Credit Crisis 2008 Ends as Economic Crisis of 2009 Begins

Economics / Recession 2008 - 2010 Dec 28, 2008 - 06:56 AM GMT Investors spent the holiday-shortened Christmas week in an un-merry mood, digesting more gloomy economic data and taking stock of a tumultuous 2008.

Investors spent the holiday-shortened Christmas week in an un-merry mood, digesting more gloomy economic data and taking stock of a tumultuous 2008.

With the S&P 500 Index and the Dow Jones Industrial Index down by 35.8% and 40.6% respectively for the year to date, many investors would be anxious to wave the old year goodbye. But changing the calendar digits from '08 to '09 will regrettably not make an iota's difference to the perilous nature of the investment environment facing investors as we usher in the New Year.

Come January 1, investors will not only be hung over from 2008's market rout (and possibly the previous night's exuberance), but also still be battling with the implications of the credit crisis for the global economy and financial markets, and in particular with the question of where to invest for decent returns during 2009. (Also see my post “ Video-o-rama: Will markets bail you out in '09? ”.)

“2008 was the year of the crisis of the financial system. 2009, unfortunately, will be the crisis of the economic system,” said Mohamed El-Erian, co-CEO of Pimco in a CNBC interview. “So the news is going to be full of unemployment, defaults, etc.”

Most markets were down during the past week (albeit on light holiday volume), with the MSCI World Index (-1.5%), the MSCI Emerging Markets Index (-5.2%), the US Dollar Index (-0.3%), the Reuters/Jeffries CRB Index (-1.6%), West Texas Intermediate crude (-11.0%) and US government bonds all closing in the red.

Source: Daryl Cagle

However, not all the Christmas stockings were left empty. On the equities side, the Japanese Nikkei 225 Average (+1.8%) and the Russian Trading System Index (+5.8%) confounded the bears as both countries are faced with a particularly grim economic situation. Among fixed-income instruments, emerging-market government debt and corporate bonds were in demand. Gold (+4.0%) and platinum (+4.5%) also fared excellently – for the third week running – on the back of a solid supply/demand situation, store-of-value considerations and upbeat charting patterns.

But if Santa has not yet made his way to your investment portfolio, don't despair. According to Jeffrey Hirsch ( Stock Trader's Almanac ), the “Santa Claus Rally” normally occurs during the last five trading days of a year and the ensuing first two trading sessions of the new year. During this seven-day period stocks historically tended to advance (by 1.5% on average since 1950), but when recording a loss, they frequently traded much lower in the new year.

Christmas Eve trading on Wednesday marked the start of this year's Santa Claus Rally period, which ends on Monday, January 5. So far so good, as the combined gain for the S&P 500 Index for the first two days (Wednesday and Friday) was 1.1%.

Given the extreme turbulence that characterized stock markets during 2008, most investors would be wishing for a calmer 2009. The red line in the chart below shows the daily percentage change in the S&P 500 Index (green line), illustrating how the volatility has been declining since the panic levels of October.

Still on the topic of volatility, the CBOE Volatility Index (VIX) has declined from 80.9 in November to 43.4 on Friday. It is not uncommon for short-term volatility to be at extreme levels at bottom turning points, and for stocks to improve as the “storm” grows quieter.

Heading into the new year, President-elect Barack Obama's transition team is still negotiating the nuts and bolts of its economic stimulus plan with Congress, but the two-year jobs target has in the meantime been raised by 500,000 to 3 million. The planning is to have legislation for the package ready by the time Obama takes office on January 20.

As far as bailout news goes, on Christmas Eve the Fed accepted GMAC's application to become a bank holding company. The lending unit thereby qualifies for TARP funds and hopefully won't have to cut off credit to the General Motors (GM) dealerships.

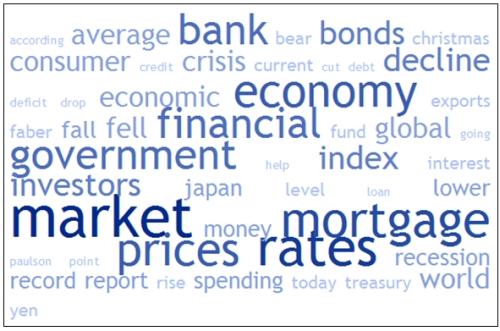

Next, a tag cloud from the dozens of articles I have read during the past week between Yule-tide activities. This is a way of visualizing word frequencies at a glance. As expected, keywords such as “bank”, “economy”, “financial”, “government”, “market”, “mortgage”, “prices” and “rates” feature prominently.

The debate regarding the outlook for the stock market is still concerned with what represents good value. Comstock Partners commented that the S&P 500's reported (GAAP) earnings estimate for 2009 had dropped to just over $42. “In the past, secular bear markets troughed at 8 to 10 times reported earnings, NOT operating earnings, which didn't even exist until 1984. In terms of timing, on average the market bottomed five months before the end of the recession. Therefore the odds are that unless the economy starts to recover five months from the November 2008 bottom, the market decline is not over, although a bear market rally is always a possibility between now and the eventual low,” said Comstock.

Richard Russell ( Dow Theory Letters ) said: “Lowry's Selling Pressure Index is now down substantially from its recent high. With the urge to sell subsiding, all that's needed now is an increase in the demand for stocks, an increase in the urge to buy … will buyers come in? I suspect we'll get the answer to that question next week.”

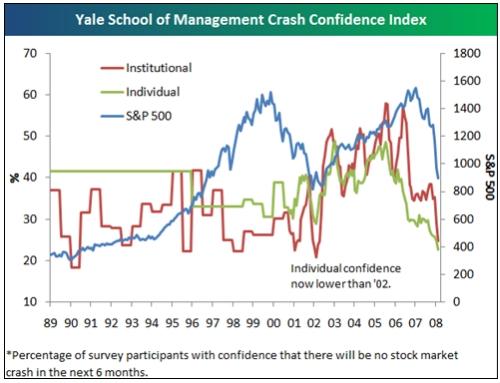

Bespoke draws the attention to the Yale Crash Confidence survey – a survey that measures investor confidence on a monthly basis, asking investors how confident they are that there won't be a market crash in the next six months.

“In November, the individual Crash Confidence reading reached its lowest level ever at 22.7%. As the green line in the chart shows, the prior low in Crash Confidence was in October 2002, which was the ultimate market low during the 2000 to 2002 bear market. This negativity is actually a positive for the market going forward,” said Bespoke.

Although the Fed and other central bank actions have resulted in some progress being made to fix the broken credit machine, the thawing of the credit markets still has a considerable way to go before liquidity starts to move freely and the world's financial system functions normally again (see “ Credit Crisis Watch – Signs of Progress ”). In the meantime, stock markets stay caught between the actions of central banks and a worsening economic and corporate picture.

It is too early to tell whether a secular stock market low was recorded on November 20 and, failing further technical and fundamental evidence, I remain distrustful of rallies. As said before, we are in a wait-and-see mode.

Economy

“Another week and another new record low for global business confidence. Businesses are equally pessimistic in North America, South America and Europe, and while Asian business confidence is not quite as dark, it is weakening rapidly,” said the latest Survey of Business Confidence of the World conducted by Moody's Economy.com . The Survey results indicate that the entire global economy is mired in recession.

Data reports released in the US during the past week confirmed an increasingly dire economic situation.

• The contraction in real GDP in the third quarter – an annualized decline of 0.5% – was unrevised in the final report. Real consumer spending expenditure declined by 3.8%, knocking 2.8% off real GDP growth.

• Personal income fell by 0.2% in November, more than expected, after increasing by 0.1% in October. Wage income fell for the second time in the last three months, driven by large job losses. The saving rate rose to 2.8% from 2.4% in October.

• Initial jobless benefit claims increased by 30,000 to a 26-year high of 586,000 for the week ended December 20. Initial claims are elevated from trends earlier in the year, indicating persistent weakening in the labor market.

• New orders for manufactured durable goods fell by 1% in November, following an 8.4% decline in October. This was the fourth monthly decline in new orders, but was a smaller than expected drop.

• Existing home sales dropped by 8.6% month-on-month in November, a reading well below expectations and a new cycle low. New home sales hit a 17-year low of 407,000 annualized units. Inventory remains elevated at more than 11 months.

• In the week ended December 19, the Mortgage Refinance Index gained 62.6% on the back of sharply lower mortgage rates.

A further indication of the severe pullback in discretionary buying came from CNNMoney.com 's report on MasterCard's SpendingPulse Data which estimates that total store sales fell about 3% in November and December combined – the worst holiday sales season for retailers in decades.

Elsewhere in the world, the economies continued to accelerate to the downside. A case in point is China and Japan that witnessed a number of particularly ugly economic reports during the past week.

• On the back of a sharp decline in Chinese exports, one of the main engines of its economic growth, the People's Bank of China on Monday lowered its one-year lending rate by 27 basis points to 5.31% – the fifth move in three months – and also reduced the proportion of deposits lenders must set aside as reserves by 0.5 percentage points, according to Bloomberg . Additional steps to spur consumer spending may follow the interest-rate cut. (Also see the Vitaliy Katsenelson's guest post “ A Far-east Fiasco? ”.)

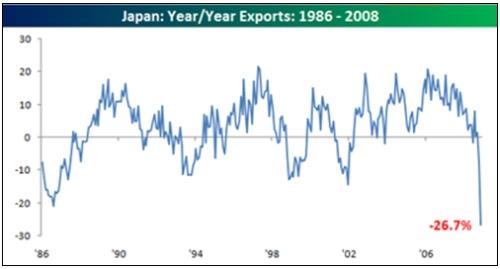

• Japan's exports also plunged at a record annual pace of 26.7% year-on-year in November. The global economic slump and surging yen slashed demand for Japanese products across the board. “The grim outlook could push the Bank of Japan to implement unorthodox monetary easing measures as it has little room left to cut interest rates after reducing them to 0.10% last week,” reported Reuters .

Source: Bespoke , December 22, 2008.

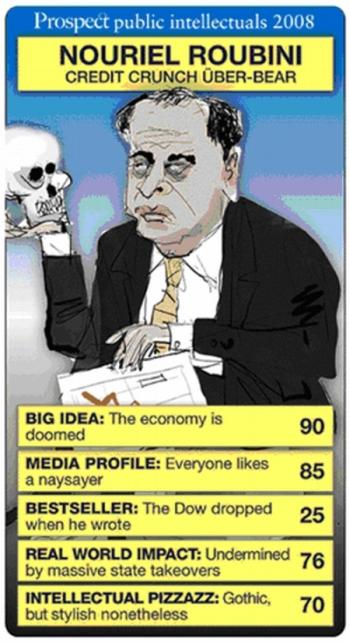

Summarizing the economic situation, Nouriel Roubini , professor at New York University and chairman of RGE Monitor , said: “It is going to be a year of economic stagnation and recession for most of the global economy with deflationary pressures … I expect a global recession and a severe one. I see a recession throughout 2009 … and maybe there will be a return to positive economic growth by 2010.”

Whether or not the recession persists into 2010 will depend on how aggressive and effective policy actions are, i.e. monetary and fiscal policy and efforts to recapitalize financial institutions in the US and elsewhere.

Still on the topic of the “Bini” – as probably the most prolific credit-crunch economist, it comes as no surprise that he was included as one of Prospect 's Public Intellectuals of 2008.

Week's economic reports

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

Date |

Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Dec 23 | 8:30 AM | Chain Deflator-Final | Q3 | 3.9% | 4.2% | 4.2% | 4.2% |

| Dec 23 | 8:30 AM | GDP -Final | Q3 | -0.5% | -0.5% | -0.5% | -0.5% |

| Dec 23 | 10:00 AM | Existing Home Sales | Nov | 4.49M | 4.95M | 4.93M | 4.91M |

| Dec 23 | 10:00 AM | New Home Sales | Nov | 407K | 415K | 415K | 419K |

| Dec 23 | 10:00 AM | Michigan Sentiment-Revised | Dec | 60.1 | 58.8 | 58.8 | 59.1 |

| Dec 24 | 8:30 AM | Durable Orders | Nov | -1.0% | -3.5% | -3.1% | -8.4% |

| Dec 24 | 8:30 AM | Initial Claims | 12/20 | 586K | 545K | 558K | 556K |

| Dec 24 | 8:30 AM | Personal Income | Nov | -0.2% | 0.1% | 0.0% | 0.1% |

| Dec 24 | 8:30 AM | Personal Spending | Nov | -0.6% | -0.8% | -0.8% | -1.0% |

| Dec 24 | 10:35 AM | Crude Inventories | 12/20 | -3.1m | NA | NA | NA |

Source: Yahoo Finance , December 26, 2008.

In addition to the Federal Open Market Committee (FOMC) releasing the minutes of its December 16 meeting (Tuesday, January 6) and the Bank of England's interest rate announcement (Thursday, January 8), the US economic highlights for the next two weeks, courtesy of Northern Trust , include the following:

1. ISM Manufacturing Survey (January 2): The consensus for the ISM Manufacturing Index is 35.5 versus 36.2 in November.

2. Employment Situation (January 9): Payroll employment is predicted to have dropped by 450,000 in December after a loss of 533,000 jobs in the prior month. The unemployment rate is expected to have risen to 7.0% during December from 6.7% in November. Consensus: Payrolls – -478,000 versus -533,000 in November, unemployment rate – 7.0% versus 6.7% in November.

3. Other reports : Consumer Confidence (December 30), Construction Spending, Auto Sales (January 5), Factory Orders, ISM Non-manufacturing, Pending Home Sales Index (January 6).

Markets

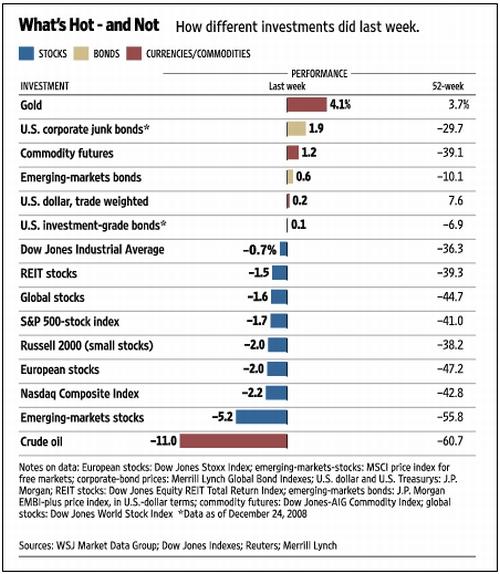

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , December 26, 2008.

This is another week of a “holiday-shortened” version of “Words” as I am again skipping the customary review of the ups and downs of the various asset classes, taking to heart Bill King 's words: “'Tis the time of the year to not overthink …”

Here's wishing you a festive season full of fun, laughter and joy. Let's remain positive and stay focussed on steering our portfolios profitably through the sometimes murky investment waters. May you have a wonderful and calm 2009 (after a calamitous 2008).

Source: Daryl Cagle

CNBC: Pimco's El-Erian – back to basics for investors in 2009

“As the meltdown in the economy gains steam, investors in 2009 will need to return to the basics of investing such as diversification and risk management, said Pimco co-CEO Mohamed El-Erian.

“Even though those same principles did not serve investors well in 2008, the coming year will present a different set of obstacles that will require a different strategy, he said.

“‘2008 was the year of the crisis of the financial system. 2009, unfortunately, will be the crisis of the economic system,' El-Erian said on CNBC. ‘So the news is going to be full of unemployment, defaults, companies defaulting, etc.

“'For investors, it's going to be going back to the three things that work well and that haven't worked well in 2008.'

“Those three things are diversified asset allocation, good implementation vehicles, and solid risk management.

“'For 2009, every investor should go back to the basics and recognize that there will be a lot of government initiatives,' El-Erian said. ‘We're going to see fiscal stimulus packages going into the trillions of dollars. We're going to see support for various sectors, and despite that the economy will be bumpy.'

“As far as specific bond investment vehicles, he identified mortgages, banks, municipal bonds, and high-quality investment grade corporate debt as well as the top emerging markets.

“Investment in stocks will lag, he said, until there's an increase in confidence that equities will provide solid rewards without all the risk, and the economy shows signs of stability.

“‘What 2008 has told you and what 2009 is telling you is that for the average investor conditions have changed and therefore the game plan has got to change, which means don't go and chase what are very attractive valuations from a historical standpoint,' El-Erian said.

“With the exception of Treasurys, which are offering historically low yields, a multitude of other investment vehicles are likely to be attractive – and possibly a trap for investors.

“‘But don't fall into that trap,' El-Erian said. ‘Rather, go for those assets that are not only dislocated but where there's a catalyst for normalization, where you can actually identify what it is that's going to bring valuations back to somewhat more reasonable levels. If you do that you will get both the upside and protection against the downside. That's going to be the key issue in 2009.'”

Source: CNBC , December 22, 2008.

BNN: Conversation with BMO's strategist Don Coxe

Source: BNN , December 23, 2008.

Bloomberg: Marc Faber predicts 2009 going to be “a catastrophe”

“Marc Faber, publisher of the Gloom, Boom & Doom Report, talks with Bloomberg about the outlook for the global economy in 2009 and his investment strategy.”

Click here for Business Intelligence article on Faber's views.

Source: Bloomberg ( via YouTube ), December 22, 2008.

CNBC: Your edge for 2009

“The market could look a lot different next year, says David Kotok, Cumberland Advisors chairman/CIO.”

Source: CNBC , December 26, 2008

Financial Times: Obama expands goals of stimulus

“Barack Obama has expanded the goals of his proposed economic stimulus, with a plan to create or save an additional 500,000 jobs.

“The president-elect raised his jobs target over the next two years to 3 million – up from the 2.5 million goal set last month – after US unemployment hit its highest level for 15 years in November.

“Transition officials said Mr Obama had agreed the outlines of a $675 billion to $775 billion two-year recovery plan last week. But the price tag is likely to rise above $800 billion as Congress makes its own demands during the legislative process.

“The moves come amid a warning on Sunday, from the International Monetary Fund, that governments must act more aggressively to prevent a deeper slump.

“Dominique Strauss-Kahn, IMF managing director, told BBC radio that inadequate stimulus measures risked making the slowdown worse than expected next year. ‘I'm specially concerned by the fact that our forecast, already very dark … will be even darker if not enough fiscal stimulus is implemented,' he said.

“The IMF has called for combined stimulus measures in 2009 of $1,200 billion – or 2% of global annual economic output – amid fears of the deepest slump since the Great Depression.

“Under Mr Obama's proposals, most of the cash would be spent on tax cuts for the middle class, aid to cash-strapped state governments and investments in infrastructure, ‘green' energy and other policy priorities.

“Detailed talks have been under way with congressional leaders for the past few days, with a view to legislation being ready for Mr Obama to sign soon after taking office on January 20.”

Source: Andrew Ward, Financial Times , December 21, 2008.

Bloomberg: US banks may turn to Asia bonds to plug funding gap

“US banks including Citigroup, Goldman Sachs and Morgan Stanley may sell government-guaranteed bonds in Asia next year, tapping growing demand for the region's local-currency debt to bolster their balance sheets.

“US financial institutions sold more than $100 billion of government-backed notes in dollars, euros and British pounds since October 14, when the Federal Deposit Insurance Corp. agreed to guarantee their bonds to help them cope with $678 billion of losses and writedowns amid the global credit crunch.

“‘Banks like Morgan Stanley and Goldman will have to tap Asian currencies because the potential supply is too big for dollars, euros and pounds to take on,' said Arthur Lau, a fund manager at JF Asset Management in Hong Kong, which oversees $128 billion. ‘It's a perfect product for insurance companies in Asia. The bonds offer good yield pick-up, high credit ratings, good liquidity and no currency mismatch.'

“US banks may be forced to follow European and Australian banks, which lured fund managers to $6.6 billion of government-backed securities in Asia-Pacific since September with yields of as much as double those on sovereign debt, data compiled by Bloomberg show. Sales of FDIC-backed notes maturing in more than a year may reach $450 billion by the end of June, Barclays Capital analysts said.”

Source: Patricia Kua, Bloomberg , December 23, 2008.

Financial Times: S&P downgrades 11 of world's top banks

“Eleven of the world's biggest banks were downgraded Friday by Standard & Poor's after the ratings agency said the current downturn could be longer and deeper than previously thought.

“Six major US banks were downgraded, including JPMorgan Chase, Bank of America and Wells Fargo, as well as five banks in Europe. The agency cut its ratings on Citigroup, Morgan Stanley, and Goldman Sachs by two notches each. In Europe, S&P shaved one notch off the ratings of Barclays, Credit Suisse, Deutsche Bank, Royal Bank of Scotland and UBS.

“S&P analyst Tanya Azarchs said that, in addition to the economic woes, the banking sector's ‘lax underwriting standards due to excess competition mean this cycle will be worse than prior cycles'.”

Source: Jane Croft and Greg Farrell, Financial Times , December 19, 2008.

Washington Post: Paulson asks Congress for second $350 billion of rescue package

“Treasury Secretary Henry M. Paulson said yesterday that Congress must release the second half of the $700 billion financial rescue package, warning that emergency loans to the nation's automakers have all but depleted the funds available to stabilize the still-fragile financial markets.

“Without fast action to replenish the fund that serves as the primary safety net for the financial system, Treasury officials and others said, the government would be hampered in its ability to respond to a fresh round of market turmoil.

“Treasury officials are also facing a hard deadline. Although they had enough to give the car companies $13.4 billion yesterday, they need the second installment of the rescue package to help General Motors make another $4 billion debt payment in mid-February.

“Paulson said the Treasury and the Federal Reserve have enough resources to handle a crisis for the time being. ‘It is clear, however, that Congress will need to release the remainder of the TARP to support financial market stability,' he said in a statement.”

Source: David Cho and Lori Montgomery, Washington Post , December 20, 2008.

Editor's note: Paulson's decision represents another policy reversal, having said just days ago “we've got what we need right now.” See excerpt from Fox News below.

Fox News: Paulson – financial firms should be stabilized

“Treasury Secretary Henry Paulson says he does not expect any more major financial institutions to fail during the current credit crisis. Paulson also says that he has no plans to ask Congress to make the second half of the $700 billion financial rescue fund available before the Bush administration leaves office.”

Source: Fox News , December 16, 2008.

The Wall Street Journal: US developers ask for bailout as massive debt looms

“With a record amount of commercial real-estate debt coming due, some of the country's biggest property developers have become the latest to go hat-in-hand to the government for assistance.

“They're warning policymakers that thousands of office complexes, hotels, shopping centers and other commercial buildings are headed into defaults, foreclosures and bankruptcies. The reason: according to research firm Foresight Analytics, $530 billion of commercial mortgages will be coming due for refinancing in the next three years – with about $160 billion maturing in the next year. Credit, meanwhile, is practically nonexistent and cash flows from commercial property are siphoning off.”

Source: The Wall Street Journal , December 23, 2008.

SafeHaven: Ron Paul – government and fraud

“Billions of dollars were recently lost in the collapse of Bernie Madoff's self-described Ponzi scheme, in which too-good-to-be-true returns on investments were not really returns at all, but the funds of defrauded new investors. The pyramid scheme collapsed dramatically when too many clients called in their accounts, and not enough new victims could be found to support these withdrawals. Bernie Madoff was running a blatant fraud operation. Fraud is already illegal, and he will be facing criminal consequences, which is as it should be, and should act as an appropriate deterrent to potential future criminals. But it seems every time someone breaks the law, politicians and pundits decide we need more laws, even though lack of laws was not the problem.

“The government itself runs a fraud much bigger than Madoff's. Our Social Security system is the very definition of a Ponzi, or pyramid scheme. If the government truly had an interest in protecting people's savings, they would allow people to opt out of Social Security altogether. We would cut wasteful spending, such as our overseas empire, to honor current obligations to seniors, and eventually phase the program out. Instead, as with Enron and Sarbanes Oxley, I expect new, unrelated legislation to be proposed that further damages freedom in the name of protecting us, amidst loud proclamations that they have made the world safe.”

Source: Ron Paul, SafeHaven , December 22, 2008.

APF: Bank of Spain chief – world faces “total” financial meltdown

“The governor of the Bank of Spain on Sunday issued a bleak assessment of the economic crisis, warning that the world faced a ‘total' financial meltdown unseen since the Great Depression.

“‘The lack of confidence is total,' Miguel Angel Fernandez Ordonez said in an interview with Spain's El Pais daily.

“‘The inter-bank (lending) market is not functioning and this is generating vicious cycles: consumers are not consuming, businessmen are not taking on workers, investors are not investing and the banks are not lending.

“‘There is an almost total paralysis from which no-one is escaping,' he said, adding that any recovery – pencilled in by optimists for the end of 2009 and the start of 2010 – could be delayed if confidence is not restored.

“Ordonez recognised that falling oil prices and lower taxes could kick-start a faster-than-anticipated recovery, but warned that a deepening cycle of falling consumer demand, rising unemployment and an ongoing lending squeeze could not be ruled out.

“‘This is the worst financial crisis since the Great Depression' of 1929, he added.”

Source: APF (via Breitbart.com ), December 21, 2008.

Ambrose Evans-Pritchard (The Telegraph): Protectionist dominoes are beginning to tumble across the world

“Greece has been in turmoil for 11 days. The mood seems to have turned – pre-insurrectionary' in parts of Athens – to borrow from the Marxist handbook.

“This is a foretaste of what the world may face as the ‘crisis of capitalism' – another Marxist phase making a comeback – starts to turn two hundred million lives upside down.

“We are advancing to the political stage of this global train wreck. Regimes are being tested. Those relying on perma-boom to mask a lack of democratic or ancestral legitimacy may try to gain time by the usual methods: trade barriers, sabre-rattling, and barbed wire.

“Dominique Strauss-Kahn, the head of the International Monetary Fund, is worried enough to ditch a half-century of IMF orthodoxy, calling for a fiscal boost worth 2% of world GDP to ‘prevent global depression'.

“‘If we are not able to do that, then social unrest may happen in many countries, including advanced economies. We are facing an unprecedented decline in output. All around the planet, the people have reacted with feelings going from surprise to anger, and from anger to fear,' he said.”

Source: Ambrose Evans-Pritchard, The Telegraph , December 22, 2008.

Marketplace: Quantitative easing

“Now the Federal Reserve has effectively cut the target lending rate to zero, it only has one more weapon in its arsenal. Quantitative easing. Senior Editor Paddy Hirsch explains what this ‘nuclear option' is, and what the Fed hopes it'll do.”

Source: Marketplace , December 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.