Bullish Stock Market Charts for S&P, Nasdaq, BKK and Gold

Stock-Markets / US Stock Markets Dec 09, 2008 - 07:13 AM GMTBy: Mike_Shedlock

Here are some bullish looking charts we are looking at. The first two show Ellliot Wave counts that we have been tracking for some time. For some background theory on Elliott Wave, please see my October 10 post S&P 500 Crash Count .

Here are some bullish looking charts we are looking at. The first two show Ellliot Wave counts that we have been tracking for some time. For some background theory on Elliott Wave, please see my October 10 post S&P 500 Crash Count .

$SPX - S&P 500 Daily Chart

In Elliott Wave terms we are looking for a "wave [4]" bounce. The short term implications are bullish with possible retrace targets of 1008 for a 38.2% retrace or 1090 for a 50% retrace of "wave [3]". The long term implications are rather nasty. Our "Wave [5]" target back down is approximately 600.

$NDX - Nasdaq 100 Daily Chart

The pattern here is the same. If this "wave [4]" up plays out as expected, the Nasdaq Index can rally 200-300 points from here.

$BKX - Bank Index

We were watching the banking index closely last Friday. One clue the market was looking to rally was strength in banks. It seems unlikely we can have any kind of sustained rally without cooperation from banks.

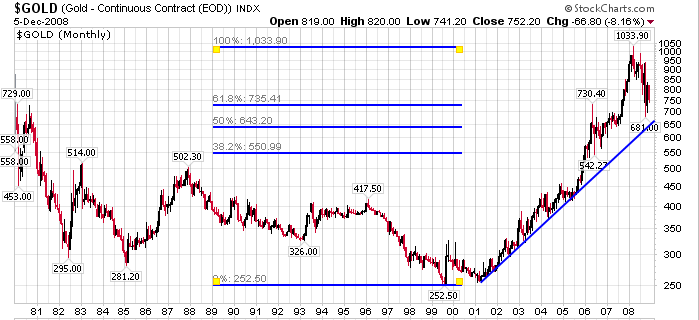

Gold Monthly

On a monthly basis gold's long term trendline is still intact.

The mining stocks have been closely correlated with the broader markets recently and there is no reason to suspect a change now. Furthermore, miners in the $HUI and $XAU are tremendously beaten up in relation to the price of gold. Thus miners can really run from both a seasonality standpoint and a technical standpoint if the markets cooperate with the expected "Wave [4]" up in the S&P and Nasdaq.

Looking North

For all these reasons, Sitka Pacific Capital Management, the firm I represent is temporarily looking North for a change. Besides, I am tired of being a bear.

Last Friday, I reported in a Minyanville Buzz that we reduced long exposure to treasuries.

" Our Absolute Return strategy had an allocation of treasuries at 33% several days ago via (TLT, IEF, TIP). Allocation reduced to 15% over last two days. "

We are still holding some treasuries for a small hedge, but overall, a selloff in treasuries now (a rally in yields) would suit us just fine. Sorry Boo, the fur suits are off, at least for a while. Let the Santa Rally begin.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.