Increase interest rates on your savings accounts by up to 4.81% by saving online says moneyfacts.co.uk

Personal_Finance / Savings Accounts Apr 11, 2007 - 11:31 AM GMTBy: MoneyFacts

Vote with your feet and get to work with your mouse

Rachel Thrussell Head of savings at moneyfacts.co.uk – the money search engine, comments: “With more and more banks closing branches, reducing opening times and cutting staff numbers, traditional branch banking may not always fit in with our busy 24/7 lifestyles. With internet banking providing a round the clock service, offering many of the facilities available in branch, it could be the perfect solution. And as the cherry on the cake, most internet accounts pay much better rates.

“Searching online to find best financial products is now more popular than ever, with the number of visitors to moneyfacts.co.uk over doubling in the last 12 months. Research from Birmingham Midshires also confirmed that online searching is not just for the young or professional market. 14% of over 45s now consult price comparison sites such as moneyfacts.co.uk before taking out any new financial product.

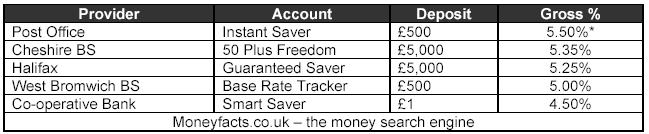

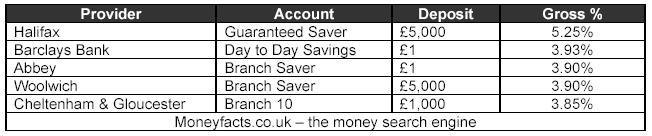

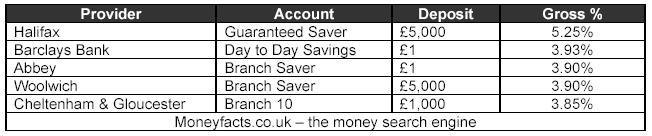

“Online savings accounts traditionally pay preferential rates, rewarding the DIY element of online applications and transactions. Today moneyfacts.co.uk best buy internet accounts pay as much as 5.71% gross from as little as £1. However the comparable branch based accounts only offer 5.50%, including a 1% bonus. As for the deals you are likely to find on your local high street, the best buy rates drop to 5.25%, requiring a minimum deposit of £5K, or 3.93% for a lower minimum deposit of £1.

“Putting this into monetary terms, it really can make a large difference to the return you might achieve on your savings. According to NS&I, the average UK saver has accumulated £20,833 worth of savings. Investing this sum in the best buy IceSave internet account could see an annual gross return of £1,187.48, whereas a similar account on the high street would return £1093.73 (5.25%) or a mere £818.74 (3.93%) by comparison.

“With inflation (RPI) reaching 4.6%, many branch based high street accounts just don’t keep pace, so keeping your savings in one of these accounts will see the real value of your money decrease over time. With many savings accounts paying rates as low as 1% to 2%, savers need to keep an eye on the rates they are receiving as they could be missing out on hundreds of pounds in interest each year. Take for example the Alliance & Leicester instant access account, currently paying a measly 0.90% gross interest on £20K. This would provide an average saver just £187.50 in interest per year, a staggering six times less than the return on the IceSave account.

“Keeping your savings in a poor paying account is almost like throwing money away. With just a little effort to find a better account, your savings could soon grow. Loyalty does not always pay, but DIY online will – so shop around the whole market for your new account, but just be aware that to get the best rates your new account will probably have to be internet based.

“Do remember that, if you do bank online and need access to your funds, it may take a few days for the transfer to hit your chosen account.

“Don’t let your bank get away with paying you a poor return on your savings, as your apathy will only boost their profits further. Vote with your feet and get to work with your mouse.”

For the Moneyfacts.co.uk best buy, Internet, branch and high street accounts see below:

Instant Access Branch Accounts

Instant Access Branch Accounts- High Street

Internet Only Accounts

*Rate includes a bonus

By Rachel Thrussell

http://www.Moneyfacts.co.uk

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.