Stock Market Valuations and Dow 5,000 Redux

Stock-Markets / Stock Market Valuations Dec 09, 2008 - 09:01 AM GMTBy: John_Mauldin

What is fair value for stocks? Are they now cheap? You can certainly make that argument by comparing valuations based on past performance. But repeat after me, "Past performance is not indicative of future returns." The investment climate of today is almost certainly going to be quite different than that of the 80's and 90's. Thus, to expect stocks to repeat the performance of the last bull market in a climate of government intervention, deleveraging and increased regulations may not be realistic?

What is fair value for stocks? Are they now cheap? You can certainly make that argument by comparing valuations based on past performance. But repeat after me, "Past performance is not indicative of future returns." The investment climate of today is almost certainly going to be quite different than that of the 80's and 90's. Thus, to expect stocks to repeat the performance of the last bull market in a climate of government intervention, deleveraging and increased regulations may not be realistic?

This week Bill Gross, the Managing Director of PIMCO (and one of my favorite analysts) moves away from his familiar neighborhood of bonds and offers a few thoughts on stock market valuations. This is not a lengthy read, but it is one you might want to read twice, as the concepts are important. And not just for stocks but for investments of all types. I trust you will enjoy this week's Outside the Box.

John Mauldin, Editor

Outside the Box

Dow 5,000 Redux

By William H. Gross

Managing Director PIMCO

Here I go again! Gosh it was only six years ago that I cemented my place in stock market history by predicting that the Dow would fall from 8,500 to 5,000, instead of going up to 14,000 where it peaked in October of 2007. Well, I could use the standard set of excuses: 1) No one else saw it coming, 2) I was misinterpreted, and taken out of context, 3) I was tired, overworked, and had family problems, or 4) I had just come out of rehab. But these days what really works is a full confession. I mean, like, uh, it was totally my fault and I take full responsibility. The fact is I was only off by 9,000 points. That's my story, and I'm stickin' to it.

Well, fools rush in. This time though I'm definitely older and maybe a little bit wiser. No magic number, nor a specific target date from the Swami of the Dow. This one will be more conceptual, but still present a "take" that you can criticize or damn with faint praise. And no, despite the title, it doesn't imply that the stock market is headed to 5,000 and that I was always right or just a little bit early. It only suggests that I'm readdressing the critical topic of equity valuation – that mysterious fragile flower where price is part perception, part valuation, and part hope or lack thereof. Press on, Swami.

Let me first announce a fundamental premise with which I think all rational investors would agree: I believe in stocks for the long run – but only if purchased at the right price. That statement packs a real punch. It says that capitalism is and will remain a going concern, that risk-taking – over the long run – will be rewarded, but only from a starting price that correctly anticipates the economy's growth and its share of after-tax corporate profits within it. Acknowledging the above, let's look at a few basic standards of valuation that historically have stood the test of time, to see if at least the price is right.

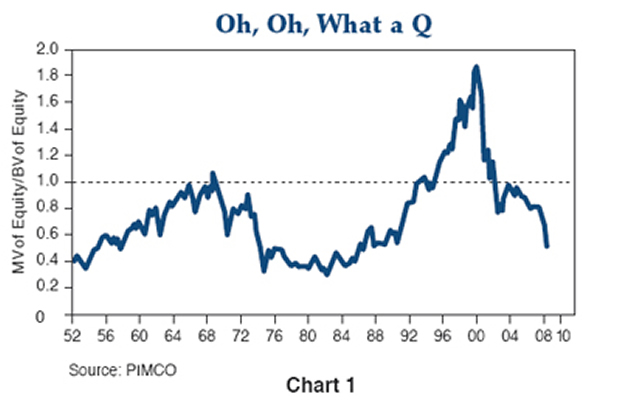

One of them is what is known as the "Q" ratio, or the value of the stock market relative to the replacement cost of net assets. The basic logic behind "Q" is that capitalism works. If the "Q" is above 1.0, then the market is valuing a company at more than it costs to reproduce it; stock prices should fall. If it is below 1.0, then stocks are undervalued because new businesses can't be created at as cheap a price as they can be bought in the open market. In the short run, this ratio is volatile as shown below but it tends to be mean reverting, which is critical. As long as capitalism is a going concern, "Q" should mean revert to 1.0. If so, then oh, oh what a "Q"! Today's Q ratio has almost never been lower and certainly not since WWII, implying extreme undervaluation, as seen in Chart 1.

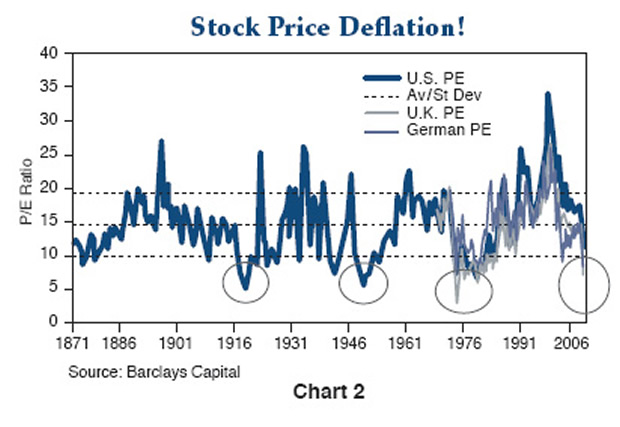

Another long-term standard of valuation comes from the good ol‘ P/E ratio, where earnings per share, or E, is compared as a function of P, or price. Chart 2, going all the way back to 1871, shows the same relatively massive undervaluation, not only in the U.S. but elsewhere. This has been a global bear market. Yet here one should be careful. The sage of rationality, Yale's Robert Shiller, cautions us to look at earnings on an historical 10-year moving average to remove adverse or fortuitous cyclicality. When measured on this basis, P/E's are cheap but less so, slightly below their mean average for the past century.

Professor Shiller may be on to something, although even his 10-year approach may not be enough to adjust for our future economy and its functioning within the context of a delevering as opposed to a levering financial system. Recent Investment Outlooks and indeed, discussions in PIMCO's Investment Committee and Secular Forums for the past several years have pointed to the necessity to view current changes as not only non-cyclical, but non-secular. They are, in fact, likely to be transgenerational. We will not go back to what we have known and gotten used to. It's like comparing Newton and Einstein: both were right but their rules governed entirely different domains. We are now morphing towards a world where the government fist is being substituted for the invisible hand, where regulation trumps Wild West capitalism, and where corporate profits are no longer a function of leverage, cheap financing and the rather mindless ability to make a deal with other people's money. Welcome to a new universe stock market investors! In this rather "sheepish" as opposed to "brave" new world, here are some considerations that may affect Q ratios, P/E's, and ultimately stock prices for years to come:

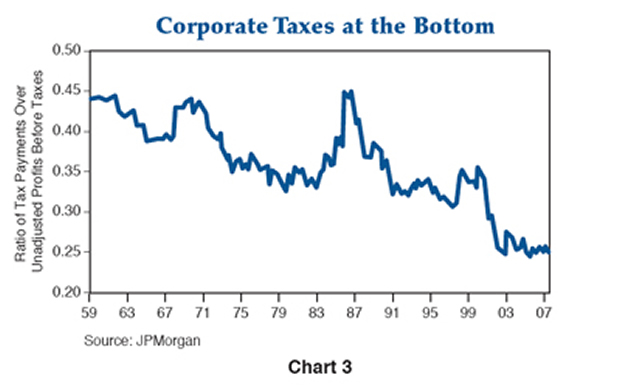

Corporate profits have been positively affected for at least the past several decades by several trends that appear to be reversing. Leverage and gearing ratios – the ability of companies to make money by making paper – are coming down, not going up. In addition, the availability of cheap financing – absent government's checkbook – will likely not return. Narrow yield spreads and low real corporate interest rates are gone. Last, but not least, the historical declines of corporate tax rates, shown graphically in Chart 3, will not likely continue downward in a Democratically-dominated Washington.

Globalization's salutary growth rate of recent years may now be stunted. While public pronouncements from almost all major economies affirm the necessity for increased trade and policy coordination, and avoiding the destructive tendencies of one-off currency devaluations as a local remedy for global problems, investors should not bank on the free trade mentality of recent years to support historic growth rates. Already we are seeing separate ad hoc policy responses with very little cooperation. Not only does the EU's approach differ from that of the U.S., but France is in many ways an odd man out within its own community. Asia is legitimately suspicious of any U.S. endorsed approach given the failure of America's capitalistic model.

Animal spirits, and with them the entrepreneurial dynamism of risk-taking has likely experienced a body blow. Not only have dancers on the financed-based dance floor been shown the exit à la Chuck Prince, but those that remain have been publicly chastened and handcuffed. Golden parachutes, options, executive compensation and bonuses themselves are now at risk. Care to climb to the throne of this new world? Well, yes, egos will always dominate, but the rules will be changed and hormone levels lowered.

The benevolent fist of government is imperative and inevitable, but it will come at a cost. The champion of free enterprise, Ronald Reagan, knew that growth of the private sector was in no small way dependent on deregulation and the lowering of tax rates. Now that those trends have necessarily come to an end, no rational investors should expect innovation and productivity to be unaffected. Profit and earnings per share growth will suffer.

My transgenerational stock market outlook is this: stocks are cheap when valued within the context of a financed-based economy once dominated by leverage, cheap financing, and even lower corporate tax rates. That world, however, is in our past not our future. More regulation, lower leverage, higher taxes, and a lack of entrepreneurial testosterone are what we must get used to – that and a government checkbook that allows for healing, but crowds the private sector into an awkward and less productive corner.

Dow 5,000? We don't have to go there if current domestic and global policies are focused on asset price support and eventual recapitalization of lending institutions. But 14,000 is a stretch as well. One only has to recognize that roughly 20% of bank capital is now owned by the U.S. government and that a near proportionate share of profits will flow in that direction as well. Better to own corporate bonds than corporate stocks, but that's a story for another Investment Outlook.

William H. Gross

Managing Director

Your thinking we will see even better valuations analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.