Junior Mining Stocks: Canada’s Subprime Market Crash

Commodities / Gold & Silver Stocks Dec 13, 2008 - 07:51 AM GMTBy: The_Gold_Report

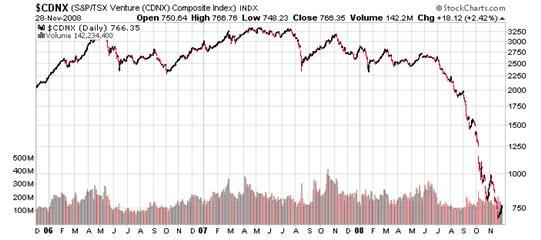

Prior to the recent market meltdown, the market for junior mining companies had already been experiencing a severe correction since its peak in early 2007. Despite rising and historically high metal prices, money began leaving the market, in earnest, in the summer of 2007. By late last year, the correction had become a full-fledged bear market. Then the credit markets collapsed in September 2008. This caused another leg down which also included the major mining companies and the underlying commodities.

Prior to the recent market meltdown, the market for junior mining companies had already been experiencing a severe correction since its peak in early 2007. Despite rising and historically high metal prices, money began leaving the market, in earnest, in the summer of 2007. By late last year, the correction had become a full-fledged bear market. Then the credit markets collapsed in September 2008. This caused another leg down which also included the major mining companies and the underlying commodities.

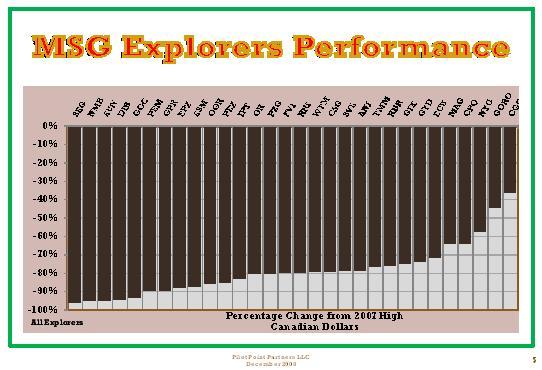

Many junior mining stocks are now trading at a market capitalization that is less than their cash holdings. Most are down over 80% from their 2007 highs. What went wrong in a market that held so much promise just 18 months ago? How can the market undervalue precious metal properties at $800 gold and $10 silver? Will the markets for junior mining stocks ever recover?

To answer these questions, we must look very closely at the cause of the demise. Unlike in the late 1990's, there is no Bre-Ex to take the blame. There is not one major speculative company, with salted samples and geologists jumping from helicopters, for the market to point to and say “they ruined it for all of us.” The fact is that in an environment of easy credit, wild speculation and an “it's different this time” attitude, many investors have been caught shamelessly doubling and tripling down in junior mining stocks that are now simply doomed to fail.

The parallels between the mortgage market in the United States and the junior mining market in Canada are striking because they are a product of the same loose credit policies. Based on the false premise that everyone should own a home, American bankers and brokers were allowed to leverage the housing market with a seemingly endless supply of mortgage-backed securities. They then leveraged these securities many times creating today's still incalculable risk in derivative products. Today, shareholders are losing all their equity. Bankers and management have already made millions in fees, salaries and bonuses that were based on the “paper profits” from all these leveraged securitized transactions.

While we won't (but probably could) make the case that Canadian investment banks operated on the like premise that everyone should run a mining company, the process is very similar. As money from yen carry trades and other loose credit sources poured into the Canadian Venture Exchange, PPOs, RTOs and IPOs flourished in the mining sector. A retired geologist and a financier could joint venture a property in an obscure part of some third world country and become a mining company. The bankers would gladly raise them $5 million, then $5 million more for fees that often approached 10% and also included a piece of the pie. The process was fueled by greed as “blue sky” was promoted as an “asset”, as defined by a 43-101 report. Insiders made millions on their private placement shares as the process was repeated over and over. No one really cared if there was a truly developable project in many of the “shells." Drill rigs began turning, with geologists in charge, and a belief that the equity window would never close. Investment bankers were highly compensated, but few of the companies ever even received (or warranted) research coverage.

Leverage was added as companies morphed themselves into separate entities, one for gold, one for silver and one for base metal. Senior executives were often found starting a new company while still holding management positions at several others. The bigger the “blue sky” the more money a company could raise. In many cases, less than fifty cents of every dollar actually went into the ground as promotion budgets swelled. Many of the majors were even caught in the folly and invested into some overpriced or questionable projects. This added to the speculation as the ‘buyout” business model replaced the concept of building a legitimate mining company. However, when buyout offers did appear they were often rejected. Management proved unwilling to part with their ticket to the equity window and their place at the feed trough.

Barrick Gold's (NYSE:ABX) 2006 buyout offer for NovaGold (TSX:NG) (AMEX:NG) was deemed inadequate by management and rejected. When the dust had cleared in April 2007, it marked the exact top of the market for the Venture Exchange. Barrick explained that their “fair and final offer of $16” was based on “deteriorating economics at Galore Creek and the newly filed litigation at Rock Creek." At the time, these appeared to be face-saving excuses for a failed tender offer. Today, they seem more prophetic, as NovaGold struggles to survive.

Interestingly, many of the pundits and gold bugs who have been warning of the leverage and speculation in the U.S. mortgage/derivatives markets failed to recognize the same risk in the junior mining stocks. Most also failed to predict the deluge for mining stocks as those loose credit policies were arrested and unwound. Many actually participated in the leverage at the private placement level. Today, they continue to bash the U.S. Dollar although it stubbornly remains the safe haven currency in a financially troubled world.

Where do we go from here and when does the market for junior mining stocks recover? Unfortunately for shareholders, a majority of the companies will never recover. Many are out of cash and have no prospects for additional equity. These will slowly fold and their only legacy will be as historic drill results. Some companies have developed bankable assets and might secure some type of debt financing. The process will be slow and painful, much like mortgage foreclosures. Many cash strapped companies are now in “hunker down” mode. It appears that “hunker down” is mining terminology for “stop all operations and cover G&A as long as possible." When their cash is depleted, many of them will also fold.

Unfortunately, even some of the best juniors failed to focus their resources on a flagship property and advance it into an actual development project. Easy capital enticed them to build a “pipeline” of properties more appropriate for larger companies. Investors were easily swayed with this “irons in the fire” business model. Today the market is seeing these undeveloped properties for what they are, liabilities not assets. There are a few that were smart (and lucky) enough to advance a project that is truly developable. These will receive additional equity, albeit at substantial dilution to existing shareholders. Others will proceed, without shareholders, as debt holders take over the projects. Some will merge. But, mergers won't bail out existing shareholders as few premiums will be paid in the consolidations. Even the companies with projects nearing production are finding it difficult to finance construction in the current market. Companies with once profitable poly-metallic mines are being forced into “care and maintenance” at current base metal prices.

Easy capital is mostly inefficient capital. Looking at mining projects today, it is amazing to see just how little was actually created with the billions invested into the junior sector over the past several years. The capital was simply spread too thin. Way too many companies were created. But, like the mortgage market, it was mostly the securitization process that created profits for insiders, bankers and management.

With mortgage backed securities, somewhere underneath all that paper, is a house. The sub-prime analogy stops here. Obviously there will be no bailout for junior mining companies, but there will be survivors. There are some real developable mining assets, under all that paper, that are currently being severely undervalued. Unlike most other assets, gold continues to hold on to the bulk of its gains of the past five years. Base metals appear to be forming a bottom and their current underperformance relative to gold cannot be sustained. President-elect Obama has stated that he will develop a series of infrastructure-based jobs programs in the U.S. This build-out will compete for metals with China, India and other emerging countries as their growth accelerates in a worldwide economic recovery. Money will begin to flow back into commodities and other hard assets as credit market free up, early next year.

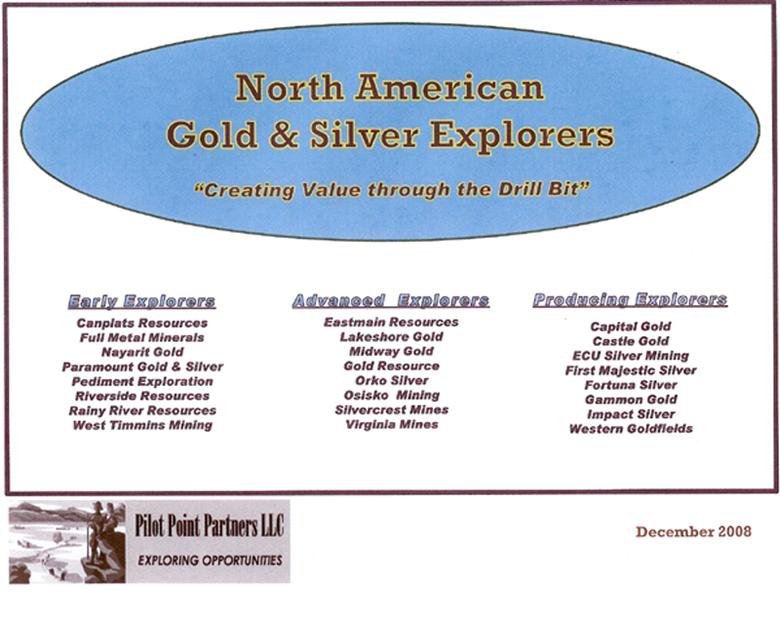

In this financially challenged market it is still difficult to differentiate the “baby from the bathwater." Our North American Gold & Silver Explorers Model is currently following 24 companies we believe will survive to drill another day. Companies with cash flow or high cash balances will not only survive, but will be positioned to acquire new assets as other companies fail or drop properties. We are currently positioning our clients for a strong rally beginning in Q1, 2009.

A few of our favorites:

We recently visited Capital Gold's (CGLD) (CGC.TO) El Chanate mine in Sonora. This is truly a first class operation. They are now producing close to 5000 ounces of gold per month at a cash cost of about $270. We believe that they will continue to increase production and achieve a 70,000-ounce profile in 2009. Capital has $11MM in cash, solid cash-flow and open credit lines. Being a U.S. company, their mining costs are currently benefitting from a stronger dollar versus the Peso. They are well positioned to pick up additional assets in Mexico.

Fortuna Silver (TSX.V:FVI) (NYSE:FVI) has over $40MM in cash and is operating their Cuylloma Mine in Peru at a small profit. They were smart enough to hedge the lead and zinc production, although most of the hedge will roll off in Q4. Next year they intend to shift production to the bonanza silver veins they have recently discovered on the property to keep the mine cash-flow positive. Fortuna has consolidated their San Jose property in Oaxaca, Mexico and should have an updated resource out early next year. They have completed construction on the first phase of the ramp and infill drilling continues to produce excellent results. We believe that the San Jose resource could grow to over 100MM silver equivalent ounces.

Eastmain Resources (TSX:ER) (ER.TO) has well over $20MM in cash from their recent offering and warrant exercises. Their corporate burn rate is very low and drilling costs in Quebec are partially offset with tax credits. The cash will support their current ($4MM) exploration budget for the next 5 years. Eastmain’s flagship asset is their Eau Claire deposit in James Bay, Quebec. They already have about 1MM ounces (indicated /inferred) and drill results continue to indicate a much larger resource. They will benefit from the infrastructure build-out at Goldcorp's (TSX:G) (NYSE:GG) Eleonore mining camp. They have joint ventured their Eleonore South property with Goldcorp who is funding the current drill program. They also have several other properties surrounding the new camp.

C. F. Wasser III (Trey), President & Director of Research, Pilot Point Partners, has been in the brokerage and venture capital business for over 23 years. Trey spent 20 years as a bond salesman and trader with Merrill Lynch, Kidder Peabody and Paine Webber. He specialized in corporate cash management and his clientele included many Fortune 100 companies and institutional money managers. In 1993, he formed III-D Capital LLC to assist early staged technology companies developing business plans and securing venture capital financing. Today, III-D Capital is involved in various consulting and finance activities for mining companies Trey organizes site visits for analysts and fund managers through DD Tours LLC where he is President. He consults with FINRA and other regulatory agencies on a pro-bono basis.

Disclosures:

1. This report has been written for informational purposes only and strictly reflects the opinion of the analyst on the date of publication. Opinions may change at any time without notice. No earnings projections or target prices are intended or implied. All conclusions are drawn from information provided by the company which the analyst has made a “best efforts” attempt to verify and confirm, but its accuracy and completeness is not guaranteed. While this report has not necessarily been written in accordance with current SEC regulations and the Standards of Practice developed by the Chartered Financial Analyst Institute (CFAI), the opinions herein are believed to be consistent, reasonable and supportable.

2. The research analyst principally responsible for preparing this report was Trey Wasser, President of Pilot Point Partners, LLC.

3. Pilot Point Partners LLC, its affiliates and family may have positions and effect transactions in the securities or options of the issuers reported herein.

4. Pilot Point Partners LLC, its affiliates and family have received no direct compensation for this research report.

5. Mr. Wasser is a Principal of DD Tours LLC and may be involved in arranging site tours of a company’s properties and may receive compensation based upon various factors involved with these tours.

6. Mr. Wasser is a Principal of III-D Capital and may have other agreements, including finders fee agreements with companies, mentioned in this report, regarding potential joint ventures and/or property sales and may receive compensation based upon various factors involved with these agreements.

7. The research provided herein should not be considered a complete analysis of every material fact regarding the companies, industries or securities named above.

8. This report was prepared exclusively for the benefit of institutional investors and Pilot Point Partners may receive compensation directly or in soft dollar arrangements.

9.Additional information and disclosures on the subject companies is available upon request.

10. As of the date of this report, Pilot Point Partners LLC, its affiliates or family hold positions in CGLD, FVI and ER. They do not hold any positions in the common stock of any other companies mentioned in this report.

11. As of the date of this report, DD Tours has been compensated by CGLD for analyst tours within the past 12 months.

12. As of the date of this report, III-D Capital has no finders fee agreements with any companies mentioned in this report.

Visit The GOLD Report - a unique, free site featuring summaries of articles from major publications, specific recommendations from top worldwide analysts and portfolio managers covering gold stocks, and a directory, with samples, of precious metals newsletters. To subscribe, please complete our online form ( http://app.streamsend.com/public/ORh0/y92/subscribe )

The GOLD Report is Copyright © 2008 by Streetwise Inc. All rights are reserved. Streetwise Inc. hereby grants an unrestricted license to use or disseminate this copyrighted material only in whole (and always including this disclaimer), but never in part. The GOLD Report does not render investment advice and does not endorse or recommend the business, products, services or securities of any company mentioned in this report. From time to time, Streetwise Inc. directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

The Gold Report Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.