Crude Oil and U.S. Dollar Inverse Relationship?

Currencies / US Dollar Dec 17, 2008 - 09:13 AM GMTBy: Richard_Shaw

Are oil and the US Dollar inverse to each other? No. At least not always.

There are numerous articles out about “Dollar Up & Oil Down”, or “Dollar Down & Oil Up”.

Sometimes that inverse movement occurs, and sometimes it does not. When the inverse correlation is working, there may be a trade, but when it is not, find something else to do.

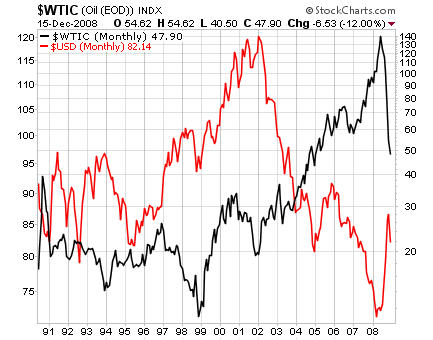

Here is an 18-year monthly chart comparing the US Dollar (proxy UUP) to West Texas Intermediate Crude (proxy USO). You can see inverse correlation sometimes and not at other times.

The red line is for the US Dollar Index (USD against a trade weighted basket of currencies). The black line is the spot price of crude.

There is substantial argument today that the Dollar will fall due to all of the debt issuance associated with the economic rescue programs. There are also strong voices saying that oil will rebound to perhaps $70+ when economies improve, based on the average deep sea finding and lifting cost. That would suggest an inverse chart correlation may exist in the future, but the causation is not described as the same for each. Any future correlation may be partly coincidental and partly cause and effect.

It is not safe to assume that if one rises the other will necessarily fall. You must stay on your toes, or lose your toes, and maybe some fingers too. Remember that a big part of making money, is not losing money. Acting on false assumption about structural price relationships is one good way to lose money.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2008 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.