The State of State Municipal Bond Funds

Interest-Rates / US Bonds Dec 10, 2008 - 05:19 AM GMTBy: Richard_Shaw

Several of our clients have come to us this past week with questions and concerns about municipal bond funds.

Several of our clients have come to us this past week with questions and concerns about municipal bond funds.

They are concerned about recent performance, about California projected cash shortages, about many states struggling with budget deficits, about the fate of revenue bonds in the face of current economic problems; and whether the US government would bailout states the way they are bailing out banks, insurance companies, industrial “banks”, federal mortgage agencies, and automobile companies.

To the last question — bailouts — we say sure, why not. What's a few hundred billion more here and there?

We have a hard time imagining a state general obligation bond defaulting for any length of time without federal financial assistance. Revenue bonds are not as likely to be aided. As for local town and city bonds maybe Yes, maybe No — Los Angeles or NYC, probably yes, but Mayberry RFD, maybe not.

It's hard to know what our government will do next, and who they will decide should be the winners and who should be the losers — whether to reward past prudence or past recklessness. We'll just have to wait and see.

Single State Muni Funds

We maintain a weekly updated list of 26 single state muni funds on our site . It is updated for the prior week each Saturday morning.

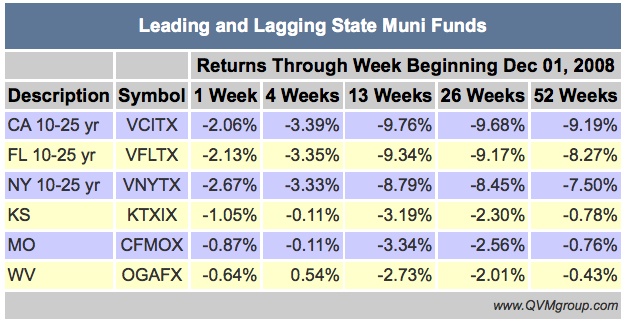

The three states in our list with the worst 52-week returns are the large states of California, Florida and New York. They are heavily represented in national muni funds, 14.5%, 10.1% and 5.8% respectively in the Vanguard long-term tax exempt fund (VWLUX).

The three states in our list with the best 52-week returns are Kansas, Missouri, and West Virgina. They are not heavily represented in national muni funds.

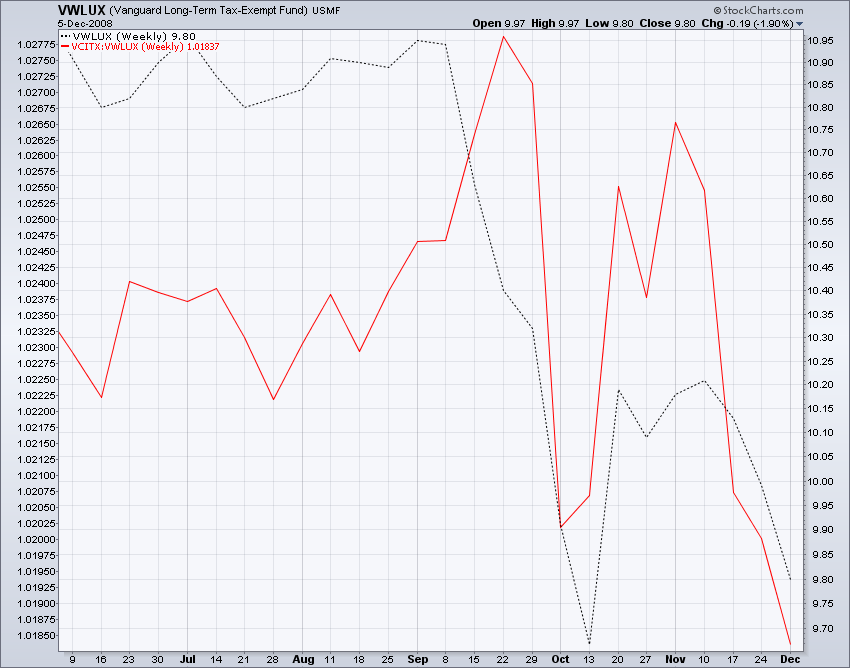

Comparing the Vanguard CA state muni fund with the Vanguard long-term national muni fund graphically, shows how the story has unfolded.

Reading the chart: A rising red line means the CA fund is outperforming the national fund. A declining red line means the CA fund is underperforming the national fund.

California was moving along about the same as the national fund until the credit crisis became hot. The national fund declined first and more. Subsequently, California recovered more, but by mid-November, when publicity about California's cash crunch (now with plans to pay workers and vendors with IOU's), the California fund declined faster than the national fund.

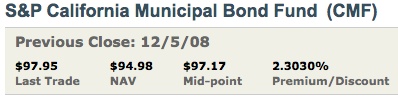

The arbritrage function for the iShares California muni ETF (CMF) is not currently functioning as intended (a large premium to NAV exists). When the arbs resume their natural role, the premium will go away and we would expect a loss for CMF equal to the current premium of 2.3%.

If you want to own a California muni fund, an ETF is not a good way to do it until the arbitrage function works well again. In the meantime, own state specific muni funds through no-load mutual funds such as those available through Vanguard or other major mutual fund organizations.

Possible federal help or not, we don't think a California state fund is a good place to be right now. It might be more prudent for Californians to own a national fund until the open questions about California's budget and the solutions to the problem are worked out. There would be a tax cost, but depending on the investor's financial and psychological situation, a more diversified municipal risk exposure may be more fitting on a temporary basis.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2008 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.