the money.

Don't worry about the children

For years Americans have worried about passing on our enormous federal debts to our children. Well there is good news on this front: you don't have to worry about the children anymore. America's massive debts aren't going to be paid for by a future generation. They will be paid for today through a massive devaluation of our currency.

What the dynamics of hyperinflation will do to the federal deficits

The current $2 trillion deficit projections being circulated in the media will prove woefully understated should the dynamics of hyperinflation take hold of the economy. A dollar collapse would cause our tax system to break down. Individuals whose income isn't keeping up with inflation will forgo tax payments to spend all their cash on food and basic necessities. Businessmen will find that by merely delaying tax payments, depreciation in the dollar will virtually eliminate their true value. Even the tax revenue that is paid will have lost most of its value by the time the government collects it. Meanwhile, the rising cost of everything will drive up the federal spending. The government, lacking adequate income to cover these rising expenses and unable to borrow due to the collapse of the treasury market, will be forced to resort more and more to money creation. If/when hyperinflation takes hold of America, do not be surprised to see 1% of government income come from taxes and 99% come from the creation of new money.

8) The "flight to quality"

During the second half of 2008, a "flight to quality" began as hedge funds sold foreign assets to meet redemptions requests. These forced repatriations by hedge funds combined with dollar's outdated reputation as a safe haven produced a record breaking rally in the treasury markets. This "flight to quality" is not something that hasn't seen before.

The phenomenon of investors blindly piling into an asset class while ignoring all warnings about the horrible fundamentals and deteriorating outlook has been so common lately that I am growing tired of seeing it. They are called bubbles, and the pattern is always the same:

A) Stock market, October 2007

In October 2007, stocks rallied to new all time highs while commentators made insane predictions about the Dow going to 20000. While this was happening, credit markets collapsing, growing mortgage default were threatened bond insurers with insolvency, and the off-balance sheet vehicles of financial institutions were imploding. Considering that the frozen credit markets are the lifeblood without which the economy can't function, these new highs made as much sense as subprime CDOs squared. It should not have surprised anyone that stocks collapsed.

B) Commodities, July 2008

In July 2008, commodities rallied to new all time highs while commentators made insane predictions about oil going to $200. All this was happening while thousands of factories in China were shutting down due to rising costs and falling orders. In the face of the world's plunging demand, the only reason that could possibly have justified $147 oil would have been a complete collapse of the dollar. That was not the case, and the oil bubble burst sending commodity prices plunging.

C) Treasuries and the dollar, January 2009.

The current rally in treasuries and the dollar is the latest in a long line of bubbles. Those same commentator which got it wrong on previous occasions are now predicting months of deflation and a new multi-year bull market for the dollar (worst prediction ever ). Out of all the bubbles so far, this current rally in treasuries and the dollar is the most ridiculous. The fundamentals behind the dollar, as outlined in this article, are horrendous. There is simply no rational reason to believe the dollar will retain an ounce of value by the end of 2009.

Side note on how to deal deflationists

When faced with a deflationist (one of those individuals who believe in months of deflation and a dollar bull market), ask them this: who is going to finance our trade deficit and bailouts? If they say the world or foreign nations, then list off all the countries with trade deficits who will not be financing the US: Japan, India, Saudi Arabia, Russia, most European countries (with the possible exception of Germany), other oil producers, etc. If they insist on the notion that China alone will pick up the tab for everything, point out that during the great depression, when the US had massive manufacturing overcapacity, America shut down factories rather than extend credit to over indebted foreign nations.

A true "flight to quality" will soon begin

Dollar inflows due to hedge fund are over now, as is the dollar rally. As a true "flight to quality" begins, foreigners will start selling their gigantic holdings of US debt. With America's total external debt standing over $14 trillion, this move will cause the dollar's value and purchasing power to plunge.

9) A loss of confidence

Confidence is the single biggest factor in determining a currency's value, and periods of deflation, such as America has been experiencing these last few months, tend to undermine that confidence and create hyperinflation . Economic troubles, deteriorating debt ratios, and scary charts are a few of the factors resulting from a deflating economy that can lead investors to lose confidence in a currency.

US economic troubles

The US has boatloads of economic troubles ahead which are sure to eradicate what little confidence is left in our economy. Here are just a few of the negative economic developments to expect this year.

A) Post-holiday wave of layoffs

There is a wave of post-holiday layoffs in the pipelines. Since employers don't like to layoff workers right before or during the Christmas/New Year's holidays (bad publicity), there is a slew of pent-up job cuts about to occur this month. Chicago, for example, is preparing for mass layoffs in 2009 , and we are likely to see at least 1 million jobs lost in the first two months of this year.

B) Manufacturing sectors problems

After having outsourced its polluting and labor-intensive industries abroad, the US manufacturing sector has been left heavily concentrated in durable and capital goods. Orders for these types of big ticket items are set months, if not years, in advance. Even before Lehman brothers went under, new orders for these products were falling drastically. The full effect of last year's big drop in orders, including job and production cuts, will only be felt throughout the course of this year. 2009 is not going to look pretty for what is left of our manufacturing sector.

C) New state taxes and spending cuts

As mentioned above, State budget troubles are worsening. Even with the eventually federal bailout, states will still need to drastically reduce spending and raise taxes. When states cut spending, they lay off employees, cancel contracts with vendors, eliminate or lower payments to businesses and nonprofit organizations that provide direct services, and cut benefit payments to individuals. These cuts, like new taxes, drain an enormous amount of money out of circulation. This leaves business and individuals with less cash and thereby removes demand from the economy, causing state and federal GDPs to contract.

Deteriorating debt ratios

With federal debt growing and our GDP shrinking, our debt ratios are rapidly deteriorating. Especially with 2008 over now, economists are going to start putting numbers together and making estimates which will be truly scary. Although official figures aren't available yet, common sense can give us a good idea of what to expect. Take, for example, our net international investment position.

US's net international investment position = US owned foreign assets - Foreign owned US assets

America's net international investment position (what the US owes the world) has likely worsened enormously in 2008. For one, US stock markets have outperformed most foreign markets last year (easy to do since fed can print dollars to prop up the market), meaning that the valuation of US assets abroad decreased far more than the valuation of foreign owned assets at home. Hedge fund deleveraging and redemptions forced the selling of US assets abroad at those discounted prices, decreasing the amount of US assets held abroad and locking in the losses in crashing foreign stock markets. Furthermore, the misguided "flight to quality" which began in the second half of the year undoubtedly increased foreign claims on US assets as money flowed into treasuries. Finally, our trade and current account deficits likely increased foreign dollar holdings by at least $600 billion.

Taken together, these factors have most probably doubled the US's negative investment position in 2008, from 2.5 trillion to 5+ trillion . Since our GDP for 2009 will shrink below 10 trillion, the US now owes around half this year's GDP to the rest of the world. News that the US owes foreigners half its GDP will not exactly inspire confidence in the dollar.

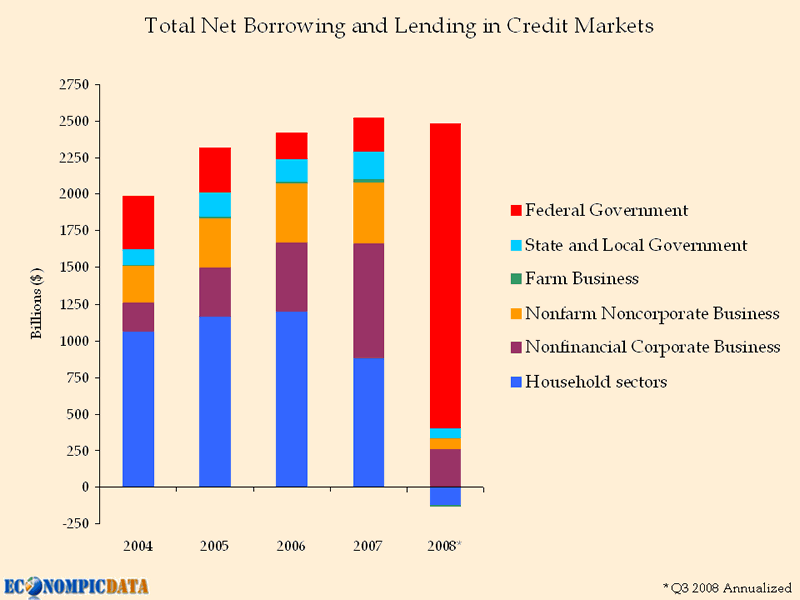

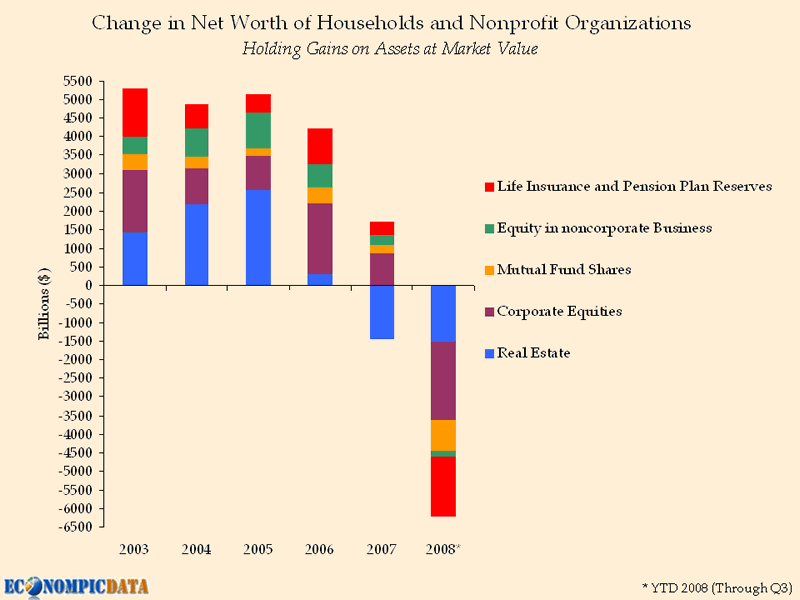

Scary charts

Charts and other visuals can fully convey the magnitude of our current economic crisis in a way words cannot. With 2008 over now, expect to see some truly terrifying graphics depicting just how badly the US economy self-destructed last year. Here are two examples of what these charts will look like:

10) The dollar's former self

The US dollar in 1944

Following the end of World War II, the United States was a global powerhouse whose domestic industries were producing half of the world's manufactured goods. At this time, the US was also creditor nation and held over half the world's foreign reserves. As the US was running a huge balance of trade surplus, these immense foreign reserves were growing fast. In additions to foreign currencies, the United States also held $26 billion in gold reserves, approximately 60 percent of the world's estimated $40 billion. Finally, the dollar was the only post-war currency fully backed by gold.

The strength of the US economy, the fixed relationship of the dollar to gold at $35 an ounce, and the dollar's full convertibility into gold at that price made the dollar as good as gold. In fact, the dollar was better than gold: it earned interest and was more flexible than gold. It was under these strong fundamentals that, in 1944, the Bretton Woods agreement was signed and the dollar became the world's reserve currency .

Today's dollar

The fundamentals backing today are just as amazing as they were back in 1944, except in a negative sense. The US has managed to outsourced its industry to the point of total dependency on foreign imports for its basic consumer goods, energy, and, to an extent, even food. The US can today claim the exalted status of the most indebted nation in human history, with every level of society (individuals, corporations, local/state/federal governments, etc) owing an unpayably large amount of money. The US capital markets have been tarnish by widespread financial failures, haphazard bailouts, and blatant corporate corruption, the latest being the Madoff's ponzi scheme. There are also growing doubts about how much gold, if any, are left in our reserves.

Perhaps the most damning Indictment of our currency comes from this contrast between its past and current self. How can today's dollar be anything but a joke when compared to its former greatness?

The dollar's status as the world's reserve currency

The dollar became the world's reserve currency through its strong fundamental and by having the longest reliable history of increasing purchasing power. Today's dollar has long since lost both those qualities . Those pointing to the dollar's special status and expecting a new dollar bull market should realize that not everything about being the favored international reserve currency is positive. The downside of being the world's reserve is that everyone is sitting on a great pile of your money, which they could decide to dump back into circulation.

By Eric deCarbonnel

http://www.marketskeptics.com

Eric is the Editor of Market Skeptics

© 2008 Copyright Eric deCarbonnel - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Eric deCarbonnel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

rob lamberson

12 Mar 10, 22:08 |

wow

This is a really great article. I'm going to look for more of your stuff. |