Consumer Spending Cutbacks Further Erode Retail Payrolls

Economics / Recession 2008 - 2010 Nov 14, 2008 - 11:08 AM GMTBy: Ashraf_Laidi

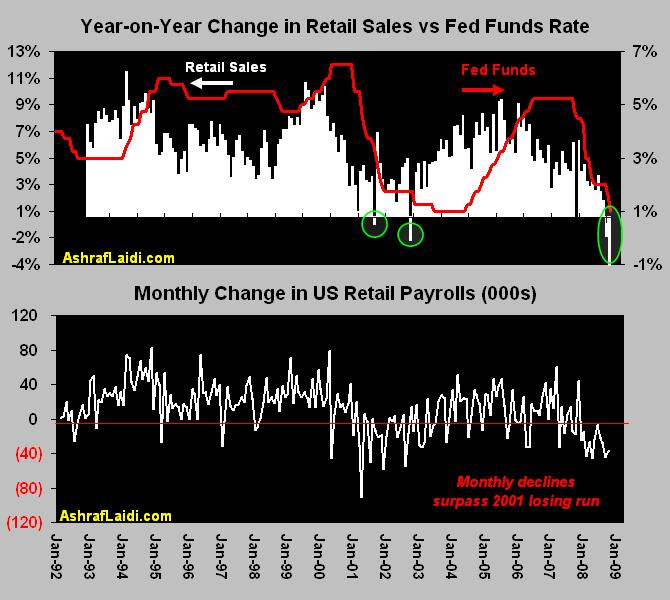

The attached chart shows the deepening implications of falling retail sales on retail sector payrolls, highlighting the deteriorating role of the US consumer, especially as Democrats dampen hopes of any additional stimulus package before year-end.US Retail sales fell 2.8% in October vs expectations of a 2.1% decline, following a revised drop of 1.3%.

The attached chart shows the deepening implications of falling retail sales on retail sector payrolls, highlighting the deteriorating role of the US consumer, especially as Democrats dampen hopes of any additional stimulus package before year-end.US Retail sales fell 2.8% in October vs expectations of a 2.1% decline, following a revised drop of 1.3%.

Sales excluding autos fell 2.2% against expectations of a 1.9% decline. The sales' decline marked the fourth straight monthly decrease, a pattern not seen in at least over the last 16 years . On a year-to-year basis, the decline is second straight annual decline, and only the fourth of such decline since 1992. Todays figures would highlight the dislocation of the US consumer, which was also borne in the 11th straight monthly decline in retail payrolls, surpassing the 8-month string of consecutive losses in 2001.

The higher than expected release of the preliminary November Univ of Michigan sentiment survey at 57.9 from Octobers 57.6 had a short-lived impact on appetite, even with the rise in the current conditions index to 61 from 58.4 and the marked decline in the 1-year inflation expectations index to a 2-year low of 2.9% from 3.9% . With stocks hovering between -2% and -1.2%, currencies are closely following the swing in risk pendulum.

EURUSD fails to break out of its $1.2730 trend line resistance charted from the Oct 29 high through the Nov 5 high. As long as stocks deepen their reversal from Thursdays gains, EURUSD is seen extending losses towards $1.2620s. One day after German growth was revealed to have slipped into recession by showing back to back quarterly declines, France escaped the recession by growing 0.1% in Q3, following a 0.3% contraction in Q2. But French payrolls did fall by 0.1% in Q3. Spain's Q3 GDP fell 0.2% after a 0.1% rise in Q2. Italy's Q3 GDP fell 0.5% following -0.4% in Q2, pushing the nation into its third recession in a decade.

GBPUSD retains composure after recovering from yesterdays latest 6-year lows of $1.4558, as sterling flexes its higher yielding muscle against USD, eyeing $1.4830. But the high expectations of further BoE rate cuts continue to limit sterlings gains, marking a clear resistance at $1.4920. USDJPY closely tracks equities, hovering within the 96-98 yen range, but overall resistance seen producing lower highs, limited at 98.20. Defensive flows are seen finding support at 96.60, with 96.20 providing a more solid foundation.

In the battle of high yielders, AUDNZD maintains its bullish tone after the Aussie hit a 5-week high of 1.1796, partly due to golds recovery and the worse than expected declines in NZ retail sales earlier this week. These dynamics are prevailing despite Australian rates standing at 5.25% versus 6.50% in New Zealand. Prolonged gains in risk appetite are seen favoring the Aussie towards 1.1900. Prolonged selling in equities is seen dragging AUDNZD towards 1.1680.

By Ashraf Laidi

CMC Markets NA

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.