Kinross Gold Corp Leads Gold Stocks Sector Rebound

Commodities / Gold & Silver Stocks Dec 10, 2008 - 07:34 AM GMTBy: Bob_Kirtley

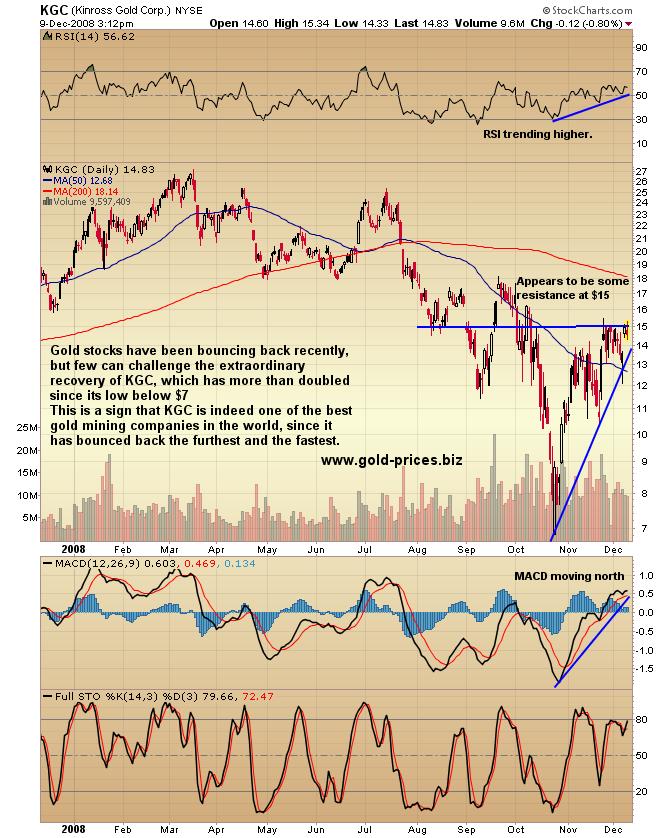

Gold Stocks have been bouncing back recently, but few can challenge the extraordinary recovery of KGC, which has more than doubled since its low below $7.

Gold Stocks have been bouncing back recently, but few can challenge the extraordinary recovery of KGC, which has more than doubled since its low below $7.

This is a sign that KGC is indeed one of the best gold mining companies in the world, since it has bounced back the furthest and the fastest.

Technically some good signs from KGC are that the Relative Strength Index is moving higher having bounced up off the oversold zone at 30. Similarly, the MACD is trending northwards and is now in positive territory, but can still rise a lot further before giving an oversold signal.

If one is too have favourite shares, Kinross Gold Corp would certainly be one of ours, as it has been a holding of ours for years now, although we have traded the ups and downs when the opportunities present themselves.

Having originally acquired Kinross at $10.08, after a large rally Kinross then went through a bit of a pull back so we signalled to our readers to “Add To Holdings” at t discounted levels of around $11.66. We also gave another ‘Kinross Gold BUY' signal when we purchased more of this stock on the 20th August 2007 for $11.48. On 31st January 2008 we reduced our exposure to this stock when we sold about 50% of our holding for an average price of $21.96 locking in a profit of about 93.60%. On the 24th July 2008 we doubled our holding with a purchase at $18.28 giving us a new average purchase price of $14.50.

As well as trading the stock we have also dabbled in options contracts with Kinross, buying call options in KGC on the 16th June 2008 paying $2.68 per contract and sold them on the 28th June 2008 for $5.30 per contract generating a 100% profit in two weeks. We then re-purchased them after they dropped for $2.50, and we are still holding them, although at a significant paper loss.

The reason we like Kinross Gold Corp so much is that it fits our criteria almost perfectly. When we look for a gold stock to buy we are looking for solid fundamentals, a stable geopolitical situation and most importantly, leverage to the gold price itself.

As far as the fundamentals go, Kinross is a mid to large cap gold producer with a market cap of $9.47 billion. Some may consider this too large a company to offer decent leverage to the gold price, but as shown by the recent performance of the stock price, Kinross is definitely providing that leverage.

As well as leverage to rising gold prices, Kinross is also growing well as a company in its own right. Having made a gross profit of $390.40M in 2006 and then $501.80M in 2007, KGC is growing well and with the Sep 08 quarterly profits at $269.80M, Kinross appears to be on track for another good year of record profits. There is also something in the financials that is particularly helpful in the present credit environment. In the last report from KGC, out of the $1284.80M in current assets, Kinross has a massive $322.90M in cash. This means they are well positioned to face any liquidity issues and will not be forced to try and raise money in the current difficult credit conditions.

Therefore we continue to like Kinross and maintain our stock and option position in the company. Kinross Gold Corp is not only well positioned to benefit from rising gold price, but it is also a great company in its own right, with good growth potential. A full list of the stocks we cover can be found in our free online portfolio at www.gold-prices.biz.

Kinross Gold Corporation trades on the Toronto stock Exchange under the symbol of ‘K' and on the New York Exchange under the symbol of ‘KGC'

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address.

Have a good one.

By Bob Kirtley

These are fast changing times and its essential that you stay up to date with what is going on in the market . For our latest commentary and trading signals on gold, click here to subscribe to The FREE Gold Prices Newsletter and click here for The FREE Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.