U.S. Dollar Falls off a Cliff

Currencies / Forex Trading Dec 19, 2008 - 12:01 PM GMTBy: Joe_Gelet

Recent move in the USD proved a good case study for a strategy EES has been working on called “Golden Grid”, an EA based on Fibonacci levels.

Unusual market conditions: USD falls off a cliff

The USD had its greatest single drop against the Euro since 1999 (since inception of the Euro) falling from 1.27 – 1.47 in 1 week, a 2000 pip move. Before this happened, it was thought USD/CHF would move lower. Of course, no one would expect the extent of the selling, due mostly to lack of liquidity. In any case, GG was loaded on USD/CHF short.

EES GG Strategy Performance Analysis

Golden Grid is a grid EA that can be traded in many ways, it can be used as a trending or countertrending strategy or as a hedging strategy. The buy and sell module can be traded individually or both together. In addition, each side can be ‘weighted’ according to further risk parameters.

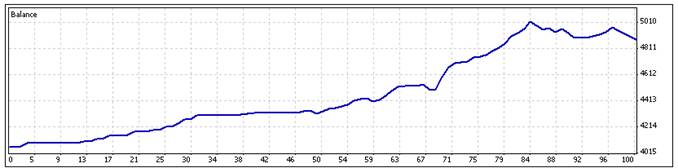

Golden Grid, using the trending module, was set to sell USD/CHF with the final result:

Summary: Deposit/Withdrawal: 0.00 Credit Facility: 0.00 Closed Trade P/L: 810.35 Floating P/L: -148.40 Margin: 366.37 Balance: 4 873.04 Equity: 4 724.64 Free Margin: 4 358.27 Details:

Gross Profit: 1 180.43 Gross Loss: 370.08 Total Net Profit: 810.35 Profit Factor: 3.19 Expected Payoff: 8.10 Absolute Drawdown: 0.00 Maximal Drawdown: 146.82 (2.92%) Relative Drawdown: 2.92% (146.82) Total Trades: 100 Short Positions (won %): 62 (67.74%) Long Positions (won %): 38 (94.74%) Profit Trades (% of total): 78 (78.00%) Loss trades (% of total): 22 (22.00%) Largest profit trade: 91.80 loss trade: -45.80 Average profit trade: 15.13 loss trade: -16.82 Maximum consecutive wins ($): 20 (212.44) consecutive losses ($): 4 (-99.97) Maximal consecutive profit (count): 525.52 (16) consecutive loss (count): -99.97 (4) Average consecutive wins: 5 consecutive losses: 1

Trades placed (visual chart representation)

$4063 – $4873 = 20% return in 3 days, but the majority (greater than 50%) of those profits were generated since the Fed announcement.

Later, it seemed USD was forming a bottom, so the strategy was taken off many accounts. The bottom was incorrectly picked in terms of price and time but the theory that USD would recover, as currencies always do, held true, as the week finish out with a higher dollar:

The taking off of the EA due to extreme market conditions caused a loss, and also lost opportunity. Overall, on most accounts, the strategy was net positive. The significance of this case study is the power of algorithmic trading combined with FX analysis. In this case, GG became a tool to automatically short the Dollar, buy the Euro, and manage the risk accordingly. This is compared to manually trading, whereby a trader may have sold a static position with a trailing stop. GG multiplied profits and limited risk, by using per trade stop losses in addition to overall account protection (which never got hit).

http://eliteeservices.net/ Elite E Services FX Systems See more articles at www.eliteforexblog.com

Elite E Services is an electronic boutique brokerage specializing in currency trading, intelligence, and technology surrounding foreign exchange markets. EES offers FX trading systems for clients and investors, FX consulting, technology and tools for trading, system development, custom programming, and FX solutions for businesses.

DISCLAIMER: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Joe Gelet Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.