Citibank Seeks More Bailout Cash as Corporate Bonds Crash to 20% Yields

Interest-Rates / Credit Crisis 2008 Nov 22, 2008 - 03:16 PM GMTBy: John_Mauldin

Leverage Is an 8 Letter Word

Leverage Is an 8 Letter Word- If Loans Are So Cheap, Why Don't They Sell?

- Deflation and Helicopters: Time for a Review

- Commercial Property Loans Start to Haunt the Banks

- Warren Makes a Bet

Leverage is an eight-letter word, which the markets now regard as twice as bad as the two four-letter words debt and pain (or fill in your own four-letter words). This week I try to give some insight into what is happening in the credit markets, some of it below the radar screen of most analysts. We will look at the potential for deflation and the Fed's response. There is a lot to cover, so let's jump right in.

If Loans Are So Cheap, Why Don't They Sell?

I talked with a friend who runs a collateralized loan obligation fund, or CLO. There are a lot of these funds in the Shadow Banking System. Typically they buy certain types of debt, with a lot of it in the bank loan space. In the "old" days of the last few years, banks would make loans to corporations and then sell them to CLOs and other institutions, making a spread on the loan and a profit on the servicing business. Some funds would typically leverage up somewhat and make a decent return.

Today, many highly rated loans are selling for 80 cents on the dollar. There is nothing wrong with the collateral or the corporation which owes the money; there is just no one with ready cash to buy the loans. I asked my friend why he doesn't buy them, since they offer very good returns.

The problem is that his fund, and most other CLOs, have covenants in their offering documents that prevent them from buying debt at less than 85 cents on the dollar. That covenant is a good thing in normal markets, as it prevents possible mischief by the manager, but right now it means that a lot of opportunity is being missed. The only way he can buy these highly undervalued bank loans is to create a new fund, which he is in the process of doing. But getting the money is tough, as the pension funds and endowments who would normally be the investors are waiting for cash to come from their redemptions in other funds, which are of course selling whatever they can to raise money for the redemptions, including these very same bank loans. Can you say vicious circle?

The good news is that the market is (albeit slowly) responding to low prices and a market for undervalued assets. But the bad news is that it could be months before there will be meaningful recovery in asset prices. In the meantime, these and many other assets are being marked down and impairing the balance sheet of a lot of banks, funds, and institutions.

As an aside, the prices for loans made for leverage buyouts in the last few years have fallen significantly. Anybody want to buy some loans made on the Chrysler sale to private equity fund Cerberus? I think not. Just because a loan is cheap does not mean it is necessarily a reasonable value.

Commercial Property Loans Start to Haunt the Banks

As I have written for a very long time, there are two aspects to the current recession and financial crisis. The first is the fallout from the subprime crisis, which has morphed into a full-blown credit crisis. That coupled with a housing crisis has sent the nation into what looks like it will be the worst recession since 1974.

The second phase to hit banks and lending institutions is the normal recession problem of increased losses on all sorts of loans. Credit cards, home equity loans, residential mortgages, and especially commercial property mortgages all suffer during a recession. As documented a few letters ago, default rates are soaring on all types of consumer loans. That is what you would expect to happen in a recession. The problem is that many of the larger banks have already had their capital depleted dealing with the credit crisis. Now they are going to have to raise even more capital (or reduce lending) to deal with the normal loan problems that come with a recession.

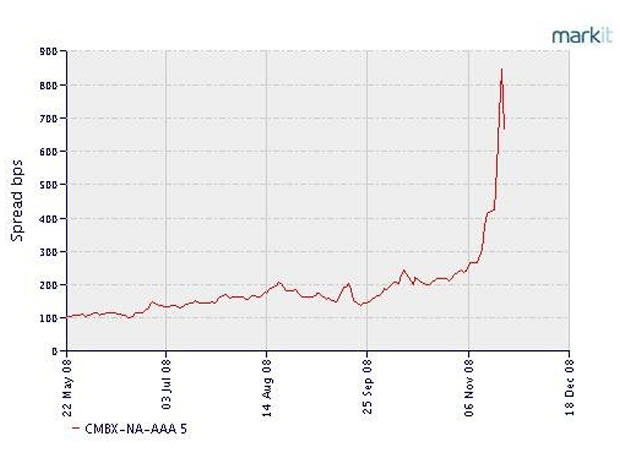

Let's look at a few charts from www.markit.com which show the stress in commercial property lending. A number of very large firms come together to create a market index for commercial mortgage-backed securities, or CMBS (which is listed at market.com). They put 25 different commercial property trusts, created by JPMorgan, Merrill, UBS (the usual suspects), and so on into the index. Traders can then trade on the market value of the underlying combined assets by trading the index. In principle, this is just like trading a stock index that gives you exposure to all the stocks included in the index.

If you have bought commercial mortgages and want to hedge your portfolio, you can do so with this index, or if you want to sell protection (insurance) you can also do so. The price is determined by the spread between the coupon and (I believe) the 10-year US Treasury bond. From trading at a spread of 100 basis points in May and 200 basis points (bps) in July, the spread on AAA-rated commercial mortgages skyrocketed in the last few weeks to 850 before settling back to 667, or more than six times what it was just a few months ago.

According to the Wall Street Journal, at the peak a few days ago this meant that the AAA part of this index was trading at $.70 on the dollar. That suggests there will be losses of 70% on the lower tranches!

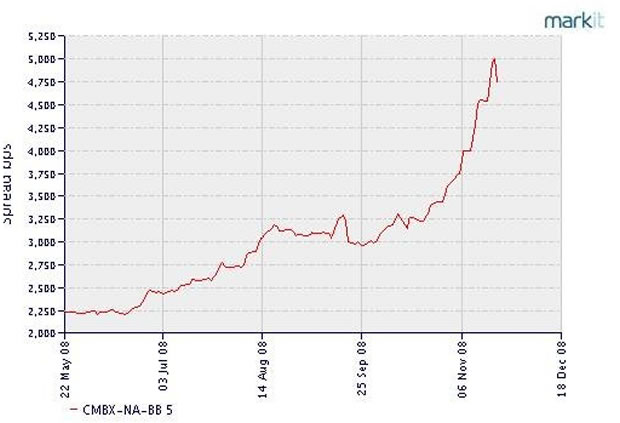

Every six months the 12 investment banks that help create the index build a new index comprised of recently created trusts composed of hundreds of individual mortgages. As with most asset-backed paper, these trusts are divided into different tranches, with the highest-rated tranche getting the lowest return but first call on the return of principle and interest. Lower-rated tranches take successively more risk.

There are seven different indexes on the Markit platform, from AAA to lowly BB. Each index is composed of the corresponding tranche in the 25 trusts within the index. Let's look at what the lowest-rated tranche has done.

The lowest tranche is now trading at 4,750 basis points or, if you add in the Treasury price, at over 50%! If you were an institution or fund and wanted to buy protection on a BB-rated CMBS in your portfolio, you would have to be willing to pay 50% annual interest!

On the web site, they note that they have not created a new series that was planned for October 25th of this year, as there have not been enough new commercial mortgages created to actually build an index. Why? Because any commercial mortgages that the banks now make will have to be kept on the books of those banks, since the price to securitize the loans is prohibitive. Is it any wonder there has been a serious reduction in large commercial property loans?

On a rather sad note, look at the logos of the banks involved in creating this index, from the marketing brochure that Markit uses to inform potential buyers and sellers of the CMBS index:

Fourteen banks were involved as of a few months ago, but now? Bear, Lehman, Wachovia, and Merrill have either passed from this world or have been swallowed up. It makes you wonder who is next. (Side bet: the Treasury or Fed will inject some capital into Citibank this weekend.)

We could do the same analysis on high-yield bonds. Interest on high-yield bonds is now approaching 20%. Credit default swaps on many issues are simply out of sight. That means that if a lower-rated company wanted to issue bonds, they would have to pay 20% or more! There are very few projects that can justify 20% in a low-inflation world. And without access to capital, it will be difficult for businesses to grow. It also means they have to cut costs and jobs. As noted above, even highly rated corporate bonds are selling at steep discounts. Deleveraging is going to be a problem for a few years. We need to get used to it.

Fourteen banks were involved as of a few months ago, but now? Bear, Lehman, Wachovia, and Merrill have either passed from this world or have been swallowed up. It makes you wonder who is next. (Side bet: the Treasury or Fed will inject some capital into Citibank this weekend.)

We could do the same analysis on high-yield bonds. Interest on high-yield bonds is now approaching 20%. Credit default swaps on many issues are simply out of sight. That means that if a lower-rated company wanted to issue bonds, they would have to pay 20% or more! There are very few projects that can justify 20% in a low-inflation world. And without access to capital, it will be difficult for businesses to grow. It also means they have to cut costs and jobs. As noted above, even highly rated corporate bonds are selling at steep discounts. Deleveraging is going to be a problem for a few years. We need to get used to it.

Deflation and Helicopters: Time for a Review

I wrote six years ago (November 2002) about Ben Bernanke's speech on deflation, where he tried to make a joke about beating back deflation by dropping money from helicopters. He was immediately tagged as "Helicopter Ben." My thoughts on that speech took up about half of one chapter in Bull's Eye Investing, and I still think it is a very important speech.

I have been saying for a long time that we would be dealing with deflation next year, and that has been met with a lot of reader skepticism. And when inflation hit 5.6% last July, that skepticism was understandable. But this would be a strange world indeed if you had the twin bubbles of housing and credit burst and didn't see a whiff of deflation. Recessions and the bursting of bubbles are by definition deflationary.

And I have been giving thought to the idea that we may have seen a mini-bubble in the price of many commodities, and that bubble has been bursting as well. And since commodity prices were the main cause of inflation, as they retreat the rise in the inflation rate is retreating. This week the latest inflation numbers showed a drop to 3.7% on a year-over-year basis.

But the Consumer Price Index (CPI) fell by a full 1% in October. You have to go back to the 1930s to find a one-month drop as large. And I don't think this is just a one-month anomaly caused by falling energy prices. The housing component, which is 32% of the index, is based on Owners' Equivalent Rents (OER). As I have written elsewhere, over very long periods of time this works as well as actual housing prices. You simply have to pick your basis for comparison and stick with it.

If, for instance, we had been using house prices for the last ten years, we would have seen large increases in inflation up until a year ago, and since then the index would have been in outright (and serious) deflation. But we use OER, so prices in the CPI have been more stable. But that looks like it could be changing.

OER has been rising steadily over the last decade as rents went up. The index showed a 3% rise in 2007, for instance. The recent trend has been down from there, and last month there was no rise in the cost of shelter. Given the number of houses for sale and a weakened economy, I think it is likely we will see outright reductions in the cost of rent, which will translate into a much lower inflation number.

Lower prices are a two-way street. When they result from improved productivity and efficiency, that is considered to be a good thing. But when they are the result of lower demand, that can be problematic.

There is the likelihood that the Fed will lower rates to 50 basis points, and some major and very seasoned economists are now predicting a zero percent Fed funds rate early next year. Given that Fed funds are actually trading at 38 basis points, a drop to 50 basis points would change nothing on a practical level. (Can we say Japan?)

With that in mind, let's revisit Bernanke's speech. Every central banker is mindful of Japan and the 1930s in the US. Deflation is something that will not be allowed. But what if the Fed lowers interest rates to zero and demand does not pick up, along with a little inflation? Quoting Ben:

"To stimulate aggregate spending when short-term interest rates have reached zero, the Fed must expand the scale of its asset purchases or, possibly, expand the menu of assets that it buys. Alternatively, the Fed could find other ways of injecting money into the system -- for example, by making low-interest-rate loans to banks or cooperating with the fiscal authorities. Each method of adding money to the economy has advantages and drawbacks, both technical and economic. One important concern in practice is that calibrating the economic effects of nonstandard means of injecting money may be difficult, given our relative lack of experience with such policies. Thus, as I have stressed already, prevention of deflation remains preferable to having to cure it. If we do fall into deflation, however, we can take comfort that the logic of the printing press example must assert itself, and sufficient injections of money will ultimately always reverse a deflation."

Just a thought here. We could see real drops in the CPI next year. We could also see a US government deficit approach $1 trillion and go right on through that heretofore unthinkable number. As I wrote last week, a reduced trade deficit means that there will be fewer dollars abroad to buy our debt. The difference will have to be made up by either increased savings in the US or higher rates to attract buyers OR the Fed monetizing the debt.

I think the Fed would be highly reluctant to monetize debt in a period of inflation like we have been in, no matter what problems we face. But in a period where we could be facing deflation? It is very possible they would consider monetizing the debt, as will central banks all over the world.

We are in unprecedented times. A (1) deep recession coupled with (2) financial institutions deleveraging, added to (3) a consumer who is going to be forced to save more and spend less while (4) commodity prices are falling, on top of (5) a serious slowdown in the velocity of money, and you have the makings of a perfect deflationary storm. The Fed would be forced to fight it.

What would they do if lowering the Fed rate to zero was not enough? As Bernanke stated, they would simply set the rates for 1- and 2-year notes and further out the curve if they felt they needed to. And if Goldman Sachs is right in its latest revised forecast, the economy is going to need some help:

"Goldman said it now expects U.S. GDP to fall 5 percent in the current quarter, with unemployment rate reaching 9 percent in the fourth quarter of 2009. It also forecast the 10-year yield to fall to 2.75 percent by the end of the first quarter of 2009, as compared to previously estimated 3.5 percent.

" 'The combination of weaker real activity and slower inflation means that profits of U.S. companies will fall even more sharply than we had previously expected,' Goldman said in a note to clients. Goldman now sees economic profits falling 25 percent in 2009 on an annual average basis, the biggest drop since 1938. It had earlier expected a fall of 20 percent. Goldman expects unemployment rates to further go up in 2010 as well, as there is little chance of the economy returning to trend growth by that year."

Other mainstream economists think GDP might fall this quarter by as much as 5%. That does not bode well for retails sales this Christmas.

Warren Makes a Bet

And let's close on this note brought to my attention by Bill King.

"MSN Money's John Markman: Shares of Warren Buffett's insurance holding company are on the ropes this month, plunging 30% in part because the famed investor dabbled in an area of the market he has long publicly derided: derivatives. And due to a tangled web of financial relationships, they may be taking Goldman Sachs shares down with them. Investors are concerned about a $37-billion bet that Buffett made last year that U.S. and world equity values would be higher in 15 to 20 years than they were then, when the Dow Jones Industrials were trading around 13,000. Through his firm, Berkshire Hathaway, Buffett sold option contracts, known as "naked puts" to an undisclosed group of investors for around $4.85 billion, reportedly using Goldman as broker...

"Because of its solid-gold credit rating, Berkshire Hathaway was not required to put up collateral to make this trade. But now rumors are flying on Wall Street that the owners of the contracts have demanded that broker Goldman Sachs put up collateral for the rest of the amount due. Since the value of the trade could be infinite, the collateral demands are said to be large, and fears that Goldman will struggle to make good on its obligation has panicked shareholders. Indeed one theory making the rounds this week is that Buffett put $5 billion into Goldman at around $125 per share in September not as an investment but to help provide funds for the collateral.

http://blogs.moneycentral.msn.com/topstocks..

"Isn't this the oracle that called derivatives, 'financial weapons of mass destruction'?"

I personally think that Warren made a very good bet. I would be shocked if the Dow was not at 13,000 in 20 years. Inflation will do most of that heavy lifting. But it does make for an interesting discussion now.

Thanksgiving, Moving, and New Orleans

Tiffani has decreed that I am going with her to New Orleans in a month to spend four days huddled away from the office, pouring over the research for our new book Eavesdropping on Millionaires and getting started on the actual writing. Somehow, she thinks I will be distracted if I am in the office.

I am looking forward to Thanksgiving next week. Most of my kids and some of my family will be coming to my apartment. I will be cooking all morning, preparing prime, lots of mushrooms and veggies, and more. I really get into it when I get the chance. And a very thoughtful reader has sent Tiffani and me some really great wines, which we will uncork.

Hopefully, this year we can avoid a fire in the building and having to carry my 91-year-old mother down 21 flights of stairs. And then the next day we pack everything up and move a few miles away to a house that will become my office a few weeks later. I am really quite excited about the move, as I really do like the house and am really enamored of the thought of a ten-second down-the-hall commute. Ask me in three years how I like it.

Congratulations are in order to my assistant of the last three years, Sommer Dooley, who has passed the exams for her nursing degree. She will be leaving us soon. She has been a real help the last few years and will be missed.

Next week I am going to write a special letter on why I am optimistic that we will come through this whole financial mess, but now it is time to hit the send button. Have a great week and enjoy your family and Thanksgiving! I think it is my favorite holiday.

Your thinking life is really pretty good analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.