Stocks Soar as Obama Assembles Recession War Council

Stock-Markets / Recession 2008 - 2010 Nov 23, 2008 - 03:00 PM GMTBy: Mick_Phoenix

Welcome to the Weekly Report. This week we look at new appointments, timings and why Obama is willing to start work early.

Welcome to the Weekly Report. This week we look at new appointments, timings and why Obama is willing to start work early.

An hour before the stock markets closed on Friday we started to get some "breaking news" scrolling across the screens of the financial TV channels, pointing to new appointments in the Obama administration-in-waiting.

Seasoned and grizzled bear market traders recognised the announcements as the usual cover (any news will do) for an end of week rally and closed out, letting the markets rebound from important lows:

The drop on Thursday, the basing move and the sudden move up into Fridays close is also a familiar pattern for those that study options expiries, albeit on a smaller scale. Does this mean the bear market is over? I doubt it very much but remember bear markets love a rally, they are usually much greater in size and speed than in bull markets, so don't be surprised if we move higher, for awhile.

As an aside, I think there is a concerted effort to give the consumer anything to make them feel a little better as we enter the retailers make or break season, I refuse to call it Christmas anymore. Just when the public should be responsible and hoard cash and reduce debt, corporate America (and the rest of the Christian developed world) is spending a fortune on advertising. Don't fall for it people:

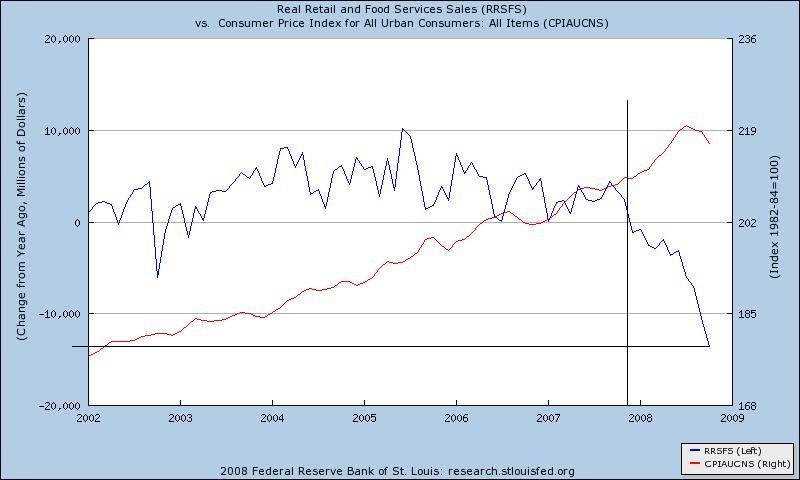

Keep the trend going folks, y-o-y retail sales have plummeted and now inflation, as shown by CPI, is starting to follow. Keep the cash in your pockets and Retailers prices will continue to fall as they seek a level where consumers eventually think goods are cheap and once again part with the asset that is so in demand - cash.

So, back to Friday's announcement, that Timothy Geithner will be the next Treasury Secretary.

So, back to Friday's announcement, that Timothy Geithner will be the next Treasury Secretary.

Is this the change Obama has been so vocal about? Are we looking at the new wave of the future being appointed to clear out the old defunct thinking and relationships that caused us to wake up daily and stare into the abyss of financial destruction?

No, I am afraid not. Let's start with the timing of the announcement, an hour before the Friday close. It looks to me that Obama is happy to be used to help "boost" markets, a pattern seen with government during the last 2 bear events, how quickly change is dropped in the face of expediency. Already I can feel that hope I held on to ebbing away as the flush of expectation dwindles to the dullness of acceptance. Did it really only take 3 weeks for political realism to replace rhetoric wrapped promises?

What of the US Treasury Secretary nominee Mr Geithner? Currently serving as the 9th President of the New York Fed, has he come from a background that would bring change? After he finished an MA in Failed Keynesian based International Economics he went to work for Henry "King maker" Kissinger at Kissinger and Associates in Washington, followed by a stint at the US Treasury, culminating as Under Secretary of the Treasury for International Affairs until 2002.

He then moved onto the Council on Foreign Relations joining the International Economics department before being appointed to his current role in 2003, becoming the Vice Chairman of the Federal Open Market Committee as well as the President of the New York Fed. He is also the Chairman of the committee on Payment and Settlement Systems with the Bank for International Settlements. He was instrumental in the bailout of Bear Stearns and allowing Lehmann to disintegrate.

We have a life long staffer, a peddler of influence and failed economic theory, a man who has never worked in the financial system outside of Government circles. Not exactly the change Obama seemed to promise. Worse than that is who does Geithner rely on for his financial education? I can do no better than to direct you to an excellent article written by Gary Weiss for Conde Nast Portfolio.com titled The Man Who Saved (or Got Suckered by) Wall Street (June 2008) . Here is an illuminating picture for you to digest that is connected to Gary's article:

I urge you read the article, its well worth the effort. We should not forget that it was Geithner who gathered officers from Wall Street as well as representatives from market supervising bodies in Europe at his office in 2005 to hold talks on how to instigate an automated and electronic trading and reporting system for the unregulated and massively inflated Credit Default Swap market. Even as the events of this year unfolded, especially the destruction of AIG, Geithner continued to have meetings that produced no outcome. This leaves me with 2 thoughts, Geithner either didn't see what could happen with CDS or some of his friends persuaded him that regulation wasn't needed or wanted.

Obama seems intent on moving forward well before his January house move and this could prove to be a political mistake. He will now be associated with the financial system crash and the current regime, rather than entering the fray riding on a wave of hope, delivering new solutions to rescue the American people (and the rest of the World). However, I believe Obama knows this and has taken the risk because he believes time is of the essence, that his influence is needed to ensure that the bailouts and stimulus plans are implemented now, rather than in 2 months down the road. This from Bloomberg :

"Obama Targets 2.5 Million Jobs With Stimulus Plan (Update1)

By Edwin Chen and Jason Gale

Nov. 22 (Bloomberg) -- President-elect Barack Obama said he aims to save or create 2.5 million jobs in a two-year plan to stimulate an economy facing a "crisis of historic proportions."

"It's likely to get worse before it gets better," Obama said today in his weekly radio address. He said that this week "financial markets faced more turmoil," potentially leading to a "deflationary spiral" that may plunge the nation further into debt and cost millions more jobs."

Later in the same article Obama unveils his methods for revitalising the US, I had to check the article twice, thinking FDR had made it back from the grave. You can view Obama's weekly address here .

Change? No I'm afraid not, just more of the mistakes of the past wrapped into the rhetoric of the present. At least we know one thing, the plan already being followed by the Fed and the US Government using the ideas and methods laid out in the Eggertsson Theory articles will continue uninterrupted. The shame is that the one premise required to make the idea work is now seriously undermined by Obama himself.

Remember to make the plan work there must be a constant expectation of future inflation in the actions of the Fed and the US Government. Obama warning that we face more turmoil that could lead to a deflationary spiral might well be true but it will not instil confidence in banks to lend, Business to invest or Consumers to spend.

Finally an announcement from An Occasional Letter. This will be the last Weekly Report that will be published in full at public sites. I will be reverting to part publishing with the rest reserved for subscribers. Publishing full articles was only ever temporary, I had to weigh up many different wants and needs, the wish to give subscribers fair value, the need to let readers know what was coming and the hope that some may take action and preserve their wealth. However the immediate need has now passed so I have to put the wishes of subscribers first and go back publishing incomplete articles.

By Mick Phoenix

www.caletters.com

An Occasional Letter in association with Livecharts.co.uk

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.