Deflation Inflates Global Bond Bubble

Economics / Bond Bubble Dec 28, 2008 - 08:04 AM GMT

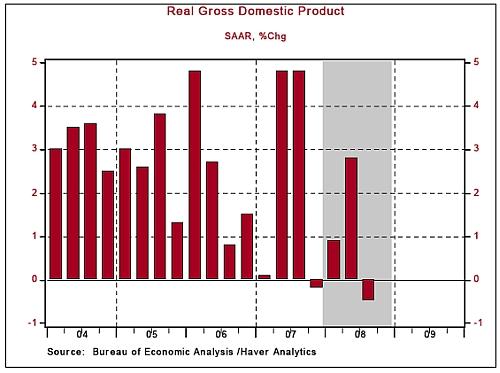

Asha Bangalore (Northern Trust): US Q3 real GDP remains unchanged

Asha Bangalore (Northern Trust): US Q3 real GDP remains unchanged

“The final estimate of third quarter GDP was unchanged at a 0.5% drop. The minor revisions show consumer spending and non-residential investment slightly weaker than the preliminary report, government spending was marginally stronger, and residential investment expenditures fell less rapidly.

“Going forward, the fourth quarter (-5.0%) and first quarter of 2009 are likely to be the weakest in the current downturn. The shutdown of production at Chrysler, GM, and Ford has increased the risk of a weaker-than-expected drop in GDP in the first quarter. Weak business conditions should translate into a further moderation of prices.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , December 23, 2008.

Asha Bangalore (Northern Trust): Chicago Fed National Activity Index shows further decline

“The Chicago Fed National Activity Index (CFNAI) declined to -2.47 in November from a revised -1.27 reading in October. The data used to compute this index have been published earlier. In November, all four major categories of the index – employment, production, income, consumer spending and housing – posted declines. The intensity of weakness in economic conditions suggested by the November reading is consistent with other economic reports which have indicated that the current recession matches the situation seen in the 1980 and 1981-82 recessions.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , December 22, 2008.

Asha Bangalore (Northern Trust): Consumer spending – weakness will persist

Nominal consumer spending fell 0.6% in November, the fifth monthly decline. However, the personal consumption expenditure price index fell 1.1% and raised real consumer spending 0.6%, following five monthly declines. Effectively, consumer spending in the fourth quarter will post a reduction but probably slightly smaller than the 3.8% drop seen in the third quarter.

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , December 24, 2008.

CNNMoney.com: For stores, a very un-merry holiday

“The 2008 holiday sales season is one of the worst for retailers in decades, as consumers' concerns about the economy and job losses crushed the typical year-end shopping exuberance.

“‘I don't see any reason for retailers to be rejoicing at all,' said Britt Beemer, chairman and founder of America's Research Group.

“Among the early sales tallies, new estimates from MasterCard's SpendingPulse Data service indicated that total store sales fell about 3% in November and December combined.

“That would be significantly worse than the original forecast from the National Retail Federation (NRF), which anticipated a 2.2% gain for the period.

“‘It's really three things that hammered retailers,' he said. ‘There were fewer holiday shopping days versus last year. We had bad winter weather in the final week before Christmas.'

“The third thing that hurt retailers, according to Krugman, was deep discounting. Even though the big sales were designed to boost store traffic and sales, and ‘minimize the damage', he said that level of discounting will ultimately hurt merchants' bottom line.

“The fourth-quarter shopping period is critical for merchants since it can account for as much as 50% of their annual profit and sales. And since consumer spending also fuels two-thirds of economic activity, any signals of a severe pullback in discretionary buying also doesn't bode well for the overall economy.”

Source: CNNMoney.com , December 26, 2008.

Reuters: US homeowners in desperate straits

“The desperate straits of many US homeowners showed in new data released on Monday, suggesting efforts to help them are having limited success.

“As the recession throws more people out of work, the rate of re-default on modified mortgages is rising and may worsen as the economy deteriorates, banking regulators said.

“After much browbeating from Congress, banks and other mortgage lenders are beginning to do more, to modify home loans so that distressed borrowers can avoid foreclosure.

“But the latest figures from regulators raise questions about how modifications are being done and how much they help, even as foreclosure rates hit record-setting levels.

“‘You have to think that it will get worse before it gets better,' John Dugan, the US Comptroller of the Currency, said in an interview with Reuters.

“Critics say most loan modifications up until a few months ago were temporary and not aimed at providing for sustainable payment plans, so it comes as no surprise that homeowners are defaulting.

“At the same time, a lenders' group known as Hope Now warned on Monday that the number of US homeowners seeking help to avoid foreclosure would double next year to 2 million.”

Source: Kim Dixon and Kevin Drawbaugh, Reuters , December 22, 2008.

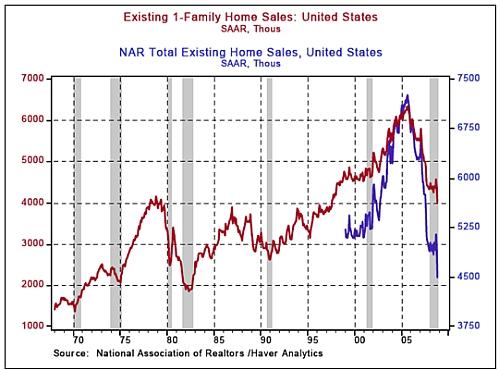

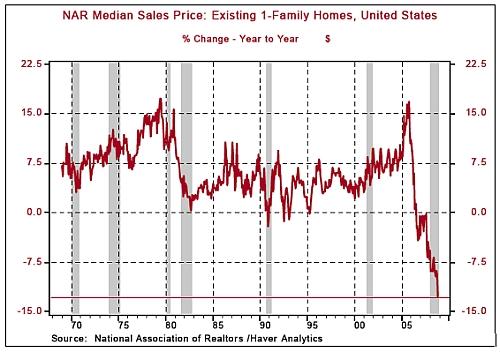

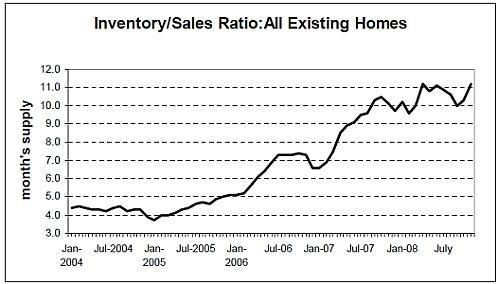

Asha Bangalore (Northern Trust): Home sales and prices continue to decline

“Sales and prices of new and existing homes fell in November and inventories are at elevated levels. The 8.6% drop in November to an annual rate of 4.49 million is the beginning of a new trajectory. Sales of both multi-family (-13.0%) and single-family (-8.0%) homes fell in November.

The median price of an existing single-family home fell 2.8% from the prior month to $181,300, but down 12.8% from a year ago – a new record.

“The inventory of unsold existing homes rose to an 11.2-month supply in November from 10.3-months in October. The inventory situation of existing homes suggests that additional declines in home prices are nearly certain.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , December 23, 2008.

MarketWatch: Fixed-rate mortgages continue to fall

“Fixed-rate mortgage rates fell again this week, with the 30-year fixed-rate mortgage setting another record low, at least since Freddie Mac began doing its weekly survey in the early 1970s.

“The 30-year averaged 5.14% for the week ending December 24, down from last week's 5.19% average, according to the survey, released on Wednesday. It was more than a full percentage point below its 6.17% average a year ago, and hasn't been lower since Freddie started doing its rate survey in 1971.

“One-year Treasury-indexed ARMs averaged 4.95%, up slightly from 4.94% last week yet still down from 5.53% a year ago.

“To obtain the rates, the 30-year fixed-rate mortgage required payment of an average 0.8 point, the 15-year fixed-rate mortgage required an average 0.7 point and the ARMs required an average 0.6 point. A point is 1% of the mortgage amount, charged as prepaid interest.

“‘Interest rates on 30-year fixed-rate mortgages eased for the eighth straight week and set another record low since Freddie Mac's survey began in 1971,' said Frank Nothaft, Freddie Mac chief economist, in a news release.”

Source: Amy Hoak, MarketWatch , December 24, 2008.

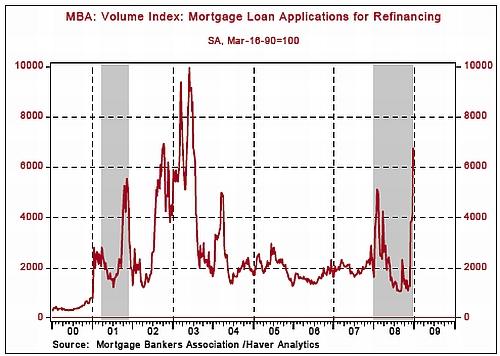

Asha Bangalore (Northern Trust): Lower mortgage rates boost refinance activity

“There is some good news from the housing market. The Mortgage Purchase Index of the Mortgage Bankers Association rose to 316.5 for the week ended December 19 from 286.1 in the prior week. Also, sharply lower mortgage rates have initiated a boom in refinancing of mortgages. The Mortgage Refinance Index rose to 6,758.6 during the week ended December 19 versus 1,254.0 a month ago.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , December 23, 2008.

Richard Russell (Dow Theory Letters): Unemployment could be surprise of bear market

“Russell thoughts: The truth – the market action isn't turning me any more optimistic, but (sigh) here goes. Every primary bear market produces its own surprises. What was the surprise of the Great Depression? I think it was this – between 1929 and 1932, 5,000 banks went out of business. This rocked the foundation of American confidence. It frightened hell out of the nation.

“And I ask myself, what could be the surprise of this bear market? My guess is unemployment. I've warned all along that high and rising unemployment is devastating (and with unemployment comes loss of income and an inability to carry one's debt).

“In the 1930s people cut back severely on their spending. Nothing was considered ‘cheap enough to be considered a bargain'. But during the Great Depression, the nation and the American people were not as indebted as they are today. In the '30s mortgages were hated and avoided. During the 1930s, the US was still largely agrarian. A huge percentage of the population lived on farms. Today most Americans live in cities. Today, more Americans work in the service industries. Living in hard times in a city can be a raw and a discouraging experience. News is more available and life is meaner and more competitive in the cities.

“The world is far more integrated today. Today, the US is competing with labor and technology with nations all over the world. The dollar is less stable today, and competitive devaluations are rampant as each nation seeks to export more of its own. It's a much more competitive world today than it was during the Great Depression. In the 1930s Japan manufactured ‘junk' items and China wasn't even a factor nor was India or Brazil. This bear market will be far more difficult for business than was the case during the 1930s.”

Source: Richard Russell, Dow Theory Letters , December 23, 2008.

The New York Times: More firms cut labor costs without layoffs

“Even as layoffs are reaching historic levels, some employers have found an alternative to slashing their work force. They're nipping and tucking it instead.

“A growing number of employers, hoping to avoid or limit layoffs, are introducing four-day workweeks, unpaid vacations and voluntary or enforced furloughs, along with wage freezes, pension cuts and flexible work schedules. These employers are still cutting labor costs, but hanging onto the labor.

“And in some cases, workers are even buying in. Witness the unusual suggestion made in early December by the chairman of the faculty senate at Brandeis University, who proposed that the school's 300 professors and instructors give up 1% of their pay.

“‘What we are doing is a symbolic gesture that has real consequences – it can save a few jobs,' said William Flesch, the senate chairman and an English professor.

“Some of these cooperative cost-cutting tactics are not entirely unique to this downturn. But the reasons behind the steps – and the rationale for the sharp growth in their popularity in just the last month – reflect the peculiarities of this recession, its sudden deepening and the changing dynamics of the global economy.

“Companies taking nips and tucks to their work force say this economy plunged so quickly in October that they do not want to prune too much should it just as suddenly roar back. They also say they have been so careful about hiring and spending in recent years – particularly in the last 12 months when nearly everyone sensed the country was in a recession – that highly productive workers, not slackers, remain on the payroll.”

Source: Matt Richtel, The New York Times , December 21, 2008.

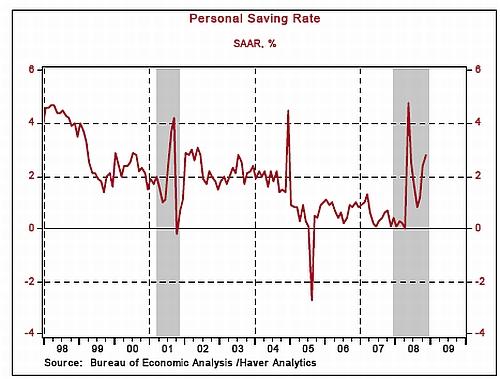

Asha Bangalore (Northern Trust): Savings rate on the up

“Personal income fell 0.2% in November due to significant weakness in the labor market. The personal saving rate moved up to 2.8% in November, putting the average of the first eleven months of the year at 1.5%, partly boosted by tax rebates of 2008. Assuming the December saving rate does not alter this average too much, the 2008 saving rate will be the first reading above 1.0% since 2004 when the saving rate was 2.1%. The saving rates in 2005, 2006, and 2007 were 0.3%, 0.7%, and 0.5%, respectively.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , December 24, 2008.

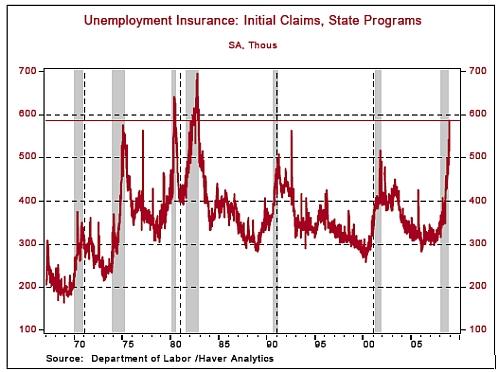

Asha Bangalore (Northern Trust): Initial jobless claims post new cycle high

Initial jobless claims for the week ended December 19 rose 30,000 to 586,000 , a new cycle high. Continuing claims, which lag initial claims by one week, moved down 17,000 to 4.37 million and the insured unemployment rate held steady at 3.3%. The main message is that labor market conditions remain significantly weak but it should be noted that the level of these claims should be seen in the context of a large labor force today compared with the 1980s.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , December 24, 2008.

Asha Bangalore (Northern Trust): Temporary bounce in non-defense capital goods orders

“Durable goods orders fell 1.0% in November following a 8.4% drop in October. A nearly 38% drop in orders of aircraft, a volatile component of this report, accounted for the weakness in the headline number. Excluding transportation, durable goods orders were up 1.2% in November. Also, orders of non-defense capital goods excluding aircraft rose 4.7% in November and bookings of non-defense capital goods increased 5.9%. In light of the weakness of consumer spending and overall weakness of the economy, the strength of these orders appears to be temporary.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , December 24, 2008.

Hal Weitzman (Financial Times): Citadel and CME win CDS clearing consent “The Chicago Mercantile Exchange (CME), the world's largest futures exchange, and Citadel, the hedge fund, were Tuesday given the green light by Washington regulators to launch a clearing house for credit default swaps.

“The CME's clearing solution was given the go-ahead by the Federal Reserve Bank of New York and the Commodity Futures Trading Commission, while the exchange said it had had ‘extensive discussions' with the Securities and Exchange Commission and was ‘well along in the SEC review process'.

“Regulators on both sides of the Atlantic have been pushing for a central clearing counterparty to be established for credit default swaps, which offer insurance against the default of banks, companies and government debt.

“The near-collapse of Bear Stearns in March and the bankruptcy of Lehman Brothers in September highlighted the counterparty risks associated with these types of derivatives. Regulators remain concerned about the effects that further counterparty failures could have on the financial system – but centralised clearing would reduce those risks.”

Source: Hal Weitzman, Financial Times , December 24, 2008.

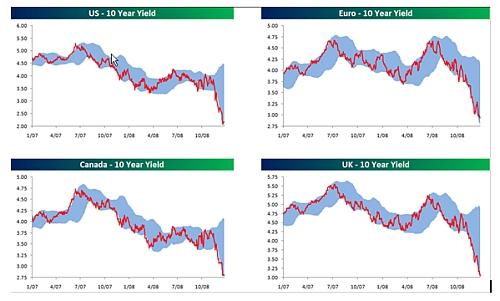

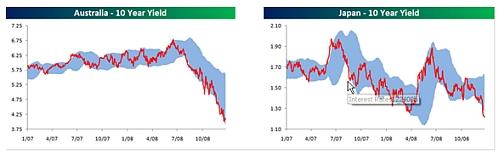

Bespoke: International long-term interest rates in downtrends

“As shown in the charts below, long-term government interest rates are in steady downtrends across the globe. While long-term interest rates with a ‘one' handle have been exclusive to Japan for several years, other countries, especially the US, are close to joining the club.”

Source: Bespoke , December 24, 2008.

Richard Russell (Dow Theory Letters): US bonds are grossly overbought

“With the bonds now overbought and overvalued, it seems to me that this could be the next trouble area. If the bonds start heading down, interest rates will head up, and this is the last thing the Fed wants to see. The Fed has insinuated that if the bonds start falling, they will buy Treasury bonds to stem the decline. Buying bonds will inject even more money into the banking system.

“So I'm going to keep a sharp eye on the bonds. Trouble in the bond market could wreak havoc with the fragile US economy. By the way, Barron's Confidence Index (CI) just dropped to a new low for the year. Thus, the bond market continues to move towards the highest-grade bonds, meaning that the bond market is continuing its trend toward safety (this tells us why the 30 year T-bond is yielding such an outrageously low number). As you know the 91-day T-bills yield nothing – in effect, the T-bills are simply a way for nervous investors to ‘warehouse' their money with safety while receiving no return.”

Source: Richard Russell, Dow Theory Letters , December 23, 2008.

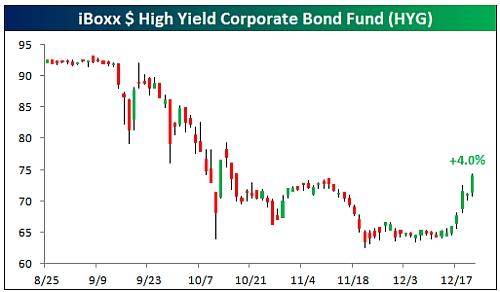

Bespoke: Corporate bonds are staging recovery

“While the S&P 500 and Nasdaq were both notoriously weak yesterday [Monday] given the usual positive bias during the Christmas week, not everything was down. In the credit markets, corporate bonds had a strong day, and if these trends continue, it will bode well for stocks.

“As shown below, using the iBoxx ETFs as a proxy, both investment grade (LQD) and high yield (HYG) corporate bonds had decent gains yesterday after rallying nicely over the past week as well.

“The stock market has really played second fiddle to the credit markets during this downturn. Many investors have been waiting for the corporate bond market to show signs of life before getting back into more risky assets. From the looks of these two ETFs, the credit markets are finally gaining some positive traction.”

Source: Bespoke , December 23, 2008.

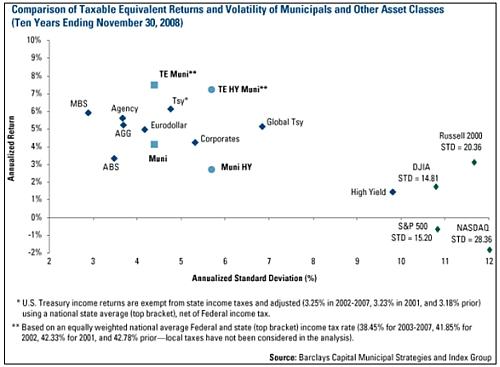

US Global Investors: Opportunity in municipal bonds

“We all know that 2008 has been a rough year for virtually all investors, and the municipal market has not been immune. Municipals, however, have weathered the storm better than most asset classes.

“Over the long term, municipals have ‘provided strong taxable-equivalent returns with lower volatility relative to their taxable counterparts,' according to Barclays Capital. The chart below shows the relative risk and after-tax performance of major equity and fixed income asset classes.

“Tax-exempt municipals (marked as ‘TE Muni' on the chart) have provided higher levels of after-tax returns than Treasuries or corporate bonds over the past 10 years, and these returns have come with lower volatility, as measured by annual standard deviation of returns.”

Source: John Derrick, US Global Investors - Weekly Investor Alert , December 26, 2008.

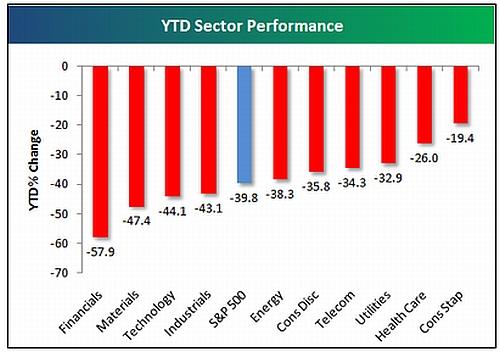

Bespoke: The few, the proud, the winners in 2008

“Below we highlight the year to date performance of the 10 S&P 500 sectors with just 6 trading days left in 2008. As shown, Financials are by far the worst with a decline of 57.9% this year. Financials are followed by Materials (-47%), Technology (-44%), and Industrials (-43%). The other 6 sectors are actually outperforming the S&P 500 as a whole, which is currently down 39.8% this year. The Consumer Staples sector has held up the best this year with a decline of 19.4%.”

Source: Bespoke , December 22, 2008.

Bloomberg: BlackRock's Robert Doll says 2009 to be “year of repair” for stocks

“Robert Doll, chief investment officer of global equities at BlackRock, talks with Bloomberg about the outlook for the equity market in 2009.”

Source: Robert Doll, Bloomberg (via YouTube ), December 23, 2008.

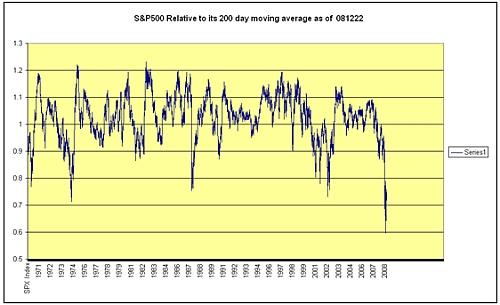

Eoin Treacy (Fullermoney): Keep an eye on divergence from 200-day moving averages

“S&P 500 and Dow Jones Industrial Average divergence from their 200-day moving averages – We first posted this indicator on October 10. The indicator hit historically oversold levels in early October as the S&P 500 and Dow Jones Industrials hit important lows. The indices and indicator both continue to consolidate above their October lows and mean reversion is certainly occurring.

“Although both indices are likely to be well off their lows by the time it occurs; sustained moves above their moving averages will indicate that a new uptrend has commenced.”

Source: Eoin Tracy, Fullermoney , December 22, 2008.

Financial Times: Tokyo talks tough on yen intervention

“In a marked sharpening of Tokyo's language on the yen, senior government officials highlighted the possibility of intervention to stem the Japanese currency's rise against the dollar.

“Takeo Kawamura, the cabinet chief secretary, told a news conference that the government was closely watching the yen's movements, saying: ‘We have conducted currency intervention in the past, and we will take appropriate measures, which include [intervention].'”

Source: Mure Dickie and Lindsay Whipp, Financial Times , December 18, 2008.

Richard Russell (Dow Theory Letters): How much is US dollar worth?

“I'm reading more and more about the viability of the dollar, if you can produce an item at no cost through a computer, what's that item worth? Why is the dollar worth anything at all? Because the US government mandates that the dollar is legal tender and can be used to settle all debt. Can the government back its fiat money? The dollar is worth something only because the US government says it is. ‘I'm from the government and I'm here to help you.' That sentence is now considered a joke, but then why should anyone take the government's pronouncement that the dollar is ‘legal tender' seriously?

“Then why do people trust Federal Reserve Notes or fiat dollars? Why do people work for, and save fiat dollar? The answer is that many generations (since 1971) have grown up with fiat dollars – they don't know anything else. It never occurs to them that Federal Reserve Notes have absolutely nothing behind them but a government decree.”

Source: Richard Russell, Dow Theory Letters , December 23 & 26, 2008.

Business Report: Don't bet on decline of SA rand

“UBS withdrew its recommendation that investors hedge against further declines in the South African rand versus the dollar, euro and yen as a lift in ‘risk appetite' shores up emerging-market assets.

“The Zurich-based bank is closing bets that the rand may weaken further at the ‘start' of 2009, as policy makers in the world's major economies lower borrowing costs to ease the effects of a global recession, Roderick Ngotho, UBS's currency strategist for emerging Europe, the Middle East and Africa, said in a report last week.

“‘We feel there could be a short-term pick-up in risk appetite at the start of next year due to the central bank actions we've seen,' Ngotho said.

“‘In an environment where liquidity is relatively thin, the rand could appreciate along with other currencies in emerging Europe, the Middle East and Africa in the short term.'

“The deficit on South Africa's current account, which widened to 7.9% of GDP in the third quarter, remained a ‘persistent vulnerability' for the rand, Ngotho said. South Africa relies on foreign purchases of its stocks and bonds to fund the shortfall, inflows that reversed this year as investors sold emerging market assets amid the worst financial crisis since the Great Depression.

“Foreign investors have sold almost R67 billion more than they bought of South African assets this year, data from its stock and bond exchanges show.

“‘Inflows into South Africa's capital account may fall short of the financing required for the current account deficit in 2009,' Ngotho said. ‘The deficit would then need to be corrected by a sharply weaker currency.'

“The government may need to access some other source of multilateral financing to fund the deficit and prevent the rand from weakening further, according to UBS. South Africa would qualify to borrow more than $13 billion under the International Monetary Fund's short-term loan facility, the report said.”

Source: Garth Theunissen, Business Report , December 22, 2008.

Javier Blas (Financial Times): Has Opec stopped the slide?

“Was Opec successful in stopping the slide in oil prices? It depends on how you analyse the numbers.

“A look at the Nymex front-month West Texas Intermediate contract, the oil market's main benchmark, gives the impression of Opec failure. It plunged from $43.60 a barrel ahead of the meeting to close at a 4½-year low of $33.87 at the end of last week. A drop of $10 sounds very much like a vote of no confidence in the cartel.

“This view is, however, misleading. The Nymex WTI front-month benchmark – in this case, the January contract – expired last Friday, distorting prices. The February contract, which on Monday became the market's benchmark, was far more stable, losing $2 to $42.36.

“But even this measure is incomplete. To attain a fairer view, it is necessary to dig deeper into the world of physical crude oil contracts.

“As the cartel pumps mostly lower quality, heavy sour crude, the cuts will affect those grades first. It is there where the market should look for clues about the impact.

“It seems to be working. The price difference between lower quality, heavy sour crude, such as Dubai – the Middle East benchmark – and higher quality, light, sweet oil, such as WTI, has narrowed sharply, pointing to a tighter market.

“Opec still faces a daunting job delivering its promised cuts amid fast-weakening demand, but investors should not disregard the cartel because the WTI January contract was weak.

“For the time being, the physical market is giving Opec a cautious thumbs up.”

Source: Javier Blas, Financial Times , December 21, 2008.

CNBC: Dennis Gartman – downward barrel

Discussing oil droppping below $40, with Dennis Gartman of The Gartman Letter.

Source: CNBC , December 23, 2008.

Richard Russell (Dow Theory Letters): Finally, gold shares showing outperformance

“I've been saying all along that somewhere the gold shares will believe in rising gold rather than a sinking stock market. The evidence is seen on the chart below. Here we see GDX divided by Gold, the ratio is finally surging in favor of GDX the gold shares. You can see that the downtrend has been reversed and I expect the gold shares to move with gold from now on. Relative strength trends tend to last a long time.”

Source: Richard Russell, Dow Theory Letters , December 26, 2008.

Commodity Online: NCDEX to launch global contracts in gold & silver

“NCDEX is all to launch Gold & Silver International futures contracts on the exchange on Monday, December 29, 2008.

“A press statement issued from NCDEX said that these contracts named Gold International and Silver International can be bought and sold in lots of one kg and 30 kg respectively.

“The contract size has been defined keeping in view the Indian consumer and the recent price trends. These contracts will be physically settled at Ahmedabad. Contracts would be settled on the basis of international prices in rupee denomination.

“On account of persistent market demand and keeping in mind the fact that India is a big importer of bullion, NCDEX has now introduced these new contracts, the statement said.”

Source: Commodity Online , December 27, 2008.

David Fuller (Fullermoney): Planinum is best value precious metal

“Markets are only efficient to the extent that they reflect sentiment. Today, many savvy investors want some gold in their portfolios. We agree and this site has previously discussed at length the reasons for doing so. A minority of precious metal enthusiasts also want silver, which Fullermoney has long argued, performs like high-beta gold. We too like silver.

“Some of us also think that platinum is the best value precious metal today. I will let this ratio chart do the talking.

“Today, the price of platinum is only slightly higher than that of gold. Consequently, platinum is trading near its lowest level relative to gold for at least 22 years. (Bloomberg does not have earlier data on platinum prices.) In this decade to date, platinum has traded at more than 2.2 times the price of gold on three occasions. Therefore in terms of relative values, we especially like platinum today.

“Inevitably, there are reasons for such wide price swings. Almost all of the platinum produced today comes from South Africa. Supply disruptions, most recently due to power outages, caused the earlier scrambles for scarce supplies of platinum. This is not a problem today, at least not at the moment. Instead, people have shunned platinum because the global automobile industry is in a slump. This reduces demand for platinum used in the manufacturing of catalytic converters.

“That factor is certainly reflected by today's low price for platinum relative to gold. I believe investors are overlooking the possibility of supply disruptions in South Africa. Meanwhile, the white metal's price has flat lined in probable base formation development.”

Source: David Fuller, Fullermoney , December 24, 2008.

Financial Times: China battles unemployment to deter unrest

“Tackling unemployment among university graduates will be China's priority next year as the economy falters, Wen Jiabao, the prime minister, said at the weekend.

“The attention given by state media to Mr Wen's visit to a Beijing university was the latest sign of the government's increasing fear of widespread unrest as growth declines much faster than expected.

“‘We have made finding jobs for university students our top priority and will come out with some measures to make sure all graduates have somewhere constructive to direct their energy,' Mr Wen told students at the Beijing University of Aeronautics and Astronautics.

“He said the government was also extremely concerned about migrant workers who had been laid off in the cities. By the end of November, 10 million migrant workers had lost their jobs nationwide and 4.85 million of those had returned home, according to government figures.

“A survey last week by a government think tank estimated the number of recent graduates who have been unable to find work at 1.5 million. Tertiary institutions are expected to churn out another 6.5 million graduates next year.

“In recent weeks, a growing chorus of official voices has raised the spectre of unrest. ‘If growth falls below 8% then that will create enormous problems in terms of unemployment,' according to Zhang Xiaojing, director of the Macroeconomy Office of the Institute of Economics at the Chinese Academy of Social Sciences.

“‘There will be lots of laid-off migrant workers returning to the villages, not to mention the many college graduates and this will affect social stability.'

“Mr Zhang linked the continuing riots in Greece directly to the global economic crisis and said that Beijing was wary of a similar situation erupting in China.”

Source: Jamil Anderlini, Financial Times , December 21, 2008.

Bloomberg: China may spur consumer spending after lowering rates

“China may follow its latest interest-rate cut with steps to spur consumer spending as deepening recessions in the US and Europe pummel exports, one of the main engines of the world's fourth-largest economy.

“The People's Bank of China yesterday lowered its one-year lending rate by 0.27 percentage point to 5.31% and the deposit rate by the same amount to 2.25%. The central bank also reduced the proportion of deposits lenders must set aside as reserves by 0.5 percentage point.

“Chinese stocks fell on concern the cut was too small to shore up the economy, which may grow at the slowest pace in two decades next year. Premier Wen Jiabao, who unveiled a $583 billion stimulus package for roads and bridges last month, may also reduce taxes and try to prop up the housing market, economists said.

“Officials ‘will continue to ease monetary policy and introduce additional fiscal stimulus measures, particularly in support of domestic consumption,' said Jing Ulrich, head of China equities at JPMorgan Chase & Co. in Hong Kong.”

Source: Li Yanping and Kevin Hamlin, Bloomberg , December 23, 2008.

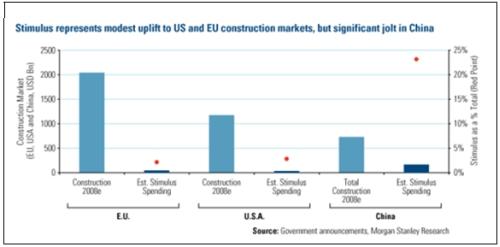

US Global Investors: China's fiscal stimulus represents long-term opportunity

“China's infrastructure stimulus represents a 23% increase in total construction spending, compared with 4 percent in the US and 2% in Europe. While the impact may not be immediate, this fiscal initiative continues to be a long term opportunity for the market overall.”

Source: US Global Investors - Weekly Investor Alert , December 26, 2008.

Financial Times: Japanese exports in record 27% fall

“Japan's exports plunged at a record annual pace in November with shipments to Asia dropping the most since 1986 as a global economic slump and a surging yen slashed demand for everything from autos to electronics.

“While imports fell 14.4% as the Japanese economy languished in recession, the 26.7% plunge in exports was large enough to keep the trade balance in deficit for a second month running. Japan last logged trade deficits two months in a row during a previous spell of yen strength in 1980.

“The Japanese currency has surged around 20% against the dollar this year as investors spooked by the global financial crisis bailed out of risky assets and brought funds home.

“Shipments to the United States sank a record 33.8 per cent on slack demand for automobiles. The United States is in recession and American demand for Japanese goods has been falling for 15 months, ever since US mortgage defaults started to squeeze global credit markets.

“By contrast Asian markets held up for much of the crisis, but are now crumbling at dizzying speed. Exports to Asia fell 26.7% in November. Shipments to China dropped 24.5%, the biggest fall since 1995, on weak demand for semiconductors, digital cameras and other electronic goods, the Ministry of Finance said.

“‘The drop shows that domestic demand in China for Japanese goods is not that strong,' said Kaori Yamato, an economist at Mizuho Research Institute. The Chinese economy is slowing sharply as exports to Europe and the United States plunge.”

Source: Mure Dickie, Financial Times , December 22, 2008.

Reuters: Japan output slumps

“Export-reliant Asian economies showed more signs of weakness on Friday, with Japan's industrial output diving at a record pace and South Korea warning it faces an ‘unprecedented crisis' as global demand wilts.

“Even the once unstoppable Chinese economy is feeling the strain, with companies recording a sharp slowdown in profit growth in the first 11 months of the year.

“On top of Japan's steep fall in industrial output in November, core consumer inflation fell faster than forecast last month, putting the shrinking economy on course for a spell of deflation next year.

“The grim outlook could push the Bank of Japan to implement unorthodox monetary easing measures as it has little room left to cut interest rates after reducing them to 0.10% last week.

“But Japan's Economics Minister Kaoru Yosano said he doubted that any so-called quantitative easing by the Bank of Japan would directly lead to an increase in loans to companies to get the economy moving again.

“Facing the worst international economic environment in more than eight decades, Yosano said his government would act flexibly on possible additional spending measures if conditions deteriorated further.”

Source: Hideyuki Sano and Yuko Yoshikawa, Reuters , December 26, 2008.

Reuters: Ireland to pour billions into 3 main banks

“The Irish government will invest 5.5 billion euros in the country's three main lenders, taking majority control of Anglo Irish Bank after a loan scandal there rocked an already beleaguered industry.

“Investors have been waiting for months for a bailout plan to match schemes in other countries, but pressure on the government intensified this week after Anglo Irish revealed its chairman had kept shareholders in the dark about 87 million euros worth of loans he had received from the lender. Its shares slumped to a record low of 19 euro cents and the financial regulator has launched a probe into directors' loans at all major Irish banks.

“‘This is a new beginning. We have to have proper lending, responsible lending, lending for the real needs of the economy,' Finance Minister Brian Lenihan said on Sunday.

“Dublin will invest 2 billion euros each in market leaders Bank of Ireland and Allied Irish Banks via preference shares giving 25% voting rights over what the government described as ‘key issues'.

“The package will be paid for from funds set aside during Ireland's ‘Celtic Tiger' economic boom and originally intended to meet the state's future pension obligations.”

Source: Kevin Smith and Carmel Crimmins, Reuters , December 22, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.