Forget Inflation Instead Focus on How Long Deflation Will Last

Economics / Deflation Dec 11, 2008 - 11:32 AM GMTBy: Mike_Shedlock

Humpty Dumpty On Inflation - There is an excellent article by Axel Merk on Market Oracle called Monetizing the Debt . The article discusses the Fed's growing balance sheet and whether or not it represents inflation. The aspect that I want to highlight is in regards to bank lending.

Humpty Dumpty On Inflation - There is an excellent article by Axel Merk on Market Oracle called Monetizing the Debt . The article discusses the Fed's growing balance sheet and whether or not it represents inflation. The aspect that I want to highlight is in regards to bank lending.

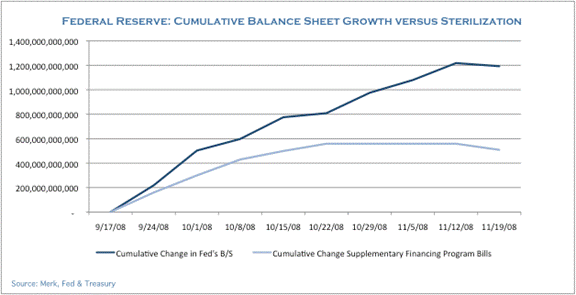

Here are a couple of charts from the article along with commentary by Merk.

Whereas traditionally, the Fed is actively managing short-term interest rates by buying and selling short-term Treasury bills, the Fed may also buy, say, 10 or 30-year bonds. It's a wonderful funding mechanism: if the Treasury needs to raise cash, the Fed could come and provide it.

Isn't this extremely inflationary? Quite possibly, quite likely, but not necessarily is the short answer. First of all, the Fed has the ability to "sterilize" its debt monetization program. Take the situation where the Federal Reserve buys "highly rated", toxic assets from the bank, but doesn't want the bank to go out and lend a multiple of the cash it receives. What the Fed can do is to sell the same bank, for example, some Treasury bills to "mop up" the extra liquidity. This would have the impact of improving the bank's balance sheet without supercharging the economy. Indeed, in late September the Treasury instructed the Fed to do just that; they even invented "Supplementary Financing Program" (SFP) bills for this purpose.

On the chart below, the dark blue line indicates the cumulative growth in the Fed's balance sheet, i.e. the Fed's "printing of money"; the light blue line shows the cumulative activity to mop up the added liquidity by selling SFP bills to banks. The Fed's balance sheet has grown by about $1.2 trillion to currently over $2 trillion; Dallas Fed President Richard W. Fisher said the Fed's balance sheet may reach $3 trillion by January.

As even the untrained eye can see, the Fed has not mopped up all of its liquidity injections; indeed, as of October 22, 2008, the Fed seems to have all but abandoned the program. In our assessment, at least for the time being, the Fed is not interested in mopping up, but to add massive amounts of liquidity.

Well, isn't that extremely inflationary? It depends on your definition of inflation; if it's a growth in money supply, then, yes, this is already extremely inflationary. But so far, this hasn't translated into higher price levels or even higher long-term inflation expectations as measured by the spread of 10 year TIPS versus 10 year Treasury bonds; TIPS are inflation protected Treasuries that provide compensation for increases in the consumer price index (CPI); it is this spread that the Fed is most concerned about when gauging the market's inflation expectations.

Why has it not (yet) been inflationary? Well, the Fed can provide all the money it wants, but it cannot force institutions to lend. Below is a chart of the "excess reserves" in the banking system; these are the reserves banks hold in excess of what they are required to maintain.

Until September, excess reserved hovered at or below about US $2 billion, but have ballooned to over $600 billion as of November 19, 2008. Read in conjunction with our discussion above on the Fed "printing money", the Fed has thrown money at the banking system, but the banks are hoarding the cash, they do not lend. For banks to lend money, two basic conditions must be bet: they must feel strong enough to provide credit; and they must feel their customers - be they consumers or businesses - are creditworthy enough.

Merk skirts the issue as to whether or not the growth in the Fed's balance sheet is inflationary, leaving it up to the reader, or more accurately the reader's definition. No doubt this is a clever way of avoiding the taking of sides in a never-ending philosophical debate as to the meaning of inflation.

Leaving definitions aside for the moment, it is important to note that the Fed's ballooning balance sheet " hasn't translated into higher price levels or even higher long-term inflation expectations as measured by the spread of 10 year TIPS versus 10 year Treasury bonds ".

That for me is the key issue. And the reason why it has not affected the prices of goods, services, asset prices, or even inflation expectations as measured by TIPs is that banks are not extending credit.

Banks Not Extending Credit

On December 9th in Huge Demand For Treasuries As Banks Refuse To Lend I posted charts showing that although base money is soaring banks are not lending, and also some historical charts looking at base money expansion during the great depression. Here are the lending charts:

Printing Not Making Circulation

M1 Money Multiplier

M1 Money Multiplier Chart Courtesy Of St. Louis Fed

The M1 multiplier is the ratio of M1 to the St. Louis Adjusted Monetary Base. the plunging ratio suggests that little of this base money is actually making its way into M1.

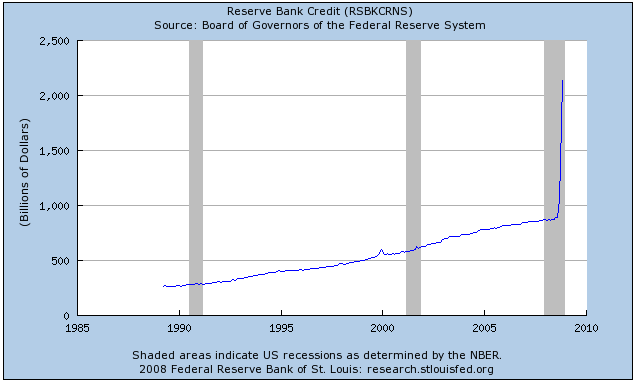

Reserve Bank Credit Soars

Reserve Bank Credit Chart Courtesy Of St. Louis Fed

Look at the Base Money chart and the Reserve Bank Credit chart. Base money is soaring but all of it is sitting in bank reserves. In other words, banks are not lending. Clearly we have a huge monetary distortion, but banks seem to understand that lending money in this environment would do nothing but increase losses.

Interestingly, refusal to lend is a worldwide phenomenon.

Worldwide Corporate, Government Borrowing Plummets

The Bank for International Settlements (BIS) is reporting Corporate, government borrowing plummets in third quarter .

The volume of debt issued around the world plunged in the third quarter to just a quarter of its level in the preceding three months, latest Bank for International Settlements (BIS) data indicated Sunday.

Net issuance of bonds and notes by corporations, financial institutions and governments fell to 247 billion dollars (195 billion euros) from 1.086 trillion dollars in the second quarter, said the world's top central bank body.

"The decline was well beyond normal seasonal patterns, and resulted in the lowest level of net issuance since the third quarter of 2005," said the BIS.

Debt issued in euros fell most, plummeting from 466 billion dollars in the second quarter to 28 billion dollars in the third quarter.

Debt issued in dollars also dropped steeply, from 396 billion to 40 billion dollars in the three months ending September.

Financial institutions made the biggest cut back on borrowing, with debt issued shrinking to just 193.1 billion dollars in the third quarter from 947.4 billion dollars a quarter ago.

By nationality, it is the US which showed the most drastic cut in borrowing, with the sum dropping to less than a tenth of the volume issued in the second quarter.

In a fiat world, in which we are clearly in, not much happens unless credit is extended or money somehow makes its way into the economy.

Merk seems to agree with that as does Austrian Economist Frank Shostak on Mises. Thus inflation problems are down the road.

Practical Definitions Of Inflation And Deflation

Most know my definitions by now but here they are again for convenience.

- Inflation is a net increase in money supply and credit.

- Deflation is a net decrease in money supply and credit.

In both cases credit must be marked to market to make any practical sense out of what is happening. Those who focus solely on money supply cannot easily explain stock markets that have fallen in half (this does not happen in disinflation), TIPs yields, a global race to ZIRP, or many other events that are happening.

Humpty Dumpty Defines Inflation

Unfortunately there are many definitions of inflation and deflation strewn about. Some play the role of Humpty Dumpty changing meanings at whim, switching from commodity prices, to consumer prices, to expansion of base money or M3 or whatever measure of money seems to be expanding at the fastest rate.

Some do the inflationista two-step to avoid admitting that we are indeed in deflation, choosing instead to call it "disinflation"

In short: "We are going to have a period of deflation that we will instead call disinflation."

'When I use a word,' Humpty Dumpty said, in a rather scornful tone,' it means just what I choose it to mean, neither more nor less.'

'The question is,' said Alice, 'whether you can make words mean so many different things.'

'The question is,' said Humpty Dumpty, 'which is to be master - that's all.'

It appears that the deflationista camp is incapable of comprehending a model, and the events that it forecasts, that lays out a two step process. For some reason they cannot grasp the fact governments will respond to disinflation with inflation, that the impact of those interventions is not instantaneous, and that markets historically are not very good at foreseeing the change in inflationary conditions in either direction.

Not quite. Rather it appears that some who suggested there would never be deflation are gracefully attempting to back into it, and indeed going out of their way with a two-step to pretend it is something else.

Every deflationist on the planet understands inflation will be back at some point and the Fed will attempt to do everything it can to avoid it.

But now that we have agreement from the inflationista camp that there is deflation (even if they choose to call it something else). At least that is a two-step in the right direction.

Many in the inflationista camp insist on prefixing the word "deflation" with the word "debt" as if that makes deflation something else. Realistically "debt deflation" is about all one is ever going to see in a fiat regime. From this standpoint, debates may sound like "violent agreement".

The reality is "Debt Deflation = Deflation" in a fiat regime. Indeed it is the destruction of debt that matters most.

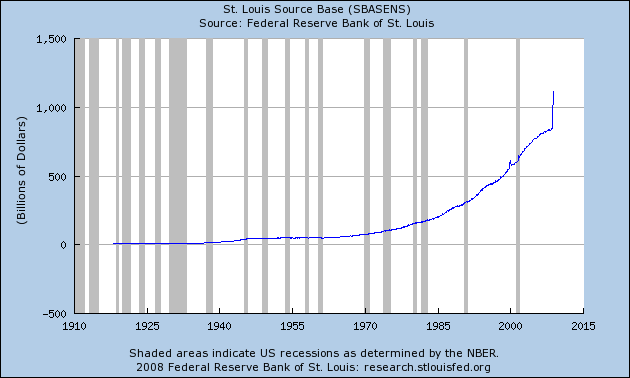

Nonetheless, base money charts and the Fed's balance sheet are both skyrocketing now which has many hyper-inflationistas screaming hyperinflation.

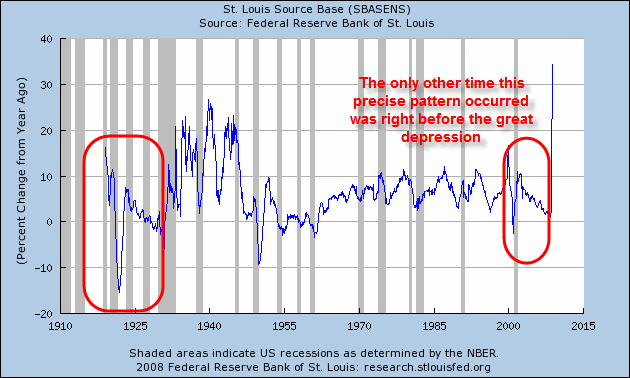

Base Money Supply

Chart Courtesy of St. Louis Fed

I must admit that chart looks pretty scary. However, let's look at it another way.

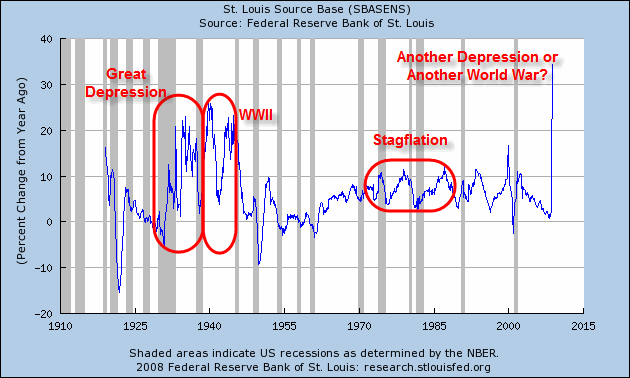

Base Money % Change From A Year Ago

Now that looks even scarier. The only other times we have seen base money supply soar like this were in the Great Depression and World War II.

While on this subject let's look at the same chart as above one more way.

The only other time since 1918 that the base money supply chart looks like it does recently was right before the great depression.

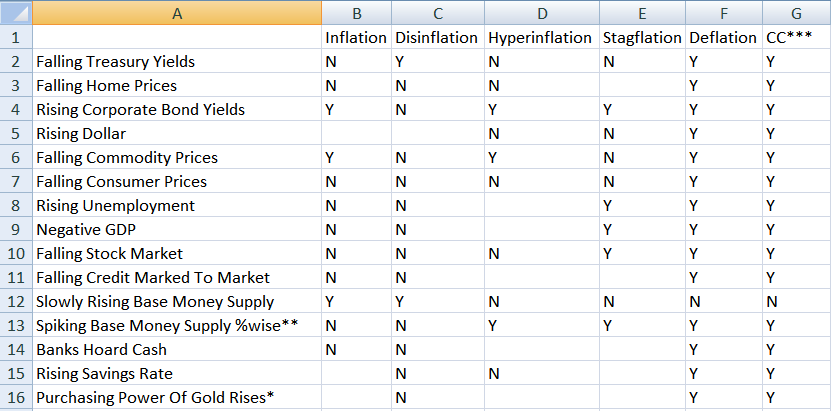

A Practical Look At "Flation"

Here is a table of conditions and whether or not one would expect to see those conditions in inflation, deflation, stagflation, hyperinflation, and disinflation. Some expectations are debatable so I left those bank.

*** Current Conditions

** Base Money Supply spiked during Great Depression as one of the previous charts shows

* The Purchasing power of gold is in relation to other commodities

I see a perfect match on 15 items using Case-Shiller CPI (CS-CPI) for number item 7. See Case Shiller CPI vs. CPI-U November 2008 Analysis , for why CS-CPI is a far better measure of consumer prices than the reported CPI-U. CS-CPI is explains treasury rates and the Fed's actions quite nicely.

Those using practical definitions have an easy time explaining things. Those lost souls screaming hyperinflation missed the boat completely. Hyperinflationists have had trouble for years explaining falling home prices, and falling treasury yields.

Those screaming stagflation no longer have a case with falling commodity prices, a rising dollar, and falling treasury yields.

Disinflation makes no sense with stock prices down 40% and corporate bond yields soaring. Stocks do best in disinflation. Corporate bond yields drop in disinflation. This is not disinflation by any stretch of the imagination.

Routine inflation makes no sense in light of corporate bond yields priced for bankruptcy, collapsing stocks, plunging commodity prices and a negative CPI.

Those who think inflation is about prices alone were busy shorting treasuries, and looking the wrong direction for over a year. Only after the stock market fell 50% and gasoline prices crashed did the media start picking up on "deflation". Only those who knew what a destruction in credit would do to jobs, to lending, to retail sales, to the stock market, to corporate bond yields and to treasury yields got it right.

What It's Not

It's Not Disinflation

It's Not Stagflation

It's Not Inflation

It's Not Hyperinflation

What's left looks like a duck, walks like a duck, flies like a duck, and squawks like a duck. And that duck is deflation no matter what Humpty Dumpty suggests.

Those who stick to a monetary definition of inflation pointing at M3, MZM, base money supply, or even Money AMS, are selecting a definition that makes absolutely no practical sense. Worse yet they do it screaming about bond-bubbles at yields of 5% or higher, all because they refuse to see or admit the destruction of credit is happening far faster than the Fed is printing.

And it is that destruction of credit, coupled with the fact that what the Fed is printing is not even being lent that matters, not some Humpty-Dumptyish academic definition that has no real world practical application!

Phooey. I prefer a practical definition of deflation that matches and even predicts what the credit markets and stock markets are going to do, not some definition that is useless for anything but academic debate.

The trick now is to figure out how long deflation will last, not whether we are in it. Humpty Dumpty is of no use, he cannot even see where we are.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.