How to Invest in Crude Oil 2009

Commodities / Crude Oil Dec 31, 2008 - 11:00 AM GMTBy: Richard_Shaw

Oil as a commodity is an interesting real asset. What investments most directly create the economic effect of owning oil itself?

Oil as a commodity is an interesting real asset. What investments most directly create the economic effect of owning oil itself?

The best answer would be to own an oil well, or better yet, own an entire oil exporting country. However, neither of those options is a practical answer for most investors, certainly not owning a country (unless, of course you are born into the right family).

So what are the practical options for the rest of us? Among others, they include:

- futures contracts

- funds that invest in futures contracts

- exchange traded notes that are priced to a futures index

- royalty trusts that own oil in the ground

- integrated oil companies

- oil & gas exploration companies

- oil & gas production companies

- general energy funds

- alternate fuels

- options on any of the above.

Options are a speculation that expire in time, so we'll exclude them from the “ownership” consideration. Futures provide a 1:1 price participation, but they also expire with time, and rolling from contract-to-contract can create losses if the far contract is more expensive than the near contract at rollover.

Let's look at other oil related categories which you can “own” without time limits to see how they correlate with the price of oil.

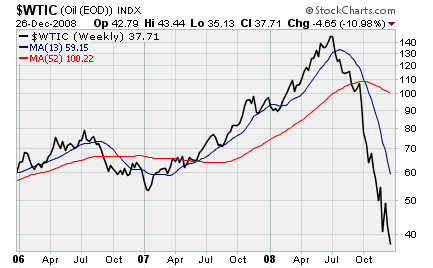

First, as a base, this chart shows the weekly price of West Texas Intermediate Crude for the past three years.

The charts that follow plot the percentage performance for the past three years for West Texas Intermediate Crude versus an investment alternative — either a directly investable security or an industry group from which you could chose one or more companies to own.

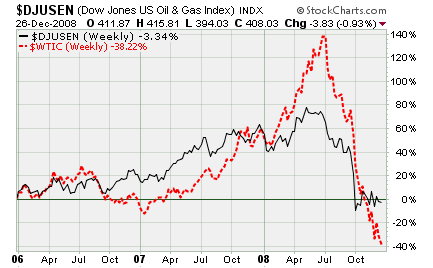

Dow Jones US Energy Industry Group

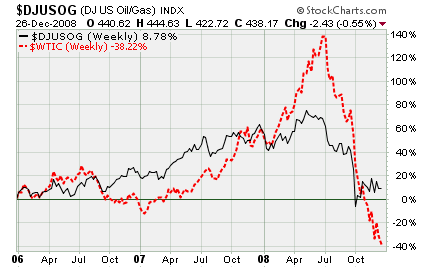

Dow Jones US Oil & Gas Producers Industry Group

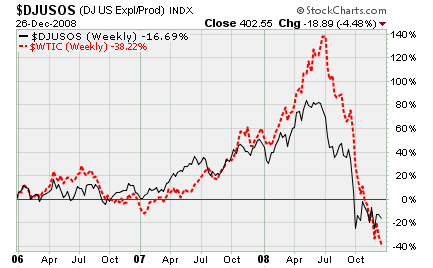

Dow Jones US Exploration & Production Industry Group

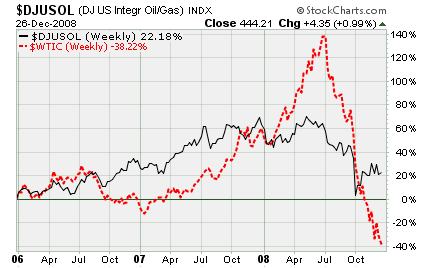

Dow Jones US Integrated Oil Industry Group

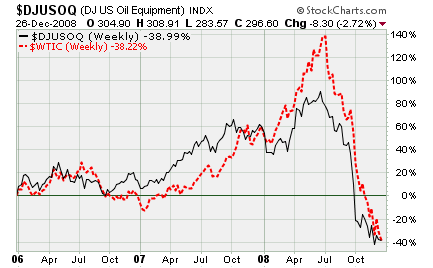

Dow Jones US Equipment, Services & Distribution Industry Group

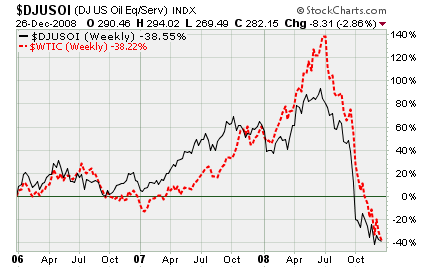

Dow Jones US Equipment & Services Industry Group

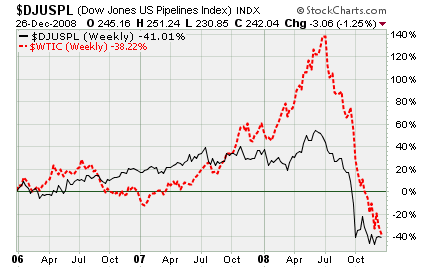

Dow Jones US Pipeline Industry Group

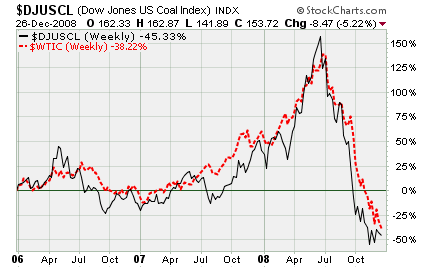

Dow Jones US Coal Industry Group

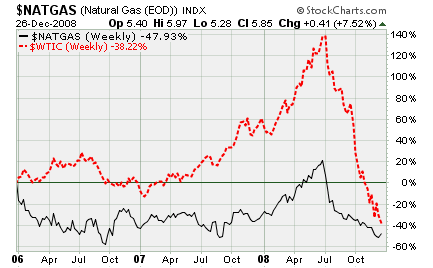

Natural Gas

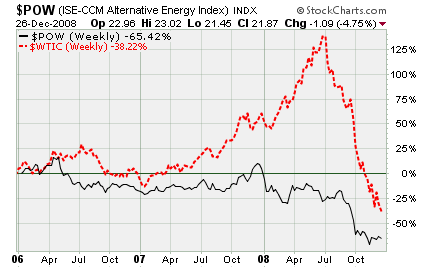

ISE-CCM Alternative Energy Index

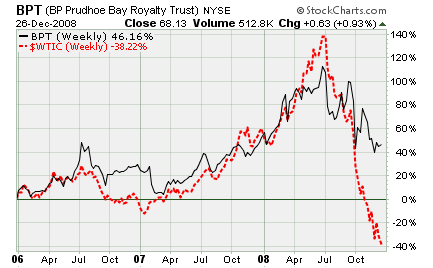

Prudhoe Bay (Oil) Royalty Trust

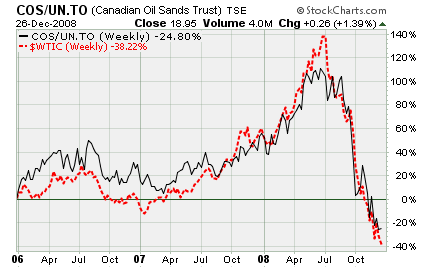

Canadian Oil Sands Royalty Trust

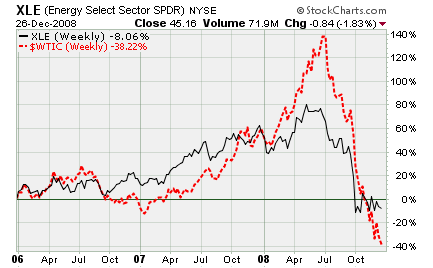

S&P 500 Energy Sector (passive)

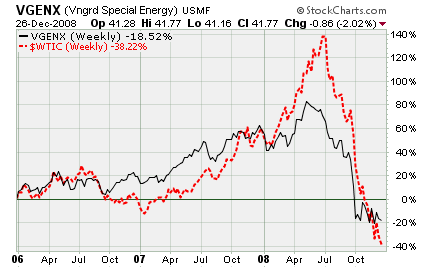

Vanguard Energy Fund (active)

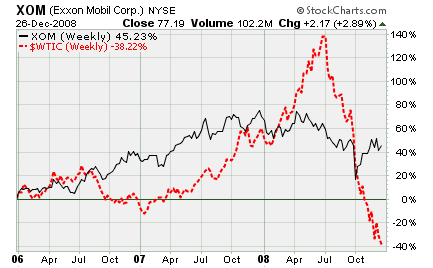

XOM

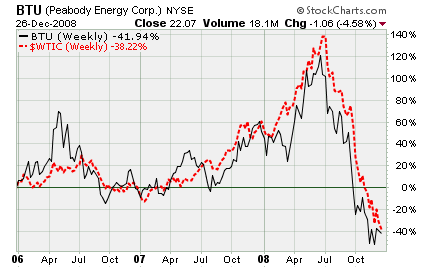

BTU

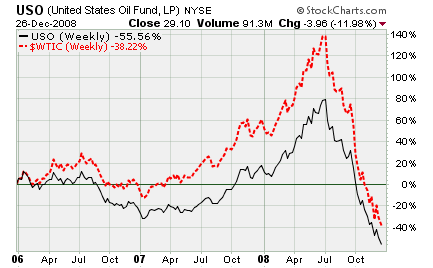

USO (ETF)

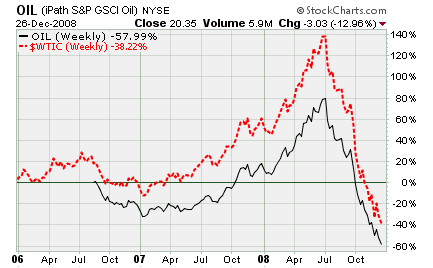

OIL (ETN)

Observations:

The equipment and services industry within the oil and gas group is the most leveraged to oil prices — up the most on high oil prices and down the most on low oil prices.

Oil and gas producers and integrated oil companies did not rise as much or fall as much as oil, perhaps serving as indicators of overbought and oversold oil price conditions — more of a long-term outlook than a spot price outlook.

Coal mining companies are highly correlated with oil prices.

When oil gets a cold, alternative energy gets pneumonia.

The unitholders of the US oil royalty trust, BPT, aren't overly worried about current oil prices, as shown by their unwillingness to sell as prices that track downward spot oil price movements.

Canadian Oil Sands (COSWF) tracks spot oil fairly closely.

Energy funds aren't particularly well correlated with oil spot prices.

The oil futures ETF and ETN (USO and OIL) have charts shaped like spot oil, but they underperform.

Conclusion:

If you expect oil to go to higher prices (such as the approximate $70+ often cited as “fair value” in terms of finding and lifting costs for replacement oil), then you would be best suited to own something that tracks oil closely.

If you can earn dividends while you wait, that would be better.

We would like to own BPT, because it is fractional ownership of oil wells without other business activity risks, but we'd like to see the price lower.

We do own some Canadian Oil Sands (COSWF), but Canadian tax laws are forcing trusts to change structure, and we are a bit uncomfortable with the uncertainties around all that. Nonetheless, we will be buying some additional units.

Coal, which powers 1/2 of our electric production, tracks oil nicely, making companies such as BTU potentially attractive oil plays, as well as electrical plays. If coal liquifaction gains traction, it could power both our future Chevy Volt and our antique Oldsmobile 442.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2008 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.