Economic Restructuring, Recessions and Politics

Economics / Recession 2008 - 2010 Dec 02, 2008 - 08:18 AM GMTBy: Hans_Wagner

Recessions impose economic discipline and punish everyone, including those that have taken advantage of the system. Companies seeking to survive look for ways to restructure their operations, with many going out of business or using Chapter 11 bankruptcy proceedings to help them break their bad habits. Politicians, ever mindful of their reelection, tend to use the public coffers to help mitigate the impact on key constituencies. This is where we are today.

Recessions impose economic discipline and punish everyone, including those that have taken advantage of the system. Companies seeking to survive look for ways to restructure their operations, with many going out of business or using Chapter 11 bankruptcy proceedings to help them break their bad habits. Politicians, ever mindful of their reelection, tend to use the public coffers to help mitigate the impact on key constituencies. This is where we are today.

Investors seeking to beat the market should understand the ramifications of these forces. Times like these help those new to the game to learn to invest in a difficult environment. The debate what to do about the “Big 3” United States auto companies is an example to follow.

Recessions lead to Economic Restructuring

Recessions occur when there are inefficiencies in the financial and economic system. These problems build up over time, culminating in excesses that cannot be sustained. The inevitable downturn of the economy inflicts an unsympathetic discipline on everyone. Recessions force everyone to become more efficient or go out of business. They also open doors to new businesses using new technologies and business models.

In 2001, the technology sector saw their share prices fall precipitously as the investors realized the perceived value of many of these companies was not achievable. The losses too many shareholders were extensive. Many technology companies closed their doors, especially those that did not have a viable business model. Now the technology sector employs more than 18 million people in the United States, many with high paying jobs. Most of the companies that survived the recession of 2001 are well prepared to weather the current down turn. Apple, Cisco, EMC, Oracle, HP and others have large cash stores, efficient business models and highly skilled people. The government did not step in to save them.

Turning to the United States auto industry presents another interesting case. The Big 3 auto industry is a high cost-manufacturing environment that is accustom to domestic sales reaching 17 million cars and trucks per year. A substantial portion of these sales stemmed from people taking money out of the appreciated value of their homes to buy or lease new cars and trucks. Most recently, the sales of vehicles in the United States fell to a 10.5 million annual rate. Once the current recession is over sales of cars and trucks will rise from that level. However, we should not expect to see it return to its former number, as consumers will not have the access to the cash from their homes to spend. This means further down sizing will be necessary if anyone of auto companies is to survive.

Currently the Big 3 have a higher cost structure places them at a disadvantage. At the top, senior management receive salaries, bonuses and other compensation that does not reflect their true performance. As they demonstrated during the recent testimony before Congress, they do not have a clear plan to rescue their companies from their current problems. By flying in their private jets to ask for a bailout loan, they demonstrated lack the leadership to show that they are spending money carefully, cutting costs where they can. Showing they are serious about saving money by starting with themselves goes a long way to gain the attention of the employees, customers and taxpayers.

The United Autoworkers Union has worked hard to create high paying jobs for their members. According to the Indianapolis Star, base wages average about $28 an hour. The average reaches $39.68 an hour, including base pay, cost-of-living adjustments, night-shift premiums, overtime, holiday and vacation pay. Health-care, pension and other benefits average another $33.58 an hour, bringing the total compensation to $61.58 to $73.26 per hour. Source: September 26, 2007 UNITED AUTO WORKERS OFF THE JOB, Striking back at globalization. By Ted Evanoff

As defined by the current United Auto Worker contract negotiated with the "Big Five" (GM, Ford, Chrysler, and top parts makers Delphi and Visteon), an auto "production worker" is a job description that covers anything from mowing grass to cleaning the toilets. In the real world, these jobs would be outsourced to $10 an hour, no-benefit wage earners. For the Big Five, these jobs get the same wages as any auto line-worker. The UAW contract also guarantees that 12,000 autoworkers get full wages for doing nothing. The Detroit News reported that "12,000 American autoworkers, instead of bending sheet metal, spend their days counting the hours in a jobs bank."

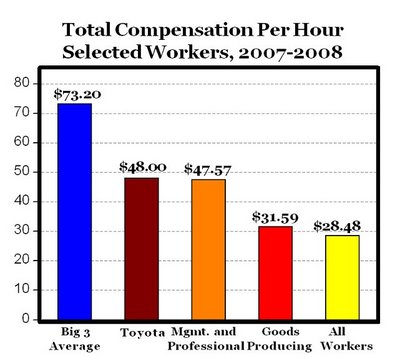

The chart below is from Professor Mark J. Perry's Blog for Economics and Finance . Dr. Mark J. Perry is a professor of economics and finance in the School of Management at the Flint campus of the University of Michigan . It compares the total compensation for workers at the Big 3, Toyota in the United States and other jobs. This clearly shows that the U.S. based auto companies are at a large cost disadvantage.

The chart below is from Professor Mark J. Perry's Blog for Economics and Finance . Dr. Mark J. Perry is a professor of economics and finance in the School of Management at the Flint campus of the University of Michigan . It compares the total compensation for workers at the Big 3, Toyota in the United States and other jobs. This clearly shows that the U.S. based auto companies are at a large cost disadvantage.

The steel industry changed dramatically when faced with this type of cost disadvantage. No longer are commodity steel products produced in the United States. In its place are specialty steel companies that provide higher value added to their customers, justifying their higher costs. The management of the auto industry needs to recognize this and make similar changes.

For example, Germany, a high labor cost economy produces more specialized autos, Mercedes, BMW, Audi, Porsche. Lower cost autos, i.e. VW are built in low cost countries.

There are many ongoing discussions why the U.S. auto industry is in such trouble. The answer lies in many places, from the decisions by management to the control over the workforce exercised by the unions and the inherent high cost structure of producing cars in the United States. The viable business model for the U.S. auto industry will see significant changes in all three of these factors.

The problem is how to get to the new environment when we are stuck in the old. Recessions are the dismal science's answer to this problem. Recessions reveal the weak business and destroy them, freeing up resources for new businesses. The transition is most difficult for everyone involved. Left to its own devices, the process will yield a harsh yet relatively quick result, leaving behind it the ashes of the old. In its place will be a new more efficient business that is able to compete in the global market. For many it will present new opportunities. Others will be left behind. The dot com bubble did its job of cleaning out the non-viable technology companies and let us with a powerful industry that is a global leader.

The Political Economy Rules

When there is an economic downturn, politicians must decide whether society, and their own political future, can stand the rigors a recession imposes. The business cycles works well, though the costs to people can be overwhelming. Inefficient businesses shrink or collapse, leaving workers without money to feed and house their families. Society becomes less stable creating a tricky situation for government leaders.

Today, politicians are facing a dilemma. Let the recession run its course and the United States will end up with a more competitive auto industry. Along the way, the drain on the economy will end and the pain will be shorter, though more intense. New industries will emerge more quickly. Unemployment will continue to rise as many auto suppliers and dealerships go bankrupt. Defaults on loans and leases will hit the banks and finance companies. Prices of homes in states with significant Big 3 auto facilities will fall further, driving up foreclosures.

The American auto industry was once the centerpiece of the U.S. economy. Over the years, other industries have supplanted it. Politically, the United States auto industry is very important as the states of the upper Midwest represent a significant constituency for the Democrats as demonstrated in the recent election. Few people believe the auto industry can survive in its current form and return to hits heyday. While healthful for the industry, the politicians in Washington may not be able to stand the trauma. Spending money on the industry will delay the necessary changes, not stop them. However, it will present an image to the public that their government is doing what it can to fix the problem. The politicians will even ask for green electric plug-in cars in return. I hope that people will buy them. While not official the Chevrolet Volt electric car is expected cost $40,000. This is a car that can get 40 miles on a single charge. Remember, homeowners taking money out of their homes to buy things like cars and trucks fueled the recent spending spree. With out the housing piggy bank, car buyers are likely to be more careful in their purchases.

Should Washington bail out the auto industry it will delay the problem, not solve it. A bail out will include substantial ownership of the companies participating, meaning the U.S. Government will have significant control over the management of the companies. There are several possible outcomes from government owning/controlling these companies. First, the investment pays off, as many hope, and the government can sell its stake to other investors. So far, this is the only outcome that has been discussed. The talking heads and politicians point to the bail out of Chrysler that ended up in a nice gain for the Treasury. What if circumstances have changed? The second possible outcome is much less desirable. In this case, the investment keeps the companies alive, but hardly competitive. They become smaller and the value to the government investment remains below what was paid. In this case, the U.S. Government remains a significant owner of all or part of the domestic based auto industry. Eventually another recession will come along and these state owned companies will face another crisis. Like other state-owned enterprises, the companies will be over staffed, possess older factories and require additional money to just keep them operating. Will the government have the heart to let them fail then? It depends who is in charge.

The Bottom Line

Recessions are the result of over heated economies. They cause weak companies to close their doors creating pain for all those affected. This process clears the way for the economy to return stronger and more vibrant than before. A stronger economy helps to lift everyone who wants to participate and willing to adjust to the new situation. When a company is bailed out, it is likely to delay the inevitable. While people feel good about the saving jobs, in the end it can turn out to affect everyone negatively. No one wants to experience a bankruptcy. Using taxpayer dollars to protect the taxpayer from the consequences of mismanagement only further compounds the problem. In the mean time, politicians are trying to protect their political position by taking a short-term view. Investors will be left holding two bags, one from the companies they own and the other from the government.

If you are interested in reading more about the affect global competition has on economies I suggest reding: When Markets Collide: Investment Strategies for the Age of Global Economic Change ![]() by Mohamed El-Erian a co-CEO and co-CIO of PIMCO, one of the largest investment management companies in the world. He formerly served as president and CEO of Harvard's $35 billion endowment.

by Mohamed El-Erian a co-CEO and co-CIO of PIMCO, one of the largest investment management companies in the world. He formerly served as president and CEO of Harvard's $35 billion endowment.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

Copyright © 2008 Hans Wagner

Hans Wagner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.