Profit from China's Railroad Expansion

Companies / China Stocks Apr 18, 2007 - 01:15 PM GMTBy: Michael_K_Dawson

Many thought that Warren Buffet had lost his touch when he continued buying old boring companies in the late nineties when clearly technology stocks were the key to riches. Today, how many wished that they had bought McDonald's instead of Microsoft in 1999? Last week, news surfaced that he was buying into another industry that doesn't have much appeal to modern investors. The smirks have long since faded. Now Buffet creates a buzz.

According to a filing with regulators, Warren Buffet's Berkshire Hathaway, Inc. had amassed a 10.9% stake, worth more than $3 billion, in railroad operator Burlington Northern Santa Fe Corp. A Berkshire Hathaway spokeswoman also confirmed to Reuters that the company was investing nearly $1.4bn in two other unnamed railroad groups as well. Once again Buffet is doing what no one does better – investing in long term growth opportunities.

Railroads are so heavily tied to fixed capital – how can it be a growth play? Two factors make rail the preferred the shipping method: economic growth and rising energy costs. If you really want to get excited – think about that in the context of emerging markets. Right now there is a shortage of freight trains to carry raw materials from China's western provinces to the manufacturing centers along the coast. Huang Min, chief economist with China's Railways Ministry, said “Our railroad service can only satisfy 35% of cargo demand.”

For the past three years, leveraging the emerging markets has been my primary investment theme. Initially, my thesis was simply to “buy what China wants.” Eventually, it expanded to include the BRIC economies (Brazil, Russia, India and China) as well. About 3 months ago, I did some rudimentary research on china railroads. My conclusions were – it is a must own sector, but implementation is difficult for U.S. based investors.

Buffet's moves caused me to revisit this thesis. I found two recent articles that got the juices following again: Business Week, March 20, “China Great Rail Spree Continues” and Forbes, March 26, “Fast Train to China.” If the following quote doesn't cause you see dollar signs I don't know what will. Simon Charlesworth, Vice-President of Business Development for Alstom Transport, at the Asia-Pacific Rail 2007 conference said,

“China has by far the biggest needs in the region. And as crazy as this may seem, its economy would probably be growing at even a faster rate than the current 10%-plus a year pace if its rail infrastructure were truly up to snuff.”

Cha-Ching!

I often say that knowledge is not power, but acting on knowledge is power. It is interesting to know that Beijing is spending $190 billion on its railroad build-out through 2010, but profiting on that knowledge is much more meaningful. To date I have leveraged the China theme by buying global companies that supply to China. It is the old pick and shovel play. During a gold rush a few miners get rich, but many of the suppliers of mining equipment get rich. Extrapolating that to China's massive industrialization would imply investing in companies that supply items such as raw materials and machinery to China. Take a look at any Copper mining company's chart and you will understand what I am saying.

Since this indirect approach has worked so well, ideally I would like to extend it to the railroad build-out. However, that has proved to be a challenge. Bombardier Transportation (Canada), Mitsui (Japan), Kawasaki Heavy Industries (Japan), Alstom Transportation (France) and Siemens (Germany) are the largest rail equipment companies. General Electrical is also a significant player. All are conglomerates with exception of Bombardier and only GE and Siemens trade on U.S. Stock exchanges. Kawasaki Heavy Industries trades on the pink sheets.

Since trading Canadian stocks is fairly easy for US investors, Bombardier would be an interesting choice. However, I would prefer a basket approach (multiple stocks) as opposed to hitching my wagon to one star.

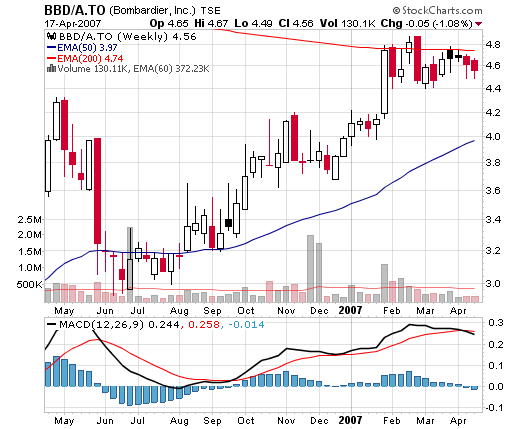

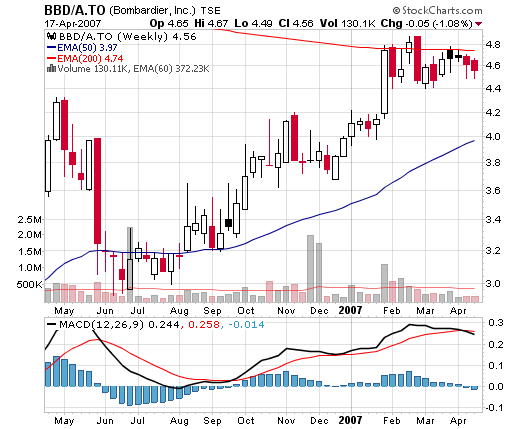

Bombardier has performed fairly well since the middle of last year. However, with such limited selections; the indirect approach doesn't appear to be viable.

Our other option would be directly investing in a Chinese railway company. There is currently only one Chinese railway company that trades in the U.S. – Guangshen Railway Company (GSH).

All in all, there appears to be limited options for U.S. based traders to leverage the Chinese railroad build-out.

In my previous life, I sold software to high tech companies. Back in the late nineties, many of the up and coming internet companies were our clients. After many of those meetings, our first call was often to our stock brokers. Sometimes we made as much by trading their stock as the sale. I remember one company that had some very hot technology, but I didn't make the call after the meeting.

The company made a wireless email device. It was ideal for anyone who spent much time out of the office. Who wouldn't want one? This company was sitting on a gold mine. However, after the meeting I simply drove to the next appointment without calling my broker. I wasn't comfortable buying a stock on the Canadian stock exchange. That company was Research in Motion, the maker of the Blackberry. Back then their stock was trading for short money. I don't want to know what it is trading for today.

I say all that to say, sometimes we have to go to the opportunities to profit. The China Railroad theme may require direct investment in Hong Kong.

By Michael K Dawson

http://www.thetimeandmoneygroup.com/

Copyright © 2007 Michael K Dawson

Michael K Dawson founded the Time and Money Group with the aim of educating and sharing 20 years of experience on how to reach financial freedom. "Financial Freedom is freedom to focus on what is truly important to you and your family without having to trade time for a wage. It is enabled by a portfolio of income producing assets, managed by you, which generates sufficient income to cover your yearly expenses on an ongoing basis. It provides both time and money". The intent of his website is to become a repository of information to put you on the fast track to becoming financially free. For further infromation visit http://www.thetimeandmoneygroup.com/

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.