Global Recession, Crashing Interest Rates Igniting Government Bond Bubbles

Interest-Rates / Recession 2008 - 2010 Dec 21, 2008 - 11:41 AM GMT

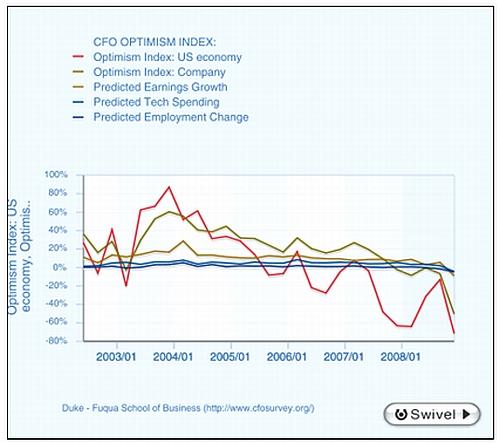

Duke University: CFO Survey – historic recession to last another year

Duke University: CFO Survey – historic recession to last another year

“Chief financial officers in the United States and around the world are more pessimistic than at any time in the history of the Duke University/CFO Magazine Global Business Outlook Survey. The majority of chief financial officers in the US and Europe say their firms will slash spending and employment in 2009, and their firms will post losses. The recession will last another year, according to nearly two-thirds of CFOs.

“These are some of the findings of the year-end 2008 quarterly survey, which asked 1,275 CFOs from a broad range of global public and private companies about their expectations for the economy.

CFO Optimism Index: Key Measures

“Weak consumer demand is the top corporate concern. CFOs also continue to worry about credit markets, which are devastating lower-rated firms. Companies rated B or lower face interest rates that are 225 basis points higher than their cost of borrowing before the crisis began.

“The CFO optimism index has proven accurate in predicting future GDP growth, employment and capital spending. This quarter's extreme pessimism foretells a poor economy in 2009. Thirty-nine percent say the economy will not begin to recover until 2010.”

Source: Duke University , December 10, 2008.

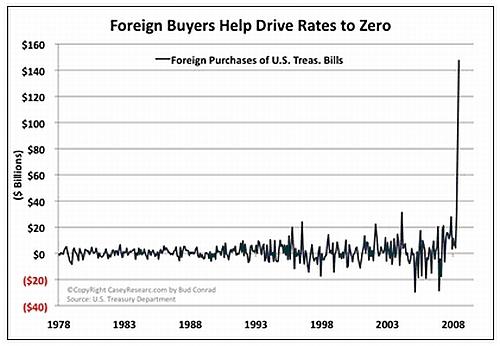

Casey's Charts: Foreign buyers help drive rates to zero

“Foreign purchases of US Treasury Bills hit a record $147 billion in October, helping drive yields to near zero percent on short-term government debt. Traditionally, foreigners have invested primarily in long-term bonds. This surprising shift into T-Bills reveals that nervous foreigners are transferring their mounds of dollars into more liquid assets. They must think there's no alternative – why else would they accept a zero return?”

Source: Casey's Charts , December 17, 2008

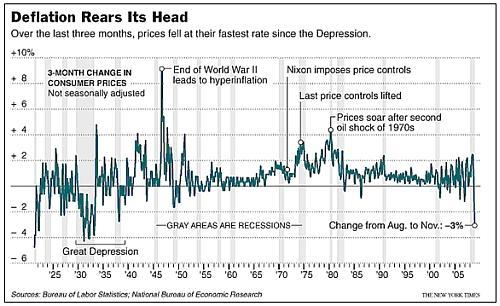

The New York Times: Chart of the day - deflation

Source: The New York Times , December 17, 2008 (hat tip: Barry Ritholtz ).

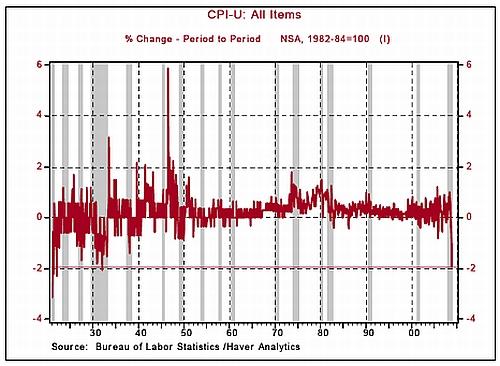

Asha Bangalore (Northern Trust): CPI plunges

“The Consumer Price Index (CPI) fell 1.7% in November following a 1.0% drop in October. On a year-to-year basis, the CPI has fallen 1.1% versus a 4.1% increase in all of 2007 and a cycle high of 5.6% year-to-year increase in July 2008. In November 2008, the seasonally unadjusted CPI, which goes back to 1921, fell 1.9%, the largest drop since the 1930s.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , December 16, 2008.

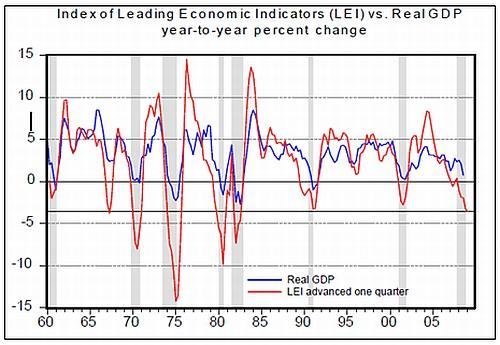

Asha Bangalore (Northern Trust): Money supply growth trims decline of LEI

“The Index of Leading Economic Indicators (LEI) dropped 0.4% in November, after a revised 0.9% decline in the prior month. The index has fallen in ten out of the last fourteen months. The October-November average of the LEI as a proxy for the fourth quarter is down 3.6% from a year ago, a magnitude that is comparable with declines seen in the 1980's recession.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , December 18, 2008.

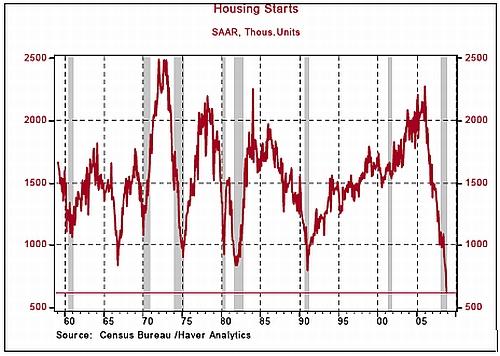

Asha Bangalore (Northern Trust): Construction of new homes at new low

“Home builders remain reluctant to break new ground. Housing starts fell 18.9% in November to an annual rate of 625,000, the lowest on record since record keeping for this series began in 1959.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , December 16, 2008.

Washington Post: New poll shows 63% are already hurt by downturn

“The deepening recession has eroded the financial standing and optimism of a broad swath of Americans, nearly two-thirds of whom say that they have been hurt by the downturn and that the country has slipped into long-term economic decline.

“A new Washington Post-ABC News poll also found that a rapidly increasing share of Americans - 66%, up from just over half a year ago - are worried about maintaining their standard of living. Nearly two in 10 said they or someone living in their household had lost a job in the past few months, and more than a quarter said they had their pay or hours reduced. And 15% said that at some point in the past year they fell behind on their rent or mortgage.

“The poll captures the widening fallout from the faltering economy that policymakers are struggling to contain.

“The poll found that nearly two-thirds of Americans support new federal spending to stimulate the economy, and majorities of both Democrats and Republicans back the idea. Concern about deficit spending, however, mutes enthusiasm for the stimulus plan. When respondents were asked whether they would back the plan if it increased the deficit, support dropped to 47%. Overall, nearly nine in 10 said they are worried about the size of the federal budget deficit, including nearly half who are ‘very concerned'.”

Source: Michael Fletcher & Jon Cohen, Washington Post , December 17, 2008.

Bloomberg: Retailers may be weeded out during “Darwinian” competition

The US retail industry will undergo a weeding-out process next year as companies run out of cash as soon as January and competition forces store closings, according to private-equity buyers and restructuring experts.

“‘The United States is massively over-stored in all categories,' Gregory Segall, a managing partner at buyout firm Versa Capital Management, said today during a panel discussion held at Bloomberg LP's New York offices. ‘You could probably see 50,000 retail outlets close and it wouldn't impact the availability and selection and choice of what you buy.'

“Only retailers with healthy balance sheets will survive the recession, said Matthew Katz, a managing director at consulting firm AlixPartners.‘This is a very Darwinian time,' Katz said.

“Plunging home prices, rising unemployment and tightening credit have led consumers to rein in spending, resulting in what may be the worst holiday season in at least four decades. Macy's, Kohl's Corp. and other retailers have marked down items 50% to lure customers, eroding margins at a time when store owners hope to make a third or more of their annual profit.”

Source: Allison Schwartz, Bloomberg , December 17, 2008.

Clusterstock: Bernie Madoff's victims: the slideshow

“The Bernie Madoff Ponzi scheme is a mess. Bernie himself says $50 billion has vanished. The tales of woe seem to fall into four categories: Superrich Individuals, Little Guys, Funds + Banks, and Charities + Universities + Hospitals. We've selected some of each, along with some scenes of the crime.

Click here to view the slideshow

Click here for a more comprehensive text list of Madoff's victims.

Source: Clusterstock , December 14, 2008.

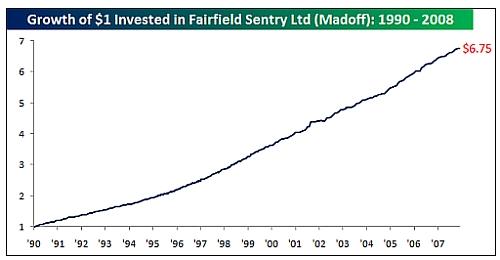

Bespoke: If you ever see a chart like this, run away fast

“We've all heard how Bernie Madoff's returns sounded too smooth and consistent to be true. In picture form, however, the returns are even more eyebrow raising. The chart below shows the cumulative returns of $1 invested in the hedge fund Fairfield Sentry Limited, which was a fund run by Fairfield Greenwich Group that essentially directed all of its assets to the stewardship of Bernie Madoff. As shown, $1 invested in Madoff back in 1990 was supposed to be worth $6.75 today. NPB Bank, out of Zurich, even offered a version of this fund with three times the leverage. Talk about too good to be true.”

Source: Bespoke , December 16, 2008.

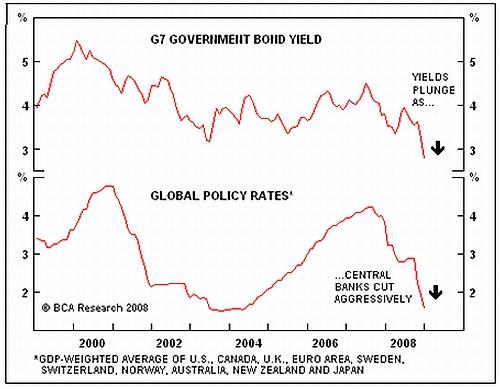

BCA Research: Still a bond-friendly world

“While most of the upside in government bonds has likely already been made, we maintain our long duration call.

“Aggressive monetary easing by each of the major central banks has helped fuel the rally at the long-end of the curve. While the recent drop in yields leaves most government bond markets well into overvalued territory, we are in no rush to take profits on our long duration call. Government bond prices may not have much more upside but value is not a timing tool and the growth and inflation backdrop is likely to keep yields suppressed for an extended period.

“However, we do advise clients to shift their long bond allocations to high quality nongovernment spread product, as we expect a significant narrowing in early 2009. We will await evidence that the global economy is beginning to stabilize, which will most likely take until the second half of 2009, before shifting further down in quality. The time-frame would move up if the Fed signaled that it would begin buying corporates in the interim. While legislation prevents the central bank from directly buying these issues, the Fed could purchase corporate bonds off balance sheet by setting up an SIV.”

Source: BCA Research , December 15, 2008.

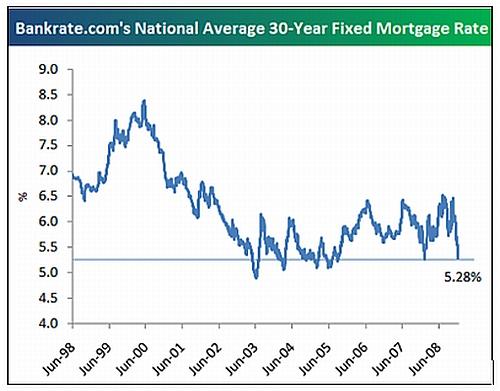

Bespoke: 30-year fixed mortgage rates down to 5.28%

“Thirty-year fixed mortgage rates have declined significantly in recent weeks, down from 6% on November 20 to 5.28% as of yesterday [Wednesday]. The Fed is definitely happy to see rates fall, and they've still got further to go to get to the 10-year record low of 4.88% seen in 2003.”

Source: Bespoke , December 18, 2008.

CNN Money: Stock picks from the experts

“The crash has driven prices so low that even extreme value investors see some safe buys. The stakes are high whenever you invest, but they're extra high when you're managing your money amid a historic financial mess and record volatility.

“For advice equal to the task – in a setting chosen to inspire thoughts of security – we invited five champion fund managers to sit down inside a massive underground vault that's now part of a restaurant a block from Wall Street: Bob Rodriguez of First Pacific Advisors, who manages the FPA Capital and New Income funds; Susan Byrne, who heads Westwood Holdings Group; Leslie Christian, president and chief investment officer of Portfolio 21 Investments; Tom Forester, manager of the Forester Value fund; and Jeremy Grantham, chairman of asset manager GMO.

“Fortune's Geoff Colvin led the discussion. Edited excerpts follow; stock prices are as of December 1.

“Let's get right down to business. Bob, you've held a lot of cash in recent years because stocks looked too expensive. Are stocks finally cheap?

“BOB RODRIGUEZ: My value screen went to a new record low in June of 2007, and only 33 companies out of 10,000 qualified. In January of this year we went north of 200 for the first time since the summer of 2002. We went to 250 in the Bear Stearns crisis. And the week of October 16, we hit 447 – the most qualifiers in more than 20 years.

“So stocks are cheap by historical standards. However, we're being very cautious because what we're experiencing now is a major shift, the culmination of failed policies in the regulatory system and the private sector that have been building up for 30 years.

“Susan, are stocks cheap?

“SUSAN BYRNE: The markets are providing real returns for the risk that you take all along the spectrum, from equities to debt. So, yes, I think that prices reflect the fact that people are quite rightly very afraid of the risk in the stock market.

“Jeremy, you've written that stocks will get cheaper.

“JEREMY GRANTHAM: If you look back at 1982 and 1974, the market was much cheaper than it is today. In ‘74 it was about 40% cheaper, and in ‘82 it was about 60% cheaper. Look at the bad times we had in ‘74 and ‘82, and I think several of us would conclude that this time is likely to be as bad – possibly worse. Bubbles like this always overcorrect.

“How bad will you feel if you put in your cash reserves and the market continues to go down? You're going to feel awful. And how will you feel if you don't buy in the cheapest market for 20 years and it runs away and leaves you? Horrible. You have to step your way through so that the regret, which is going to be huge anyway, is about neutral.”

Click here for the full article.

Source: Geoff Colvin, CNN Money , December 15, 2008.

David Stevenson (MoneyWeek): Stock markets might not bottom out until 2014

“Tobin's Q ratio … This is a ratio developed by Nobel Prize-winning economist James Tobin to compare the market value of companies to the cost of their constituent parts, i.e. their real net asset value.

“When the gauge is more than 1.0, it indicates that the market is overvaluing company assets, while a reading of less than 1.0 suggests shares are undervalued because it's cheaper to buy quoted companies than build them up.

“The Q ratio on US equities has now dropped to 0.7 from a 1999 peak of 2.9. That could indicate shares are now cheap.

“But think again. The ratio needs to fall to 0.3 to signal the final stage of a major bear market like this one, says Russell Napier at CLSA. How does he know? Because that's what it did at the end of the four largest US stock price declines in 1921, 1932, 1949 and 1982. That translates into the US S&P 500 index plunging another 55% by 2014. Ouch.

“But between now and then, there's certainly a good chance of a bear market rally – maybe up to two years long, so those strategists may be right about 2009 – as Obama and the US Fed manage to delay the start of deflation with New Deal II. But those efforts will eventually blow up as ballooning government debt devalues the dollar and prompts a massive share sell-off – on both sides of the Atlantic.

“‘Bear markets always end when they begin ‘pricing in' deflation, as the value of assets falls and the value of debt stays up, so equity gets crushed', say Napier. ‘The results are always horrific, and equities will become incredibly cheap.'

“Albert Edwards at SocGen has christened this period the Ice Age. Another bull market will start in time. But as Edward's description suggests, it's still a long way away.”

Source: David Stevenson, MoneyWeek , December 11, 2008.

Jeffrey Saut (Raymond James): A rally of some import is in the works

“The call for this week: The two questions du jour are: 1) when will the credit crunch end? and 2) how long will the economy remain weak as it attempts to correct the housing situation?

“Speaking to the first question, participants need to monitor the credit spreads, which so far have not improved.

“As for question two, delinquencies and bank repossessions appear to finally be stabilizing. If the stock market is a discounting mechanism, the 50% decline in the S&P 500 may have already discounted everything.

“Moreover, my sense is that just like participants were conditioned to believe that any decline would not gather much traction back in 1999 and 2000, they are now being conditioned to believe that any rally will not sustain. With stocks' aggregate value currently below the year's GDP, we continue to think a rally of some import is in the works”.

Source: Jeffrey Saut, Raymond James , December 15, 2008.

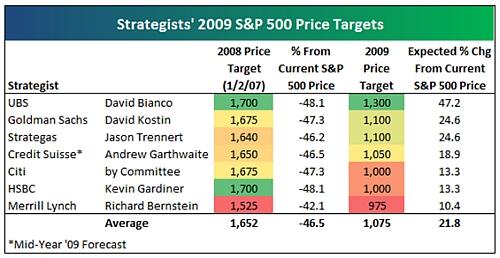

Bespoke: Strategists' 2009 S&P 500 price targets

“Bloomberg recently surveyed market strategists for their 2009 S&P 500 price targets, and collectively, they're looking for a gain of 21.8% from the index's current price level.

“As shown below, UBS is the most bullish of the group with a year-end 2009 price target of 1,300 (a 47.2% gain). UBS was the most bullish last year as well with a 2008 price target of 1,700. Goldman and Strategas are the second most bullish this year with price targets of 1,100. Credit Suisse has a target of 1,050 (for mid-year ‘09), Citi and HSBC are at 1,000, and Merrill Lynch is at 975. Merrill is the least bullish strategist of those surveyed, but they're still looking for a gain of 10.4% from current levels.

“For those looking for direction from these strategists, their 2008 projections should be noted. All were looking for gains this year, and their targets at the start of the year are far above where the S&P 500 is currently trading.”

Source: Bespoke , December 16, 2008.

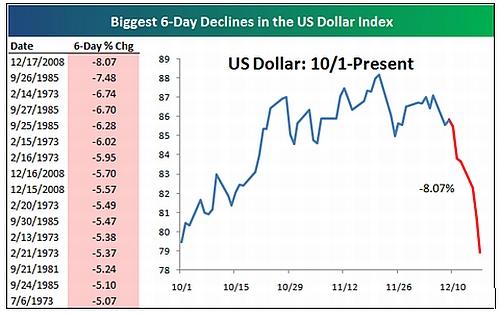

King Report: US Dollar Index is collapsing

“What does this mean and what are the implications?

“Bernanke can continue to expand the Fed's balance sheet until a critical mass of investors loose confidence in either Ben or the Fed's balance sheet. And the confidence is reflected in the dollar.

“After Ben monetized an enormous amount and assortment of assets after the Bear Stearns, GSE, Lehman, AIG and Big Nine ‘problems' the dollar rallied sharply. This showed confidence in Ben and the Fed.

“But now the dollar is in collapse. This is a clear sign of something other than confidence in Ben/the Fed. The dollar collapse implies that Ben and the Fed are now ‘on the clock' and investors will react negatively to further Fed balance sheet hyper expansion.

“Here's the really big problem with Ben's gambit. It is the same thing that FDR attempted – devalue the dollar to avert deflation and depression. However, devaluation exports deflation and depression to other countries and they will retaliate, which they did to FDR. This is another reason for The Great Depression.

“So key questions are: How long will it take for China, Japan, Germany or others to retaliate against Ben's scheme to export deflation and depression to them? And what will be the retribution?”

Source: Bill King, The King Report , December 18, 2008.

Bespoke: Biggest six-day decline for the dollar ever

“The US Dollar index fell another 2.2% today [Tuesday] for its biggest 6-day decline ever. As shown in the table below, the current 6-day decline of 8.07% tops the prior record decline of -7.48% set back in September of 1985. If it's not one asset falling these days, there's sure to be another.”

Source: Bespoke , December 17, 2008 .

James Turk (GoldMoney): Whatever it takes

“The Federal Reserve today made clear its intention to continue flooding the system with newly created dollars. It says in effect that it will do whatever it takes. Its Federal Open Market Committee (FOMC) lowered the federal funds interest rate target to a range of 0%-to-0.25%, which is an historic low, but it didn't stop there. The FOMC also announced that it would “employ all available tools” in an attempt to jumpstart the moribund economy. That means it will monetize assets of all sorts. It will turn debt into more US dollar currency.

“The consequences of the Fed's actions will debase the dollar, perhaps irreparably so. The dollar's bear market rally that began in July ended last month.

“Since last month's peak in the Dollar Index, gold has climbed 6.3%, while silver did even better. It has climbed 12.6%. These precious metals are clearly the place to be, given the path of monetary debasement being taken by the Fed.”

Source: James Turk, GoldMoney , December 16, 2008.

David Fuller (Fullermoney): Positioning for an upside move in gold

“I think all gold bulls are currently onto something. These are scary times. Gold feels comfortable in this environment. It is still appreciating against most currencies, including sterling, and also stock markets.

“Against this background, gold could spike higher once again – watch out if / when it maintains a break above that last high just over $900. I am not saying a huge move will occur, because I do not know. However I want to be positioned for an upside move in precious metals at this time. The price charts are increasingly showing us that gold and gold shares are performing once again.”

Source: David Fuller, Fullermoney , December 15, 2008.

I-Net Bridge: Platinum now cheaper than gold

“It is now cheaper to buy platinum than it is to buy gold. On Friday (November 12) the price of gold surpassed the price of platinum for the first time in 12 years.

“Both precious metals eased despite the dollar weakness, bringing a two-day rally to an end as sentiment in global markets after plans to bail out the US automotive industry collapsed.

“The $14 billion bailout for the US automotive industry, besides being a lifeline for faltering vehicle manufacturers, would have boosted platinum demand.

“Platinum, which is mainly used as a component in catalytic converters, is particularly vulnerable to a downturn in the automotive sector since the sector makes up 50% of total demand.

“Failure to provide US carmakers with the financial lifeline they so desperately need has triggered concern over additional job cuts and a possible industry collapse.

“The BullionDesk's James Moore said gold's movement over the past few days was ‘very encouraging', But he said it ‘does raise a few questions about its sustainability short-term, which we suspect won't be answered until early next year.'

“‘Overall though we would look for gold to continue trading sideways to higher as the Fed's printing presses further erode the value of the greenback,' Moore said.

“Turning to platinum, Moore said while the news from the US auto makers may generate some bearish sentiment, the ongoing downgrading of production forecasts should see the metal remain near equilibrium. He expected platinum to remain in the broad $780 to $880 range for the time being.”

Source: I-Net Bridge , December 12, 2008.

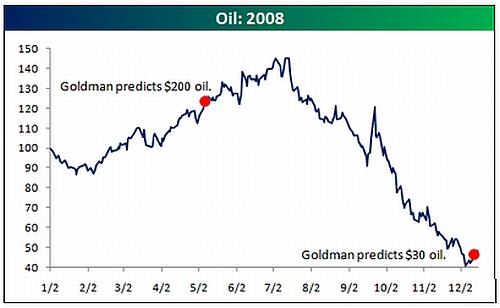

Bloomberg: Goldman expects crude to fall to $30 early next year

“Goldman Sachs cut its forecast for oil prices in the first quarter by half to $30 a barrel as the global economic slowdown curbs consumption.

“Crude demand will fall by 1.7 million barrels a day in 2009, analysts Jeffrey Currie and Allison Nathan said in a note. Goldman previously expected West Texas Intermediate, the US benchmark oil, to average $62 in the first quarter.

“The worldwide economic decline has reduced consumer spending and weakened demand for fuel. Demand growth in China and other non-member states of the Paris-based Organization for Economic Cooperation and Development is ‘on the cusp of a sharp deceleration', the analysts said.

“Crude has fallen for five straight months since trading at a record $147.27 a barrel, as countries including the US, Japan and Germany have entered recessions. Goldman Sachs forecast in July that oil would recover to $149 by the end of this year because consumer demand was ‘restrained, but not destroyed'.”

Source: Rachel Graham, Bloomberg , December 12, 2008.

Bespoke: What a difference seven months makes

“We all remember back in May when Goldman Sachs issued a report predicting that oil's ‘super spike' would likely send the commodity to $200 ‘over the next 6-24 months'.

“Seven months later, Goldman is now advising clients that ‘oil prices will fall to $30 a barrel in the next three months'. If the call for $30 oil is as accurate as the call for $200 oil, investors may want to fill up their gas tanks and lock in their heating oil prices asap.”

Source: Bespoke , December 15, 2008.

Financial Times: Record oil cut fails to lift prices

“The depth of the world's economic downturn was highlighted on Wednesday when the Opec oil cartel appeared powerless in its quest to drive up prices even after agreeing a record cut in its production.

“Opec, which controls about 40% of the world's oil supplies, announced a further 2.2 million barrel a day cut on top of the 2 million b/d it has already pledged since September. It said it would cut 4.2 million b/d from its September output of 29.045 million b/d, bringing its production ceiling to 24.845 million b/d in January.

“Russia said its companies would be forced to cut another 320,000 b/d early next year only if low oil prices persisted.

“The oil market, however, took a dim view of Opec's action. Nauman Barakat, of Macquarie in New York, said: ‘A cut of 2.2 million b/d is a pretty decent cut but it will take a while for the market to see the Opec cut actually filtering into the market.'

“Even Washington questioned whether Opec members would comply fully with the announced cuts. ‘It's not clear that Opec's actions will be effective, given the shift in global demand and the ability of Opec members to meet the cartel's targets,' said Tony Fratto, the White House spokesman.

“‘Regardless, Opec has an obligation to keep the market well supplied and to consider the health of the global economy, so efforts to limit the benefits of lower energy prices are short-sighted,' he said.

“But Chakib Khelil, Opec president, said Opec had a long-established record in meeting the challenges it faced.”

Source: Carola Hoyos, Financial Times , December 17, 2008.

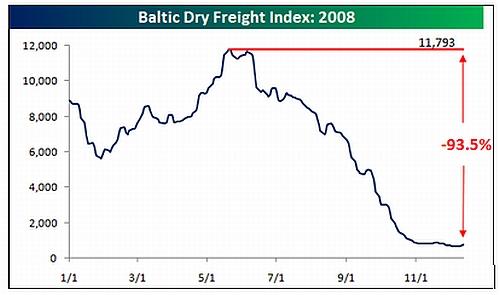

Bespoke: Baltic Dry Index rally?

“The Baltic Dry Index has been getting some attention recently after rallying more than 15% from its lows. One headline we came across even said that shipping companies were benefiting from the ‘revival' of the Baltic Index. Revival? While the Baltic Index is indeed up from its lows, it is still down 93.5% from its highs in May, and as the chart below illustrates, the recent gain is barely even visible to the naked eye. Global shipping rates will bottom at some point, and may have already done so, but to call the action of the last two weeks a revival seems a bit premature.”

Source: Bespoke , December 15, 2008.

Financial Times: Shipping charter rates soar

“One of the world's key shipping markets has begun to recover from a slump, with a revival in Chinese demand for iron ore and coal pushing some average charter prices up almost threefold in the past week.

“The revival in prices, after a disastrous six months for the industry in which charter rates fell nearly 99% for the largest vessels, could encourage ship owners to bring mothballed vessels back into service.

“One participant said yesterday that some owners were able to charge enough to cover the costs of operating Capesize ships, the largest dry bulk carriers. Average rates for these ships, which move coal and iron ore, have nearly tripled over the past week.

“The return of mothballed ships to the market could lead to a repeat of the over-supply which, combined with disappearing demand for coal, iron ore and wheat, depressed prices this year.”

Source: Robert Wright, Financial Times , December 14, 2008.

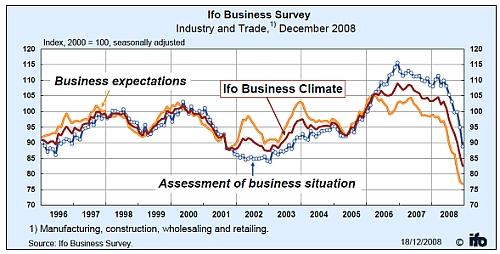

IFO Business Survey: Business climate in Germany continues to decline

“The Ifo Business Climate for industry and trade in Germany has clearly fallen in December, continuing its decline of more than one year. The dominant feature of the December decline is the worsening of the firms' current business situation. With regard to the six-month business outlook, the scepticism of the survey participants remains nearly unchanged. A similarly low level of the business climate index was last reached during the second oil crisis at the end of 1982.

“The downturn is affecting above all the manufacturers of export and capital goods and less, up until now, retailing and construction.”

Source: IFO Business Survey , December 18, 2008.

BBC News: France set for 2009 recession

“France will enter recession in 2009, according to Insee, the country's national statistics agency.

“The agency says the French economy has shrunk by 0.8% in the last three months of 2008 and will contract by another 0.4% in the first quarter of 2009.

“France is eurozone's second biggest economy, and would be the latest major world economy to enter recession.

“Figures have already shown that Germany and Japan have endured two quarters of negative economic growth, while economists in the US have declared that its economy has been in recession since earlier in 2008.

“France only narrowly avoided negative economic growth between July and September, posting growth of 0.1%.”

Source: BBC News , December 18, 2008.

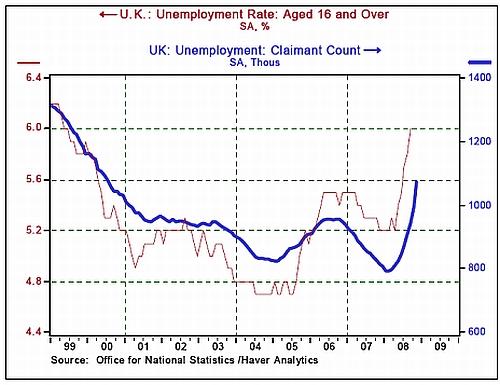

Victoria Marklew (Northern Trust): Increasingly grim outlook for UK

“The economic news out of the UK is ever more grim. Today was the turn of employment. Claimant count unemployment surged by 75,700 last month, taking the number of unemployed by this measure past the psychologically-important one million mark for the first time since 2001. The broader ILO-basis jobless rate rose from 5.8% in the three months to September, to 6.0% in August-October. As unemployment is usually a lagging indicator, the fact that jobs are being shed at this fast a pace this early in the economic downturn points to a harsh year ahead for employment.”

Source: Victoria Marklew, Northern Trust – Daily Global Commentary , December 17, 2008.

Bloomberg: Japan's Tankan confidence plunges most in 34 Years

“Sentiment among Japan's largest manufacturers fell the most in 34 years, signaling companies are likely to cancel spending plans and cut more jobs, pushing the economy further into recession.

“An index that measures confidence among large makers of cars and electronics dropped to minus 24 from minus 3, the Bank of Japan's quarterly Tankan survey showed today. A negative number means pessimists outnumber optimists.

“The yen's surge to a 13-year high last week has compounded woes for Japanese manufacturers who are already reeling from a collapse in export markets. Job cuts by companies including Sony and Toyota have brought the recession home to households and increased the risk of a prolonged slump.

“‘The overseas situation is worsening so quickly and so dramatically; it's really getting dangerous,' said Tomoko Fujii, head of economics and strategy at Bank of America in Tokyo. ‘The next few months are going to be a very severe period.'”

Source: Jason Clenfield, Bloomberg , December 14, 2008.

Asha Bangalore (Northern Trust): Japan – that sinking feeling

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , December 15, 2008.

Reuters: Ecuador defaults – fighting “monster” creditors

“President Rafael Correa declared a default on Ecuador's foreign sovereign bonds on Friday, vowing to fight ‘monster' debt-holders in court in one of the most aggressive moves against investors in the region for years.

“Ecuador's dollar-denominated debt prices plunged on news of its second default in a decade and the first in Latin America since Argentina in 2002, although the decision was not expected to lead to similar moves around the region.

“Correa, a US-trained economist and ally of Venezuela's anti-US President Hugo Chavez, refused to make a $31 million interest payment due on Monday on 2012 global bonds, saying the debt was contracted illegally by a previous administration.

“‘I gave the order not to pay the interest and to go into default,' Correa said. ‘We know very well who we are up against – real monsters.'

“‘If we have to face international litigation due to this, we will,' he added at a news conference in the OPEC nation's largest city of Guayaquil.

“The default is unlikely to have a knock-on effect in other Latin American countries' debt policies even if some, such as Venezuela, have pledged to investigate any irregularities in their own debt …

“Correa, who had often threatened to default, will offer bond-holders a tough restructuring deal. Last month, Ricardo Patino, a top debt adviser to Correa, said investors should expect a reduction of more than 60% in the nominal value of the global paper in any negotiations.

“Ecuador's global bonds – the 2012s, 2015s and 2030s – total $3.8 billion of its roughly $10 billion debt.”

Source: Maria Eugenia Tello, Reuters , December 12, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.