Bailout for GE But not Yet for GM

Stock-Markets / Financial Markets Nov 15, 2008 - 02:39 PM GMT

Holiday Retail Sales aren't what they used to be.- “ The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $363.7 billion, a decrease of 2.8 percent (±0.5%) from the previous month and 4.1 percent (±0.7%) below October 2007.”

Holiday Retail Sales aren't what they used to be.- “ The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $363.7 billion, a decrease of 2.8 percent (±0.5%) from the previous month and 4.1 percent (±0.7%) below October 2007.”

Retailers have now logged the longest string of monthly declines since the Commerce Department's comparable data series began in 1992. Excluding automobiles, purchases decreased 2.2 percent, almost twice as much as the 1.2 percent decline anticipated and also the worst performance on record. Do I hear an echo in that mall?

GE gets theirs…

General Electric Co. has secured the temporary backing of the Federal Deposit Insurance Corp for up to $139 billion of the debt of its finance arm, a spokesman said on Wednesday. "We are eligible now and included in the FDIC temporary liquidity guarantee program," said Russell Wilkerson, a spokesman for the U.S. conglomerate.

"This allows us to source our debt competitively with other financial institutions that are eligible. It certainly helps put us on a level playing field with other issuers," he said, adding, "It's beneficial to us in the market and it's part of a very clear plan and a number of decisive steps here to strengthen our liquidity plan through this volatile time."

FDIC officials did not immediately respond to a call for comment.

…While GM doesn't.

Advocates for the nation's automakers are warning that the collapse of the Big Three — or even just General Motors — could set off a catastrophic chain reaction in the economy, eliminating up to 3 million jobs and depriving governments of more than $150 billion in tax revenue. Industry supporters are offering such grim predictions as Congress weighs whether to bail out the nation's largest automakers, which are struggling to survive the steepest economic slide in decades.

"We've got to do this because the cost of inaction is so high to communities, to workers, to companies," said Sen. Sherrod Brown, a Democrat from Ohio. He was among many lawmakers worried that an industry collapse would be devastating for everything from school districts to small businesses. Do you think there is a bit of favoritism here?

Bottom Fishing or a sucker's Rally?

Wall Street started holiday shopping early on Thursday with its busiest bargain-hunting spree of the year. With so many prime stocks at historic lows, investors decided to pounce yesterday instead of possibly missing the upside boat of an anxious pent-up market. Stocks soared nearly 7 percent, with the Dow Jones industrial average swinging in a wild, 900-point range as a more than 300-point decline early in the day reversed in a late-day surge to end the session up nearly 553 points. Friday's market closed down over 4%.

Wall Street started holiday shopping early on Thursday with its busiest bargain-hunting spree of the year. With so many prime stocks at historic lows, investors decided to pounce yesterday instead of possibly missing the upside boat of an anxious pent-up market. Stocks soared nearly 7 percent, with the Dow Jones industrial average swinging in a wild, 900-point range as a more than 300-point decline early in the day reversed in a late-day surge to end the session up nearly 553 points. Friday's market closed down over 4%.

Ahem! The new low made on Thursday may have to be retested all over again!

Bond owners aren't going to like this news!

U.S. Federal Reserve Chairman Ben Bernanke said in a speech in Frankfurt that challenges remain for the global economy and that policy makers stand ready to take additional action should conditions warrant. Barclays Capital said it expects the central bank to again lower its target lending rate for banks next month, this time to 0.75%. This would be the lowest rate since the Fed started announcing a target.

U.S. Federal Reserve Chairman Ben Bernanke said in a speech in Frankfurt that challenges remain for the global economy and that policy makers stand ready to take additional action should conditions warrant. Barclays Capital said it expects the central bank to again lower its target lending rate for banks next month, this time to 0.75%. This would be the lowest rate since the Fed started announcing a target.

But how will the bond market take the news that the Treasury is issuing massive amounts of new debt?

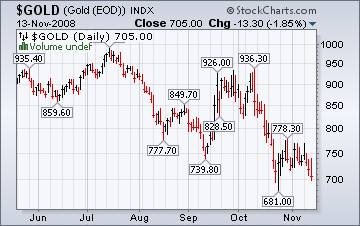

Can Gold regain some lost ground?

( MarketWatch ) -- Gold futures rallied as much as $47 an ounce Friday and were poised to gain almost 2% for the week as bleak global economic news and losses on Wall Street combined to boost the metal's investment appeal. Traders continue to believe that the continued deterioration of the economy will be good for gold. They do not believe that longer-term fundamentals support the dollar, therefore gold should become more attractive. Do the charts bear this out?

( MarketWatch ) -- Gold futures rallied as much as $47 an ounce Friday and were poised to gain almost 2% for the week as bleak global economic news and losses on Wall Street combined to boost the metal's investment appeal. Traders continue to believe that the continued deterioration of the economy will be good for gold. They do not believe that longer-term fundamentals support the dollar, therefore gold should become more attractive. Do the charts bear this out?

Do Japan's investors think stocks are cheap enough?

( Bloomberg ) -- Japan stocks climbed, easing a weekly drop, as investors snapped up shares near the cheapest valuations on record, the yen fell and expectations grew that a financial summit this weekend will produce policies to stabilize markets. “I've been telling our clients that just looking at valuations, you can see that the declines are excessive,'' said Seiji Iwama , a Tokyo-based fund manager at Daiwa SB Investments Ltd., which oversees $53 billion. ``Japanese companies are not only cheap, they're in a relatively stronger position than their foreign rivals.''

( Bloomberg ) -- Japan stocks climbed, easing a weekly drop, as investors snapped up shares near the cheapest valuations on record, the yen fell and expectations grew that a financial summit this weekend will produce policies to stabilize markets. “I've been telling our clients that just looking at valuations, you can see that the declines are excessive,'' said Seiji Iwama , a Tokyo-based fund manager at Daiwa SB Investments Ltd., which oversees $53 billion. ``Japanese companies are not only cheap, they're in a relatively stronger position than their foreign rivals.''

Chinese investors looking for a rebound.

( Bloomberg ) -- China's stocks rose, sending the benchmark index to its best week since April, after the government pledged higher spending on agriculture and on speculation the central bank may cut borrowing costs.

( Bloomberg ) -- China's stocks rose, sending the benchmark index to its best week since April, after the government pledged higher spending on agriculture and on speculation the central bank may cut borrowing costs.

``It looks like the rebound will carry on,'' said Yan Ji , an investment manager at HSBC Jintrust Fund Management Co. in Shanghai, which manages about $850 million. ``There's very strong speculation the central bank will cut rates again and that will benefit rate-sensitive stocks such as developers the most.''

The dollar is pausing to regroup.

(Reuters) - The dollar's rally against most major currencies should extend into next week against as some investors repatriate funds and others hunt for safe havens and shun risky assets amid the worldwide economic downturn. Of particular interest is this weekend's meeting of Group of 20 leaders in Washington. Investors will be watching for any measures aimed at calming anxious financial markets, but few are expecting concrete proposals that could detract from the dollar's allure.

(Reuters) - The dollar's rally against most major currencies should extend into next week against as some investors repatriate funds and others hunt for safe havens and shun risky assets amid the worldwide economic downturn. Of particular interest is this weekend's meeting of Group of 20 leaders in Washington. Investors will be watching for any measures aimed at calming anxious financial markets, but few are expecting concrete proposals that could detract from the dollar's allure.

What??? No oversight on the bailout???

Is In the six weeks since lawmakers approved the Treasury's massive bailout of financial firms, the government has poured money into the country's largest banks, recruited smaller banks into the program and repeatedly widened its scope to cover yet other types of businesses, from insurers to consumer lenders. Along the way, the Bush administration has committed $290 billion of the $700 billion rescue package.

Yet for all this activity, no formal action has been taken to fill the independent oversight posts established by Congress when it approved the bailout to prevent corruption and government waste. Nor has the first monitoring report required by lawmakers been completed, though the initial deadline has passed.

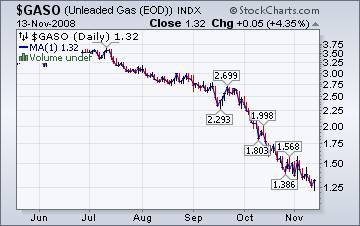

Gasoline may see $1.85/gallon at the pump!

The Energy Information Administration reports that, “Our revised forecast for crude oil prices next spring is down by almost $60 per barrel and our price outlook for gasoline and heating oil over that same period is down by more than $1.40 per gallon in some months! EIA has never before revised its short-term oil price forecast by such a large amount, and we feel it is important to explain the reasons behind such a dramatic change.”

The Energy Information Administration reports that, “Our revised forecast for crude oil prices next spring is down by almost $60 per barrel and our price outlook for gasoline and heating oil over that same period is down by more than $1.40 per gallon in some months! EIA has never before revised its short-term oil price forecast by such a large amount, and we feel it is important to explain the reasons behind such a dramatic change.”

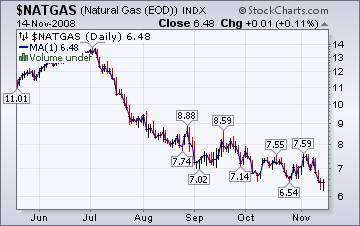

Winter heating is more affordable.

The Energy Information Agency's Natural Gas Weekly Update reports, “At the New York Mercantile Exchange (NYMEX), futures prices for the near-month contract decreased in five of the six trading sessions covered by this report, resulting in a weekly net decrease of $0.931 per MMBtu. The December 2008 contract settled yesterday at $6.318 per MMBtu.”

The Energy Information Agency's Natural Gas Weekly Update reports, “At the New York Mercantile Exchange (NYMEX), futures prices for the near-month contract decreased in five of the six trading sessions covered by this report, resulting in a weekly net decrease of $0.931 per MMBtu. The December 2008 contract settled yesterday at $6.318 per MMBtu.”

The End of Wall Street as we know it.

Did you know that Wall Street is full of 24-year olds who think they are the Masters of the Universe? Did you also know that their primary focus was to concentrate the wealth of the many into the hands of the few? The author of Liar's Poker , Michael Lewis, gives his insight.

T o this day, the willingness of a Wall Street investment bank to pay me hundreds of thousands of dollars to dispense investment advice to grownups remains a mystery to me. I was 24 years old, with no experience of, or particular interest in, guessing which stocks and bonds would rise and which would fall. The essential function of Wall Street is to allocate capital—to decide who should get it and who should not. Believe me when I tell you that I hadn't the first clue.

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.