Credit Collapse, U.S. Treasury Yields Fall to Record Lows

Interest-Rates / US Interest Rates Nov 20, 2008 - 12:52 PM GMTBy: Mike_Shedlock

Once again treasury bears who do not understand the implications of a collapse in credit are taking a beating as Treasury Yields Drop to Record Lows .

Once again treasury bears who do not understand the implications of a collapse in credit are taking a beating as Treasury Yields Drop to Record Lows .

Treasury yields declined to record lows, with two-year notes dropping below 1 percent for the first time, as global stocks slumped and a deepening recession drove investors to the safest assets.

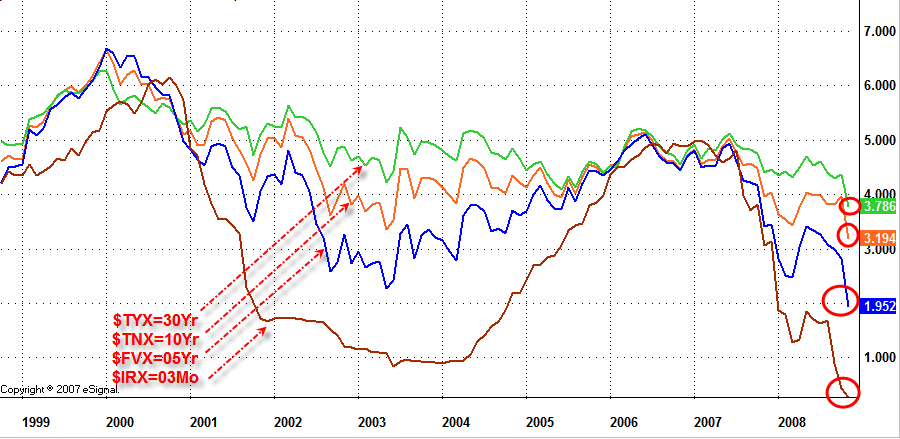

Yields on two- and five-year notes and 30-year bonds dropped to the least since the Treasury began regular issuance of the securities. Ten-year note yields touched the lowest since 2003 after yesterday's release of the minutes of last month's Federal Reserve meeting showed policy makers expect the economy to contract through the middle of 2009 and more interest-rate cuts may be needed to counter deflation.

“Fear is dominating the market place,” said Andrew Richman, who overseas $10 billion in fixed-income assets as a strategist in West Palm Beach, Florida, for SunTrust Bank's personal asset management division. “People are seeing their net worth evaporate.”

My Comment : Is it fear? Perhaps. But if so perhaps the fear is rational. This economy may not come back for years.

The 30-year yield fell 19 basis points to 3.72 percent, the lowest level since regular sales started in 1977. Yields on five-year notes declined to 1.92 percent, not seen since 1954, according to data compiled by Bloomberg and the Fed.

My Comment : I have been calling for record low yields. So far the only one not to happen is the 10 year note.

Some Fed policy makers said they were prepared to cut interest rates further as “more aggressive easing should reduce the odds of a deflationary outcome,” according to minutes of the Oct. 28-29 meeting released yesterday.

My Comment : Any cuts by the Fed now are purely symbolic. The Fed Funds Rate is effectively zero. Remember the claim that paying interest on reserves would put a floor under the Fed Fund Rate at 2? Another Bernanke academic solution meets real world experience.

Fed officials lowered their economic-growth estimates to zero to 0.3 percent for 2008, from 1 percent to 1.6 percent previously, the median forecast of Fed governors and district- bank presidents showed. The predictions for GDP next year ranged from a contraction of 0.2 percent to growth of 1.1 percent. The jobless rate is projected to be 7.1 percent to 7.6 percent.

My Comment : This is amazing optimism. I expect an unemployment rate of 8 percent minimum and 9 would not be surprising. Target GDP is complete silliness as well.

“You have the cloak of a declining inflationary environment,” said Tom Tucci, head of U.S. government bond trading in New York at RBC Capital Markets, the investment- banking arm of Canada's biggest lender. “People are denying it, but we are mirroring the whole Japanese situation and if that's the case interest rates are going to go a lot lower.”

My Comment : A "cloak a declining inflationary environment” is not what we have. We have outright deflation not disinflation. Yes, we are mirroring Japan.

Swap Spreads Collapse

Bloomberg is reporting Swap Spreads Collapse as Concern of Global Recession Deepens .

The spread between the rate to exchange floating for fixed interest payments and U.S. Treasury yields collapsed amid concern a protracted recession will prompt the Federal Reserve to lower borrowing costs again.

The difference between the five-year swap rate and the benchmark Treasury yield, known as the swap spread, narrowed to 78.56 basis points today, the lowest since May 22.

“The drop in swap rates reflects the belief that interest rates might stay lower for longer than previously expected,” said Tony Crescenzi, chief bond strategist at Miller Tabak & Co. in New York.

Yields on two- and five-year notes and 30-year bonds fell to the lowest since the Treasury began regular issuance of the securities, amid signs the economy is faltering further.

“A massive tightening in swap spreads is occurring today as the market prices for slower global growth, disinflation or deflation, unwinds hedges of curve positions and prices in significant U.S. Treasury supply,” wrote Jim Caron, head of U.S. interest-rate strategy at Morgan Stanley in New York, in a note today.

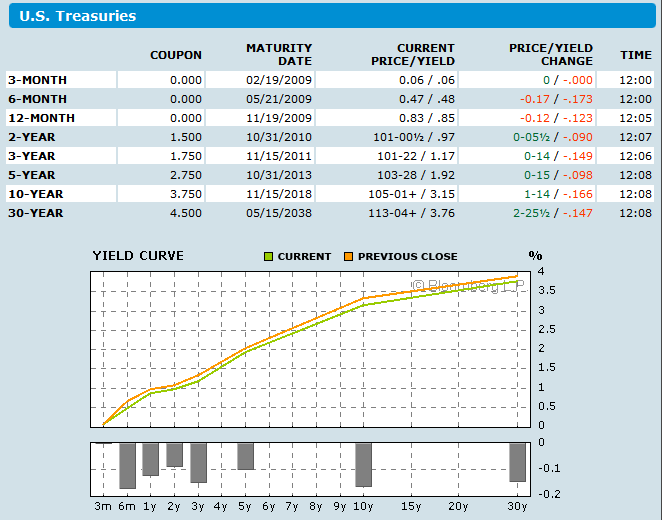

Yield Curve As Of 2008-11-20

US Treasuries Snapshot

Chart courtesy of Bloomberg .

Is that a 2 handle approaching on the 10 year treasury?

Why yes it is.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.