Stock Market Deflationary Trend Scenario Into into 2013

Stock-Markets / Stocks Bear Market Dec 03, 2008 - 01:27 PM GMTBy: Mick_Phoenix

Welcome to An Occasional Letter, the third part of the development of the new scenario that I believe will play out over the next 5 or so years. In the last 2 articles we looked at the new themes emerging from the pyre that was Financial Innovation, in this article its time to develop the new road ahead.

Welcome to An Occasional Letter, the third part of the development of the new scenario that I believe will play out over the next 5 or so years. In the last 2 articles we looked at the new themes emerging from the pyre that was Financial Innovation, in this article its time to develop the new road ahead.

If you want to catch up on the first 2 articles click article 1 and article 2 .

Although the media refuse to acknowledge the similarities between the 1920s-30s and the 1990s-2008 it cannot be ignored that the symptoms are the same as are the present cures. Therefore to expect an outcome that would be different now, compared to the recovery post 1938 would require something radical.

With Monetarism and Keynesian economic theories debunked, surely we have seen enough evidence that for a true change in the macro-economic environment the adoption of the Austrian School of Economics would be required. However, let's face reality, the Austrian model is not bank friendly, it argues against all the methods banks, corporations and indeed the public wish to employ in their search for wealth. The chances of Mises becoming the next figurehead for global finance is nil, it is alien to the current "want it now" generations and the banks (and governments) would find it rather easy to persuade the public not to follow the Austrians.

We also cannot ignore the Japanese experience since the 1990's, were the failure to allow true capitalistic forces to cull worthless banks, instead deliberately inflating the money and bond supply in an attempt to destroy deflation, failed miserably.

So, no new way, just the long march to the inevitable outcome stretches ahead of us. We are already witness to the model being followed by the US and the UK and being adopted by more governments by the week. I refer of course to the articles I wrote about called the Eggertsson Theory . If you haven't already committed them to memory then I urge you to re-visit them.

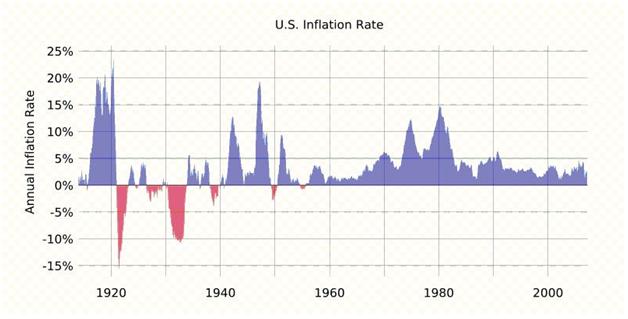

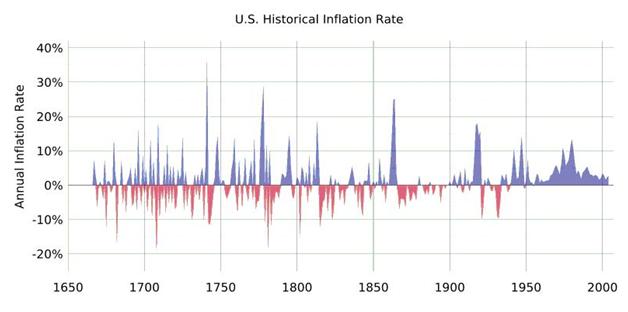

The past 60 years have been remarkable in one particular way. The lack of deflation or the willingness to allow deflation to take hold:

We can go back over 400 years and view regular swings between periods of inflation and deflation and yet during all those past 400 years we have seen humankind expand its trade, commerce and production at a rate that made the previous 100,000 years look like a flat-line on a chart. The nuance that deflation is bad is only apt for those that hold and service debt. Deflation does not stifle growth and expansion as the Fed et al would have you believe. Indeed a debt free business that re-invested profits for expansion and saved further profits would be in an enviable position.

However, our economic world is built upon the idea that you can borrow money and use it to make enough profit to service the debt, pay wages, buy materials and services and pay dividends. Even if the business model didn't work, you just roll the borrowing over on new terms and with the help of creative accounting (not including losses as losses for instance) kept the sham going.

We see the results of this all around us now with government bailouts being the last line of credit available for outdated manufacturing, banking, insurance and investment methods. We have reached the point were the final wave of credit, through securitization of debt, has failed. Not only has the original debt turned toxic but the investments based upon that debt have imploded, truly the credit candle is burning at both ends.

I want to show you 3 charts, all are very important to me and hold clues for the future. The first 2 act as road maps, firstly the Nikkei from 1988 to present:

Now the Dow 1928-48:

Finally Dow current:

The point of these charts is that even if we formed a bottom around 8000 this year it doesn't bode well as a buy and hold or pension enhancing future for stocks unless you are in a period of no inflation / deflation. To see what I mean look at the Dow 1928-48 chart, specifically the last 5 years into '48. Then scroll up to the shorter range inflation chart posted earlier. The Dow flat lined as inflation rose to near 20%.

Even more obvious is the same comparison carried out from 1932-38. Stocks rose in a deflationary environment and stagnated as inflation re-occurred. Now how many economists or governments told you about that in the past 60 years?

Deflationary environments are not necessarily bad for investments. The charts may look somewhat less spectacular than in late bull markets but without the hidden devaluation of inflation returns can be good, even great. Only if debt needs to be serviced is deflation an evil to be fought at all costs. Until recently those that had debt in huge amounts were governments and banks, specifically Investment Houses (RIP). It was in their own interests to ensure inflation continued and devalued the debt burden over time.

As we all know that has changed, the consumer has been gifted the same power to create a debt burden as those traditional holders and they will suffer the same result.

Some time ago I wrote this Gone in Sixty Seconds, originally written in June 2007:

- If you have debt you are bending over and picking up the soap.

Straightforward, no nonsense, in the prison block showers, soap collecting. Hopefully coffee has been spat at screens, wives/delicate husbands have been offended and stopped reading within 60 seconds. Because what I'm about to impart to you should make you feel this way. You, Joe Public, are about to be ridden into the oblivion. No one can save you, no one really cares. Big boyz, from companies like mine are going to take your possessions away. Faceless corporations are going to take your home away. All because you have debt."

Now, I have banged on enough about debt, more importantly I hope you now see why I have been encouraging readers to hold cash and to continue saving. In a deflationary environment cash is king but it becomes an Emperor when it can be used to invest.

With that in mind, what do I see on the long march ahead of us? Well here is the new scenario, the potholes and opportunities that we will see:

- Deflation, credit contraction, Conglomerate destruction, nationalisation, mis-placed rejection of sound shares, Bank asset hoarding, historically low base rates, wide spreads to commercial rates, low/no access to credit, sovereign default and bankruptcy, widespread poverty, increase in regional wars, Quantative Easing in the US/UK, attempted reflations, savings growth, debt repudiation, FX re-pricing, non-governmental intervention from IMF and BIS, co-ordinated protectionism, a new form of capitalism leading to profit sharing through true ownership/part ownership and not based on risk transference...... eventual emergence of new trading and commercial environments.

Remember these events are not listed in a strict chronological order, they will overlap and in some cases occur more than once. I am also looking to the optimistic side of the coin in that I believe eventually the macro-economic picture will benefit from the rejection of debt when coupled with faulty risk models.

I think we have enough there to keep us busy over the next few years........

By Mick Phoenix

www.caletters.com

An Occasional Letter in association with Livecharts.co.uk

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.