Financial Markets Wild Ride Between Fear and Optimism

Stock-Markets / Credit Crisis 2008 Nov 23, 2008 - 01:22 PM GMT A new bout of fear gripped financial markets during the past week, causing the slide in global stocks, commodities and emerging-market assets to deepen. As investors' angst escalated, positions in risky assets were liquidated in exchange for perceived safe havens such as the US dollar, government bonds and gold bullion.

A new bout of fear gripped financial markets during the past week, causing the slide in global stocks, commodities and emerging-market assets to deepen. As investors' angst escalated, positions in risky assets were liquidated in exchange for perceived safe havens such as the US dollar, government bonds and gold bullion.

“We have seen fundamental selling, technical selling, forced selling (deleveraging), short selling, capitulation selling and selling due to ennui,” commented David Fuller ( Fullermoney ).

Fueling the sell-off were mounting concerns that the economic recession could not only be more intense than previously feared, but also fall into a corrosive deflationary phase. Additionally, sentiment was undermined by renewed questions about the effectiveness of the US government's bailout plans.

A clear sign of distress and fear was the US three-month Treasury Bill rate falling to zero on Thursday, before nudging up to (a still minuscule) 0.10% by the close of the week. “The financial situation at the moment is so bad that women are now marrying for love,” quipped an e-mail doing the rounds.

After the S&P 500 Index breached the grim milestone of the October 2002 lows and fell to levels last seen in 1997 - thereby threatening to wipe out the entire 2002 to 2007 bull market - Wall Street regained some confidence late on Friday. The trigger for a strong turnaround arrived just in time for the 15:00 witching hour and came in the form of Timothy Geithner's (pronounced GYTE-ner) nomination as new Treasury Secretary, resulting in the S&P 500 recovering from an intraday loss of more than 1% to a gain for the day of 6.3%.

On the bailout front, the Detroit automakers sought $25 billion from the Treasury to avert bankruptcy. However, Congress withheld financial aid for the time being, giving the companies until December 2 to submit a “viable” recovery plan.

“Don't be misled, though - the something that is rotten in the auto industry has nothing to do with the credit crunch, and everything to do with years of mismanagement, shoddy products and bad choices,” said Bloomberg columnist Mark Gilbert. “Consider the credit-rating histories of GM and Ford. For both companies, the rot started all the way back in August 2001, when Standard & Poor's put the A grades they enjoyed for a decade on review for downgrade. In October of that year they each suffered a two-level cut to BBB+ that left them just three moves away from junk status.”

I received the following note from an American friend a few days ago: “…even the children in my son's second grade class are depressed about the auto industry. I had to answer my son's questions about bankruptcy since the kids are talking about it …” This comment says it all!

Elsewhere, Citigroup's (C) share price plunged by 60.4% over the week to a 16-year low as the company wrestled the financial crisis and planned to slash 50,000 jobs. According to The Wall Street Journal , “Citigroup officials have been talking in recent days to Treasury Department and Federal Reserve officials, and those discussions are expected to continue throughout the weekend …”

A pointed comment regarding the principle of bailouts came from Jim Rogers , as quoted by the Financial Times : “What they're doing is taking the assets away from the competent people, giving them to the incompetent people and saying to the incompetent: ‘Okay, now you can compete with the competent people, with their money.' I mean this is terrible economics. This is outrageous economics.”

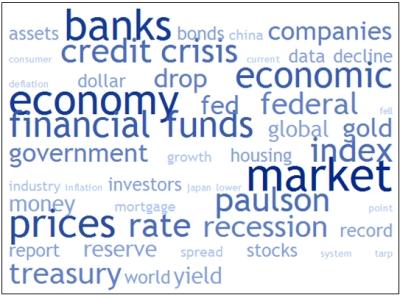

Next, a tag cloud of the text of the plethora of articles I have read since a week ago. This is a way of visualizing word frequencies at a glance. Keywords such as “banks”, “economy”, “market” and “prices” occur often, but words such as “gold” and “deflation” have also started creeping into the tag picture.

The following update on the stock market outlook arrived on Friday from Bennet Sedacca ( Atlantic Advisors ): “We have been barely invested, mostly void, in equities, since May. We went ½ long today near the lows for a rally that could last longer than some think. Mostly large cap, high-quality, excellent balance sheet companies with a little tech and financials thrown in. We must remember, buy when you can, not when you have to.”

Oversold conditions are bound to result in rallies from time to time (and possibly around Thanksgiving), but these should not be trusted at face value. For a more lasting market turnaround to happen, I would like to see evidence of base formations on the charts, a 90% up-day , and relative outperformance by the financial sector.

I am also closely monitoring the surges in the US dollar and Japanese yen - low-yielding currencies previously used for funding risky investments - as a break of the uptrends in these two currencies will be a good indicator of the forced deleveraging selling starting to subside. Once this situation has played itself out, we should see a return to lower volatility levels and a return of confidence. (Also read my recent posts “ Economic woes torpedo stock markets ” and “ Panic-crash sentiment causes extreme volatility “.)

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

Economic reports

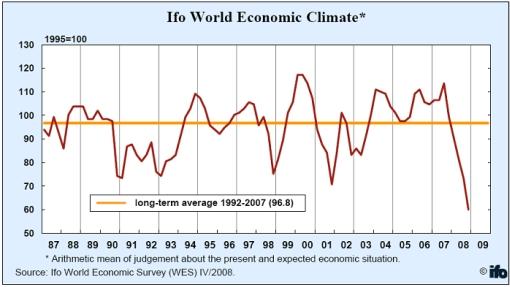

The Ifo World Economic Climate has worsened further in the fourth quarter of 2008 with the indicator falling to its lowest level in more than 20 years, according to the Ifo World Economic Survey . Not only the major economic regions of North America, Western Europe and Asia are affected, but also Central and Eastern Europe, Russia, Latin America and Australia. On the whole, the survey data point to a global recession.

Economic reports released in the US during the past week confirmed an increasingly dire situation.

• The US moved closer to deflation territory as the CPI decreased by 1.0% from September to October (the largest monthly decline since the 1930s), leaving the CPI 3.7% higher compared with a year ago and significantly down from September's 4.9% rate. The continuing decline in US economic activity is pushing down inflationary pressure.

• Because of weak demand, producer prices for finished goods gave up ground for the third month in a row, falling by 2.8% in October largely as a result of much less expensive energy products.

• On par with expectations, residential construction slowed again in October, with a 4.5% month-on-month decline in total housing starts. At 791,000 annualized units, starts have hit another record low as exceptionally weak demand was constraining homebuilding.

• The NAHB housing market index fell further in November, setting a record low.

• Slumping demand is hitting US industry hard, although production bounced back in October from hurricane-related declines in September. Total industrial production increased by 1.3% after having fallen a downwardly revised 3.7% in September, but the indicator fell around two-thirds of a percent in September and October when excluding once-off effects.

• Initial claims for unemployment insurance benefits increased by 27,000 to 542,000 for the week ended November 15, putting claims at their highest point since the early 1990s. This is a serious warning signal about the health of the labor market.

• The Conference Board Index of Leading Economic Indicators declined by 0.9% in October, led by a sharp plunge in stock prices and decreases in residential building permits and consumer expectations. The LEI in the last three months has shown an acceleration in the rate of decline, adding to evidence that the US has entered a recession that will likely be much deeper than either of the previous two.

It comes as no surprise that the minutes of the Federal Open Market Committee's meeting of October 28 to 29 indicate that members were extremely concerned about the near-term prospects for the economy, given the stresses in financial markets. With the problems in credit markets persisting, the FOMC's forecast called for falling growth through the first half of 2009, with next year's real GDP growth projection lowered to -0.2% to 1.1% (previously 2.0% to 2.8%).

Banks continue to hoard all the liquidity the Fed is injecting directly instead of lending it out. This raises the question: Is the Fed “pushing on a string”? Asha Bangalore ( Northern Trust ) commented as follows: “The lowering of the Fed funds rate, the Fed's innovative programs to provide liquidity to financial institutions and more lenient rules for borrowing through the discount window appear to have exhausted the gamut of possibilities routed through monetary policy changes to influence aggregate demand.

“The provisions of the Emergency Economic Stabilization Act of 2008 allow for recapitalization of banks. The FDIC is working on obtaining an approval for the anti-foreclosure plan to address the housing market issues that are central to the current crisis. … the probability of a hefty fiscal stimulus package … is growing every day.”

Economic reports in other parts of the world were equally dismal.

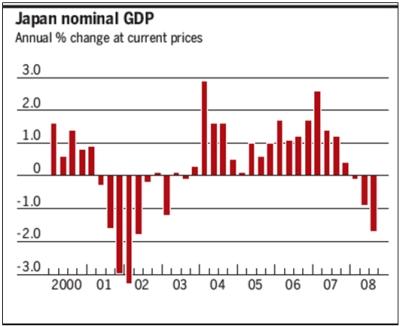

Japan entered into its first recession in seven years as the financial crisis curbed demand for its exports. GDP growth contracted by 0.1% during the third quarter, or at an annualized rate of -0.4%, following a second quarter contraction of a massive 0.9%.

Source: Financial Times , November 17, 2008.

China also warned that the unemployment outlook was “grim” as a result of the financial crisis forcing the closure of more export-oriented factories.

In Europe, a further slowdown in economic activity caused the Swiss National Bank to announce a surprise 100 basis-point cut in its three-month target range to 0.5%-1.5% - the third emergency reduction in two months.

Week's economic reports

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

Date |

Time (ET) |

Statistic |

For |

Actual |

Briefing Forecast |

Market Expects |

Prior |

Nov 17 |

8:30 AM |

NY Empire State Index |

Nov |

-25.4 |

-26.0 |

-26.0 |

-24.6 |

Nov 17 |

9:15 AM |

Capacity Utilization |

Oct |

76.4% |

76.5% |

76.5% |

76.4% |

Nov 17 |

9:15 AM |

Industrial Production |

Oct |

1.3% |

0.1% |

0.2% |

-2.8% |

Nov 18 |

8:30 AM |

Core PPI |

Oct |

0.4% |

0.0% |

0.1% |

0.4% |

Nov 18 |

8:30 AM |

PPI |

Oct |

-2.8% |

-2.0% |

-1.8% |

-0.4% |

Nov 18 |

9:00 AM |

Net Foreign Purchases |

Sep |

$66.2B |

NA |

$17.5B |

$21.0B |

Nov 19 |

8:30 AM |

Building Permits |

Oct |

708K |

760K |

772K |

805K |

Nov 19 |

8:30 AM |

Core CPI |

Oct |

-0.1% |

0.1% |

0.1% |

0.1% |

Nov 19 |

8:30 AM |

CPI |

Oct |

-1.0% |

-0.7% |

-0.8% |

0.0% |

Nov 19 |

8:30 AM |

Housing Starts |

Oct |

791K |

780K |

780K |

828K |

Nov 19 |

2:00 PM |

FOMC Minutes |

Oct 29 |

- |

- |

- |

- |

Nov 20 |

8:30 AM |

Initial Claims |

11/15 |

542K |

505K |

503K |

515K |

Nov 20 |

10:00 AM |

Leading Indicators |

Oct |

-0.8% |

-0.7% |

-0.6% |

0.1% |

Nov 20 |

10:00 AM |

Philadelphia Fed |

Nov |

-39.3 |

-30.0 |

-35.0 |

-37.5 |

Source: Yahoo Finance , November 21, 2008.

Next week's US economic highlights, courtesy of Northern Trust , include the following:

1. Existing Home Sales (November 24): Sales of existing homes are predicted to have declined in October after a small gain in September. Sales of existing homes advanced by 7.8% from a year ago in September, after posting declines since late 2005. Consensus : 5.00 million versus 5.18 million in September.

2. Real GDP (November 25): Incoming economic reports suggest a small downward revision of real GDP in the third quarter to a 0.5% drop from the advance estimate of a 0.3% decline. Consensus : -0.5%

3. New Home Sales (November 26): Sales of new homes are expected to have fallen in October after a 2.3% increase in September. Sales of new homes have dropped by 32.1% from a year ago in September. Consensus : 450,000 versus 464,000 in September.

4. Durable Goods Orders (November 26): Durable goods orders (-2.0%) are predicted to have dropped in October reflecting declines in bookings of defense and aircraft, which posted large gains in September. Consensus : -2.6% versus +0.9% in September.

5. Personal Income and Spending (November 26): The earnings and payroll numbers for October indicate a steady reading for personal income in October. Auto sales fell sharply in October and non-auto retail sales were noticeably weak, pointing to a likely drop in consumer spending (-0.6%). Consensus : Personal income +0.1%, consumer spending -0.9%

6. Other reports : Case-Shiller Price Index, OFHEO Price Index, Consumer Confidence (November 25).

Click here for a summary of Wachovia's weekly economic and financial commentary.

Markets

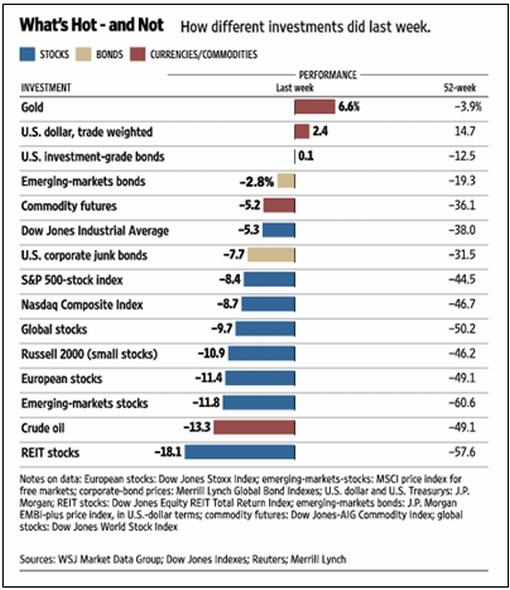

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , November 14, 2008.

Equities

Global stock markets suffered badly during the past week on mounting worries about the severity of the economic slowdown. The week's movements - MSCI World Index -9.6% and MSCI Emerging Markets Index -11.8% - tell the story of a rough ride for bourses all over the world and marked a third straight week of losses. And the scoreboard would have been even worse if not for a dramatic late-session recovery in the US on the news that Timothy Geithner would be named Treasury Secretary.

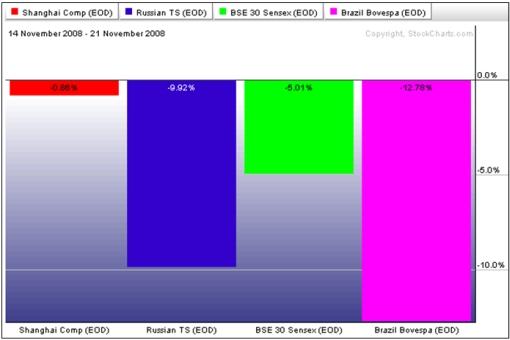

Not a single developed market closed the week unscathed. Similarly, large losses also abounded among emerging markets, with the sole exception being the Shanghai Stock Exchange Composite Index that recorded only a relatively small 0.9% decline. The Index plunged by 72.0% since its high of October 16, 2007 until hitting a low on November 4, but has subsequently bounced by 15.4% to flirt with its 50-day moving average and roundophobia 2000 level. Will the upside leadership for global stock markets come from China on this occasion?

The chart below shows the performances of the four BRIC countries during the past week.

Click here or on the thumbnail below for a (very red) market map, obtained from Finviz , providing a quick overview of last week's performances of global stock markets (as reflected by the movements of ADR stocks).

The US stock markets all declined sharply over the week as shown by the major index movements: Dow Jones Industrial Index -5.3 (YTD -39.3%), S&P 500 Index -8.4% (YTD -45.5%). Nasdaq Composite Index -8.7% (YTD ‑47.8%) and Russell 2000 Index -10.9% (YTD -46.9%).

The S&P 500 closed below its October 2002 low of 777 on Thursday, but Friday's rally (+6.3%) to 800 put it back above this key support level. The Dow remained above its 2002 low of 7,286 on Thursday and closed 760 points above this level after Friday's surge.

Click here or on the thumbnail below for a market map, also from Finviz.com , showing the performances of the various segments of the S&P 500 over the week.

Click here or on the thumbnail below for a market map, also from Finviz.com , showing the performances of the various segments of the S&P 500 over the week.

As far as industry groups are concerned, gold (+19%) was the top performer for the week, led by Newmont Mining (NEM) on the back of a sharp rise in the price of gold bullion.

On the other side of the performance spectrum, the industrial real estate investment trust (REIT) group (-40%) was the worst performer. The diversified financial services group (-38%) was the second worst performer, with each of the group's large banks - Citigroup (C), JPMorgan Chase (JPM) and Bank of America (BAC) - dropping sharply. Investor concerns about future credit losses, valuations of “toxic” securities on the banks' books, job layoffs and capital adequacy issues were the drivers for the declines.

David Fuller ( Fullermoney ) commented as follows on the outlook for stock markets: “… we have yet to see evidence of bottoming out on many major stock market charts. While this is worrying, to put it mildly, and sentiment is diabolical, investors should recall an extremely important behavioural conditioning process. The crowd has always turned progressively more bearish with each additional decline towards the eventual low for every bear market. This is inevitable as more people sell, and unfortunately, few are more bearish than a battered holdout who finally capitulates.

“If global stock markets are not close to a major buying opportunity, then I suggest we should all head to sea and become Somali pirates.”

Fixed-interest instruments

Government bond yields across the world plunged last week as spooked investors rushed out of equities into sovereign debt.

The ten-year US Treasury Note yield declined by a massive 57 basis points to 3.18%, the UK ten-year Gilt yield dropped by 20 basis points to 3.87% and the German ten-year Bund yield fell by 30 basis points to 3.38%. However, emerging-market bonds, in general, lost ground as further deleveraging took its toll on risky assets.

The yield on ten-year Treasuries touched a 5½-year low (3.01%) on Thursday before rebounding by the close of the week, whereas the yield on 30-year bonds dropped to its lowest level (3.53%) since the start of regular issuance in 1977 before snapping back by 14 basis points.

US mortgage rates also declined, with the 30-year fixed rate dropping by 9 basis points to 6.09% and the 5-year ARM also by 9 basis points to 5.89%.

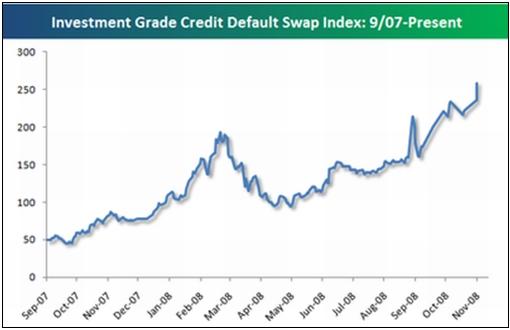

A number of indicators show that the credit crisis is still severe. For example, credit default swaps that measure default risk for investment grade debt are trading at their highest levels of the bear market. This is seen from Bespoke 's index that measures default risk for 125 companies with investment grade debt ratings.

Currencies

The week's feature among currencies was safe-haven flows into the US dollar and Japanese yen as investors liquidated risky assets previously funded with these low-yielding currencies.

The Swiss franc came under pressure as the Swiss National Bank slashed interest rates a full percentage point to 1% as an emergency step to soften the economic slowdown.

The chart below illustrates the accent of the US dollar and Japanese yen since September 15. (The US dollar is measured against a trade-weighted basket of currencies, whereas all the other currencies are measured against the US dollar.)

Emerging-market currencies had another bad week as a result of increasing risk aversion. Examples of losses against the greenback include the Brazilian real (‑10.4%), the Turkish lira (-4.5%), the South Korean won (-6.7%) and the South African rand (-4.4%).

RGE Monitor raised the question whether Bulgaria and the Baltic states will be forced to reset their fixed exchange rate pegs to the euro as a result of their large external imbalances and the global financial crisis. “Because of their fixed exchange rates, these economies cannot conduct independent monetary policy so the burden of macro-economic adjustment falls on fiscal policy.”

Commodities

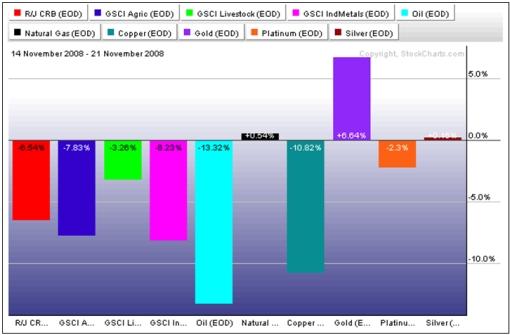

The Reuters/Jeffries CRB Index (-6.5%) witnessed a further decline amid fears of a protracted global economic recession and expectations that demand will drop.

Gold bullion (+6.6%) bucked the trend and surged as the yellow metal found support among nervous investors as a safe store of value. A report that China might embark on a gold-buying program provided an additional boost.

On the other hand, West Texas Intermediate crude declined by a further 13.3% to $49.9 - a level not seen since May 2005. OPEC meets on November 29 to consider additional production cuts.

The graph below shows the movements of various commodities over the past week - a continuation of the intense bear market that has been in force since the beginning of July.

Lau-Tzu said: “Those who have knowledge, don't predict. Those who predict, don't have knowledge.” Wise words indeed, but hopefully the news items and words from the investment wise below will cast some light on the lie of the investment land. And may the markets bring you additional reason to celebrate a joyous Thanksgiving.

That's the way it looks from Cape Town.

Source: Pat Oliphant, Slate

Barry Ritholtz (The Big Picture): Record-breaking data everywhere!

“One of the interesting aspects of this unprecedented housing collapse, credit crisis, economic recession and market crash has been all the new records we keep seeing:

• Over the past year, the S&P 500 Index lost ~$1 trillion more than the entire 2000-2002 bear market, according to Standard & Poor's. From the October 2007 highs of 1,565, to yesterday's close of 806.58, the S&P 500 market capitalization lost $6.69 trillion. That's almost $1 trillion more than entire 2000-03 bear market losses of $5.76 trillion. ( Marketwatch )

• The S&P 500 hasn't been this far below its 200-day moving average on a percentage basis since the Great Depression. ( Doug Kass )

• CPI: US consumer prices in October registered their largest single-month decline since before World War II. It is the largest monthly drop in the 61-year history of the data;

• PPI, down 2.8% for the month, was also a record-breaking drop.

• The dividend yield on the S&P 500 is now greater than the yield on the 10-year Treasury. That hasn't happened since 1958. ( Barron's )

• First-time claims for US unemployment insurance rose to the highest level since September 2001. The total number of people on unemployment benefit rolls jumped to the highest level since 1983.

• Housing starts fell to 791,000, off 38% from a year ago. That's the slowest pace of starts since data began being compiled in 1959. Starts are now down 65% from the early 2006 peak - this has become the very worst housing downturn on record.

• Permits for new houses, at a 708,000 pace, were off 40% from a year ago, also the lowest total since it has been tracked starting in 1960. Put this into context of population - in 1960, the total US population stood at 180 million - 60% of today's 300 million.

• The 30-year return for BBB-rated corporate bonds is now greater than the 30-year return for stocks. So it has not paid to take equity risk for 30 years! ( The Street.com )

• The TIPS Spread ( Treasury Inflation Protected Securities versus the 10-year Treasury) is at a record low 54 basis points (1997).

• The Russell 3,000 now has 1,228 stocks a share price under $10. That's 42% of the index. At the market's 2002 lows, there were significantly less stocks trading below $10/share - just 884. ( Bespoke )”

Source: Barry Ritholtz, The Big Picture , November 20, 2008.

The Wall Street Journal: Obama likely to pick Fed's Geithner for Treasury

“President-elect Barack Obama is expected to nominate as Treasury Secretary Timothy Geithner, the president of the Federal Reserve Bank of New York and a figure who has been deeply involved in tackling the financial crisis.

“Mr. Geithner, 47 years old, would be one of the youngest-ever US Treasury secretaries. His nomination would come as Wall Street is being challenged by the financial crisis and a Washington power vacuum, and as the world's debt markets show fresh signs of falling into deeper problems.

“Mr. Obama is expected to introduce his entire economic team on Monday, according to people familiar with the matter. The president-elect has been under pressure to speed up his transition as stock markets this past week fell to lows not seen since the late 1990s.

“Mr. Geithner served as a Treasury attaché in Japan in the 1990s and later at the International Monetary Fund. He was a protégé of former Treasury Secretaries Lawrence Summers and Robert Rubin. Mr. Summers, who was also a potential candidate, instead is expected to take a position within the White House as an economic adviser.

“Mr. Geithner has spent most of his career managing government responses to financial crises, from the 1990s bailouts of Mexico, Indonesia and Korea, to the debt-market meltdown that has brought Wall Street to its knees this year.

“Mr. Geithner (pronounced GYTE-ner) pushed for earlier intervention in the financial markets to stem the financial crisis, and looks likely to continue that activist approach in his new job. Among his first priorities could be a large fiscal-stimulus package.

“Unlike previous picks for Treasury secretary, who hailed from Wall Street, industry or the Senate, Mr. Geithner has been a technocrat most of his career.”

Source: Jonathan Weisman, Deborah Solomon and Jon Hilsenrath, The Wall Street Journal , November 22, 2008.

The Wall Street Journal: Paulson - we're not experimenting with bailout

“Treasury Secretary Henry Paulson defended the Bush Administration's $700 billion bailout plan, telling WSJ's Alan Murray he doesn't think he's doing FDR-like experimentation with liquid assets.”

Source: The Wall Street Journal , November 17, 2008.

CNBC: Bernanke testimony

Federal Reserve chairman Ben Bernanke testifies before the House Financial Services Committee.

Source: CNBC , November 18, 2008.

Financial Times: US economy chiefs say policies bear fruit

“The cost of insuring top quality US companies against default hit a record high on Tuesday even as Hank Paulson and Ben Bernanke told Congress that their radical policy actions to ease the credit crisis were starting to bear fruit.

“‘We have turned the corner in terms of stabilising the system and preventing collapse,' said Mr Paulson, Treasury secretary. He called for patience, saying: ‘There is a lot of work that still needs to be done in terms of recovery of the financial system.'

“Mr Bernanke said there were ‘some signs that credit markets, while still quite strained, are improving'.

“However, the Federal Reserve chairman noted that ‘overall credit conditions are still far from normal, with risk spreads remaining very elevated'.

“On Tuesday, the CDX index that measures the cost of insuring investment grade companies against default closed at a record high on mounting concern about the global economy, and there were fresh signs of dislocation in the swaps market.

“Meanwhile, indices that measure the value of securities backed by residential and commercial property loans - which have plunged since Mr Paulson abandoned his plan to buy toxic assets last week - continued to plumb new depths.”

Source: Michael Mackenzie and Krishna Guha, Financial Times , November 18, 2008.

The Wall Street: Paulson, Summers, Rubin debate crisis

“Current Treasury Secretary Henry Paulson and predecessors Lawrence Summers and Robert Rubin locked horns over the best way to get the US economy back on track.”

Source: The Wall Street Journal , November 17, 2008.

Bespoke: Paulson trying to rewrite his own history

“Treasury Secretary Henry Paulson spoke at the Reagan Library this afternoon, and judging by the speech, it appears as though Mr. Paulson is embarking on a PR campaign to rewrite the history of his handling of the credit crisis. One line that stood out was when he said: ‘By pro-actively addressing the problems we saw coming …'

“Judging by excerpts of prior comments the Treasury Secretary made during 2007, if Mr. Paulson saw the problems coming, he wasn't telling anybody.

“ Marketwatch 3/13/07: Paulson also said the fallout in subprime mortgages is ‘going to be painful to some lenders, but it is largely contained .'

“ Reuters 4/20/07: ‘I don't see (subprime mortgage market troubles) imposing a serious problem. I think it's going to be largely contained .'

“ Bloomberg 5/22/07: Paulson, also speaking to CNBC , said the housing slump was ‘largely contained ‘ and that market's correction was mostly ‘behind us.'

“ Bloomberg 6/20/07: Subprime fallout ‘ will not affect the economy overall.'

“ Forbes 7/27/07: Appearing on CNBC with other members of the Bush administration's economic team, he again said mortgage industry problems would be ‘largely contained .'

“ Boston.com 8/1/07: Paulson added that he did not see anything that caused him to reconsider his view that the economic damage from the housing correction was ‘largely contained .'

“Another classic line from today was, ‘As I assess our current situation, I believe we have taken the necessary steps to prevent a financial collapse.' Mr. Paulson, what is it going to take for you to consider this a financial collapse?

“Given that the extent of the credit crisis was underestimated by almost everyone, you can give Paulson somewhat of a pass for missing it. But to try and rewrite history through speeches even while the credit crisis is still playing out is inexcusable.”

Source: Bespoke , November 20, 2008.

Financial Times: Congress reaches an impasse on car bailout

“The US Congress is unable to approve a new emergency loan to the country's troubled car sector, Democratic leaders said on Thursday.

“Industry chiefs' pleas for aid appeared to backfire after two days of hearings on Capitol Hill. News of the impasse over one of the hardest-hit sectors of the US economy came as President George W. Bush agreed to extend unemployment benefits after US weekly jobless claims hit a 16-year high.

“Harry Reid, Senate majority leader, and Nancy Pelosi, speaker of the House of Representatives, said there were not enough votes to pass a $25 billion loan for Detroit that Democrats had advocated. They said car companies had to be more specific about restructuring.

“The pair gave the big three carmakers - General Motors, Ford and Chrysler - until December 2 to submit a ‘viable' recovery plan, with the prospect of convening hearings immediately afterwards and possible congressional votes a week after that.

“The announcement came in spite of last-minute efforts by six Democratic and Republican senators from car-producing states to reach a deal on a bridging loan.”

Source: Daniel Dombey, Andrew Ward and Bernard Simon, Financial Times , November 20, 2008.

ABC News: Auto bailout - would be better to burn the money

“Congress is debating cutting the Big Three Autos a check … something to tide them over through these tough times. General Motors is bleeding money … some 2 billion dollars a day. Bail them out or let them go bankrupt? That's the billion dollar question. And its billions of your money.

“One side says give them money - they're too big to fail, too many jobs will be lost, the American economy will be hit hard, they need time to get fuel efficient cars to the market.

“The flip side - let them fail, they brought this on themselves, pouring 25 billion into these failed models is a waste, bankruptcy protections will let them out of their incredibly expensive labor contracts.

“… David Yermack from NYU Stern Business School chimed in: ‘The implications of this story for Washington policy makers are obvious. Investing in the major auto companies today would be throwing good money after bad. Many are suggesting that $25 billion of public money be immediately injected into the auto business in order to buy time for an even larger bailout to be organized. We would do better to set this money on fire rather than using it to keep these dying firms on life support, setting them up for even more money-losing investments in the future.'”

Source: ABC News , November 17, 2008.

Paul Kedrosky (Infectious Greed): The auto bankruptcy teeter-totter

“GM, for its part, isn't taking this lying down. It has posted a video on YouTube explaining - okay, propagandizing - the implications of letting it die. Watch it to see how the straight-to-consumer “Save us!” game is played.”

Source: Paul Kedrosky, Infectious Greed , November 15, 2008.

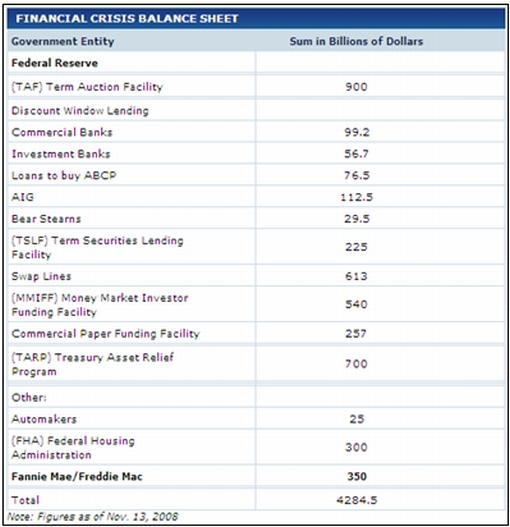

CNBC: Financial crisis tab already in the trillions

“Given the speed at which the federal government is throwing money at the financial crisis, the average taxpayer, never mind member of Congress, might not be faulted for losing track.

“CNBC, however, has been paying very close attention and keeping a running tally of actual spending as well as the commitments involved.

“Try $4.28 trillion dollars. Not only is it a astronomical amount of money, it's a complicated cocktail of budgeted dollars, actual spending, guarantees, loans, swaps and other market mechanisms by the Federal Reserve, the Treasury and other offices of government taken over roughly the last year, based on government data and new releases. Strictly speaking, not every cent is directed as a result of what's called the financial crisis, but it arguably related to it.”

Source: CNBC , November 17, 2008.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.