Stocks Bear Market Rally Showing Signs of Rolling Over

Stock-Markets / Stocks Bear Market Dec 14, 2008 - 03:23 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Down! The very-long-term cycles have taken over earlier than anticipated and if they

make their lows when expected, the bear market which started in October 2007 should continue until 2012-

2014. This would imply that much lower prices lie ahead.

SPX: Intermediate trend - An intermediate low may have been reached in November, but this remains to be confirmed. There is good possibility that January 2009 will bring a new low, or at least a test of the lows.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which determines the course of longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com .

Overview:

The markets spent the better part of last week focusing on the auto industry rescue debate. During the first three days of the week it went sideways waiting for congressional approval of the plan, sold off sharply late Thursday and after-hours when it was announced that the senate had killed it, and rallied Friday on news that the White House was ready to come to the rescue with funds from TARP. Hopefully this matter will soon come to a conclusion so that the market can move on to broader issues. In the meantime, the rally from SPX 741 is still in effect, but technical considerations tell us that it's not a question of if but when we roll over again.

We are in a bear market rally, and there is no convincing evidence that the low of 11/21 was an intermediate low. As you will see on the following charts, the momentum indicators are overbought and ready to retrace, and the breadth indicator is beginning to show negative divergence to price. Not a good technical condition to keep this rally going.

At the very least, the index will have to test its low and form a larger base that can support a better rally, and/or complete some conclusive Elliott Wave pattern that points to a more solid bottom. Since this is already mid-December, we should probably look to late January before this is achieved. In the meantime, it’s a matter of whether we have already seen the short-term high at 918.57, or if one more short wave is needed to finish the job.

What's ahead?

Chart pattern and momentum:

The pattern being made by the daily chart and oscillators of the SPX are not encouraging for the bulls.

The rally from 11/21 is making a formation which could either be a corrective a-b-c pattern or which may require one more little up-wave to complete an "a-b-c-d-e" bearish wedge. Either way, the odds are very good that this uptrend is on borrowed time.

This is reflected in the two bottom indicators. The momentum oscillator, in the middle, is overbought and has given a preliminary sell signal by crossing lines and breaking the short-term trend line which corresponds to the price line. The lower indicator is a breadth indicator and is even more bearish. At the top of the rally it showed negative divergence while in an overbought condition. It has now started a downtrend and broken below its former lows.

The index appears to be making a typical "consolidation in a downtrend" formation from which the decline should resume. Confirmation will come when the short uptrend line is broken and followed by a penetration of the 815 level.

It's always important to look at the hourly chart to see if it confirms what the daily is saying, or if it's telling us a different story.

The only positive feature of the hourly chart is that the indicators, just like the price, are trying to re-establish an uptrend. So far, it's a weak attempt, and the price pattern looks like a little bearish flag which is riding on the uptrend line. For it to improve, the index would have to trade above the downtrend line which is drawn across the two short tops. It's only about 18 points away and in this volatile environment, bolstered by some good news, the SPX could easily open at that level.

Expectations that the auto industry was going to be rescued after all, prompted prices to close higher in after-hours trading Friday, so we'll have to see if this carries through to Monday morning. But the upside momentum would have to continue past the former top. Even if this were accomplished, it would only complete the bearish wedge pattern which may be forming, and would only buy the uptrend a little more time before a downward reversal takes place.

Whether or not the move has already ended, this looks more like a bear market rally than an intermediate bottom. I have drawn on the chart the potential path of prices from this point on. The only question is whether or not the down move will only be a test of the lows, or if the index will make new lows.

Cycles

I have given up trying to label the lows of the 7-yr and 6-yr cycles and leave it up to the future to make this clear. There is a good chance that they have both bottomed since we have market lows in the time frames where they were expected to do so, but their ability to lift prices is being diminished by the worsening economy as well as the very long-term cycles which will be pressuring prices relentlessly for a few more years.

The 9-mo cycle low should still be ahead of us, and the next 20-wk cycle, which is due at the end of January, is in a good position to mark an intermediate bottom.

There is a minor cycle due about 12/19, and the next 6-wk cycle is due at the end of the month.

Projections:

There is a projection to 935-950 which is still unfilled, and if the SPX decides to make another move to a new high, this is where we would expect it to top.

Also, Friday's SPX action created a small base which has the potential of moving it to about 913 if the final minutes of trading upside momentum carries into Monday morning and beyond.

IF a top is already in, and IF it drops below 815, the initial down thrust can take the SPX to about 765.

Breadth

The McClellan summation index (SI) (courtesy of StockCharts), continues to be in an intermediate and long term downtrend. It recently made a small double-bottom, and the second higher low corresponded to the 11/21 741 low of the SPX. This positive divergence (which was more readily visible in shorter term A/D indicators) led to the present short-term rally.

Since 11/21, there have not been enough positive readings in the McClellan oscillator to return the SI to a positive number. And the RSI of the SI is now overbought, suggesting -- as are many other signs -- that the rally is nearly over.

As I pointed out, the daily A/D index is still overbought and has already begun a declining pattern. When it becomes negative, the SI will turn down once again .

By contrast, the hourly A/D indicator turned up last Friday, suggesting that a little more upside may still be ahead.

Market Leaders and Sentiment

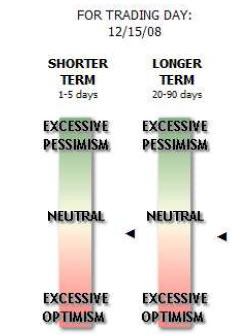

Sentiment has steadily deteriorated in the past few days, to the point that both short and longer-term readings are now negative, as depicted in the index below (courtesy of Sentimentrader). This does not bode well for the market in either time frame.

On the other hand, last week was the first time in many weeks that the NDX has shown some positive divergence to the SPX. So far, it is so slight that it is probably not even worth mentioning, but if this continues as the market weakens further, it will be one of the many signs that we are approaching an intermediate low.

Summary

The price pattern of the rally which started on 11/21 is corrective i.e. a short-term rally in a bear market, and the daily oscillators are overbought and beginning to roll over. This signals that a reversal to the downside is near which could bring about a test of the recent lows, or even new lows.

However, the hourly indicators turned up on Friday, signaling that there could still be another small push to the upside. Next week's Fed meeting and the unresolved situation with the auto industry can affect the market in the short term.

Andre

The following are examples of unsolicited subscriber comments:

What is most impressive about your service is that you provide constant communication with your subscribers. I would highly recommend your service to traders. D.A.

Andre, you did it again! Like reading the book before watching the movie. B.F.

I would like to thank you so much for all your updates/newsletters. As I am mostly a short-term trader, your work has been so helpful to me as I know exactly when to get in and out of positions. I am so glad I decided to subscribe to Turning Points… Please rest assured that I shall continue to be with Turning Points for a long time to come. Thanks once again! D.P.

But don't take their word for it! Find out for yourself with a FREE 4-week trial. Send an email to ajg@cybertrails.com .

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.