Misguided Bets On The Yield Curve Steepening

Interest-Rates / US Bonds Nov 19, 2008 - 03:58 PM GMTBy: Mike_Shedlock

Bloomberg is reporting U.S. Long-Term Treasuries Advance as Consumer Prices Plummet .

Bloomberg is reporting U.S. Long-Term Treasuries Advance as Consumer Prices Plummet .

Treasuries maturing in 10 years or more, the most sensitive to inflation expectations, rose after a government report showed consumer prices dropped in October by the most on record.

The difference between yields on 10-year Treasury Inflation Protected Securities and conventional notes, which reflects the outlook for consumer prices, was 44 basis points, the least since Bloomberg began tracking the data in 1998. Two-year yields touched the lowest since 2003 as traders raised bets the Federal Reserve will cut interest rates to spur the economy.

"The theme now seems to be one of deflation," said Tom di Galoma, head of U.S. Treasury trading at Jefferies & Co., a brokerage for institutional investors in New York. "That's the fear at this point. That almost makes bonds look cheap."

Consumer prices plunged 1 percent last month, more than forecast and the most since records began in 1947, after being unchanged the prior month, a Labor Department report showed. The drop came as fuel costs plunged and retailers used discounts for cars and clothing to attract consumers.

U.S. builders broke ground last month on the fewest new homes and obtained permits for future construction at the lowest levels on record. Housing starts fell 4.5 percent in October to an annual rate of 791,000, the lowest since records began in 1959, a Commerce Department report showed.

The gap between 10-year swaps and the 10-year Treasury note yield reached as low as 31 basis points, the narrowest since May 2003.

Traders exiting bets that the gap between the 10-year and 30-year interest-rate swap rates would widen may also be driving the 30-year swap rate lower, said Eric Liverance, head of derivatives strategy in Stamford, Connecticut at UBS Securities LLC, another primary dealer.

"These are powerful forces," Liverance said. "You'd better get out of the way, or you're going to get run over."

The breakeven rate on two-year notes, which shows the difference in yield between inflation-protected bonds and nominal bonds, fell to a negative 3.78 percentage points, indicating traders are betting that slumping economic growth may lead to deflation over the next two years.

Deflation Is Here

There is no longer any debate (at least there should not be). Industrial Bond Yields Strongly Support Deflation Thesis .

10 year to 30 year Gap Narrows

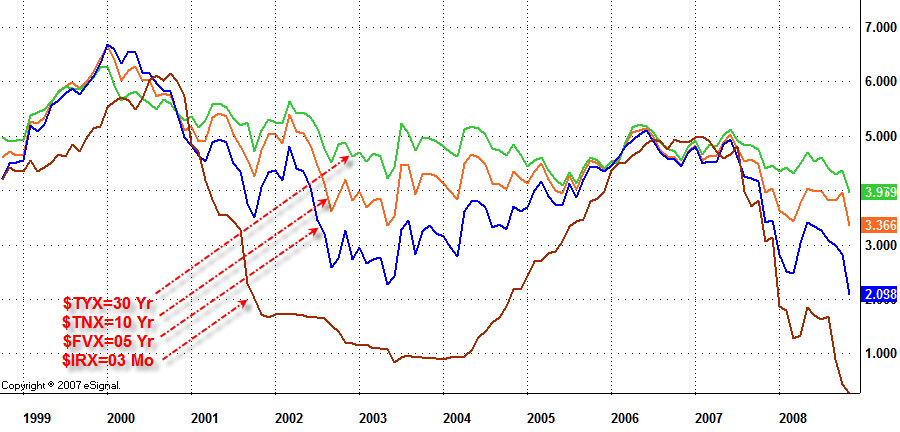

I could see by the action in treasuries that players were betting the gap would widen and the yield curve would steepen. However, I never understood why those bets were made.

Someone from one of the big brokerage houses emailed me last week saying the yield curve would steepen. My response was "Why should it?"

The reason for my statement was that one month and 3 month Treasuries were already trading at or near zero. The Fed Funds rate was effectively trading at zero as well. There is no more room for the Fed to cut other than symbolically. OK. The Fed is going to cut by at least 50 basis points in December. Then what?

In the midst of the biggest consumer led recession since the great depression, there is simply no reason to expect treasury yields to rise. Banks are hoarding cash and any cash infusions from the Fed will likely go straight into treasuries or perhaps used for mergers.

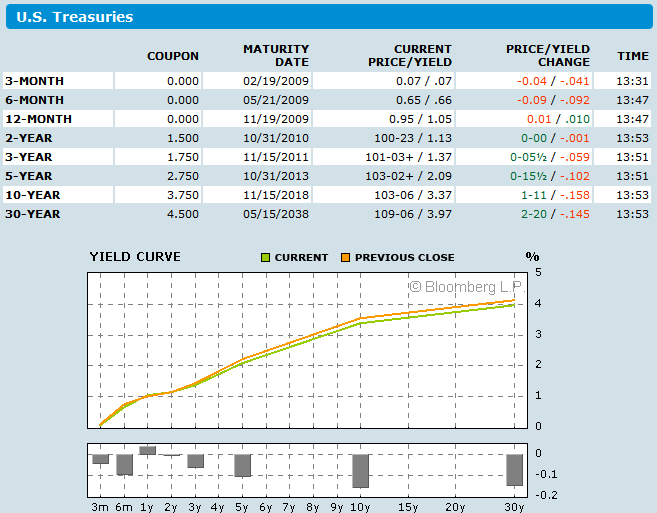

Yield Curve As Of 2008-11-19

Here is another look at the yield curve.

Chart courtesy of Bloomberg .

A bet on the yield curve to steepen is a bet the economy improves. Why should it? An even better question is "How low do 10 year and 30 yield yields go?" Certainly 3% or lower on the 10 year and even 30 year are in the realm of possibilities. That's how nasty this recession is likely to get.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Jun

15 Mar 09, 22:45 |

It steepens. Then what?

The latest report shows a steepening yield curve. Is our economy improving? |