Central Banks Fight to Prevent Hyperinflation by Manipulating Gold Price

Commodities / Gold & Silver Dec 30, 2008 - 12:02 PM GMTBy: Rob_Kirby

The global gold trade – or at least its price discovery – is historically and primarily conducted on major exchanges; primarily at the London Bullion Market Association [LBMA] and to a lesser extent the New York Commodities Exchange [COMEX].

The global gold trade – or at least its price discovery – is historically and primarily conducted on major exchanges; primarily at the London Bullion Market Association [LBMA] and to a lesser extent the New York Commodities Exchange [COMEX].

Let's take a look at the primary sources of global gold supply :

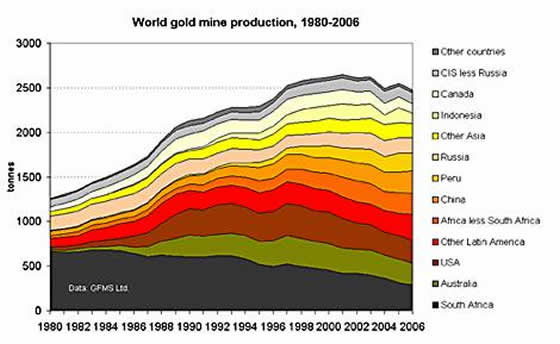

1] - Global gold production : has been running at roughly 2,500 metric tonnes per annum in recent years:

To give this chart a little bit more meaning: 2,500 metric tonnes = 88,184,904.9 ounces

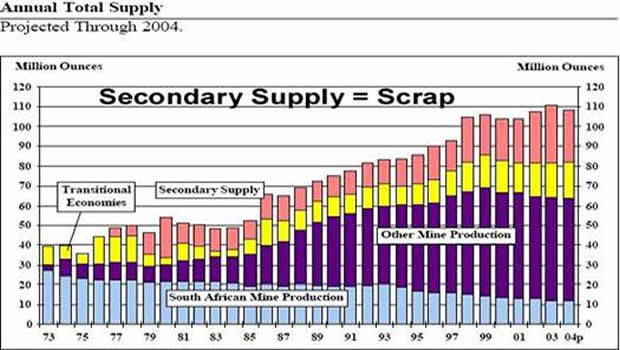

2] – Scrap: To wrap one's head around the scope or size of how many ounces of gold are returned to “world supply” each year, exact or up-to-date numbers are hard to ascertain. What can be said about scrap supply is that its source is dis-hoarding of jewelry by investors and higher gold prices tend to increase its supply. CPM [providers of much gold market data to the World Gold Council] does produce work in this regard and here is the most recent estimation I was able to find for use as a benchmark:

From the available evidence, we might guesstimate that as much as 25 million ounces of gold is added to world supply through “scrap sales.”

3] – Central Bank Dis-Hoarding [Gold Sales]: Exact numbers in this category should [arguably] be the easiest to ascertain, but in reality, this is and has not been the case for a host of reasons.

First and foremost, one needs to understand that Central Banks globally are exclusive purveyors of irredeemable fiat currencies:

Irredeemable currency -- Paper money redeemable neither in gold nor silver - otherwise known as fiat money.

History demonstrates that fiat money systems have been tried countless times over the past two or three thousand years, and in EVERY case they collapse into a hyperinflation, followed by a deflationary depression. These depressions usually destabilize societies leading to chaos and war. Because fiat currencies have such a “perfectly futile historical record,” the only means by which Central Banks can delay this inevitable conclusion is through “control” of the perceived value of precious metal.

| Month | Millions of Ounces Transferred |

| Dec 07 | 25.0 |

| Jan 08 | 25.3 |

| Feb 08 | 22.9 |

| Mar 08 | 25.7 |

| Apr 08 | 21.1 |

| May 08 | 22.1 |

| Jun 08 | 21.2 |

| Jul 08 | 21.5 |

| Aug 08 | 23.3 |

| Sep 08 | 24.8 |

| Oct 08 | 24.0 |

| Nov 08 | 18.3 |

| Total | 275.2 |

For this reason – ALONE – accurate and verifiable data regarding vaulted Central Bank stocks of gold bullion are often said to be more closely guarded than nuclear technology.

You see folks, grade six math dictates that fundamentally, world gold supply [1 and 2, above] equal approximately 113 million ounces [88 + 25 million ounces]. Now, if one simply looks at the number of ounces of gold transferred at the LMBA in the most recent 12 month period [Dec. 07 – Nov. 08], we can see that 275.2 million ounces of gold [ two and one half times annual global production + scrap ] allegedly changed hands:

This does not even touch on amounts transacted / settled on New York's COMEX.

That such a discrepancy exists between annual global gold supply and amounts of physical ounces being transferred DICTATE that someone or something is “filling the gap.”

That something “ IS ” vaulted Central Bank / Sovereign gold.

Once one understands that vaulted Central Bank gold stocks are “filling the gap” between global bullion demand and global bullion supply, one quickly realizes that “the burn rate” is of paramount importance.

In the same manner that investors can anticipate the timing of a future re-financing [equity offering] of a junior resource company ‘burning through cash' while exploring for a mine-able asset, gold bugs can and do attempt to forecast when Central Banks will run out of vaulted gold stocks necessary to fill the gap.

The implication of what happens when this gap can no longer be filled is EXACTLY what history has demonstrated time-and-time-again; a collapse into hyperinflation, followed by a deflationary depression.

To fend off this inevitibility – or buy time – Central Banks, acting in cahoots with political leadership lie to the masses regarding the true state of affairs regarding both the levels of and the true ownership of remaining vaulted gold stocks. They may rightfully claim that they have paper ownership of the metal when in fact, the physical ownership of the metal has been physically transferred via swap and / or lease to various purchasers, and practically speaking, this disgorged metal is not recoverable at existing or prevailing prices.

This is why organizations such as GATA have been rebuffed in their [2008] requests under the Freedom of Information Act [FOIA] to have the U.S. Treasury and Federal Reserve provide transparency and disclosure regarding the true state of America's alleged holding of 8 thousand+ metric tonnes of gold.

Anecdotal evidence like the refusal to disclose [above] and the decoupling of physical metals [gold and silver] prices from their futures derived counterparts strongly suggest that “the gap” is getting harder to fill by the day.

When this gap can no longer be filled, paper gold and fiat burns.

Failure to disclose will not alter the outcome. It's a question of “when,” not “if.”

Got physical gold yet?

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research. Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

Copyright © 2008 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.