Bond Investors Turn Bullish on U.S. Treasuries

Interest-Rates / US Bonds Dec 18, 2008 - 08:54 AM GMTBy: Mike_Shedlock

Here is a headline I am laughing at: Bond Investors Turn Most Bullish on Treasuries Since February

Here is a headline I am laughing at: Bond Investors Turn Most Bullish on Treasuries Since February

Treasuries will appreciate over the next six months as the U.S. economy reels from its worst recession in a quarter-century, a monthly survey of Bloomberg users showed.

Participants turned the most bullish on 10-year Treasury notes since February, while continuing to expect yields on government debt from Brazil, France, Germany, Italy, Japan, Mexico, Spain, Switzerland and the U.K. to decline, according to the Bloomberg Professional Global Confidence Index. The survey questioned 2,991 Bloomberg users last week.

Investors stung by losses in equities and credit markets are buying Treasuries, pushing rates on three-month bills to below zero for the first time last week. The Federal Reserve reduced its main interest rate yesterday to as low as zero to prevent the recession from deepening.

Bullish now? Where were they all year?

Flashback Friday, September 05, 2008: Treasury Bull Alive And Kicking

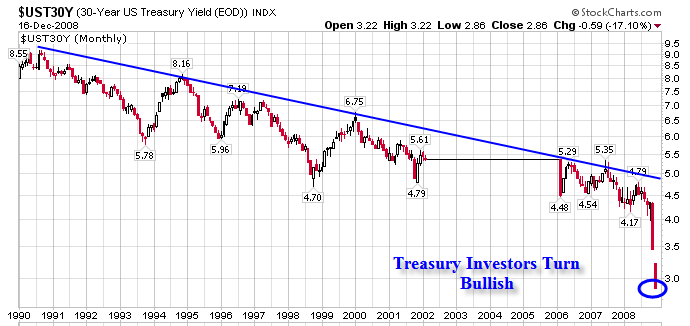

The US Treasury Bull market is still intact after 27 years.

30 Year Long Bond 1990-Present

Many have been stating that treasuries are in a bubble, the bond market is reacting irrationally, the treasury market is manipulated, and all sorts of other similar statements. Who wants to buy a 30 year treasury at 4.3% when "inflation" is so high?

Deflation Models

I had several models for how deflation might play out. Here they are.

- Everything but treasuries sink

- Everything but treasuries and gold sink

- Gold sells off initially then rallies with treasuries

Yes, this treasury bull is extremely long in the tooth. And yes there will be a time to short treasuries. But there has not been a bull market in history, in anything, that ended with that asset class being nearly universally despised.

And make no mistake about it, treasuries are despised. Foreign central banks do not count because they are not buying treasuries to make a profit, and they are relatively unconcerned about losses.

All things considered there is genuine pent up demand for treasuries right here in the US should foreign buying subside. The reason is simple. It is far better to make 3% in treasuries than to lose 30% in equities, commodities, or corporate bonds.

Deflation Model Winner Announced

The winner is behind door number 3: Gold sells off initially then rallies with treasuries. Note that treasuries were behind all three doors.

30 Year Long Bond 1990-Present

On September 05, the long bond yield was close to 4.5%. Nearly everyone despised treasuries then. Most bond investors love treasuries now with the yield under 3% for the first time in history. Go figure.

However, there are still a few holdouts as evidenced by Treasury Bubble Talk Grows as Investors Give U.S. Free Money .

“Treasuries have some bubble characteristics, certainly the Treasury bill does,” said Bill Gross, co-chief investment officer of Newport Beach, California-based Pacific Investment Management Co., which oversees the world's largest bond fund. “A Treasury bill at zero percent is overvalued. Who could argue with that in terms of the return relative to the risk?” he said in a Bloomberg Television interview yesterday.

Treasuries have “absolutely” entered a bubble, said David Brownlee, who oversees $15 billion as head of fixed income at Sentinel Asset Management in Montpelier, Vermont. “There is very little rationality in my mind to bills trading at zero.”

David Rosenberg, the chief North American economist at New York-based Merrill Lynch, said last week that demand for Treasuries had reached the “bubble” phase like in technology stocks in 2000 and real estate six years later.

“At some point we are going to get some signal, some indication that this massive policy response is getting some traction,” said Mitchell Stapley, who oversees $22 billion as chief fixed-income officer for Grand Rapids, Michigan-based Fifth Third Asset Management. “The flight out of Treasuries is something that will be breathtaking.”

Now if we can just get some of these holdouts to sing the praises of the long bond, we will have the makings of a top. Don't count on it anytime soon, and keep in mind the huge demand for treasuries as noted in Quantitative Easing American Style: Free Money .

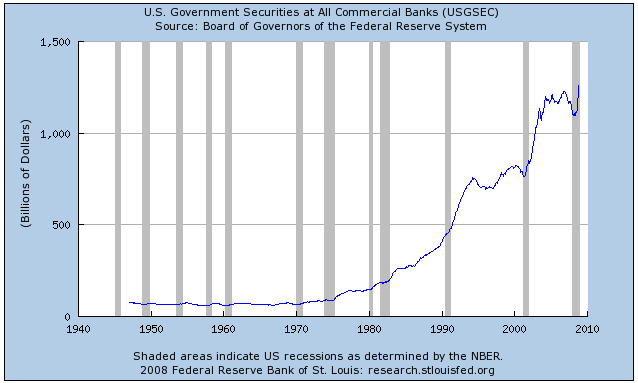

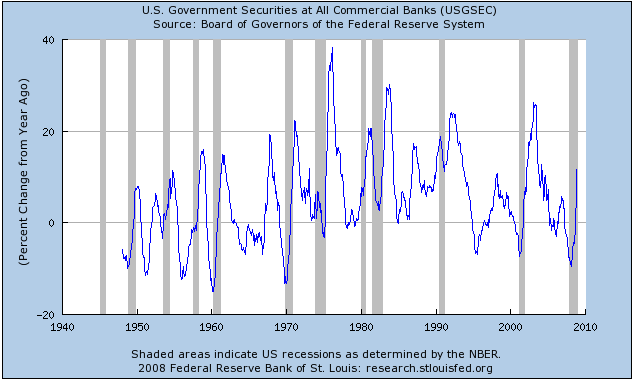

US Government Securities At Commercial Banks

In addition to a continuing increase in banks' cash assets (to increase their cash ratios against liabilities and loans), we should now see banks' holdings of treasuries rise significantly. By the mid to late '2010s, expect to find that the Fed and US member banks will be the largest holders of US Treasury debt by far.

Just as happened in Japan, those expecting instant and lasting fireworks when the bond bubble explodes are likely to be very disappointed. Low yields can easily be the norm for a long time to come.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.