The Great Crash of U.S. Dollar Begins Following Record Low Interest Rate

Currencies / Forex Trading Dec 17, 2008 - 09:39 AM GMTBy: ForexPros

The USD started a bit better overnight but began to fall off as traders trimmed long positions ahead of today’s economic news. This morning’s CPI and Housing data was mixed for traders as lower CPI was offset by weaker housing data; the majors began a steady climb into the FOMC rate announcement which of course was the big news of the day. In a surprise move, the FOMC voted unanimously to cut rates a larger than expected 75 BP putting the FF rate at .25% and announcing to the world that the USD is now the cheapest currency on the planet.

The USD started a bit better overnight but began to fall off as traders trimmed long positions ahead of today’s economic news. This morning’s CPI and Housing data was mixed for traders as lower CPI was offset by weaker housing data; the majors began a steady climb into the FOMC rate announcement which of course was the big news of the day. In a surprise move, the FOMC voted unanimously to cut rates a larger than expected 75 BP putting the FF rate at .25% and announcing to the world that the USD is now the cheapest currency on the planet.

Traders responded by dumping Dollars against everybody in what is sure to become common practice in the year ahead. In the move to quantitative easing, similar to what the BOJ announced in the 1990’s, the FED has made the Greenback to worlds lowest yielding currency period. Although equities are rallying and like the positive approach to the cost of money, the resulting inflation will certainly drive Gold, Oil and Commodities pricing higher during the next year.

Traders note that the resulting loss of prestige for holding USD will likely cause a rise in EURO and GBP back to levels seen prior to the financial crisis began. GBP rallied sharply on the news but so far high prints are still below previous resistance as cross-spreaders remain fixed on record high prices for EURO/GBP; highs at 1.5511 likely to fall the next few days. EURO also rallied after retreating from the 100 day MA at 1.3770 area; high prints at 1.3993 area just shy of technical resistance but the resulting rally will likely see higher prices.

USD/JPY remained inside range and the only pair that didn’t respond more aggressively; low prints in the rate at 89.09 but traders note bids on dips suggesting that the rate may be ready for a technical bounce although traders remain optimistic that further losses may be in the works without BOJ intervention.

USD/CHF broke through key support at the 1.1420/30 level and ran for the boarder; low prints at 1.1262 with more on the way most likely. USD/CAD also slipping aggressively as USD melts down elsewhere dropping to a low print at 1.2012 with more on the way. Heading into press time the majors are extending their highs again and most likely will see follow-on selling of USD overnight. In my view, the Greenback has topped for sure at this point and traders need to be positioned for further losses in the coming months.

Any rallies in the USD most likely will be selling opportunities and quite possibly history will show that today was the start of the greatest slide in USD value in history. Look for follow-on selling overnight.

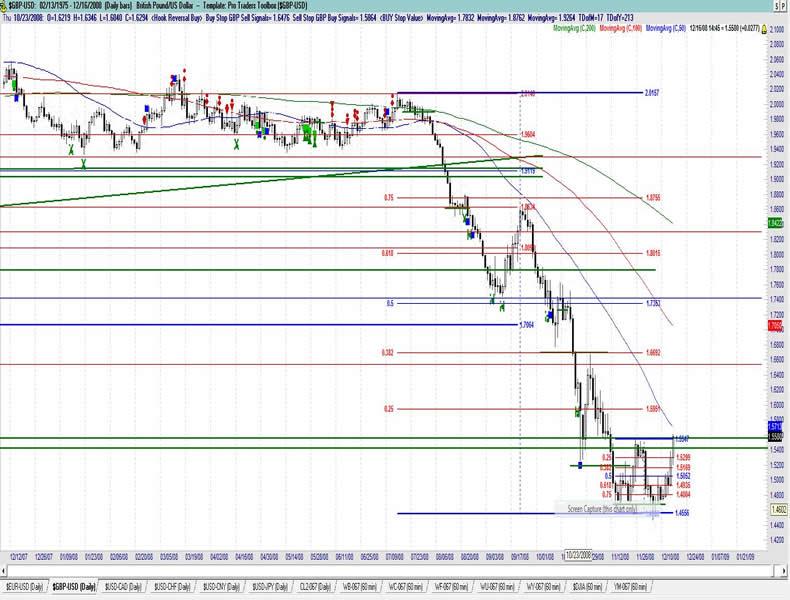

GBP/USD Daily

Resistance 3: 1.5700/10 , Resistance 2: 1.5650 , Resistance 1: 1.5610/20 , Latest New York: 1.5546

Support 1: 1.4850 ,Support 2: 1.4740 , Support 3: 1.4680

Comments

Two-way technical trade gives way to short covering and one-way action; lots of spillover from EURO no doubt. Lows holding at 1.5200/10 area. Bounce off early weakness suggests buyers are willing on dips but they are meeting willing sellers on the recovery traders say; aggressive traders can buy the next dip in my view. Stops around the 1.5200 area and higher cleared so be ready for whipsaw. Cross-spreaders likely keeping pressure on as GBP/EURO cross holds near lifetime high. Although today was a strong rally; failure at next resistance at 1.5550 area still a caution. Traders note solid two-way action. Sellers hold control above 1.5100 area so far; profit-taking likely to result in a squeeze on the further strength.

Data due Wednesday: All times EASTERN (-5 GMT)

4:30am GBP Claimant Count Change

4:30am GBP MPC Meeting Minutes

4:30am GBP Average Earnings Index 3m/y

4:30am GBP Unemployment Rate

6:00am GBP CBI Realized Sales

EURO/USD Daily

Resistance 3: 1.4200/10 , Resistance 2: 1.4150 , Resistance 1: 1.4080 , Latest New York: 1.4037

Support 1: 1.3360 , Support 2: 1.3280, Support 3: 1.3200

Comments

Rate scores another new high after rate announcement and finds resistance at previous breakdown area. Technical traders will be looking for a test of the 200 day MA near-term; follow-on buying overnight likely. Sellers may be taking a stand above 1.3700 but they will need to see a move lower right away to stay short. Traders note lots of aggressive active buying. Stops building in size over the 1.3750 area cleared. Traders note some stops within range overnight suggesting longs are late or nervous. Correction is likely. Likely bulls will lighten up but will need to see failure at 1.4100 area first I think.

Data due Wednesday: All times EASTERN (-5 GMT)

2:00am EUR German Final CPI m/m

4:00am EUR Italian Trade Balance

5:00am EUR CPI y/y

5:00am EUR Core CPI y/y

Join us for the Afternoon US Dollar Wrap-Up daily at 3:15 pm Central/Chicago time (GMT -6)

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2008 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.