U.S. Fed Fighting Deflationary Credit Contraction

Economics / Deflation Nov 30, 2008 - 04:08 PM GMTBy: Mick_Phoenix

Welcome to the Weekly report. There is much talk these days about the inflationary bias of the US Federal Reserve, the rationale being all that money being pumped into banks, brokers (RIP), insurance, car makers and so on (monetary inflation) will eventually flood into the economy and cause prices to rise as too much cash seeks too little supply of goods and services (price inflation).

Welcome to the Weekly report. There is much talk these days about the inflationary bias of the US Federal Reserve, the rationale being all that money being pumped into banks, brokers (RIP), insurance, car makers and so on (monetary inflation) will eventually flood into the economy and cause prices to rise as too much cash seeks too little supply of goods and services (price inflation).

In normal circumstances, I would readily agree that lending on this scale would eventually lead to a hyper-inflationary period, however we live in interesting times, were we are at the mercy of a credit contraction, the likes of which has never been witnessed before. Right now I believe we are entering a period of deflation that must be traversed before we can expect an increase in inflation.

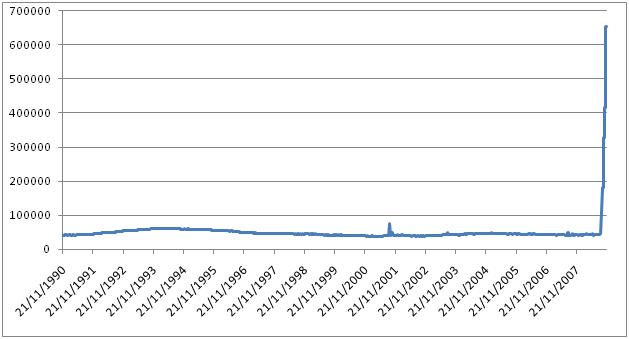

Below are 2 charts showing the total reserves of depository institutions as at the 19th November:

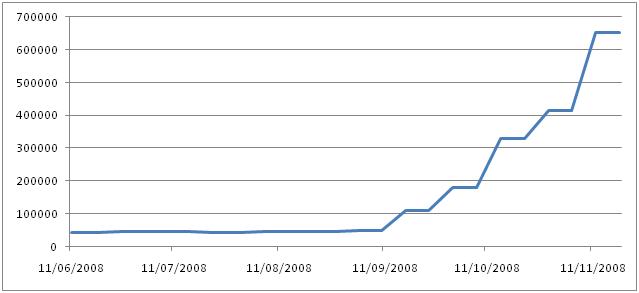

This one shows the recent action:

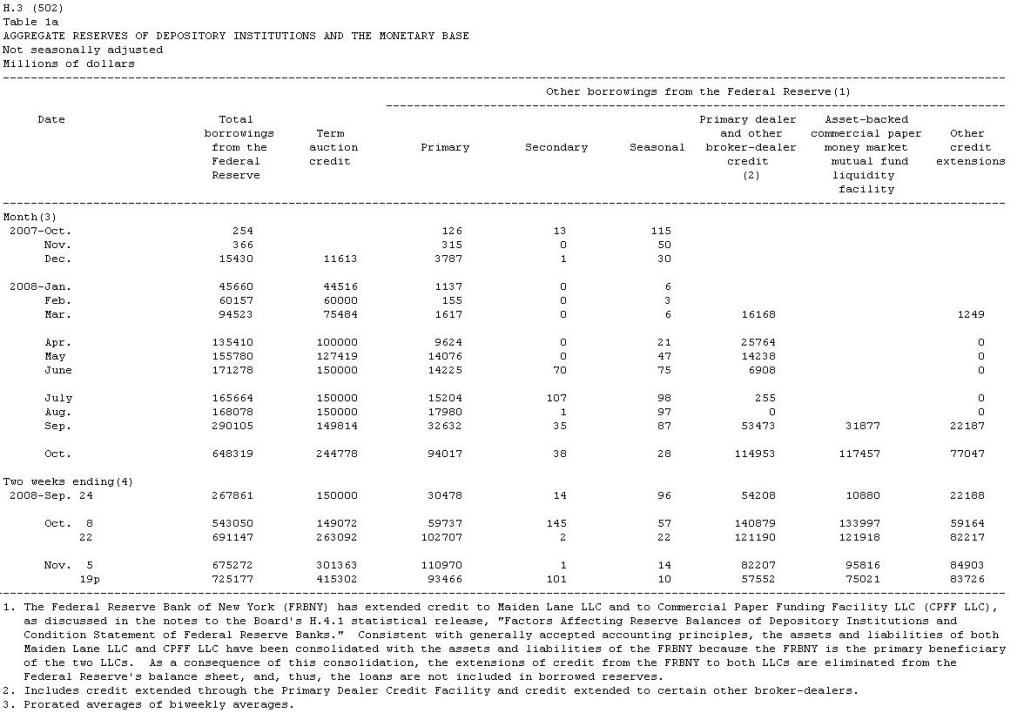

Total reserves as of the 19th November were $652831Million but total borrowing from the Fed was $725177Million. In other words the reserves do not meet the liabilities, what we would call insolvent. The borrowing is to offset losses, to re-capitalise the Bankers et al who have blown the lot on dodgy derivative purchases, debt liabilities and the default of borrowers. The following table from the Fed shows the massive increase in lending since October '07:

The Fed is replacing cash and cash like assets that have been eradicated either as a direct loss or through a devaluation as assets are savagely re-priced lower. The funds are not an addition to the amount that can be used to create credit, they are a replacement for the losses incurred by the re-pricing of risk and the closure of credit facilities. The Fed will continue to throw cash into the bottomless pit of debt destruction but this is not inflationary, it is not adding to the availability of funds, just replacing them.

We should remember, the Fed is lending out the funds, it will want the money back. Banks and the rest of the borrowers are being given time to sort out their positions and extract as much profit as possible to allow them to make up the shortfall. Those profits will go straight into the reserves, they will not be used for investment to expand business. As the profits will essentially come from the pockets of the consumers the amount of cash in circulation will fall unless the Fed replaces the shortfall by printing or the US Treasury directly parachutes cash into the accounts of the consumers. Again, these actions are not inflationary, the direct cash injections will be replacing the cash withdrawn from circulation as it sits in the reserves of banking and corporate America.

Yet the future inflationary expectations of many are not mis-placed. There is good reason to think that inflation may well be the deliberate, planned outcome of the US Fed and Treasury actions. We know that the Fed will just about accept anything as collateral to allow borrowing to take place. It is this willingness to expand lending, coupled with the increase in debt liabilities of the Government that make many think the only outcome can be a future increase in inflation. Indeed it is vital for the Fed/Treasury plan to work that such future expectations exist. As I wrote in An interpretation of The Deflation Bias and Committing to Being Irresponsible by G B Eggertsson :

- "If Bernanke and Co keep with the blueprint (it would be difficult to see how they could deviate now without destroying carefully implanted expectations) we can expect to see continuous and expanding intervention in what was previously thought to be off limit areas.

Treasury bond issuance should rise and does not have to have a defining limit. Tax rebates will continue and grow, expanding beyond traditional areas. Use of current GSEs to expand government debt will be encouraged and may well lead to the formation of "Super GSE's" that could take on second lien loans on property, for example.

The Fed will expand its facilities, including more market participants and widening the range of assets that can be used, including stocks. The facilities will become permanent but will be allowed to run down in use as circumstances dictate. It will be imperative to remove any stigma associated with the use of such facilities, possibly by converting the facilities to a type of GSE, or more likely, a Fed Sponsored Enterprise.

Concerted and possibly international intervention in Forex markets should be given a high level of probability. This will allow a slow and orderly re-pricing lower of the dollar and a continued bias toward inflation.

A campaign of "anti-inflationary" bias will continue and be ramped up if necessary. Rates could be raised without affecting the fight against deflationary forces because expectations would require such a move. A constant attempt will be made to anticipate a move higher in growth."

- "WASHINGTON (Reuters) - The U.S. economy is likely to shrink for at least half a year and the Fed should act aggressively against any risks that deflation could take hold, Federal Reserve Vice Chairman Donald Kohn said on Wednesday.

"We have a very weak economy. The U.S. economy is declining right now," he said in response to questions after a speech at the Cato Institute.

"My most likely outcome is for a couple of quarters of negative growth, and inflation coming down, but not getting to that deflationary state," he added.

Kohn said that while risks of deflation are small, they had risen in recent months and that policy-makers should be vigilant to ensure the phenomenon does not become sustained.

Kohn said the U.S. central bank should consider forms of "quantitative easing," the effective lowering of interest rates by flooding markets with funds.

"We have already engaged in forms of quantitative easing and we should be looking carefully at the effects that they might have, what other forms of quantitative easing might happen as a contingency plan, should that still remote possibility -- but I think less remote than it was -- occur."

Where does this leave the Dollar and by implication all dollar based assets?

The rest of the Weekly Report is reserved for subscribers. To visit An Occasional Letter From The Collection Agency click here

By Mick Phoenix

www.caletters.com

An Occasional Letter in association with Livecharts.co.uk

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.