Extreme Stock Market Volatility as Corporate America Heads Towards Bankruptcy

Stock-Markets / Recession 2008 - 2010 Nov 16, 2008 - 01:22 PM GMT The Oxford Dictionary defines “volatility” as “liable to change rapidly and unpredictably, especially for the worse”. It's not as if investors do not know this by now, as global stock markets were again subjected to extreme fluctuations during the past week.

The Oxford Dictionary defines “volatility” as “liable to change rapidly and unpredictably, especially for the worse”. It's not as if investors do not know this by now, as global stock markets were again subjected to extreme fluctuations during the past week.

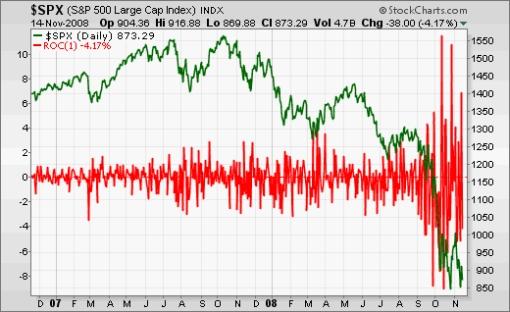

The red line in the chart below shows the daily percentage change in the S&P 500 Index, illustrating the severe movements stock markets have seen in recent times.

Turbulence was rife as more data pointed to the world economy facing a longer and more intense downturn than feared. Battle-weary investors were also spooked by continued financial trauma and a bleak corporate earnings outlook for at least the next few quarters, and found little comfort in hints of additional interest rate cuts.

Global stock markets were beset by angst and plunged by more than 6% over the week in the case of the MSCI Word and Emerging Markets indices, with the only safe havens for risk-averse investors being the US dollar, developed-market government bonds and gold bullion. Unsurprisingly, the US one- and three-month Treasury Bills declined to minuscule yields of 0.066% and 0.117% respectively.

Financial markets reacted badly to US Treasury Secretary Henry Paulson's decision to shelve plans to buy troubled mortgage assets, shifting the focus of the government's TARP bailout plan to non-bank financial institutions and consumer credit. Priorities going forward are: 1) to strengthen the capital base of the financial system; 2) to provide support for securitization of credit-card receivables, auto loans and student loans; and 3) to explore ways of reducing the risk of foreclosure.

Further dealings in Washington were concerned with the debate over whether to provide government aid to the US auto industry in what looks to be a showdown among the lame-duck US Congress, President Bush and the incoming Obama administration.

According to MarketWatch , Deutsche Bank analyst Rod Lache slashed his price target for General Motors (GM) from $4 to $0. Meanwhile, Richard Russell ( Dow Theory Letters ) pointed out: “Mattel (MAT) makes toy cars. Mattel is now worth more as a company than General Motors.” It gives one pause for thought.

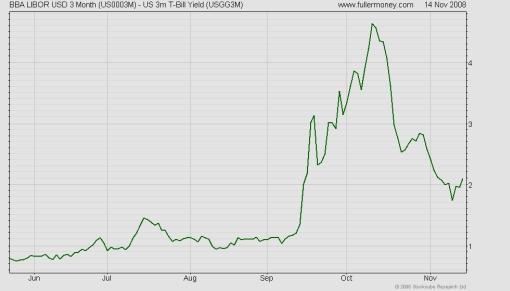

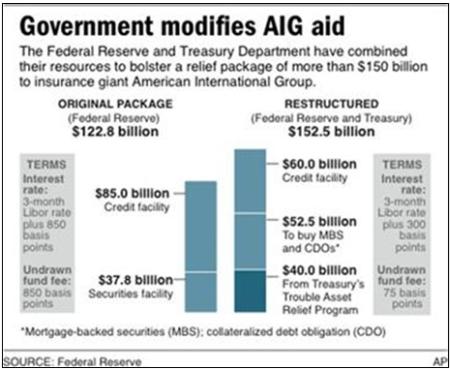

An end to the credit turmoil does not seem to be in sight as AIG (AIG) and Fannie Mae (FNM) reported huge losses, and renewed strains surfaced in the money markets after the US Treasury's decision not to buy toxic assets. The three-month dollar Libor rate ended a 23-day run of consecutive falls and edged up from 2.13% to 2.24% on Thursday and Friday.

In the spirit of the tumultuous times, a microbrewery in British Columbia is toasting the economic downturn by launching a special brand of recession-style beer, naming its brew “Bailout Bitter” in honor of the government bailouts, reported CBC News . Truly a “bitter ale for bitter times”!

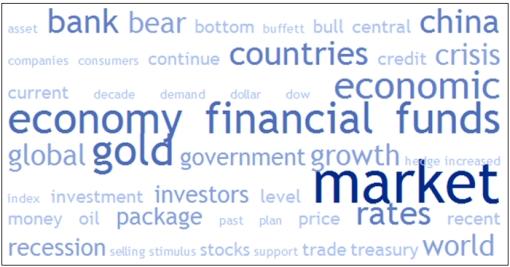

Next, a tag cloud of the text of the dozens of articles I have devoured during the past week. This is a way of visualizing word frequencies at a glance. As expected, keywords such as “market”, “economy” and “bank” feature prominently. “Gold” has also been receiving a fair bit of publicity as the yellow metal improved in price during the past week.

Back to Richard Russell for more wisdom from the venerable analyst: “This bear market is a bloody brute. I'm not trying to frighten my subscribers. What I am trying to do is to caution subscribers, and notify them that the lows for this bear market may still be far away. We simply do not know, nor do we have evidence to indicate that the bottom is in or near. I continue to believe that the 2002 Dow low will be closely tested, and that the test will fail in that the Dow will break through the 2002 low of 7,286.”

Regarding the shorter-term outlook, Michael Panzer ( Financial Armageddon ) commented: “It's been said that markets do whatever is necessary to hurt the most people. That is why prices sometimes shoot higher when news flow, investor sentiment and speculative positions are skewed to the negative, and why rampant euphoria is occasionally the set-up for a violent correction. With that in mind, I still believe the path of least resistance for the equity market over the next month or two is up, in large part because bad news and increasing volatility have so many people worrying and thinking – and betting – otherwise.”

A further positive for the bulls is that, according to Jeffrey Hirsch ( Stock Trader's Almanac ), the Dow has been up 12 out of the last 14 years during the week before Thanksgiving.

I summarized my current views in a post (“ Is Stock Market Rally ‘Real' ”) on Friday: “Stock markets are caught between the actions of central banks, governments and the IMF frantically fending off a total economic meltdown on the one hand, and a worsening economic and corporate picture on the other. This situation has a ‘no-man's-land' feel to it. By all means try to play a possible nascent rally, but be cognizant that, failing further technical and fundamental evidence, you are trading against the primary trend. Caution is still warranted!” (Also, read my post of Wednesday: “ Stock Markets: Which Way José ”.)

I will be donning my winter woollies and visiting New York City from December 3 to 7, 2008. There are still a few gaps on my itinerary for those wishing to meet me to discuss global financial markets, financial blogging or, for that matter, any money-making ideas. If you happen to be in the Big Apple at the same time, let's get together and share a cup of coffee (or glass of wine).

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

Economic reports

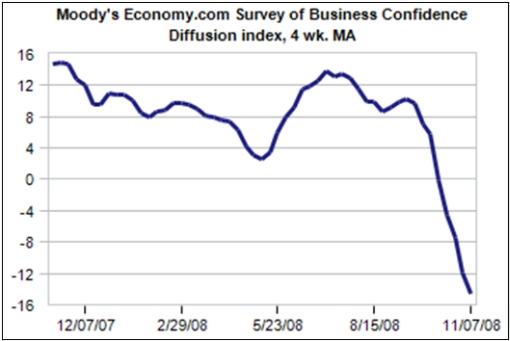

“Global business confidence continues to evaporate, as sentiment fell again during the first week of November to another new record low,” said the latest Survey of Business Confidence of the World conducted by Moody's Economy.com . “Sentiment is extraordinarily negative everywhere, including heretofore stalwart Asia. The global financial panic which hit in early September and has yet to abate has been a body blow to global business confidence.” The global economy is now in recession according to the Survey.

Economic reports released in the US during the past week confirmed the severity of the economic recession and included the following:

• Initial claims for unemployment insurance increased by 32,000 to 516,000 for the week ended November 8. This was well above expectations and could be an early indication that labor market slack is beginning to grow more quickly.

• Falling for a fourth consecutive month, total retail sales plunged by 2.8% in October, somewhat more than expected due to tumbling gas station sales and widespread weakness elsewhere. The October drop is the largest since record keeping for the current series began in 1992.

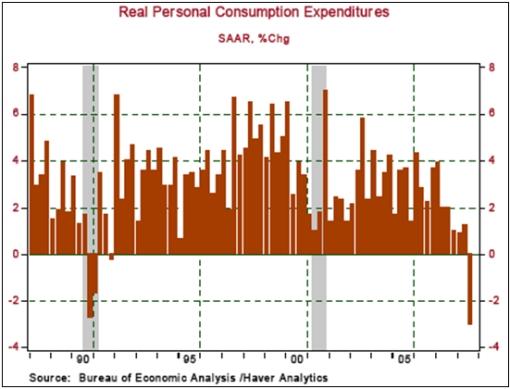

Weak retail sales set a poor foundation for the PCE component of the fourth quarter GDP report. Asha Bangalore ( Northern Trust ) commented as follows: “It is important to note that the boom in consumer spending has come to a screeching halt after an extended period of spending that began in the fourth quarter of 1991 and ended with the 3.1% annualized decline in real consumer spending in the third quarter (see chart below).

“The drop in net worth of households resulting from declines in prices of homes and equity, the historically high debt levels of households and the debt service burden associated with the debt, the rising trend of the jobless rate, additional likely layoffs, and a serious lack of savings are factors that will hold back consumer spending.”

Elsewhere in the world, economic reports showed an acceleration in the weakening of activity.

Notably, the 15-nation Eurozone entered its first recession since the launch of the single currency in 1999. The region's third-quarter GDP shrank by 0.2% compared to the previous quarter, following a second quarter that also saw a 0.2% decline.

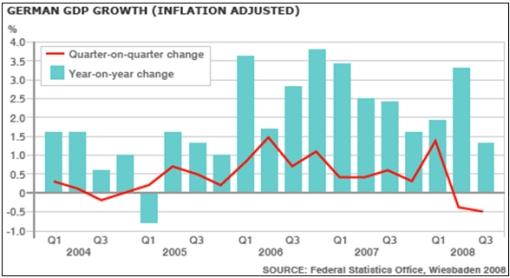

Europe's largest economy, Germany, fell into a recession after government data showed that the economy contracted by 0.5% in the third quarter. This is the second consecutive quarter that the economy has shrunk after a 0.4% contraction in the second quarter.

GDP growth in the UK declined by 0.5% during the third quarter – the first official evidence that the economy is heading for recession and the first decline since 1992. The Bank of England's GDP projection for 2009 was slashed, showing a low point of close to -2.0% year on year from the previous forecast of +0.5%.

Further afield, Hong Kong became the second Asian economy, after Singapore, to officially tip into recession. Economic figures also showed worse-than-expected declines in output growth in China and Japan.

Week's economic reports

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Nov 13 | 8:30 AM | Initial Claims | 11/08 | 516K | 475K | 479K | 484K |

| Nov 13 | 8:30 AM | Trade Balance | Sep | -$56.5B | -$56.0B | -$57.0B | -$59.1B |

| Nov 13 | 2:00 PM | Treasury Budget | Oct | -$237.2B | NA | -$134.0B | -$55.6B |

| Nov 14 | 8:30 AM | Export Prices ex-agriculture | Oct | -1.2% | NA | NA | -0.9% |

| Nov 14 | 8:30 AM | Import Prices ex-oil | Oct | -0.9% | NA | NA | -0.9% |

| Nov 14 | 8:30 AM | Retail ales | Oct | -2.8% | -1.9% | -2.1% | -1.3% |

| Nov 14 | 8:30 AM | Retail Sales ex-auto | Oct | -2.2% | -1.0% | -1.2% | -0.5% |

| Nov 14 | 10:00 AM | Business Inventories | Sep | -0.2% | 0.2% | -0.1% | 0.2% |

| Nov 14 | 10:00 AM | Michigan Sentiment-preliminary | Nov | 57.9 | 58.5 | 57.0 | 57.6 |

Source: Yahoo Finance , November 14, 2008.

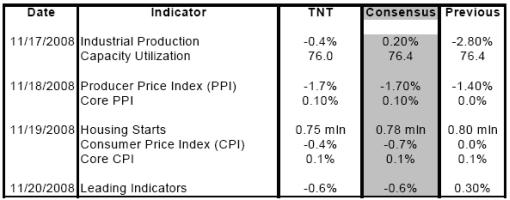

In addition to the release of the minutes of the FOMC's October meeting on Wednesday, November 19, next week's US economic highlights, courtesy of Northern Trust , include the following:

Other reports include the NAHB Survey (November 18) and the Philadelphia Fed Survey (November 20).

Click here for a summary of Wachovia's weekly economic and financial commentary.

Markets

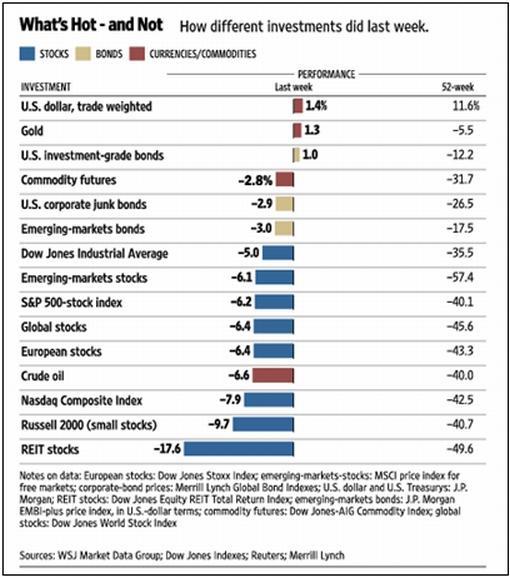

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , November 14, 2008.

Equities

Stock markets experienced another wild week on the back of large swings in sentiment as investors focused on a more severe economic downturn and worsening earnings outlook. Developed and emerging markets alike closed a second straight week with significant losses, with the MSCI World Index down by 6.4% and the MSCI Emerging Markets Index losing 6.1%.

Among developed markets, the Nikkei 225 Average (-1.4%) fared the best, whereas some of the US markets such as the Russell 2000 Index (-9.7%) and the Nasdaq Composite Index (-7.9%), Australia (-7.0%) and Canada (-5.6%) were at the bottom end of the performance rankings.

As far as emerging markets are concerned, Russia bore the full brunt of the selling pressure with a decline of 15.3%, taking its losses since the peak of about six months ago to a massive 74.1%. On the other hand, the Philippines (+3.0%) and China (+13.7%) were two of the few markets to register gains.

The Shanghai Stock Exchange Composite Index has bounced by 16.4% off its low of November 4 on the back of the Chinese government announcing a $586 billion economic stimulus package. This makes for an interesting-looking chart with the Index challenging its 50-day moving average and roundophobia 2,000 level. Also, the Chinese trailing price-earnings multiple has fallen from 45.9 to 14.3 – cheap for a country still seen as a top growth situation over the medium term.

The US stock markets all declined over the week as shown by the major index movements: Dow Jones Industrial Index -5.0 (YTD -35.9%) and S&P 500 Index -6.2% (YTD -40.5%). The Dow closed 321 basis points (3.9%) above its October 27 low of 8,176 and the S&P 500 24 basis points (2.8%) above its low of 849.

Click here or on the thumbnail below for a (predominantly red) market map, obtained from Finviz.com, providing a quick overview of the performance of the various segments of the S&P 500 Index over the week.

Click here or on the thumbnail below for a (predominantly red) market map, obtained from Finviz.com, providing a quick overview of the performance of the various segments of the S&P 500 Index over the week.

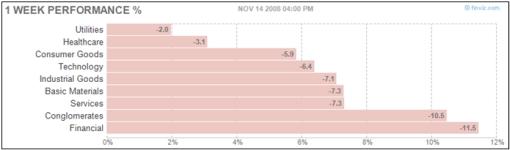

The bar chart below, also from Finviz , shows the US sector performance for the past week, and specifically how defensive sectors such as utilities and healthcare outperformed on a relative basis.

A reason for Wall Street's extreme volatility is the great uncertainty regarding the outlook for US companies' earnings. During the past week, Best Buy (BBY), the leading consumer electronics retailer, and Intel (INTC), the world's largest semiconductor company, were key contributors to analysts' concerns as both companies reduced their forecasts sharply.

Putting the stock market outlook in perspective, Jim Rogers was quoted by Bloomberg as saying: “Stocks in the West are still expensive on any historical valuation method, while bonds are going to be a terrible place to be for the next 10, 20 years”. Equities in the West will be “in a trading range for years to come”, he said.

Fixed-interest instruments

Yields on government bonds, especially shorter maturities, declined during the past week as a result of escalating economic woes prompting safe-haven buying.

The two-year US Treasury Note yield declined by 10 basis points to 1.24%, the UK two-year Gilt yield dropped by 39 basis points to 1.86% and the German two-year Schatz yield fell by 18 basis points to 2.23%. However, emerging-market bonds, in general, lost ground as further deleveraging took its toll on risky assets.

But not everybody was enamored with investing in bonds. Bill King ( The King Report ) posed the question: “Who will buy all the bonds that will be issued throughout the known universe in coming days?”

US mortgage rates edged higher, with the 30-year fixed rate rising by 4 basis points to 6.18% and the 5-year ARM by 6 basis points to 5.98%.

The cost of buying credit insurance for US and European companies increased as shown by the wider spreads for both the CDX (North American, investment grade) Index (up from 188 to 203) and the Markit iTraxx Europe Crossover Index (up from 762 to 813).

The three-month dollar Libor rate edged up on Thursday and Friday, limiting the week's decline to 5 basis points from 2.29% to 2.24% – 124 basis points (compared to 43 basis points at the start of 2008) above the Fed's target rate of 1.0%. The TED spread (i.e. three-month dollar Libor less three-month Treasury Bills) also perked up, indicating that credit strains are not quite back to normal yet.

Currencies

The week's feature among currencies was the dramatic collapse of the British pound as the market factored in further aggressive easing of UK monetary policy and dumped the currency. Sterling dropped to a 13-year low against a basket of currencies and to its lowest level ($1.47) since 2002 against the US dollar.

Over the week the US dollar gained against the euro (+0.9%), the British pound (+5.8%), the Swiss franc (+1.4%), the Canadian dollar (+3.9%), the Australian dollar (+3.7%) and the New Zealand dollar (+3.9%). However, the greenback lost ground against the Japanese yen (-1.2%) as investors liquidated assets previously funded with low-yielding currencies such as the yen.

Emerging-market currencies had a torrid time as investors shunted risky assets. Examples of losses against the US dollar include: the Brazilian real ( 6.2%), the Turkish lira (-4.8%), the South Korean won (-5.3%), the South African rand (-3.2%) and the Russian ruble (-1.2%). The ruble lost 15.4% against the US dollar over the past four months as the downturn in commodity prices negatively impacted the Russian economy.

Commodities

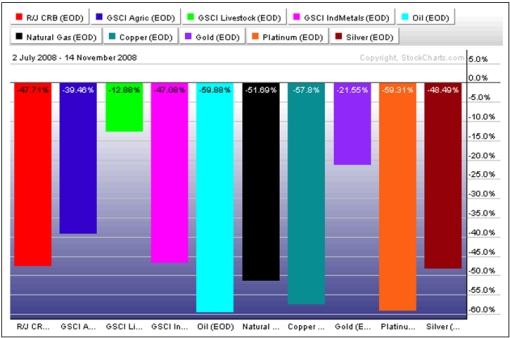

The Reuters/Jeffries CRB Index (-3.6%) witnessed a further decline on the back of an ailing economy and a slump in global demand for commodities.

Gold (+1.1%) bucked the trend and edged higher as some commentators punted the yellow metal as being poised for a rally.

On the other hand, West Texas Intermediate crude declined by a further 5.6% to levels last seen in the first quarter of last year. This has prompted OPEC to call an emergency “consultation” meeting on November 29 to consider a further production cut.

The graph below shows the movements for various commodities since the peak of July 2. Interestingly, the Baltic Dry Index, which is closely correlated with economic growth and demand for commodities, declined by 91.0% over the same period.

Now for a few news items and some words and charts from the investment wise that will hopefully assist in optimally managing our wealth in these troubled times. Also remember what John Kenneth Galbraith said: “The conventional view serves to protect us from the painful job of thinking.”

That's the way it looks from Cape Town.

Source: McClatchy

Financial Times: Obama set to push “big bang” reform package

“US President-elect Barack Obama intends to push a comprehensive programme of social and economic reform beyond an immediate emergency stimulus package, Rahm Emanuel, the next White House chief of staff, indicated on Sunday.

“Mr Emanuel brushed aside concerns that an Obama administration would risk taking on too much when it takes office in January. He said Mr Obama saw the financial meltdown as an historic opportunity to deliver the large-scale investments that Democrats had promised for years.

“Tackling the meltdown would not entail delays in plans for far-reaching energy, healthcare and education reforms when all three were also in crisis, he said. ‘These are crises you can no longer afford to postpone.'

“Mr Emanuel, Mr Obama's first appointment after his emphatic victory over John McCain last week, added that Mr Obama would push hard during the 11-week transition before he is inaugurated for early assistance to the collapsing US car industry, which he described as ‘an essential part of our economy'.

“His comments increased pressure on George W. Bush to approve a widely-touted $25 billion emergency package for Detroit – possibly as part of a second emergency stimulus package to stave off further decline in the rapidly deteriorating US economy.

“Sunday's comments also reinforce the impression that Mr Obama's transition economic advisory board – which includes leading lights of the Clinton era, such as Lawrence Summers and Robert Rubin – is tilting heavily towards a ‘big bang' approach that would combine a short-term stimulus with large public investments to raise the longer-term US growth rate.”

Source: Edward Luce, Financial Times , November 9, 2008.

Bloomberg: Paulson shifts focus of rescue to consumer lending

Click here for the full article.

Source: Simon Kennedy, Bloomberg , November 12, 2008.

BCA Research: Paulson changes focus

“The focus of the US Treasury appears to be shifting from helping banks directly to supporting homeowners and consumers.

“Treasury Secretary Paulson has decided that purchasing troubled mortgages from banks is not the most effecitive use of the TARP funds. Instead, Paulson will shift focus to areas where problems are growing even faster. First, he will broaden the availability of TARP funds (i.e. capital injections) to non-bank financial institutions. Second, he will try to resuscitate the flow of credit to consumers by creating a liquidity facility for AAA-rated asset-backed securities (ABS), including credit card receivables, auto loans and student loans. Finally, the Treasury is also considering strategies to mitigate foreclosures that would ‘require substantial government subsidies'.

“This suggests that a meaningful taxpayer-backed housing bailout package could be on the way. Bottom line: It is too early to tell whether the change in focus is positive or negative for financial markets at the margin, but government support for the economy and financial system continues to change and broaden. More taxpayer funds will likely be required before the crisis is over. Stay tuned.”

Source: BCA Research – Daily Insights , November 14, 2008.

Bill King (The King Report): TARP was fatally flawed

“Stammerin' Hank now admits that his TARP plan was fatally flawed, as we stated, and he will do precisely what we proposed before all this ‘buying troubled asset' nonsense – inject capital directly into troubled firms in order to recapitalize them. And, as we proposed, Hank wants firms taking taxpayer funds to procure matching private investment.

“Hank even gave our reason for injecting capital instead of buying crappy paper – with increased capital you get more leverage to create credit, the multiplier effect.

“All those media types and Street shills should now apologize for pimping for Hank and scaring the heck out of the US public. All that they accomplished was to frighten consumers to a degree that made the US economy collapse in October.

“What disturbed the market on Wednesday is the realization that Hank's epiphany about the TARP indicates that there is much more crappy paper than initially suspected. And as we warned, $700 billion is not nearly enough taxpayer funds to bailout the crappy paper in the system.

“So estimates of the ever-increasing bailout are soaring … CNBC commentators facetiously talked about ‘a rescue plan for the rescue plan'.”

Source: Bill King, The King Report , November 13, 2008.

The Wall Street Journal: Fed delays its big plan to shore up money funds

“The Federal Reserve said its big rescue plan for money-market funds will be delayed until later this month.

“The delay, announced Monday, presents a challenge for the $3.6 trillion money-market industry, which is struggling to sell short-term debt into tight credit markets. The Fed plans to finance purchases for as much as $540 billion of the money funds' short-term debt.

“Many had expected the buying program to be up and running last week, but now the Fed says it will start on or about November 24. The funds need the money to meet investor redemptions.

“The reason for the delay appears to be the Fed's preoccupation with other bailouts and wrangling over how the money-fund program will be set up.

“Money funds have been under pressure since September, when a popular offering called the Reserve Primary Fund suffered losses tied to commercial paper from Lehman Brothers Holdings Inc. and ‘broke the buck' with its per-share net asset value dropping below $1.

“The losses prompted massive investor redemptions across the money-fund spectrum, especially for ‘prime' money funds that invest in commercial paper. A lot of commercial paper is issued by financial institutions, and buyers are worried about further bank collapses.”

Source: Diya Gullapalli, The Wall Street Journal , November 11, 2008.

CNBC: Calls for bailouts

“Discussing government help for struggling businesses, with James Galbraith, University of Texas economics professor.”

Source: CNBC , November 12, 2008.

Barry Ritholtz (The Big Picture): Why bailouts attract handout seekers

“A truisim of all bailouts: Enormous amounts of taxpayer cash attract all manner of unsavory, undeserving characters. What was supposed to be a narrow and limited attempt to reduce the systemic risk of a financial collapse has become a taxpayer funded free-for-all …

“Next pig at the trough is the heinous derivatives hedge fund, formerly-known-as-AIG. They were taken over so quickly, with so little oversight and essentially no due diligence, that the price tag on this has already doubled. What no one at the NY Fed is likely to tell you anytime soon is that this price tag is very likely to double yet again.

“Here's a forecast: After the eventual investigation and audit at Maiden Lane, someone will go to jail. (You read it here first) …

“Last month, I suggested the bailout plan might cost as much as 3 trillion dollars. At the present rate, this will scale up to 8-10 trillion dollars before long. We could even end up spending a full year's GDP before its all said and done.”

Source: Barry Ritholtz, The Big Picture , November 11, 2008.

Breitbart: Fed's bailout for AIG swells to more than $150 billion

Source: Jeannine Aversa, Breitbart , November 10, 2008.

Asian Times: Who will finance America's deficit?

“Indirectly, the rapid expansion of leverage in the global banking system contributed to demand for Treasuries. When de-leveraging commenced in August, an important component of demand for Treasuries declined sharply. That is bad news for Washington, but even worse news is that it will continue to decline sharply, just when Washington most requires global support for the US government debt market …

“Foreign net purchases of US Treasury securities peaked at a $400 billion annual rate, and will fall sharply from this level. Domestic resources to purchase Treasury securities, moreover, are thin. When Ronald Reagan took office, America's personal savings rate was 10%; today it is around 0%, although it has spiked up in recent months. Disposable income in the US now stands at slightly under $11 trillion. If the US returned to the personal saving rate of 1981, individuals would save $1 trillion a year, enough to fund the Treasury deficit, assuming that all net new portfolio investment flowed into Treasury securities. Nothing, though, would be left over for investment in anything else.”

Source: Asian Times , November 12, 2008.

Forbes: Washington's $5 trillion tab

“For all the fury over Treasury Secretary Henry Paulson's $700 billion emergency economic relief fund, it seems downright puny when compared to the running total of the government's response to the credit crisis.

“According to CreditSights, a research firm in New York and London, the US government has put itself on the hook for some $5 trillion, so far, in an attempt to arrest a collapse of the financial system.

“The estimate includes many of the various solutions cooked up by Paulson and his counterparts Ben Bernanke at the Federal Reserve and Sheila Bair at the Federal Deposit Insurance Corp., as the credit crisis continues to plague banks and the broader markets.

“The Fed has taken on much of that total, including lending a cumulative $1 trillion in overnight or short-term loans since March to primary dealers through its emergency discount window and making a cumulative $1.8 trillion available through its term auction facility, a series of short-term transactions it began making available twice a month in January. It should be noted that a portion of the funds lent in these programs has been repaid and that the totals represent what has been made available.

“The Fed also took on tens of billions in debt, including $29 billion in debt of Bear Stearns, and made $60 billion of credit available to AIG. It is committing $22.5 billion to set up a special purpose vehicle to manage some of AIG's residential mortgage-backed securities, and it is financing $30 billion of a second fund to hold $70 billion of multi-sector collaterized debt obligations on which AIG wrote credit default swaps.

“The Treasury, in addition to the $700 billion raised in the Emergency Economic Stabilization Act, agreed to guarantee money market funds against losses up to $50 billion, will inject $40 billion of capital into AIG and is backing the conservatorship of Fannie Mae and Freddie Mac, to the tune of $200 billion.

“The FDIC, meanwhile, is guaranteeing $1.5 trillion of senior unsecured bank debt.

“Not included in the total are the Fed's long-existing discount window lending to commercial banks, the mortgage modification plan announced by regulators on Tuesday, support for the Federal Home Loan Banks and a myriad of other programs.”

Source: Elizabeth Moyer, Forbes , November 12, 2008.

Financial Times: G20 leaders unite to restore global growth

“World leaders agreed to take ‘whatever further actions are necessary' to tackle the financial crisis and restore global growth at an emergency summit of the Group of 20 in Washington on Saturday.

“They set out an ambitious agenda for reform of the financial regulatory system and institutions such as the World Bank and International Monetary Fund and agreed to meet again in April to consider more concrete steps.

“The 20 leaders, whose countries represent more than 85% of the world's gross domestic product, also vowed to use ‘fiscal measures' and monetary policy to shore up the world economy but stopped short of announcing a coordinated stimulus program.

“George W. Bush, the outgoing US president, declared the summit a ‘very successful' first step but acknowledged it would fall to his successor, Barack Obama, to take the process forward.

“In a five-page communiqué setting out broad principles for reform and a detailed action plan, the G20 agreed to increase supervision of banks and credit rating agencies, tighten regulation of high-risk financial products such as credit default swaps, and ‘review' executive compensation practices.

“In a blunt assessment, the communiqué blamed the crisis on, ‘weak underwriting standards, unsound risk management practices, increasingly complex and opaque financial products and consequent excessive leverage'.

“Without naming the US, the leaders concluded that ‘policymakers, regulators and supervisors, in some advanced countries, did not adequately appreciate and address the risks building up in the financial markets'.”

Source: Financial Times , November 16, 2008.

Financial Times: World Bank in $100 billion aid push

“The World Bank is set to provide up to $100 billion in new aid to developing countries, amid fears that the spreading effects of the financial crisis could devastate poorer and middle-income states.

“Ahead of an international summit on the crisis this weekend, Robert Zoellick, World Bank president, said it would be an ‘error of historic proportions' to ignore the interests of developing states whose projected growth rates have been slashed in the wake of the crisis.

“As requests for aid continued to come in from around the world, he forecast the Bank would provide up to $100 billion in loans over the next three years through its International Bank for Reconstruction and Development (IBRD) arm. He said the IBRD would increase loans available for developing countries to more than $35 billion this year, up from about $16 billion planned a few months ago. Last year, such aid totalled $13.5 billion.

“‘You are seeing countries that had very good, sound macroeconomic programmes – Mexico, Indonesia – that are in a position where they are not at financial risk but they are worried about getting financing,' Mr Zoellick said. ‘These are the types of countries – Colombia, others – that we are offering as much support as we can.'

“Underlying his concern, Mr Zoellick said global trade was projected to contract next year for the first time since 1982, while developing countries' growth, which had been expected to reach 6.4% in 2009, was now projected to be 4.5%. On Tuesday the MSCI emerging markets index fell 5.2%.

“The World Bank estimates that each percentage point decline in developing country growth rates pushes an additional 20 million people into poverty.”

Source: Daniel Dombey and Michael MacKenzie, Financial Times , November 11, 2008.

Financial Times: China authorises “massive” stimulus package

“China announced on Sunday a ‘massive infrastructure spending programme' as part of a new fiscal stimulus plan aimed at boosting the country's rapidly slowing economy.

“The State Council, China's cabinet, authorised $586 billion of investment on infrastructure and social welfare over the next two years, although it did not say how much of the spending would be on new projects not already in the budget.

“The government said the spending plan reflected a decision to adopt an ‘active' fiscal policy to deal with the global financial crisis, while monetary policy would be ‘moderately active'.

“The announcement reflects mounting anxiety in Beijing that China's economy is cooling much more quickly than was initially expected in the face of weaker international demand and a slowdown in the local property market.

“Beijing has also been under growing international pressure to take fiscal measures to boost its economy in the hope that continued strong growth can provide some counter-balance to recession in the developed world.

“The government has already cut interest rates three times, scrapped quotas for bank lending and unveiled measures to help house buyers and some exporters. However, economists said those measures had not been enough to overcome growing gloominess among companies and consumers.”

Source: Geoff Dyer, Financial Times , November 9, 2008.

Forbes: Roubini – the worst is not behind us

“It is useful, at this juncture, to stand back and survey the economic landscape – both as it is now, and as it has been in recent months. So here is a summary of many of the points that I have made for the last few months on the outlook for the US and global economy, as well as for financial markets.”

Click here for the full article.

Source: Nouriel Roubini, Forbes , November 11, 2008.

BCA Research: Measures of reflation

“Aside from various spreads, we advise clients to look to gold prices and currency volatilities for evidence that policymakers are winning the battle over debt-deflation.

“Additional monetary and fiscal support will be needed before the easing cycle ultimately comes to an end. Still, global policymakers are aggressively pulling out all the stops to shore up both investor and banking sector confidence and limit downside in their various economies (China's announcement of a massive $US586 billion fiscal package was the latest example).

“Correspondingly, we continue to watch various bond spreads closely for evidence that the credit logjam is starting to unfreeze. So far, there are encouraging signs that US Libor/OIS spreads have adjusted lower (even at longer maturities), although this measure of banking sector risk has not yet narrowed much throughout Europe and both corporate bond yields and mortgage rates are still near their peaks across the globe.

“Aside from these conventional measures, we are also watching gold prices and currency volatilities. In our opinion, gold is a great barometer of excess liquidity and a sustained rise across a broad range of currencies would suggest that reflation measures are starting to work. Similarly, a dramatic reduction in currency volatility may indicate that we are returning to a world of competitive currency devaluation as policymakers seek external support for weakness in their domestic economies. In this environment, no currency adjusts lower but significant monetary stimulus is provided.

“Bottom line: Further evidence in the weeks ahead that policymakers are finally getting ahead of the curve would prove supportive of risky assets.”

Source: BCA Research , November 11, 2008.

Bloomberg: Morgan Stanley's Roach says Fed following BOJ “script”

“Stephen Roach, chairman of Morgan Stanley Asia, talks with Bloomberg in Singapore about the US's $700 billion Troubled Asset Relief Program, the effectiveness of the bailout package, and European and US monetary policies.”

Source: Bloomberg , November 13, 2008.

Yahoo News: Soros says deep recession inevitable, depression possible

“George Soros, chairman of Soros Fund Management, testified at a House Oversight and Government Reform Committee hearing on Thursday.

“Highlights are:

* Said ‘a deep recession is now inevitable and the possibility of a depression cannot be ruled out'.

* Said hedge funds were an integral part of the financial market bubble which now has burst.

* Said hedge funds will be ‘decimated' by the current financial crisis and forced to shrink their portfolios by 50% to 75%.

* Said Fed, Treasury Department and the SEC must accept responsibility to prevent market bubbles from growing too big in future.

* Said impossible to prevent market bubbles from forming, but they can be kept within ‘tolerable bounds'.

* Said financial engineering should be regulated and new products approved by regulators, and that such regulation should be a high priority of the new Obama administration.

* Said a recent IMF credit facility not large enough to stabilize markets.”

Source: Yahoo News , November 13, 2008.

CEP News: RealtyTrac says US foreclosures rose 5% in October

“Foreclosure activity in the United States is not relenting, according to RealtyTrac's latest survey for October, which suggests filings rose 5% in October and 25% from 12 months ago.

“‘We've seen sharp declines in new foreclosure filings after legislation mandating delays to the foreclosure process was signed into law in several states – most notably in California, where overall foreclosure activity was down by double-digit percentage points for the second straight month in October, and where default filings were 44% below October 2007 levels,' said James J. Saccacio, chief executive officer of RealtyTrac.

“‘Despite this, October marks the 34th consecutive month where US foreclosure activity has increased compared to the prior year.'”

Source: Erik Kevin Franco, CEP News , November 13, 2008.

The New York Times: F.D.I.C. offers plan to stem foreclosures

“Breaking with the Bush administration's position, the Federal Deposit Insurance Corporation proposed Friday to use $24 billion in government financing to help 1.5 million American households avoid foreclosure.

“The source of the money, though, is in dispute. Agency officials want to use part of the $700 billion bailout of the financial industry to pay for it. But the Treasury Department is opposed to that idea.

“Testifying on Capitol Hill Friday, Neel Kashkari, the Treasury Department's assistant secretary for financial stability, said the intent of the $700 billion plan was to make investments with the hope of getting the money back. That, he said, was ‘fundamentally different from just having a government spending program' that would disburse money with no chance of ever seeing any returns.

“Congressional Democrats could take up the plan when they return for a lame-duck session next week. Or the plan could set the stage for a new foreclosure prevention initiative once President-elect Barack Obama takes office in January.

“The agency's plan, posted on its Web site Friday, would guarantee 2.2 million modified loans – mainly risky loans made to borrowers with weak credit or small down payments – through the end of next year. Borrowers would get reduced interest rates or longer loan terms to make their payments more affordable.

“The F.D.I.C. said the government's backing will make the lending industry more willing to modify loans because taxpayers will absorb half of the losses if the borrower defaults again. Also, loan servicing companies, which collect and distribute mortgage payments, would be paid $1,000 for each loan they modify.”

Source: Associated Press (via The New York Times ), November 15, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.