End of the Era of Big Consumer Spending

Economics / US Economy Nov 15, 2008 - 11:31 AM GMT

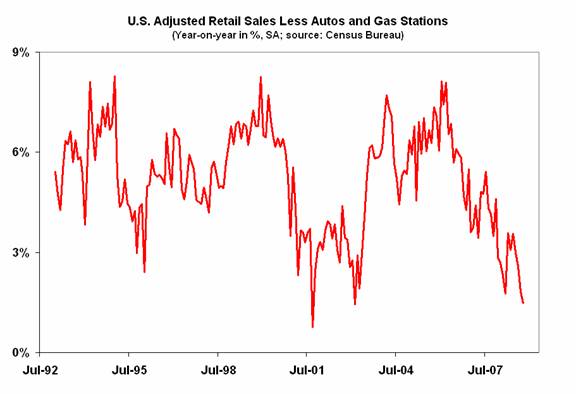

Friday morning, the Commerce Department announced that October retail sales fell 2.8%, the fourth straight drop and the worst one-month decline since records began in 1992. Stripping out sales of autos and gasoline, the year-over-year total rose just 1.5%, less than the rate of inflation and the worst 12-month rate of change since February 2003.

Friday morning, the Commerce Department announced that October retail sales fell 2.8%, the fourth straight drop and the worst one-month decline since records began in 1992. Stripping out sales of autos and gasoline, the year-over-year total rose just 1.5%, less than the rate of inflation and the worst 12-month rate of change since February 2003.

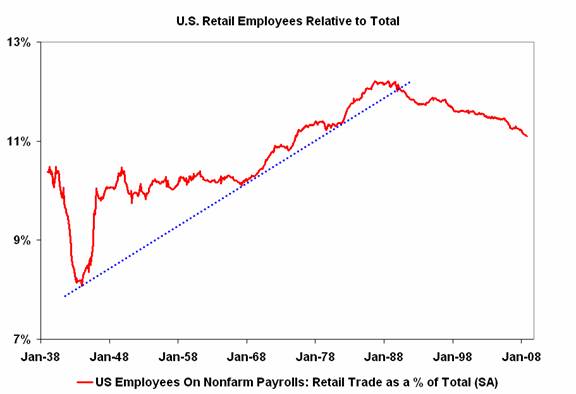

Under the circumstances, it seems likely that the relative decline we've seen in retail-related jobs over the past decade or so -- spurred by retailer efforts to boost productivity and faster growth in other segments of the U.S. economy -- will continue on the same downward path, though for altogether different reasons.

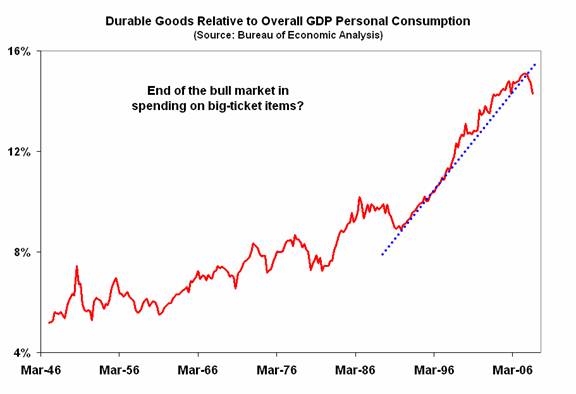

One spending category that has seen a boom in comparative terms over the past several decades is durable goods, which includes items like automobiles and airplanes (to name a few). However, amid signs that Americans are tapped out and have already bought many of the “toys” they need (or want), it seems a good bet that demand for such goods has seen its peak, at least in the short-to-medium term.

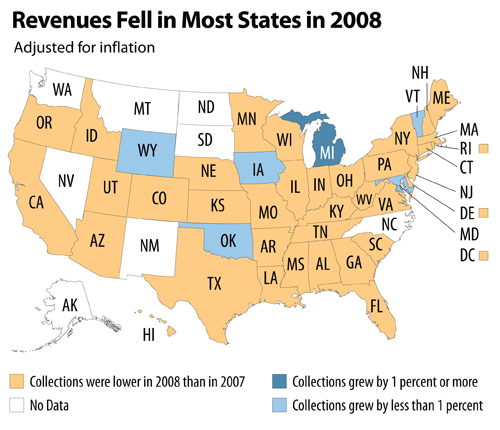

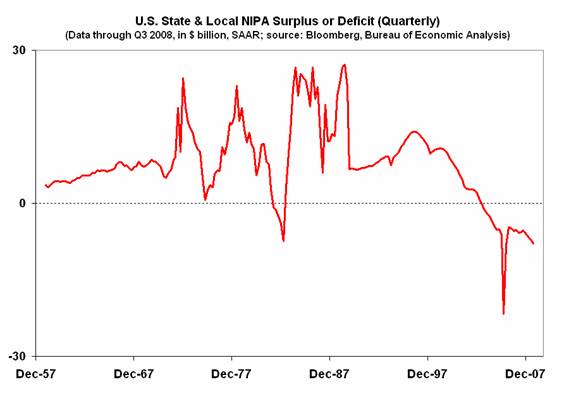

This week, the Center on Budget and Policy Priorities (CBPP) highlighted data from the Rockefeller Institute of Government showing “conclusively that state revenue dropped sharply in the July-September 2008 quarter, creating large, additional state budget shortfalls.” According to the CBPP, “all indications are that revenue collections will worsen further in coming months.” Below is a chart put together by the nonpartisan research group that reveals the extent of the difficulties.

(Source: Center on Budget and Policy Priorities)

Needless to say, the combination of falling income, sales, and property taxes, together with rising financing and social services costs, only adds to existing shortfalls.

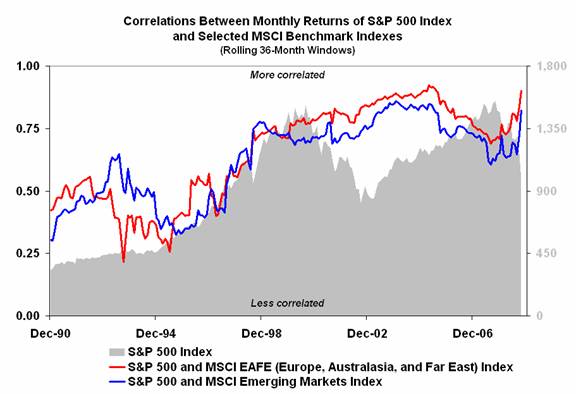

Finally, up until this year, many investment advisors liked to bang the table about the advantages of international diversification. However, as the following chart reveals, returns in foreign equity markets have been fairly well correlated to those in the U.S. for quite a while now.

In addition, as has been the case for decades, there is usually no place to hide during severe bear markets, as correlations around the globe have a nasty habit of converging towards one.

One day after share prices staged a dramatic intraday upside reversal, stocks ended sharply lower, giving back a sizeable chunk of yesterday's gains. Prices were dragged lower by a disappointing report on retail sales, as well as weakness in energy -- hurt by a sell-off in crude oil futures -- and technology shares.

At the close, the Dow Jones Industrial Average fell 337.94, or 3.8%, to 8,497.31. The S&P 500 Index lost 38, or 4.2%, to 873.29. The Nasdaq Composite Index tumbled 79.85, or 5%, to 1,516.85.

Spot gold rose $5.80, or 0.8%, to $742.30, while the U.S. Dollar index eased 0.7%. Ten-year Treasury bond yields fell 14 basis points to 3.72%.

By Michael J. Panzner

http:/www.financialarmageddon.com

Copyright © 2008 Michael J. Panzner - All Rights Reserved.

Michael J. Panzner is the author of Financial Armageddon: Protecting Your Future from Four Impending Catastrophes and The New Laws of the Stock Market Jungle: An Insider's Guide to Successful Investing in a Changing World , and is a 25-year veteran of the global stock, bond, and currency markets. He has worked in New York and London for HSBC, Soros Funds, ABN Amro, Dresdner Bank, and J.P. Morgan Chase. He is also a New York Institute of Finance faculty member and a graduate of Columbia University.

Michael J. Panzner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.